Italy Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

Italy Paper Packaging Market Overview:

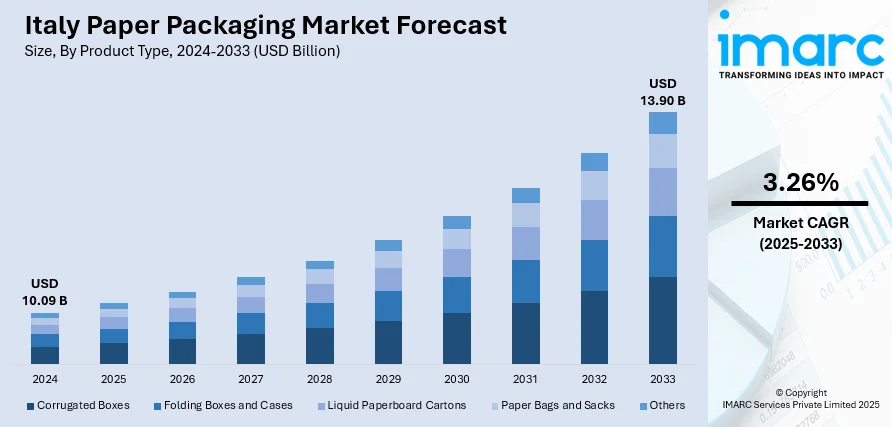

The Italy paper packaging market size reached USD 10.09 Billion in 2024. The market is projected to reach USD 13.90 Billion by 2033, exhibiting a growth rate (CAGR) of 3.26% during 2025-2033. The market is driven by the expansion of the food, beverage, cosmetics, and e‑commerce sectors, which require durable and visually appealing packaging; strong regulatory pressures from the European Union (EU) and national policies promoting recyclable and biodegradable materials. Moreover, the Italy’s legacy of design innovation combined with advanced industrial capabilities is surging the Italy paper packaging market share. These drivers collectively push businesses toward adopting sustainable, high-quality paper packaging solutions that meet both consumer expectations for eco-friendly products and the functional needs of various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.09 Billion |

| Market Forecast in 2033 | USD 13.90 Billion |

| Market Growth Rate 2025-2033 | 3.26% |

Italy Paper Packaging Market Trends:

Growth in Food, Cosmetics, and E‑Commerce

Italy’s paper packaging market is strongly influenced by its thriving food and beverage industry, which relies heavily on corrugated boxes and paperboard for transporting and presenting products like wine, pasta, and confectionery. The cosmetics sector, known for its premium positioning, also drives demand for high-quality, aesthetically appealing packaging solutions. Additionally, the rapid expansion of e‑commerce has transformed packaging needs, increasing the demand for protective yet lightweight materials that can withstand shipping. Paper packaging has emerged as a preferred solution due to its versatility, durability, and consumer appeal as a sustainable option. Together, these industries are creating consistent demand for innovative and functional paper-based packaging across both domestic and export markets, making this a key Italy paper packaging market trends.

To get more information on this market, Request Sample

Regulatory and Sustainability Pressures

Regulations at both the European Union and national levels are reshaping Italy’s packaging industry, pushing businesses toward paper-based solutions over traditional plastics. These policies emphasize recyclable, biodegradable, and circular-economy-friendly materials, making paper packaging an appealing choice for companies aiming for compliance and a stronger environmental image. This regulatory momentum is supported by Italy’s strong recycling performance—in 2023, the country recycled 75.3% of all packaging waste, with paper and cardboard achieving an impressive 92.3% recycling rate, exceeding EU 2030 targets. At the same time, Italian consumers are becoming increasingly conscious of sustainability, actively seeking eco-friendly packaging. This blend of progressive legislation and evolving consumer preferences is accelerating the shift toward responsibly sourced, recyclable, and compostable paper packaging. As a result, paper has become a leading alternative for industries seeking to meet both regulatory demands and expectations thus aiding the Italy paper packaging market growth.

Innovation, Design, and Industrial Strength

Italy’s long-standing reputation for design excellence and innovation extends naturally into its paper packaging industry, which continues to evolve with new technologies and creative solutions. Producers are focusing on advanced features such as lightweighting, improved recyclability, and coatings that maintain product integrity while remaining eco-friendly. Italian companies also prioritize aesthetic design, making packaging not only functional but also appealing, which is especially important for premium food and cosmetics products. The country’s strong industrial base, including its expertise in packaging machinery and manufacturing capabilities, supports continuous innovation and scalability. This synergy between design heritage, technological advancement, and industrial capacity ensures that Italy remains competitive in delivering high-quality paper packaging that meets both domestic and international demand.

Italy Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

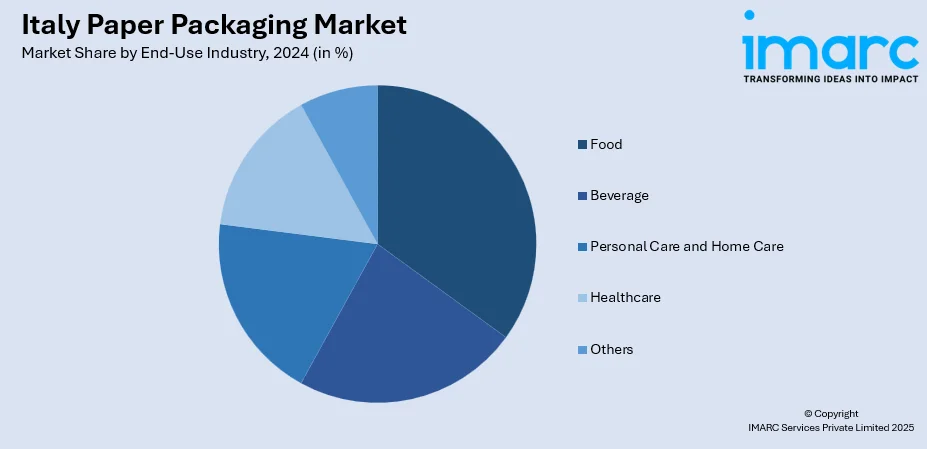

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Paper Packaging Market News:

- In April 2025, VPK Group acquired Open Imballaggi, a family-owned corrugated packaging producer in Calcinate, Italy, strengthening its presence in one of Europe’s largest packaging markets. Open Imballaggi operates a sheet plant with a capacity of 40 million m², serving 700 customers across various industries. This move builds on VPK’s previous Italian expansions, including acquiring Zetacarton and forming a joint venture with Iemme Packaging, further boosting its corrugated packaging operations in the country.

- In September 2024, Nestlé is advancing its sustainability goals by expanding paper-based packaging across major brands. The company recently introduced paperboard canisters for its Vital Proteins brand, reducing plastic use significantly while ensuring durability and functionality. Developed at Nestlé’s R&D center with external partners, the design features a proprietary leak-proof coverlid. Nestlé’s global R&D teams are also collaborating with suppliers to create next-generation high-barrier paper packaging for diverse product categories, including more sensitive items like coffee.

- In August 2024, Valmatic and Ital-Agro partnered to launch Valpeck, a paper-based single-dose packaging solution aimed at the agricultural sector. Developed for Ital-Agro’s Blackjak Bio bioactivator, Valpeck combines sustainability with functionality, offering an eco-friendly alternative to traditional single-dose packs. This collaboration highlights both companies’ commitment to innovation and reducing environmental impact in agricultural packaging solutions. The launch took place on 5 August 2024.

Italy Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy paper packaging market on the basis of product type?

- What is the breakup of the Italy paper packaging market on the basis of grade?

- What is the breakup of the Italy paper packaging market on the basis of packaging level?

- What is the breakup of the Italy paper packaging market on the basis of end-use industry?

- What is the breakup of the Italy paper packaging market on the basis of region?

- What are the various stages in the value chain of the Italy paper packaging market?

- What are the key driving factors and challenges in the Italy paper packaging market?

- What is the structure of the Italy paper packaging market and who are the key players?

- What is the degree of competition in the Italy paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)