Italy IT Training Market Size, Share, Trends and Forecast by Application, End User, and Region, 2026-2034

Italy IT Training Market Summary:

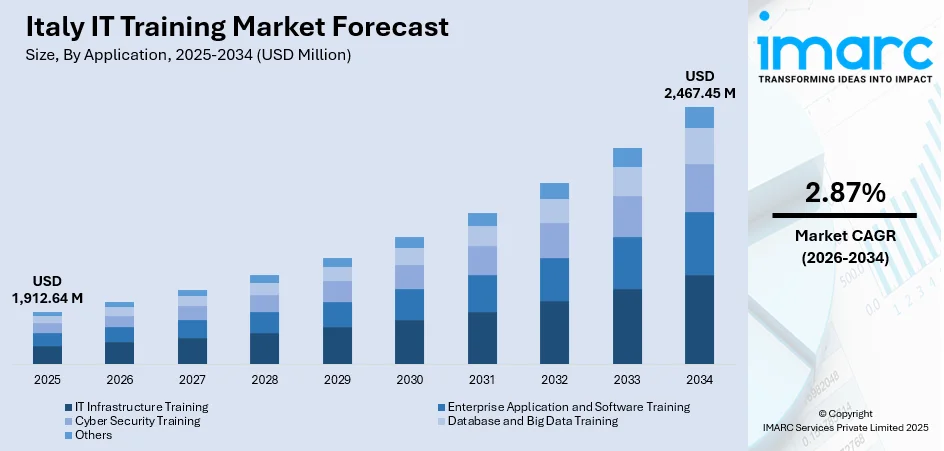

The Italy IT training market size was valued at USD 1,912.64 Million in 2025 and is projected to reach USD 2,467.45 Million by 2034, growing at a compound annual growth rate of 2.87% from 2026-2034.

The Italy IT training market is experiencing expansion driven by accelerating digital transformation initiatives across industries, stringent regulatory compliance requirements, and substantial government investment through programs such as the National Digital Skills Strategy. The growing emphasis on artificial intelligence integration, cloud computing adoption, and cybersecurity preparedness is compelling organizations to invest significantly in workforce upskilling. Corporate entities are prioritizing enterprise application training to enhance operational efficiency, while educational institutions are modernizing curricula to address the widening skills gap affecting Italy IT training market share.

Key Takeaways and Insights:

-

By Application: Enterprise application and software training lead the market with approximately 34% revenue share in 2025, driven by the accelerating digital transformation across Italian industries requiring proficiency in ERP systems, customer relationship management platforms, and cloud-based enterprise solutions essential for operational efficiency.

-

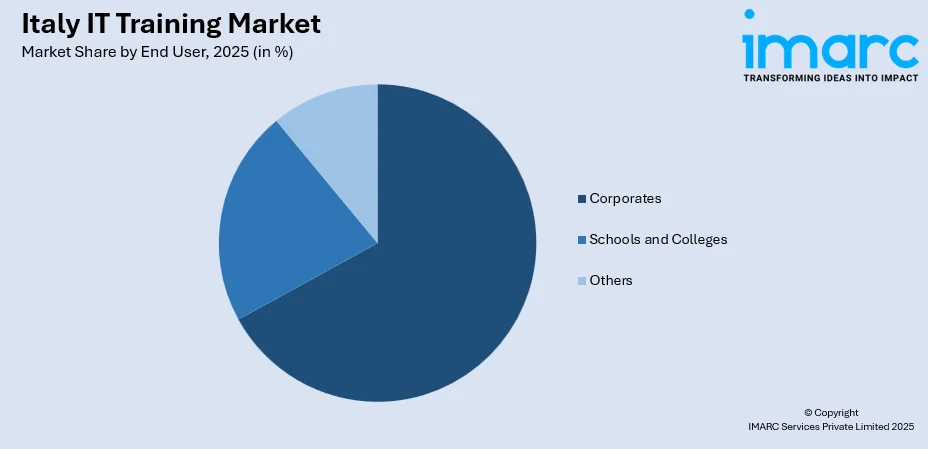

By End User: Corporates hold 67% revenue share in 2025, owing to mandatory compliance training requirements under regulatory frameworks, strategic workforce development initiatives, and the imperative to maintain competitive advantage through continuous technological skill enhancement.

-

Key Players: The Italy IT training market exhibits moderate competitive intensity, characterized by a diverse ecosystem comprising global technology training providers, regional specialized academies, and corporate learning platforms competing across multiple training modalities and specialization domains.

To get more information on this market Request Sample

The market landscape reflects Italy's strategic prioritization of digital competency development aligned with European Union Digital Decade targets. Government initiatives have allocated substantial funding to support enterprise training programs focusing on digitalization, artificial intelligence, and green economy skills. For instance, an additional funding of EUR 318.8 Million is added to the "New Skills Fund" to allow for the complete assessment of cooperative projects, double enterprise support, and enhance lifelong learning through ITS, universities, and recognized institutions. Furthermore, the adoption of generative AI solutions among Italian companies has demonstrated remarkable growth, with a significant increase in organizations implementing these technologies at various operational levels. Technology partnerships between global hyperscalers and Italian institutions are catalyzing market expansion, with major investments committed to establishing cloud infrastructure and comprehensive AI skills training programs targeting extensive beneficiary populations. This convergence of regulatory mandates, corporate imperatives, and government support positions the Italy IT training market for sustained growth throughout the forecast period.

Italy IT Training Market Trends:

Artificial Intelligence Integration in Corporate Learning Programs

Italian enterprises are increasingly integrating artificial intelligence capabilities into their training ecosystems to personalize learning pathways and optimize skill development outcomes. The Italian Strategy for Artificial Intelligence emphasizes workforce training as a strategic priority, driving organizations to adopt AI-powered learning management systems and adaptive training platforms. Corporate training programs are evolving to incorporate generative AI fluency, technical AI skills development, and responsible AI deployment methodologies to prepare employees for the emerging technology landscape.

Regulatory-Driven Cybersecurity Training Expansion

The implementation of the NIS2 Directive has catalyzed significant expansion in cybersecurity training demand across Italian organizations. Critical infrastructure operators, essential service providers, and digital service companies face stringent compliance requirements necessitating comprehensive security awareness programs and specialized technical training. The National Cybersecurity Strategy emphasizes workforce development through targeted training initiatives, compelling organizations to invest in cybersecurity certification programs, incident response training, and security governance education to meet regulatory obligations.

Hybrid Learning Model Adoption Acceleration

Italian training providers are embracing hybrid delivery models combining virtual instructor-led training with asynchronous digital learning components. Organizations recognize the efficiency benefits of blended approaches that enable flexible scheduling while maintaining interactive engagement essential for technical skill acquisition. Higher Technical Institutes and accredited training institutions are expanding their digital delivery capabilities, offering cloud-based learning platforms that enable scalable training deployment while preserving experiential learning elements critical for practical skill development.

Market Outlook 2026-2034:

The Italy IT training market revenue is anticipated to demonstrate consistent expansion throughout the forecast period, supported by sustained government investment in digital skills development and escalating corporate demand for specialized technology training. The market trajectory reflects Italy's commitment to achieving European Digital Decade targets, with initiatives aiming to equip the majority of the population with foundational digital competencies while substantially increasing advanced technical skill attainment. Enterprise investment in training technologies, combined with public-private partnerships fostering workforce development. The market generated a revenue of USD 1,912.64 Million in 2025 and is projected to reach a revenue of USD 2,467.45 Million by 2034, growing at a compound annual growth rate of 2.87% from 2026-2034. Furthermore. government initiatives, combined with major technology investments like Microsoft's €4.3 Billion commitment to train over one Million Italians in AI skills, will continue driving demand for comprehensive IT training solutions across enterprise, public sector, and individual learner segments.

Italy IT Training Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Application | Enterprise Application and Software Training | 34% |

| End User | Corporates | 67% |

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

Enterprise application and software training holds with 34% share of the Italy IT training market in 2025.

The enterprise application and software training segment maintains market leadership driven by the comprehensive digital transformation initiatives sweeping across Italian industries. Organizations are investing substantially in training programs covering enterprise resource planning systems, customer relationship management platforms, supply chain management applications, and business intelligence tools. The proliferation of cloud-based enterprise solutions has intensified demand for certification programs and practical training enabling workforce proficiency in platforms essential for operational excellence and competitive positioning.

Italian enterprises across manufacturing, financial services, and retail sectors recognize that effective utilization of enterprise applications directly impacts productivity and customer experience outcomes. Training providers offer structured curricula combining theoretical foundations with hands-on application exercises, enabling learners to develop practical competencies applicable to real-world business scenarios. The segment benefits from partnerships between enterprise software vendors and training institutions, ensuring curriculum alignment with evolving platform capabilities and industry best practices.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Corporates

- Schools and Colleges

- Others

Corporates lead with 67% share of the Italy IT training market in 2025.

Corporates commanding market position reflects the strategic imperative for Italian businesses to maintain technologically proficient workforces capable of navigating accelerating digital transformation. Large enterprises and small-to-medium businesses alike allocate substantial training budgets to address skills gaps, ensure regulatory compliance, and enhance operational capabilities. Government programs supporting corporate training investments, including mechanisms enabling companies to allocate working hours to employee development with reimbursement provisions, have stimulated significant participation in structured learning initiatives.

Corporate training investments increasingly focus on strategic technology domains including artificial intelligence applications, cybersecurity competencies, cloud platform expertise, and data analytics capabilities. Organizations recognize that continuous workforce development represents a critical differentiator in competitive markets, driving sustained investment in comprehensive training programs. The segment benefits from sophisticated learning management systems enabling scalable training deployment, progress tracking, and competency assessment aligned with organizational development objectives.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

Northwest is anchored by major industrial and financial centers that host significant corporate headquarters and technology companies. This region benefits from prestigious educational institutions, advanced digital infrastructure, and concentrated enterprise demand driving substantial investment in workforce development and specialized technical training programs.

Northeast demonstrates strong IT training engagement driven by its robust manufacturing sector requiring enterprise software proficiency and industrial automation expertise. Small and medium enterprises in this region increasingly invest in digital skills development to enhance operational efficiency, with training providers offering specialized curricula addressing regional industry requirements and export-oriented business needs.

Central benefits from concentrated public administration training initiatives and government digitalization programs requiring workforce upskilling across multiple ministries and agencies. Educational institutions in this region collaborate with public sector entities to deliver compliance-focused training programs, while private enterprises invest in enterprise application training to support service sector modernization efforts.

South is supported by government programs targeting regional digital skills development and economic inclusion objectives. Training providers are expanding presence to address workforce development needs, with initiatives focusing on bridging digital divides, supporting youth employment through technology certification programs, and enabling local enterprise digital transformation capabilities.

Market Dynamics:

Growth Drivers:

Why is the Italy IT Training Market Growing?

Government Investment in Digital Skills Development

The Italian government has demonstrated substantial commitment to workforce digital competency development through comprehensive funding programs and strategic initiatives. The Fondo Nuove Competenze program has evolved through multiple editions, with the third iteration dedicated to Skills for Innovation receiving substantial budgetary allocations exceeding one billion euros. This fund enables businesses to dedicate working hours to employee training with reimbursement mechanisms, significantly reducing barriers to workforce development investment. The program has attracted substantial participation, with applications from thousands of organizations seeking to enhance employee capabilities in digitalization, artificial intelligence, and sustainable technology domains. Additionally, the National Digital Skills Strategy establishes ambitious targets for population-wide digital proficiency, creating sustained demand for training services across corporate and educational sectors.

Corporate Digital Transformation Acceleration

Italian enterprises are accelerating digital transformation initiatives requiring comprehensive workforce upskilling across multiple technology domains. Organizations recognize that competitive positioning increasingly depends on workforce proficiency in enterprise applications, cloud platforms, data analytics, and emerging technologies. The adoption of generative artificial intelligence solutions has demonstrated exceptional growth, with the proportion of Italian companies implementing these technologies expanding substantially within a single year. Corporate training budgets reflect this strategic priority, with organizations investing significantly in learning technologies and structured development programs. Major technology companies have committed substantial investments to establish cloud infrastructure and deliver AI skills training programs targeting extensive beneficiary populations, creating catalytic momentum for broader market expansion.

Regulatory Compliance Requirements Intensification

The implementation of comprehensive regulatory frameworks has created mandatory training requirements across multiple industry sectors. The NIS2 Directive imposes stringent cybersecurity obligations on critical infrastructure operators, essential service providers, and digital service companies, necessitating systematic security awareness programs and specialized technical training. Organizations subject to these requirements must demonstrate workforce competency in risk management, incident response, and security governance. The regulatory landscape extends beyond cybersecurity to encompass data protection, artificial intelligence ethics, and sector-specific compliance domains. Training providers have responded with comprehensive certification programs and compliance-focused curricula enabling organizations to meet evolving regulatory obligations while developing robust internal capabilities.

Market Restraints:

What Challenges the Italy IT Training Market is Facing?

Persistent Digital Skills Gap in Workforce

Italy faces a substantial digital skills deficit compared to European counterparts, with a significant proportion of the population lacking foundational digital competencies. According to the Digital Decade Report 2024, only 45.8% of Italians have basic digital skills compared to the EU average of 55.6%. The percentage of ICT specialists in employment remains below the European average, constraining the pool of qualified trainers and limiting advanced training delivery capacity. This foundational skills gap creates challenges for organizations seeking to implement sophisticated training programs.

Low Adult Participation in Lifelong Learning

Adult participation in training activities remains below European averages, reflecting cultural and structural barriers to continuous professional development. Many workers express concerns about lacking digital skills required for future employment while participation rates in formal learning programs remain insufficient to address these concerns. This participation gap limits market expansion potential despite demonstrated training needs.

Fragmented Training Quality and Standards

The training market exhibits variable quality standards across providers, with assessments indicating that average digital training maturity remains modest. A substantial proportion of organizations rely on basic compliance-focused training without advancing to strategic skill development approaches. This fragmentation creates challenges for organizations seeking to identify high-quality training partners delivering measurable competency outcomes.

Competitive Landscape:

The Italy IT training market exhibits a diversified competitive structure comprising global technology training providers, specialized regional academies, corporate learning platforms, and educational institutions. Market participants differentiate through specialized domain expertise, delivery modality flexibility, certification partnerships, and technology platform capabilities. Global technology companies maintain significant presence through authorized training partner networks and direct enterprise education programs. Regional providers leverage local market knowledge and language capabilities to serve small and medium enterprise segments. The competitive landscape is evolving with increased emphasis on hybrid delivery models, AI-enhanced learning platforms, and outcome-based training methodologies. Strategic partnerships between technology vendors and training institutions continue shaping market dynamics.

Recent Developments:

-

In January 2025, BCC Iccrea Group, Italy's largest cooperative banking group, signed partnership agreement with Accenture to support IT transformation including investment program of over €300 Million over three years, covering improvement and modernization of core banking applications, expansion of digital channel products and services, and acceleration of AI strategy program.

Italy IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporates, Schools and Colleges, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Italy IT training market size was valued at USD 1,912.64 Million in 2025.

The Italy IT training market is expected to grow at a compound annual growth rate of 2.87% from 2026 to 2034 to reach USD 2,467.45 Million by 2034.

Enterprise application and software training segment dominated the market with approximately 34% revenue share in 2025, driven by accelerating digital transformation initiatives across Italian industries requiring workforce proficiency in enterprise resource planning systems, customer relationship management platforms, and cloud-based business solutions.

Key factors driving the Italy IT training market include substantial government investment through programs such as Fondo Nuove Competenze exceeding one billion euros, corporate digital transformation acceleration with major technology investments in AI infrastructure and training, and intensifying regulatory compliance requirements under the NIS2 Directive mandating workforce cybersecurity competencies.

Major challenges include a persistent digital skills gap with significant portions of the population lacking foundational digital competencies, below-average adult participation rates in lifelong learning programs, fragmented training quality standards across providers, limited ICT specialist availability constraining advanced training delivery capacity, and coordination challenges between educational institutions and evolving industry requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)