Italy Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2026-2034

Italy Private Equity Market Summary:

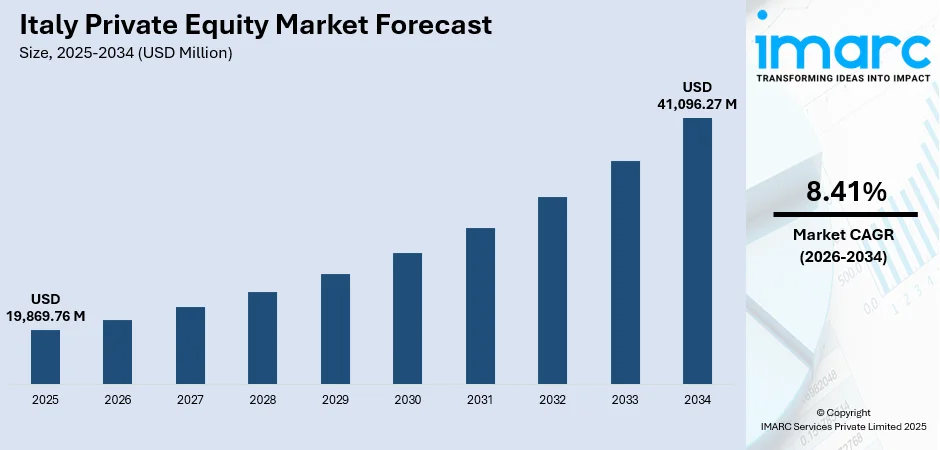

The Italy private equity market size was valued at USD 19,869.76 Million in 2025 and is projected to reach USD 41,096.27 Million by 2034, growing at a compound annual growth rate of 8.41% from 2026-2034.

The market is driven by increasing investor confidence, robust capital inflows, and favorable government reforms promoting business-friendly environments. Strategic focus on innovation-led enterprises, efficient deal structuring mechanisms, and supportive regulatory frameworks continues to attract both domestic and international investors. The growing emphasis on cross-border investment activities and sector diversification strengthens long-term opportunities, contributing significantly to Italy private equity market share.

Key Takeaways and Insights:

-

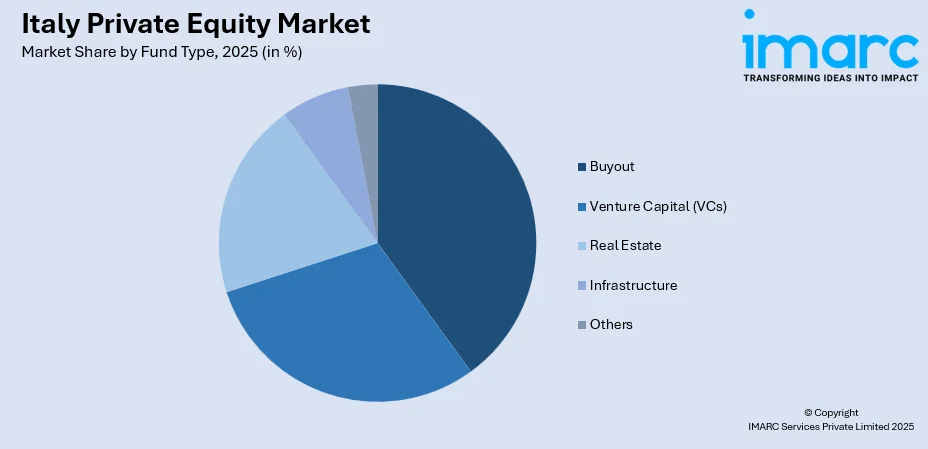

By Fund Type: Buyout dominates the market with a share of 38.07% in 2025, driven by investors favoring established firms with predictable cash flows, operational efficiencies, and strategic growth via management optimization and market consolidation.

-

Key Players: The market exhibits a moderately fragmented competitive landscape, with established international investment firms competing alongside domestic players across various fund types and investment stages, fostering innovation and value-driven deal approaches.

To get more information on this market Request Sample

Italy private equity market continues to evolve as a dynamic investment landscape characterized by increasing institutional participation and strategic capital deployment across diverse sectors. The market benefits from Italy's strong industrial heritage, particularly in manufacturing, fashion, and design sectors, which provide substantial opportunities for value creation through operational improvements and digital transformation initiatives. Growing interest from international investors seeking exposure to Southern European markets has accelerated deal activity, while domestic family offices increasingly participate in co-investment structures. As per sources, in 2023, Fondo Italiano’s FIPEC Fund reached €113 million in its second close, targeting €150 million to co-invest alongside private equity firms in Italian SMEs. Moreover, the favorable regulatory environment, enhanced corporate governance frameworks, and streamlined acquisition processes have collectively strengthened market fundamentals, positioning Italy as an attractive destination for private equity investments seeking both stable returns and growth potential.

Italy Private Equity Market Trends:

Digital Transformation and Technology Integration

Italian private equity investors increasingly target enterprises advancing digital transformation and adopting cutting-edge technologies across traditional sectors. Technology-driven modernization is recognized as a key driver of operational efficiency, cost optimization, and enhanced competitive positioning. Investors focus on opportunities in areas such as manufacturing automation, enterprise software, AI-enabled processes, and digitally integrated business models. Firms demonstrating scalable technological infrastructure and potential for process optimization, market expansion, and measurable value creation are particularly attractive, aligning investment strategy with long-term growth and innovation objectives. In October 2025, TIM Enterprise announced a €1 billion three-year plan to expand 17 data centers, AI-ready facilities, and edge cloud infrastructure, driving Italy’s digital transformation and technology sovereignty.

Sustainable and ESG-Focused Investments

Sustainability and ESG principles have become central to Italian private equity investment strategies. Fund managers are systematically integrating environmental, social, and governance metrics into due diligence, portfolio management, and capital allocation decisions. According to sources, in 2025, Fondo Italiano d’Investimento partnered with ESG.IAMA Private to quantitatively assess and map the sustainability levels of Italian private market fund managers, with findings. Moreover, companies demonstrating measurable reductions in environmental impact, adherence to social responsibility standards, and transparent governance structures are increasingly prioritized. This approach aligns with evolving regulatory frameworks and stakeholder expectations, while enhancing long-term investment value. ESG-focused investments are seen not only as responsible but also as drivers of operational resilience, brand reputation, and market differentiation.

Succession-Driven Transaction Activity

The Italian market experiences robust transaction activity due to generational succession in family-owned enterprises, particularly in manufacturing and specialized industrial sectors. According to sources, Fondo Italiano d’Investimento acquired a 70% stake in Santangelo Group for $34.6 Million via its Agri&Food Fund, marking the fund’s fifth transaction in less than two years. Further, private equity investors are engaging to provide professional management support, liquidity solutions, and growth capital, ensuring business continuity during ownership transitions. These partnerships facilitate strategic internationalization and modernization initiatives while preserving legacy value. Succession-driven deals offer investors high-quality, established assets with strong operational foundations, while enabling families to realize liquidity, optimize management structures, and implement long-term growth strategies in alignment with evolving market demands.

Market Outlook 2026-2034:

Italy private equity market is expected to witness substantial revenue growth throughout the forecast period, driven by sustained investor confidence and expanding deal pipelines across multiple sectors. Revenue generation opportunities are anticipated to strengthen as institutional capital allocation toward alternative investments increases, supported by favorable yield differentials compared to traditional asset classes. The market revenue trajectory reflects continued interest in technology-enabled enterprises, healthcare innovations, and sustainable infrastructure, positioning Italy as a compelling destination for private equity capital deployment. The market generated a revenue of USD 19,869.76 Million in 2025 and is projected to reach a revenue of USD 41,096.27 Million by 2034, growing at a compound annual growth rate of 8.41% from 2026-2034.

Italy Private Equity Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Fund Type |

Buyout |

38.07% |

Fund Type Insights:

Access the comprehensive market breakdown Request Sample

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Buyout dominates with a market share of 38.07% of the total Italy private equity market in 2025.

Buyout remains the most significant area of activity in the Italian private equity market, driven by investor interest in established companies with stable cash flows and strong operational foundations. Private equity firms leverage buyouts to implement efficiency improvements, strengthen governance structures, and pursue strategic initiatives that enhance value. These investments enable firms to optimize performance, scale operations, and position businesses for sustainable growth, generating attractive risk-adjusted returns while maintaining long-term operational stability.

It is further supported by opportunities for market consolidation and expansion. Investors often target companies with professional management teams, scalable business models, and potential for digital or technological integration. As per sources, in October 2025, One Equity Partners acquired a 57.8% stake in Italian IT services firm Digital Value SpA, while River Pines Capital invested in marketing company Growthloop BV, highlighting active buyout activity. Moreover, this segment also benefits from succession-driven transactions in family-owned enterprises, where structured private equity partnerships provide continuity, growth capital, and professional oversight. Overall, buyouts offer investors the ability to combine operational improvements, strategic expansion, and financial discipline to create meaningful value.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

Northwest dominates Italy's private equity landscape, anchored by Milan's position as the nation's financial capital and home to major banking institutions, investment management firms, and corporate headquarters. Lombardy's robust industrial manufacturing ecosystem, spanning automotive components, machinery, and precision engineering, provides extensive investment opportunities. The region benefits from superior transportation infrastructure, skilled workforce availability, and established business networks facilitating efficient deal origination and execution processes.

Northeast represents a significant market segment characterized by numerous family-owned industrial enterprises concentrated across Veneto, Emilia-Romagna, and Friuli-Venezia Giulia. The area's manufacturing excellence in furniture, fashion accessories, agricultural machinery, and food processing creates attractive investment targets. Strong export orientation and established supply chain networks enhance portfolio company growth potential, while succession dynamics among generational businesses generate consistent deal flow opportunities.

Central encompassing Tuscany, Lazio, and Umbria, offers diversified investment opportunities spanning luxury goods, pharmaceuticals, and service-oriented enterprises. Rome's concentration of government-related contracts and infrastructure projects attracts private equity interest, while Florence's fashion and craftsmanship heritage provides niche investment targets. The region's tourism infrastructure and cultural assets create additional value creation pathways through hospitality sector consolidation and experiential economy investments.

South presents emerging investment opportunities supported by government incentive programs promoting regional development and industrial modernization. In 2023, Italy merged 8 southern SEZs into a Single Special Economic Zone effective 1 January 2024, offering tax credits, bureaucratic benefits, and infrastructure support to over 160 approved Italian and foreign investors. The area's agricultural sector, particularly premium food production and wine manufacturing, attracts specialized private equity interest. Improving infrastructure connectivity and expanding renewable energy installations enhance the region's investment attractiveness, though transactions require careful due diligence regarding operational and regulatory considerations specific to southern markets.

Others including Sicily, Sardinia, and smaller administrative areas contribute modestly to overall market activity while presenting selective opportunities in tourism, renewable energy, and agribusiness sectors. These areas benefit from targeted investment incentives and structural funding mechanisms designed to stimulate economic development. Private equity interest remains concentrated on specific asset classes demonstrating competitive advantages derived from geographic positioning, natural resources, or established market positions within niche industries.

Market Dynamics:

Growth Drivers:

Why is the Italy Private Equity Market Growing?

Favorable Regulatory Environment and Policy Support

Italy's regulatory framework has undergone significant modernization to enhance investment attractiveness and streamline transaction processes. Legislative reforms have strengthened corporate governance requirements, improved transparency standards, and reduced bureaucratic complexities that historically impeded business operations. Government initiatives specifically targeting foreign investment promotion, combined with tax incentives for venture capital and startup investments, create supportive conditions for private equity activity. In March 2024, Italy issued a ministerial decree implementing the Investment Management Exemption regime, easing compliance for foreign investment vehicles and promoting private equity and crossborder fund activity. Moreover, these regulatory improvements facilitate smoother merger and acquisition processes while protecting stakeholder interests, thereby encouraging both domestic and international capital deployment.

Expanding Entrepreneurial Ecosystem and Innovation Focus

Italy's entrepreneurial landscape has strengthened considerably through proliferating incubator programs, accelerator networks, and venture capital initiatives supporting early-stage enterprises. This developing ecosystem produces a growing pipeline of investment-ready businesses across technology, sustainability, and life sciences sectors. According to reports, the Techstars Transformative World Torino Accelerator launched its Class of 2025, featuring 12 startups supported by Intesa Sanpaolo Innovation Center, enhancing Turin’s entrepreneurial ecosystem and innovation landscape. Additionally, educational institutions continue producing skilled graduates equipped with technical expertise and entrepreneurial capabilities, while collaborative frameworks connecting academia with industry foster innovation commercialization. Private equity investors benefit from increased deal flow quality as startups mature through structured development pathways, presenting attractive growth capital and buyout opportunities.

Increasing Institutional Capital Allocation and Investment Diversification

Growing institutional investor participation continues driving market expansion as pension funds, insurance companies, sovereign wealth entities, and family offices increase allocations toward alternative investment strategies. Italy's relatively stable economic outlook and attractive return potential across various sectors encourage capital inflows from both domestic and international sources. Financial institutions are developing more sophisticated and flexible financing structures, including debt-equity combinations and hybrid instruments, which reduce investment barriers while enabling participation across diverse transaction sizes and company profiles.

Market Restraints:

What Challenges the Italy Private Equity Market is Facing?

Economic Volatility and Macroeconomic Uncertainties

Italy’s integration within the broader European economy exposes investors to macroeconomic fluctuations, including sovereign debt concerns, inflationary pressures, currency volatility, and interest rate changes. These factors influence valuation assumptions, risk-adjusted return expectations, and deal structuring. Private equity firms must adopt comprehensive risk assessment frameworks and may experience prolonged due diligence timelines, as economic uncertainty necessitates cautious investment decision-making to safeguard capital and maintain projected portfolio performance.

Complex Administrative Procedures and Regional Disparities

Despite ongoing regulatory reforms, Italy’s administrative environment remains complex, with multi-layered bureaucratic procedures that can delay transactions and increase execution costs. Significant regional differences in business practices, regulatory enforcement, and judicial efficiency contribute to inconsistent operating conditions. Effective portfolio management and value creation initiatives therefore require localized knowledge, targeted expertise, and adaptive strategies to navigate regional disparities while ensuring compliance and operational continuity across diverse jurisdictions.

Limited Exit Opportunities in Certain Market Segments

Private equity investors in Italy face constrained exit options, particularly for small enterprises or niche-sector businesses. Limited domestic capital market depth and subdued strategic buyer activity can extend holding periods, influencing liquidity planning and return projections. This environment necessitates careful investment sizing, exit strategy formulation, and scenario modeling, ensuring that portfolio companies maintain sustainable growth trajectories while positioning for eventual divestment under favorable market conditions.

Competitive Landscape:

Italy private equity market demonstrates a moderately fragmented competitive structure characterized by diverse participant profiles competing across varying investment stages, fund sizes, and sector specializations. Established international investment management organizations maintain significant market presence, leveraging global networks, substantial capital reserves, and cross-border transaction expertise to pursue larger buyout opportunities. Domestic investment firms differentiate through deep local market knowledge, established relationships with family-owned enterprise networks, and specialized sector expertise particularly valuable in mid-market transactions. The competitive environment continues evolving as new market entrants, including corporate venture units and specialized growth capital providers, expand the investor base while intensifying competition for quality deal flow.

Recent Developments:

-

In September 2025, Ropes & Gray deepened its European private equity presence by opening a Milan office, adding partners Cataldo Piccarreta, Giorgia Lugli, and Luca Maranetto. The expansion enhances the firm’s cross-border M&A and private equity advisory capabilities, supporting clients in Italy’s rapidly growing private market and complementing its established London and Paris offices.

Italy Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Italy private equity market size was valued at USD 19,869.76 Million in 2025.

The Italy private equity market is expected to grow at a compound annual growth rate of 8.41% from 2026-2034 to reach USD 41,096.27 Million by 2034.

Buyout commands the market, reflecting investor preference for established companies with predictable cash flows, strong operational improvement potential, and opportunities for strategic consolidation, enabling value creation through efficiency enhancements and market expansion initiatives.

Key factors driving the Italy private equity market include favorable regulatory reforms, increasing institutional capital allocation, growing entrepreneurial ecosystem, cross-border investment activity, and succession-driven transaction opportunities among family enterprises.

Major challenges in Italy private equity market include economic volatility impacting investment confidence, complex regional administrative procedures, limited exit options in niche sectors, valuation gaps between buyers and sellers, and intensified competition for high-quality deals, requiring careful risk assessment and strategic execution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)