Italy Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

Italy Foreign Exchange Market Overview:

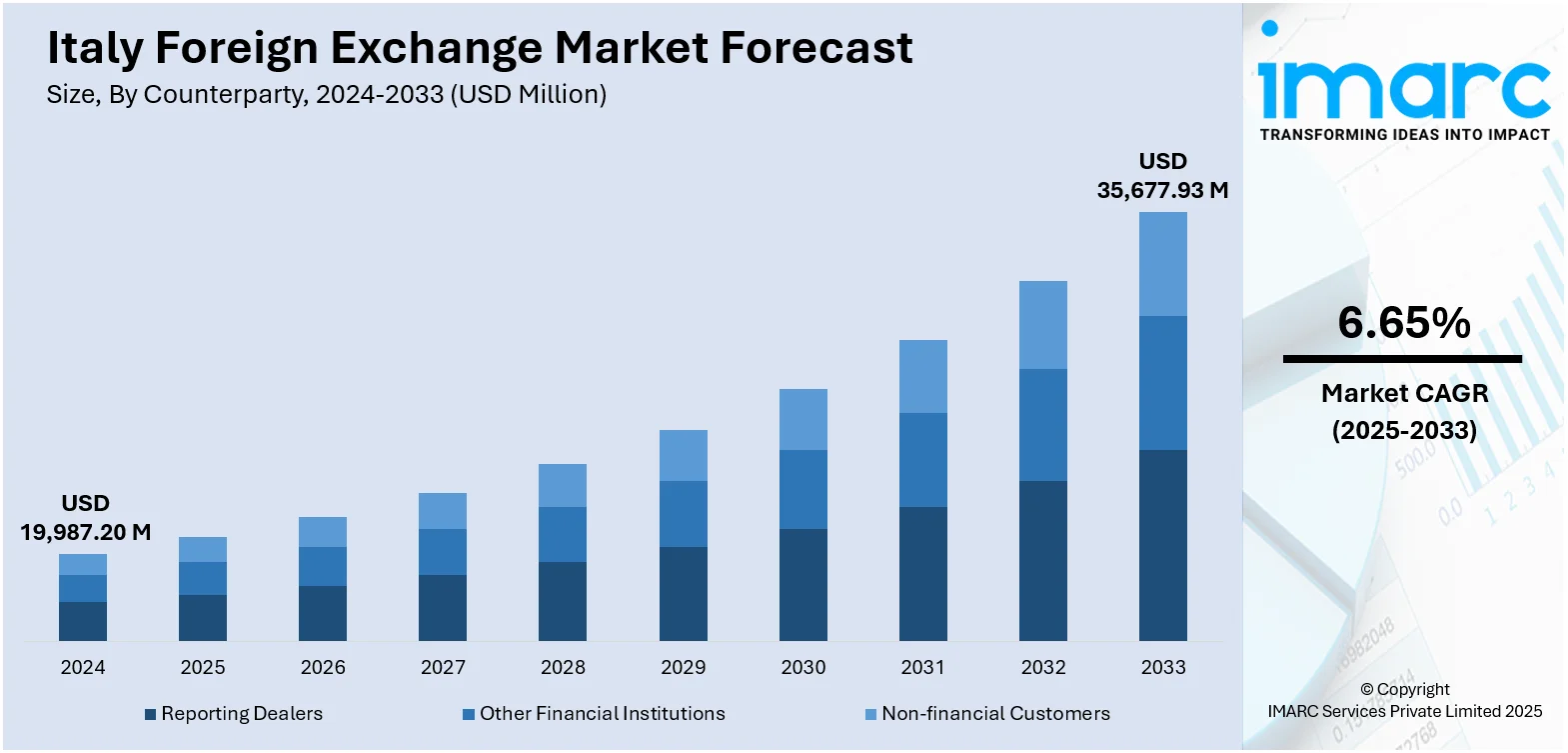

The Italy foreign exchange market size reached USD 19,987.20 Million in 2024. The market is projected to reach USD 35,677.93 Million by 2033, exhibiting a growth rate (CAGR) of 6.65% during 2025-2033. The market is fueled by the country's robust trade relationships within the Eurozone, growing export demand, and its role as a key participant in the European Central Bank's monetary policy framework. Further, the market also benefits from steady inbound tourism and capital inflows, which contribute to consistent euro liquidity and currency exchange activity. Besides that, Italy's evolving digital payments landscape and cross-border fintech innovations have enhanced transaction efficiency, further augmenting the Italy foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19,987.20 Million |

| Market Forecast in 2033 | USD 35,677.93 Million |

| Market Growth Rate 2025-2033 | 6.65% |

Italy Foreign Exchange Market Trends:

Advancements in Technology and Financial Innovation

Continuous improvements in financial technology and the adoption of cutting-edge trading platforms to improve user experience is impelling the market growth. Improved digital infrastructure enables quicker, more precise, and secure transactions, allowing participants to engage with increased assurance. Automation in trading methods are enhancing market accessibility and effectiveness, generating chances for wider involvement. The implementation of advanced analytical systems further aids informed decision-making, enhancing transparency and accountability in everyday operations. Ongoing investment in technological integration guarantees that the market stays in synchronization with international standards of performance and dependability. Organizations focus on supporting cybersecurity protocols, thus protecting the integrity of transactions and increasing trust among stakeholders. Additionally, the adoption of innovation in product offerings guarantees that financial services stay diverse, meeting a broad spectrum of currency needs. This focus on technology and innovation establishes foreign exchange market in Italy as progressive, robust, and able to support growth while remaining flexible in a swiftly evolving global financial landscape.

To get more information on this market, Request Sample

Strong Tourism Revenues

Tourism significantly supports Italy’s foreign exchange market by generating a steady influx of currency, as international travelers directly contribute to financial circulation through their expenditures across various sectors of the economy. This constant flow of foreign currency provides stability, sustains liquidity, and reinforces the overall vibrancy of the market by ensuring balanced inflows that complement other financial activities. According to the World Travel & Tourism Council’s 2024 Economic Impact Research, the industry contributed €215 billion, representing 10.5% of Italy’s total economic output, a figure that underscores its central role as a foundation of the national economy. Beyond its direct monetary impact, tourism drives investment in infrastructure, hospitality, and services, which further broadens the scope of currency operations. It also strengthens Italy’s position as an international destination, promoting long-term growth in both foreign exchange and overall financial engagement. The sector’s enduring vitality demonstrates its ability to anchor stability, diversify inflows, and enhance resilience within Italy’s foreign exchange market.

Stable Payment Infrastructure and Settlement Systems

Effective payment channels guarantee that transactions are conducted quickly, precisely, and safely, fostering trust among participants. Robust settlement systems minimize risks linked to international transactions, facilitating smooth financial exchanges between currencies. The incorporation of technology with international payment systems enhances market competitiveness, facilitating smoother interactions with international networks. By emphasizing security and promptness, the system guarantees confidence to both institutional and individual stakeholders. Consistency in settlements also diminishes operational obstacles, improving overall effectiveness. The ongoing enhancement of financial infrastructure, alongside strong oversight, guarantees that Italy’s payment systems stay responsive to technological advancements and changing market demands. This dependability establishes foreign exchange as a reliable and reachable platform for ongoing activities. By maintaining the integrity of settlement processes, Italy supports a financial landscape that fosters growth, safeguards participants, and ensures resilience in the worldwide currency exchange.

Italy Foreign Exchange Market Growth Drivers:

Expansion of Digital Economy and E-Commerce

The Italy foreign exchange market derives considerable strength from the expansion of the digital economy and the rising prominence of e-commerce, both of which generate consistent cross-border transactions requiring efficient currency exchange. These activities increase overall market liquidity while encouraging digital enterprises to depend on streamlined financial systems for the settlement of payments, sustaining active engagement in currency operations. In 2025, Coop Alleanza 3.0, one of Italy’s largest retailers, launched an advanced e-commerce platform in the Greater Rome area, introducing flexible delivery options such as customized time slots and SMS reminders, with plans for nationwide expansion. This initiative highlights how innovation within retail directly enhances online user experiences while simultaneously reinforcing the demand for reliable financial infrastructure to support the growing transaction volumes. As e-commerce continues to expand, the necessity for real-time settlement of international purchases intensifies, further accelerating foreign exchange flows. By integrating technological advancement with user-driven commerce, Italy positions its market as adaptive, resilient, and aligned with the evolving financial dynamics of the global digital economy.

Skilled Workforce and Financial Expertise

Individuals involved in trading, financial analysis, and regulatory compliance enhance the market's efficiency through the use of their expertise and specialized capabilities. Educational entities and training initiatives strengthen this foundation, guaranteeing a continuous flow of skilled individuals able to adjust to changing methods. Skilled financial experts boost the trustworthiness of market activities by advocating for precision, rigor, and commitment to elevated standards. The combined knowledge in the field creates a setting where choices are well-informed and risk management is anticipatory. In addition, the existence of skilled professionals enhances institutional resilience, as their capacity to adapt swiftly to changes supports overall stability. This expertise guarantees that Italy’s market players stay competitive in an ever-more complex global landscape. By cultivating strong human capital, the system is positioned to maintain growth, strengthen its reputation, and align with global best practices in foreign exchange activity.

Innovation in Risk Management and Hedging Instruments

The Italian foreign exchange market is influenced by improvements in risk management tools and the accessibility of hedging instruments. Companies and investors look for ways to reduce their exposure to currency changes, and the availability of advanced solutions guarantees consistent engagement in the market. Derivatives, forward contracts, and hedging techniques offer protection, fostering active participation even in times of uncertainty. The presence of these tools enhances confidence by minimizing vulnerabilities and encouraging balanced operations. Organizations persist in improving risk management frameworks, conforming them to global best practices and bolstering resilience. This focus on proficient risk management encourages lasting involvement, as individuals gain confidence that possible losses can be reduced. The existence of these instruments also enables a wider variety of users, including corporations and financial institutions, enhancing diversity in market involvement. By emphasizing innovation in protective measures, Italy guarantees that its foreign exchange market stays robust, flexible, and able to maintain operations amid diverse global financial environments.

Italy Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

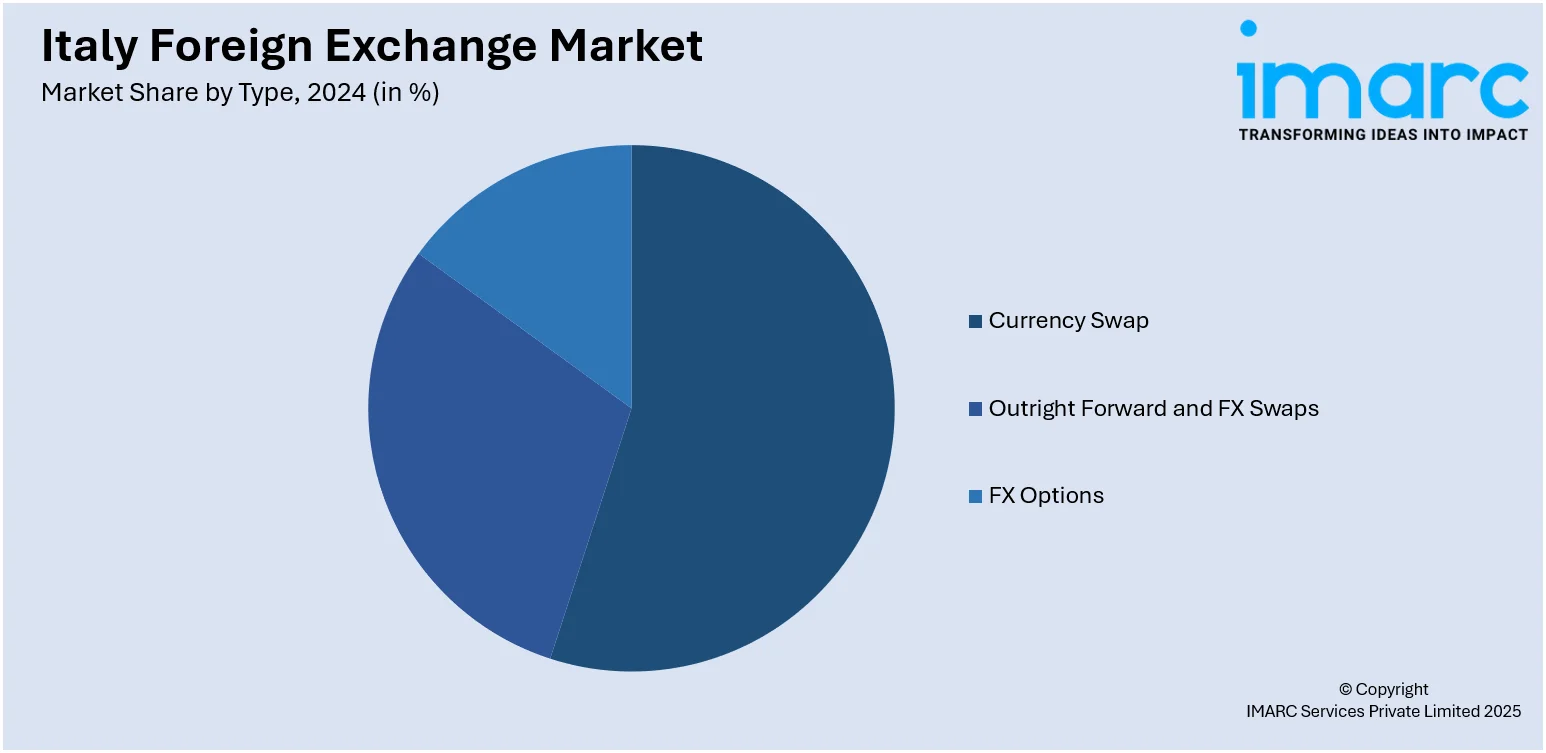

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Foreign Exchange Market News:

- July 2025: UniCredit launched a new international payment service in collaboration with Wise, allowing Italian retail customers to send foreign-currency payments directly through its mobile banking app. This service ensures fast, secure, and transparent transactions, with funds credited within seconds in selected currencies. The initiative is part of UniCredit’s efforts to become Europe’s leading bank for payments, starting in Italy with plans for expansion.

- April 2025: The BIS launched Project Meridian FX, focusing on synchronized settlement in foreign exchange (FX) transactions. The project involved collaboration with Italy's Banca d'Italia, testing interoperability between real-time gross settlement (RTGS) systems and distributed ledger technology (DLT). It showed potential for more efficient cross-border FX settlements and the broader application of the synchronization model in various asset markets.

Italy Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The foreign exchange market in Italy was valued at USD 19,987.20 Million in 2024.

The Italy foreign exchange market is projected to exhibit a CAGR of 6.65% during 2025-2033, reaching a value of USD 35,677.93 Million by 2033.

The Italy foreign exchange market is supported by strong economic stability, active participation from domestic and international investors, and a favorable regulatory environment. Advancements in digital trading platforms, integration with European financial systems, and consistent trade and tourism inflows further enhance growth. The market also benefits from strategic geographic positioning, boosting cross-border financial transactions and currency exchange activities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)