Italy Electric Vehicle Market Size, Share, Trends and Forecast by Component, Propulsion Type, Vehicle Type, and Region, 2026-2034

Italy Electric Vehicle Market Size and Share:

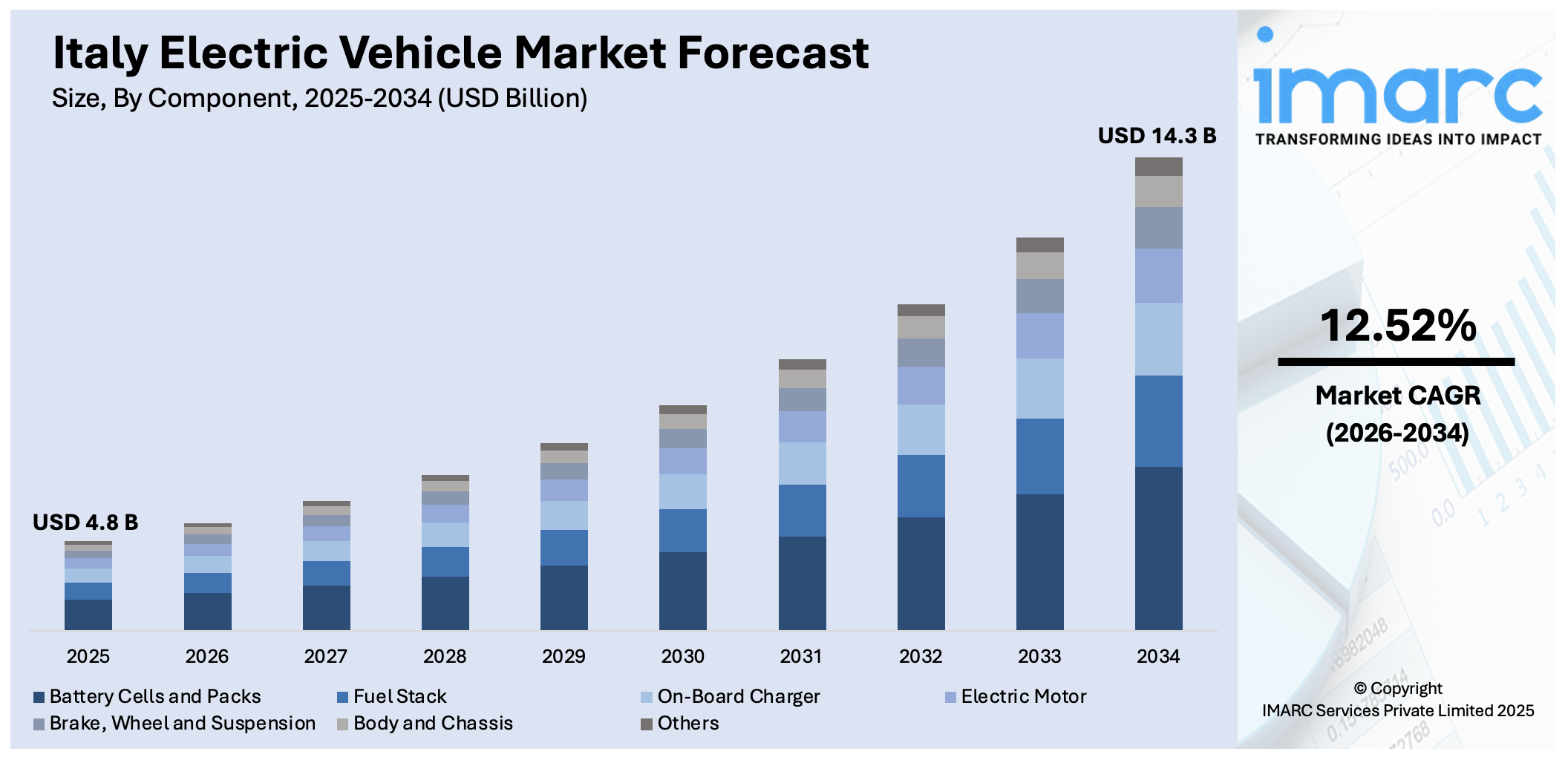

The Italy electric vehicle market size was valued at USD 4.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 14.3 Billion by 2034, exhibiting a CAGR of 12.52% during 2026-2034. Northwest dominated the market, holding a significant market share of over 32.1% in 2025. Some of the key factors contributing to Italy electric vehicle market share include supportive government policies, ongoing technological advancements, rising environmental awareness, extensive charging infrastructure development, economic benefits, industry collaborations, urbanization, rising fuel prices, corporate sustainability initiatives, public transportation electrification, and the integration of renewable energy sources.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 4.8 Billion |

|

Market Forecast in 2034

|

USD 14.3 Billion |

| Market Growth Rate 2026-2034 | 12.52% |

Government incentives and subsidies for electric vehicle (EV) purchases encourage consumers to opt for greener alternatives. Increasing environmental awareness and concerns about pollution are pushing both consumers and businesses toward EV adoption. Advancements in EV technology, such as longer battery life and faster charging infrastructure, make electric vehicles more practical and convenient. Moreover, Italy’s push for carbon neutrality and stricter emissions regulations are accelerating the shift toward electric mobility. The expansion of public and private charging networks further enhances the convenience of EVs. Additionally, the rise of eco-conscious consumers, along with the growing availability of diverse EV models, including luxury and affordable options, is also driving the Italy electric vehicle market growth. Increased investment in EV production and infrastructure solidifies the future of the sector.

To get more information on this market Request Sample

The Italy electric vehicle market is witnessing an increasing shift toward the ultra-premium segment. New models, featuring advanced materials and long-range capabilities, are emerging to cater to the growing demand for luxury electric vehicles. These innovations highlight a move toward combining high performance, sustainability, and cutting-edge technology in the electric mobility sector. For instance, in August 2024, Italian EV startup Aehra unveiled its first two ultra-premium models, the Impeto SUV and Estasi sedan. Set for production in mid-2026, the vehicles feature carbon fiber monocoques and target an 800 km range.

Italy Electric Vehicle Market Trends:

Government Incentives and Policies

The Italy EV market is heavily impacted by government incentives and policy. These policies include incentives, such as financial subsidies based on tax savings, as well as grants, to assist both electric vehicle producers and customers in making the transition to electric vehicles. ACEA reported that, in Italy, BEVs are exempt from ownership tax for five years, then receive a 75% tax reduction compared to petrol cars. HEVs pay a flat rate of EUR 2.58/kW, with some regions offering additional discounts. Currently, Italy has expanded many schemes to boost demand for electric vehicles. The Ecobonus program provides significant incentives to encourage the usage of electric and hybrid cars, discouraging customers' initial investment risk. Furthermore, decreased registration charges and the elimination of some tolls in metropolitan areas encourage the use of EVs. These measures are part of Italy's long-term energy conservation strategy, which aims to reduce carbon footprints and comply with EU environmental and climate change policies.

Expansion of Charging Infrastructure

A strong and comprehensive network of charging stations is required to reduce range anxiety, a major issue among prospective EV buyers. According to an industry report, as of March 2025, Italy had 65,992 public EV charging points, reflecting a 60% increase from 2023. The vehicle number rose by 11,828 units in the past year, with 1,601 were added since the start of 2025. Italy has been making significant investments in the construction of public and private charging outlets, including fast-charging stations along important routes and metropolitan areas. The government, in partnership with private enterprises, has started measures to expand the number of charging stations, making electric vehicles more convenient for daily usage. The Italy electric vehicle market forecast indicates that the integration of smart charging solutions, as well as the marketing of home charging devices, improves an electric vehicle's accessibility and convenience. As charging infrastructure expands, customer trust in the viability of EVs grows, propelling market growth.

Continual Technological Advancements

Emerging innovations across the automotive industry are creating a positive Italy electric vehicle market outlook. Battery technology developments, such as lithium-ion batteries with increased energy density and faster charging capacity, are driving expansion. Accordingly, in 2025, Gruppo Seri secured EUR 150 Million to expand its Teverola lithium battery gigafactory in Italy, aiming for 8 GWh annual production. The expansion contributes to the EU's environmental aims by combining recycling and innovative manufacturing to provide long-lasting battery solutions. These developments assist to increase the range of EVs and minimize the time required to recharge the car batteries. Furthermore, advancements in electric drive trains and smart systems, such as ADAS and vehicle-to-grid (V2G) connections, improve the possibilities for EVs. Technology innovation also helps to enhance the efficiency of EVs and significantly cuts production costs, making them more competitive when compared to ICE cars. As a result, technical innovation is crucial since it improves both the practicality and appeal of electric vehicles in Italy.

Environmental Concerns and Consumer Awareness

Rising customer knowledge and concern about the negative effects of climate change from fuel usage is increasing the need for ecologically friendly transportation options. Technological breakthroughs, such as electric automobiles with zero exhaust emissions, are being used to reduce air pollution and hence minimize environmental damage. Educative initiatives, social publicity, and cooperation from environmental charity organizations have all played important roles in raising awareness about the relevance of EVs among the general public. Furthermore, consumer actions for sustainability and environmental commitment have increased significantly, as customers are prepared to spend more on 'green' items. According to a study, in 2023, Italy was awarded tenders for nearly 2,500 zero-emission buses, accounting for an investment of EUR 1.8 Billion, expected to be operational by June 2026. This marks a 250% increase in electric bus registrations, contributing to Italy's goal of 88% electric buses by 2050. The emphasis on the use of eco-friendly items is also seen in electric cars as customer tastes shift toward contributing to an ecologically sustainable future.

Italy Electric Vehicle Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Italy electric vehicle market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on component, propulsion type, and vehicle type.

Analysis by Component:

- Battery Cells and Packs

- Fuel Stack

- On-Board Charger

- Electric Motor

- Brake, Wheel and Suspension

- Body and Chassis

- Others

Battery cells and packs stood as the largest component in 2025, holding around 38.6% of the market. As the demand for electric vehicles rises, the need for high-performance, efficient battery systems has become crucial. Battery cells and packs are essential for powering EVs, directly impacting their range, performance, and overall consumer adoption. In Italy, advancements in battery technology, such as increased energy density and faster charging capabilities, have spurred interest in electric vehicles. Additionally, government policies and incentives supporting the development of local battery manufacturing and charging infrastructure have further bolstered the market. The growing push for sustainable, low-emission transportation has driven investments in battery production, making this segment a primary factor in Italy's EV market expansion.

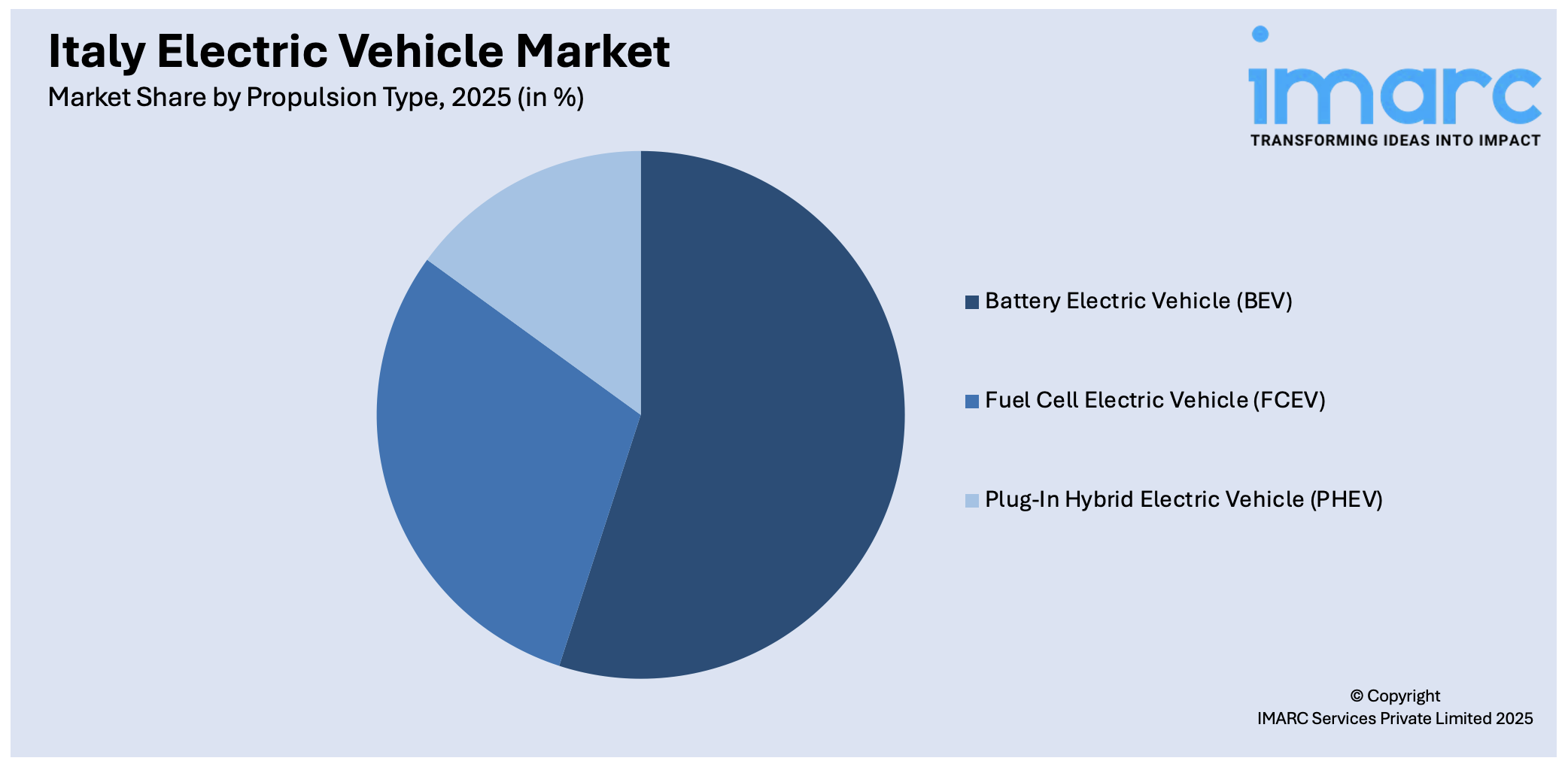

Analysis by Propulsion Type:

Access the comprehensive market breakdown Request Sample

- Battery Electric Vehicle (BEV)

- Fuel Cell Electric Vehicle (FCEV)

- Plug-In Hybrid Electric Vehicle (PHEV)

Battery electric vehicle (BEV) led the market in 2025 due to government incentives such as tax rebates and subsidies, which have made BEVs more affordable. Owing to Italy's focus on reducing carbon emissions and meeting EU sustainability targets, there is a growing push for cleaner transportation options. Additionally, the expansion of charging infrastructure and improvements in battery technology have made BEVs more practical and appealing. This has led to greater consumer adoption, further fueling the BEV segment's growth. With improved vehicle range and lower operating costs, BEVs are seen as a more sustainable alternative to traditional vehicles, which has solidified their role as a key driver in Italy electric vehicle market.

Analysis by Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Others

Passenger vehicles led the market with around 88.5% of market share in 2025, owing to the growing consumer preference for sustainable and cost-efficient transportation options. As Italian consumers increasingly seek environmentally friendly alternatives to traditional cars, the demand for electric passenger vehicles has surged. This shift is fueled by government incentives, such as subsidies for purchasing EVs, and stricter emission regulations, which encourage the adoption of electric models. Additionally, the availability of a wider range of electric passenger vehicles, including compact cars and family sedans, has made EVs more accessible to a broader market. Owing to improvements in battery technology, increased driving ranges, and expanded charging networks, electric passenger vehicles are becoming more practical and appealing to Italian consumers, driving market growth.

Regional Analysis:

- Northwest

- Northeast

- Central

- South

- Others

In 2025, Northwest accounted for the largest market share of over 32.1%, driven by a combination of factors. This area includes major urban centers like Milan, Turin, and Genoa, which are key hubs for economic activity, innovation, and technology. The region benefits from well-developed infrastructure, including widespread charging stations, making it more convenient for consumers to adopt EVs. Government incentives and subsidies have also played a significant role in encouraging the transition to electric vehicles. Furthermore, the region's focus on sustainability, environmental awareness, and commitment to reducing carbon emissions aligns with the increasing demand for cleaner, eco-friendly transportation options. These factors, along with a higher disposable income among residents, have positioned the Northwest as a leader in Italy's electric vehicle market.

Competitive Landscape:

The Italy electric vehicle market is growing due to strong government initiatives, including purchase incentives and investments in charging infrastructure. Key developments include partnerships and collaborations aimed at enhancing EV adoption, along with significant funding for EV-related research and development. The focus is on improving battery technology and vehicle performance. Government support, alongside ongoing partnerships with energy companies, is crucial to expanding EV adoption. Additionally, the market is witnessing increased product launches and technological advancements in EVs, with a strong emphasis on enhancing vehicle range and performance through continuous research.

The report provides a comprehensive analysis of the competitive landscape in the Italy electric vehicle market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Mobilize, Renault Group's mobility brand, finalized its strategic alliance with Autostrade per l’Italia by acquiring a significant stake in Free To X, a leader in Italy's high-power charging (HPC) market. This partnership aims to expand Italy's EV charging infrastructure, featuring over 110 stations delivering up to 400 kW, powered entirely by renewable energy.

- April 2025: Ferrari unveiled the 296 Speciale coupé and Speciale A convertible, lightweight, 880-horsepower hybrid supercars built in Maranello, Italy. Deliveries are expected to begin in early 2026. Showcasing Ferrari’s hybrid shift, these exclusive models reflect Italy’s automotive legacy and bolster the brand’s collector-focused strategy.

- April 2025: Atlante, Electra, Fastned, and IONITY launched the Spark Alliance to create Europe’s largest unified charging network. Covering 11,000+ renewable-powered chargers in 25 countries, including Italy, the alliance simplifies EV charging via app interoperability, supporting seamless electric travel and accelerating the continent’s sustainable mobility shift.

- March 2025: Stellantis announced an EUR 38 Million (USD 41 Million) investment in its Verrone plant in Northern Italy to produce steel components for electric drive modules. Set to begin production in late 2027, the facility aims to support over 400,000 units annually.

- January 2025: Italy-based MTA acquired a 60% stake in EFI Technology, a leader in powertrain control systems. The move expands MTA’s offerings for OEMs and strengthens its international reach, while reinforcing Italy’s role in advancing automotive electronics for electric and combustion vehicle systems.

Italy Electric Vehicle Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Battery Cells and Packs, Fuel Stack, On-Board Charger, Electric Motor, Brake, Wheel and Suspension, Body and Chassis, Others |

| Propulsion Types Covered | Battery Electric Vehicle (BEV), Fuel Cell Electric Vehicle (FCEV), Plug-In Hybrid Electric Vehicle (PHEV) |

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy electric vehicle market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Italy electric vehicle market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric vehicle market in Italy was valued at USD 4.8 Billion in 2025.

The Italy electric vehicle market is projected to exhibit a CAGR of 12.52% during 2026-2034, reaching a value of USD 14.3 Billion by 2034.

Key factors driving the Italy electric vehicle market include government incentives, growing environmental awareness, advancements in EV technology, expanding charging infrastructure, and stricter emissions regulations. Additionally, increasing consumer preference for sustainable mobility and support from automakers in launching new EV models contribute to market growth.

Northwest accounted for the largest share, holding around 32.1% of the market in 2024 due to its high urbanization, robust infrastructure, and government incentives, driving demand for EVs in cities like Milan and Turin.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)