Italy Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Italy Insurtech Market Overview:

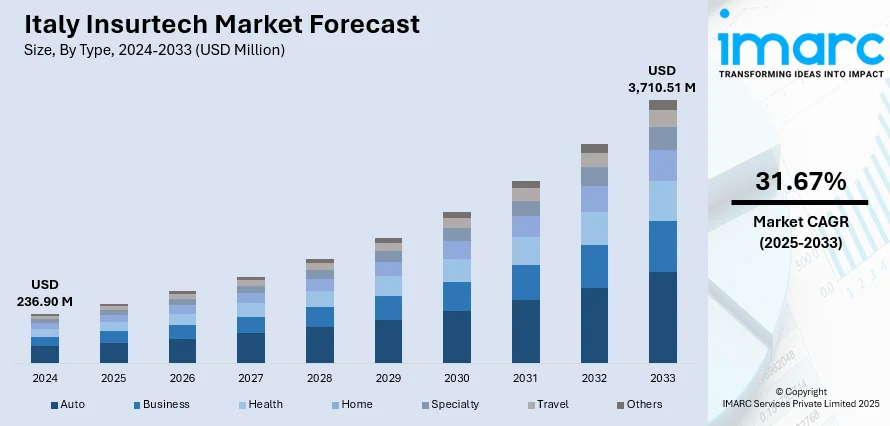

The Italy Insurtech market size reached USD 236.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,710.51 Million by 2033, exhibiting a growth rate (CAGR) of 31.67% during 2025-2033. The market is gaining momentum through rising investor interest and a stronger focus on wellness-linked insurance products. Wellness integration is reshaping insurance design, pricing, and user engagement around preventive health and lifestyle habits. Venture capital is supporting startup growth, rapid product development, and increasing the Italy Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 236.90 Million |

| Market Forecast in 2033 | USD 3,710.51 Million |

| Market Growth Rate 2025-2033 | 31.67% |

Italy Insurtech Market Trends:

Health and Wellness Integration

The growing emphasis on health and wellness is becoming a central force behind the expansion of Italy’s Insurtech sector, as insurers adapt to evolving user expectations and public health priorities. More insurance providers are embedding wellness-oriented features into their products, ranging from telemedicine services and wearable fitness integration to preventive care tools and personalized health tracking. This shift caters to the rising demand for insurance solutions that support healthier lifestyles and offer rewards for active participation in health improvement. The integration of wellness programs not only enhances user engagement but also helps insurers manage long-term risks by encouraging healthier behaviors, which ultimately lowers claim volumes and healthcare costs. The momentum is supported by the robust growth of the Italy health and wellness market, which is projected to reach USD 124.07 Billion by 2033, according to the IMARC Group. This projection reflects increasing individual expenditure on wellness services and products, and it provides a strong foundation for insurers to expand offerings tailored to this segment. Insurtech platforms are leveraging digital tools to make these offerings more accessible and interactive, fostering a stronger connection between health management and insurance value. As wellness becomes a strategic pillar in insurance innovation, it continues to shape product design, pricing models, and long-term engagement strategies across the market in Italy.

`To get more information on this market, Request Sample

Increased Investment in Insurtech Startups

Capital influx from venture funds and private investors is supporting the Italy Insurtech market growth by driving product development, accelerating expansion, and enabling startups to compete with traditional insurers at scale. Investors are focusing on startups aiming to transform how insurance is distributed, pricing, and product design using advanced digital tools. This financial backing enables early-stage companies to develop scalable tech, hire talent, and expand their footprint, both geographically and across product lines. The market is experiencing an increase in significant funding rounds, indicating both investor trust and the development of certain participants. For instance, in January 2025, Italian Insurtech Wopta Assicurazioni secured a total of €12 million in funding, led by Belluzzo International Partners and other notable investors. The funds will support domestic and European expansion, including acquisitions. Wopta also launched a €50 million Series B round to further scale its operations. Such investments are driving competition, speeding up product innovation, and expanding the possibilities of insurance in a digitally oriented marketplace. The outcome is not only more firms entering the field but also quicker innovation cycles, enhanced market visibility, and a change in user expectations. Investors are not merely backing technology but are also transforming the insurance experience throughout Italy.

Italy Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

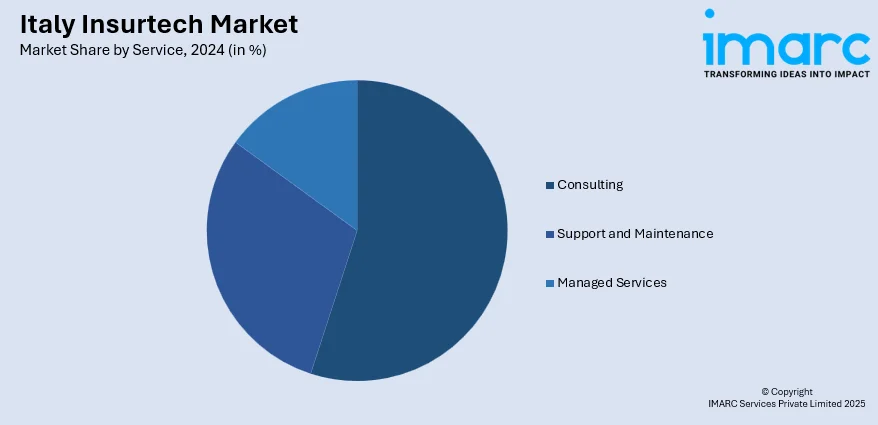

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Insurtech Market News:

- In June 2025, Ageas Re finalized an 80% quota share reinsurance deal with Slovenian insurer Triglav Group for motor insurance distributed by Italy’s Prima Assicurazioni. This partnership expands Ageas Re’s presence in the profitable Italian motor insurance market, leveraging Prima’s tech-driven platform and user base.

- In May 2025, the Italy Insurance Forum was held in Milan, bringing together over 700 attendees and 150+ speakers for its 12th edition. Organized by iKN Italy, the event features 10 focused tracks covering marketing, innovation, claims, data, and more. It also showcases Insurtech innovations on the Smart Village stage, fostering networking and industry advancement.

Italy Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy Insurtech market on the basis of type?

- What is the breakup of the Italy Insurtech market on the basis of service?

- What is the breakup of the Italy Insurtech market on the basis of technology?

- What is the breakup of the Italy Insurtech market on the basis of region?

- What are the various stages in the value chain of the Italy Insurtech market?

- What are the key driving factors and challenges in the Italy Insurtech market?

- What is the structure of the Italy Insurtech market and who are the key players?

- What is the degree of competition in the Italy Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)