Italy Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Italy Steel Tubes Market Overview:

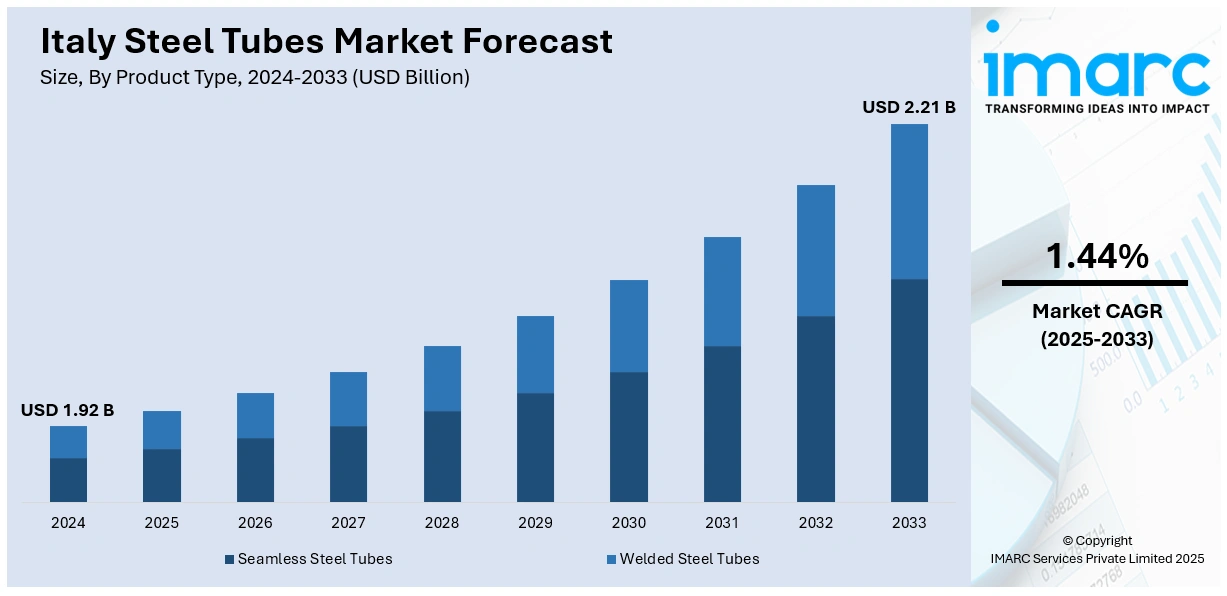

The Italy steel tubes market size reached USD 1.92 Billion in 2024. The market is projected to reach USD 2.21 Billion by 2033, exhibiting a growth rate (CAGR) of 1.44% during 2025-2033. The market is progressing steadily, supported by growing demand in sectors such as construction, automotive, and energy. Improvements in steel processing and increased focus on green infrastructure are defining industry trends. Domestic production as well as export opportunities are driving market resilience. With changing consumer preferences and continued industrial developments, industry leaders are concentrating on product diversification and strategic partnerships. This report presents a critical examination of trends and projections that affect the Italy steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.92 Billion |

| Market Forecast in 2033 | USD 2.21 Billion |

| Market Growth Rate 2025-2033 | 1.44% |

Italy Steel Tubes Market Trends:

Infrastructure Renewal and Production Momentum

In March 2025, national data showed that Italy’s crude steel production rose in February, marking a steady month-on-month recovery from January lows. This increase signals early signs of industrial momentum returning, with strong implications for downstream segments like steel tubes. Much of the uptick ties into infrastructure renewal efforts across Italy particularly in energy transport, water systems, and urban development where steel tubing plays a critical role. The steady rollout of modernization projects under regional recovery plans has helped drive consistent demand for tubes with both structural and performance specifications. Local tube producers are benefiting from more stable domestic supply conditions, minimizing disruptions tied to fluctuating imports or long logistics lead times. While the market remains sensitive to broader European shifts, the alignment of local production capacity and infrastructure demand is helping build stronger short-term confidence. In this environment, consistency and lead time are becoming just as important as pricing. This growing alignment between public investment and domestic production is currently shaping Italy steel tubes market growth.

To get more information on this market, Request Sample

Green Transition Accelerates Tube Demand

In April 2025, Italy’s national steel industry reported its strongest monthly output since the start of the year, pointing to renewed momentum across construction and energy-related sectors. This resurgence is closely tied to the country’s green building policies and clean energy targets, which are shifting how materials like steel tubes are sourced and specified. As projects increasingly demand environmentally compliant materials, tube manufacturers are seeing more orders for products used in solar installations, energy efficient buildings, and modular structures. At the same time, steel producers are adjusting processes to meet stricter emissions and traceability standards, making domestically produced tubes more attractive to builders and contractors. Beyond structural requirements, clients now expect certifications that align with EU climate directives. This shift is raising the bar for steel tube applications and pushing the industry toward cleaner, more responsive manufacturing. As low-carbon construction takes hold across Italy, the integration of sustainability into production and procurement is set to reshape demand. In this evolving landscape, Italy steel tubes market trends are being directly shaped by the country’s accelerating transition to greener infrastructure.

Trade Policy and Regional Supply Dynamics

In July 2024, Italy’s national steel distributors reported a noticeable decline in domestic flat steel sales, marking a shift in how downstream products like tubes are being ordered across key industrial sectors. This slowdown came at a time when European Union safeguard measures were extended, directly influencing the availability of key inputs such as hot-rolled coil used in tube manufacturing. While intended to protect EU producers, the new quotas are reshaping sourcing patterns, making it more difficult for Italian buyers to access steady volumes from outside Europe. As a result, tube manufacturers are beginning to adjust lead times and shift supply chain planning to rely more heavily on regional sources. This has downstream implications for construction timelines, export logistics, and pricing visibility. Though the intent behind the trade measures is to stabilize the internal market, they also introduce new friction that businesses must navigate carefully. These dynamics are prompting a rethink of sourcing strategies, especially for fabricators and contractors operating on tight delivery schedules.

Italy Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

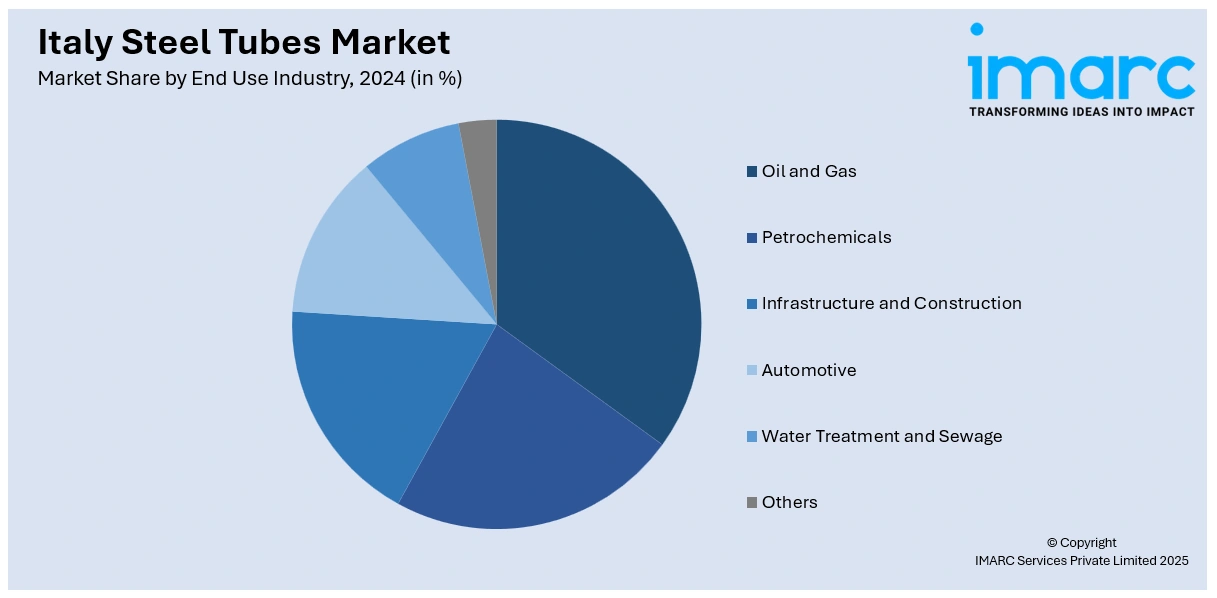

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Steel Tubes Market News:

- January 2025: Marcegaglia UK, a subsidiary of the Italian steelmaker Marcegaglia Group has expanded its Oldbury facility by introducing electro‑welded stainless‑steel tubes to its portfolio. This strategic enhancement complements existing carbon‑steel production and reinforces the firm’s commitment to offering a broad range of products for diverse industries. Focused on grade 304 stainless steel and adhering to EN10296‑2 and ASTM A544 standards, the new capability underscores the group’s dedication to quality and responsiveness to evolving customer needs across the UK and Europe.

- November 2024: Cogne Acciai Speciali, an established Italian stainless‑steel specialist based in Aosta, has successfully completed the acquisition of Germany’s Mannesmann Stainless Tubes from Salzgitter AG. The move marks a strategic expansion into seamless tube production, enhancing vertical integration and reinforcing the company's competitive edge. Under the deal, the acquired business will be rebranded as DMV and further integrated into Cogne’s operations. This milestone reflects Cogne’s ambition to deepen its industrial capabilities and international footprint.

Italy Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Others |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy steel tubes market on the basis of product type?

- What is the breakup of the Italy steel tubes market on the basis of material type?

- What is the breakup of the Italy steel tubes market on the basis of end use industry?

- What is the breakup of the Italy steel tubes market on the basis of region?

- What are the various stages in the value chain of the Italy steel tubes market?

- What are the key driving factors and challenges in the Italy steel tubes market?

- What is the structure of the Italy steel tubes market and who are the key players?

- What is the degree of competition in the Italy steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)