Italy Mushroom Market Size, Share, Trends and Forecast by Mushroom Type, Form, Distribution Channel, End Use, and Region, 2025-2033

Italy Mushroom Market Overview:

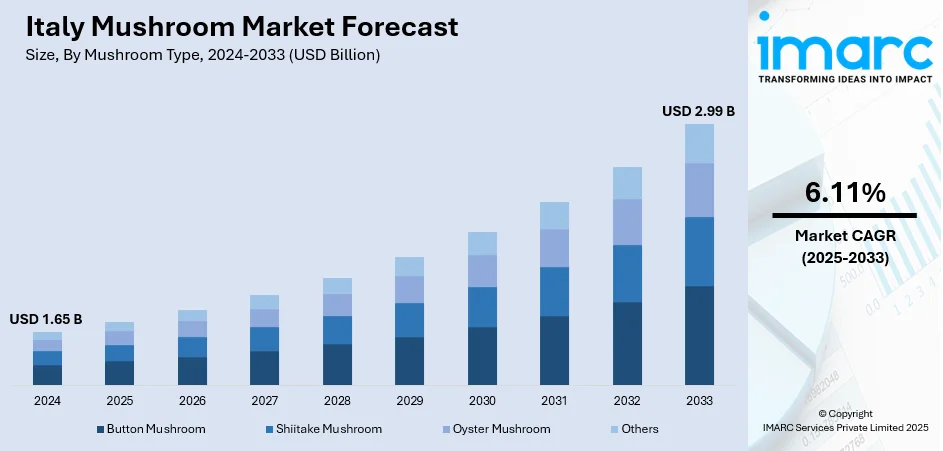

The Italy mushroom market size reached USD 1.65 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.99 Billion by 2033, exhibiting a growth rate (CAGR) of 6.11% during 2025-2033. Health-conscious lifestyles and an aging population in Italy are driving the demand for nutrient-rich mushrooms, while the rising number of e-commerce and direct-to-consumer (DTC) platforms is reshaping access and distribution. Together, these trends support market innovation, greater consumer reach, and expanded opportunities for mushroom producers across the country, thereby boosting the overall Italy mushroom market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.65 Billion |

| Market Forecast in 2033 | USD 2.99 Billion |

| Market Growth Rate 2025-2033 | 6.11% |

Italy Mushroom Market Trends:

Rise of E-commerce and Direct-to-Consumer (DTC) Channels

The growth of e-commerce and direct-to-consumer (D2C) sales models is greatly changing the dynamics of mushroom marketing and distribution in Italy. As online grocery platforms, specialty food delivery services, and farm-to-table networks gain popularity, consumers are now able to access a wider selection of mushrooms, including gourmet and unique varieties, that are frequently missing from standard supermarket offerings. This change is especially beneficial for small and medium-sized mushroom growers, allowing them to avoid major distributors, establish their brand presence online, and directly reach health-oriented, ethically aware consumers. Subscription services and curated produce boxes are progressively incorporating mushrooms as key ingredients, addressing the growing demand for convenience, freshness, and seasonal foods. The clarity and trackability provided by e-commerce platforms attract consumers who value informed decisions regarding food. The IMARC Group estimates that Italy's e-commerce market will attain USD 1,261.4 Million by 2033, highlighting significant digital growth opportunities that the mushroom industry can effectively leverage. This digital transformation improves visibility and promotes immediate consumer interaction, while allowing producers to swiftly adjust to shifting market demands. This result in a more flexible, adaptive, and varied mushroom supply chain that fosters innovation and continued market growth.

To get more information on this market, Request Sample

Growing Health Consciousness and Dietary Trends

The rising health consciousness among consumers in Italy, partly driven by a heightened emphasis on nutrition-oriented lifestyles, is impelling the Italy mushroom market growth. Mushrooms have a naturally low-calorie count, are fat-free, and are high in antioxidants, making them a suitable option for individuals looking for healthier food choices. Their rich protein levels, ability to enhance immunity, and function as a meat substitute in plant-based diets are increasing their nutritional attractiveness. With a growing number of people embracing functional and sustainable diets, mushrooms are being acknowledged not just as common ingredients but also as essential elements in health-conscious meal plans. This change is particularly evident in older adults, who tend to focus more on immune health, digestion, and preventing chronic diseases through their diet. As per Eurostat (2025), Italy possesses the oldest demographic in the EU, with a median age surpassing 48 years and almost 24% of its population being 65 years or older. This demographic change is influencing consumption trends, as older individuals are progressively looking for organic, locally sourced foods that promote health and longevity. Mushrooms, known for their nutrient richness and adaptability, are satisfying this need in both domestic cooking and health-focused dining establishments. This broad and demographic-led acceptance of mushrooms is influencing buying choices and encouraging producers to create new varieties and formats tailored specifically for the health and wellness market segment.

Italy Mushroom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on mushroom type, form, distribution channel, and end use.

Mushroom Type Insights:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

The report has provided a detailed breakup and analysis of the market based on the mushroom type. This includes button mushroom, shiitake mushroom, oyster mushroom, and others.

Form Insights:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh mushroom, canned mushroom, dried mushroom, and others.

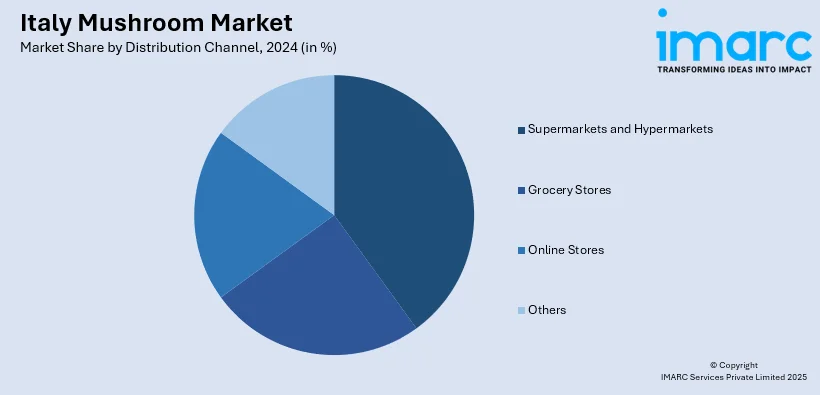

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, grocery stores, online stores, and others.

End Use Insights:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes food processing industry, food service sector, direct consumption, and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Mushroom Market News:

- In May 2024, Treviso, Italy hosted the European Mushroom Producers Group meeting to address key industry challenges and EU regulations. Delegates discussed issues like peat use, substrate imports from China, and market sustainability. A €5 million EU-funded campaign (#europeanmushrooms) was also launched to boost mushroom consumption across Europe.

Italy Mushroom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mushroom Types Covered | Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others |

| Forms Covered | Fresh Mushroom, Canned Mushroom, Dried Mushroom, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| End Uses Covered | Food Processing Industry, Food Service Sector, Direct Consumption, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy mushroom market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy mushroom market on the basis of mushroom type?

- What is the breakup of the Italy mushroom market on the basis of form?

- What is the breakup of the Italy mushroom market on the basis of distribution channel?

- What is the breakup of the Italy mushroom market on the basis of end use?

- What is the breakup of the Italy mushroom market on the basis of region?

- What are the various stages in the value chain of the Italy mushroom market?

- What are the key driving factors and challenges in the Italy mushroom market?

- What is the structure of the Italy mushroom market and who are the key players?

- What is the degree of competition in the Italy mushroom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy mushroom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy mushroom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy mushroom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)