Italy Running Gear Market Size, Share, Trends and Forecast by Product, Gender, Distribution Channel, and Region, 2025-2033

Italy Running Gear Market Overview:

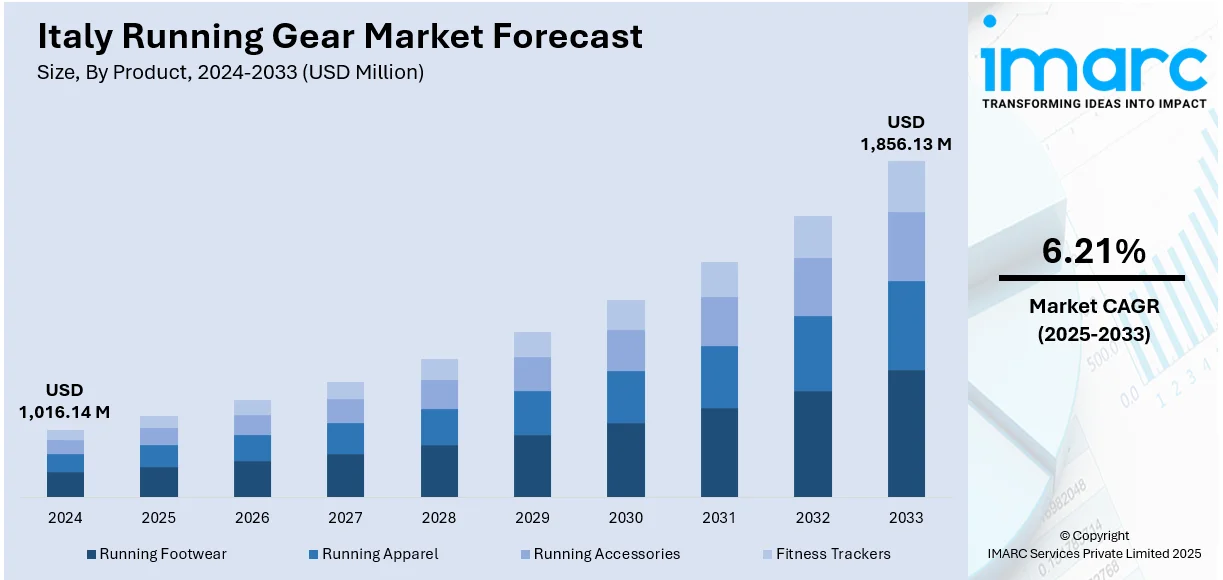

The Italy running gear market size reached USD 1,016.14 Million in 2024. Looking forward, the market is projected to reach USD 1,856.13 Million by 2033, exhibiting a growth rate (CAGR) of 6.21% during 2025-2033. The market is fueled by a countrywide move towards urban fitness lifestyles and increased involvement in amateur running pursuits. Local and international brands are driving innovation at pace through performance-led but design-driven products that are specifically accommodated for Italian tastes. Retail diversification and digitalization are also enhancing Italy running gear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,016.14 Million |

| Market Forecast in 2033 | USD 1,856.13 Million |

| Market Growth Rate 2025-2033 | 6.21% |

Italy Running Gear Market Trends:

Fitness Culture and Urban Wellness Lifestyles

Italy has witnessed a significant lifestyle transformation, with growing public interest in fitness, wellness, and outdoor recreation. Running has gained momentum as a convenient, low-cost form of physical activity embraced by both young adults and middle-aged consumers across urban centers such as Milan, Rome, and Turin. Public investments in parks, running tracks, and wellness infrastructure have encouraged participation in 5Ks, half-marathons, and informal jogging routines. This cultural shift is reflected in rising demand for performance-oriented running gear, including breathable apparel, cushioned shoes, and wearable accessories. Italian consumers, particularly in metropolitan areas, seek stylish yet functional gear that supports both athletic performance and daily wear. Influencers and health professionals increasingly promote running as a solution for stress management and cardiovascular health, influencing consumer buying behavior. Retailers and fitness brands capitalize on these trends through digital marketing campaigns and personalized shopping experiences. As health consciousness rises and urban populations embrace active living, running gear has evolved from a niche product to an essential component of the wellness wardrobe. The Italy running gear market growth is directly supported by this convergence of urban fitness culture, aspirational lifestyles, and increasing engagement in personal health.

To get more information on this market, Request Sample

Innovation by Domestic and Global Brands

Italy’s running gear market benefits from the presence of both premium domestic manufacturers and globally recognized athletic brands. Companies emphasize innovation in footwear cushioning, moisture-wicking apparel, and lightweight materials tailored to varying runner profiles—from beginners to elite athletes. Italian brands blend performance engineering with fashion-forward aesthetics, leveraging the country’s design heritage to create products that resonate with both style and utility. Meanwhile, international players like Nike, Adidas, and Asics invest in localized product strategies and limited-edition launches tailored to Italian climate and terrain. These offerings include trail running shoes for mountainous regions and breathable gear optimized for Mediterranean heat. Augmented reality (AR) sizing tools, gait analysis in-store, and AI-powered product recommendations are enhancing retail experiences, particularly in flagship stores and e-commerce platforms. Collaborations with Italian sports personalities and running clubs further cement brand relevance and build consumer trust. The competitive landscape drives continuous innovation in fit, performance, and design, encouraging higher product turnover and premiumization. These brand-led advancements maintain product freshness and consumer loyalty, ensuring a dynamic and responsive market.

Retail Diversification and E-Commerce Integration

The distribution landscape for running gear in Italy is expanding beyond traditional sportswear stores, driven by digital transformation and omni-channel retail strategies. Large format chains, specialty running outlets, department stores, and fitness clubs now carry technical footwear, apparel, and accessories catering to runners of all levels. E-commerce adoption—accelerated by post-pandemic shifts—has reshaped the consumer journey, with leading brands and platforms offering virtual fittings, home delivery, and easy returns. Local retailers have integrated digital storefronts with physical locations, offering real-time inventory tracking, in-store pickups, and member discounts to enhance engagement. Online marketplaces and D2C (direct-to-consumer) brands are thriving by targeting niche runner communities and hobbyist segments with curated collections and personalized content. Social commerce, influencer-led product demos, and interactive apps have further blurred the line between inspiration and purchase. Even in smaller towns, mobile-first retailing and national shipping logistics have expanded access to performance-grade gear. The seamless alignment of online and offline channels has significantly increased market reach, especially among tech-savvy Gen Z and millennial consumers. As omnichannel experiences improve, distribution innovation remains central to the long-term scalability and resilience of the running gear ecosystem.

Italy Running Gear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, gender, and distribution channel.

Product Insights:

- Running Footwear

- Running Apparel

- Running Accessories

- Fitness Trackers

The report has provided a detailed breakup and analysis of the market based on the product. This includes running footwear, running apparel, running accessories, and fitness trackers.

Gender Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on gender. This includes male, female, and unisex.

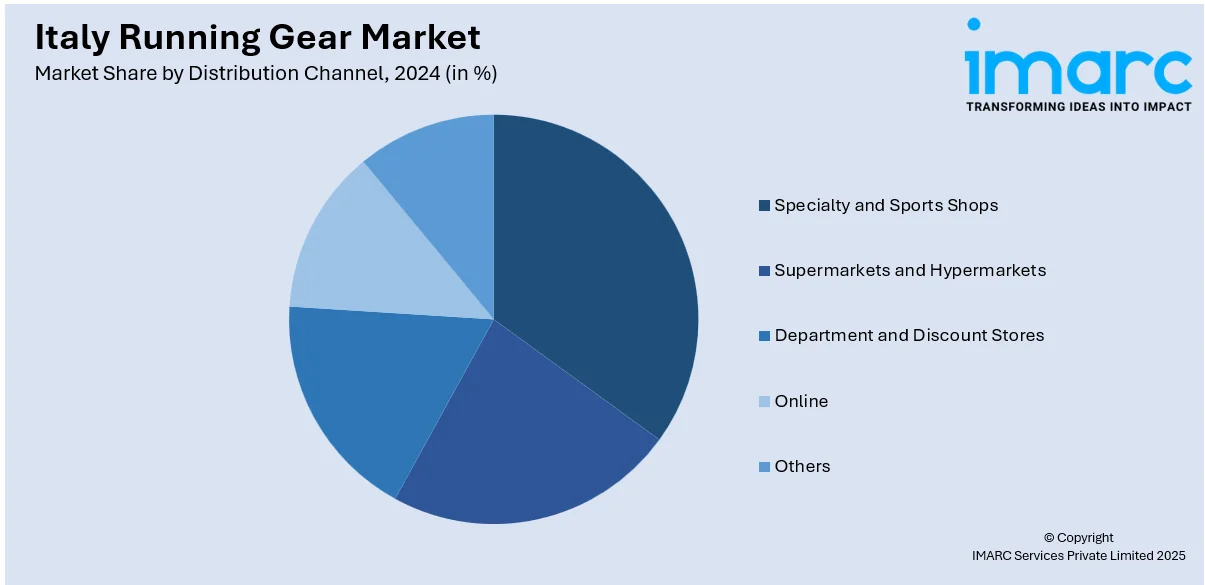

Distribution Channel Insights:

- Specialty and Sports Shops

- Supermarkets and Hypermarkets

- Department and Discount Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty and sports shops, supermarkets and hypermarkets, department and discount stores, online, and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Running Gear Market News:

- On December 10, 2024, Cerma Srl, an Italian manufacturer based in Vezzano sul Crostolo, Emilia Romagna was acquired by DexKo Global Inc., a global leader in trailer running gear and hydraulic components. Founded in 1966, Cerma specializes in high-precision components for off-highway and industrial markets, including hydraulic valves and manifolds. With this acquisition, DexKo strengthens its hydraulics value chain.

- On July 18, 2023, Italy’s UYN (Unleash Your Nature), a brand by Trerè Innovation, announced the launch of UYN® Running, the first running shoes engineered from socks, debuting for Spring 2024. The lineup includes three models—Synapsis (USD 179.00), Neuron (USD 179.00), and 6Sense (USD 199.00)—designed for road, trail, and cross trail running, respectively. The footwear incorporates neuro-reactive training insights and proprietary sustainable technologies such as Flexicorn bio-fiber and the Reaxing platform treadmill to enhance stability, comfort, and performance in unpredictable outdoor conditions.

Italy Running Gear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Running Footwear, Running Apparel, Running Accessories, Fitness Trackers |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Specialty and Sports Shops, Supermarkets and Hypermarkets, Department and Discount Stores, Online, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy running gear market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy running gear market on the basis of product?

- What is the breakup of the Italy running gear market on the basis of gender?

- What is the breakup of the Italy running gear market on the basis of distribution channel?

- What is the breakup of the Italy running gear market on the basis of region?

- What are the key driving factors and challenges in the Italy running gear market?

- What is the structure of the Italy running gear market and who are the key players?

- What is the degree of competition in the Italy running gear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy running gear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy running gear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy running gear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)