Italy Tire Market Size, Share, Trends and Forecast by Design, End Use, Vehicle Type, Distribution Channel, Season, and Region, 2025-2033

Italy Tire Market Overview:

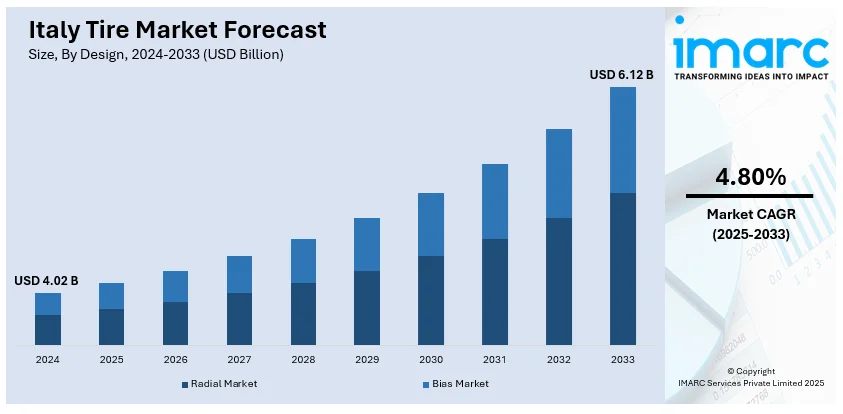

The Italy tire market size reached USD 4.02 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.12 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is driven by inflating disposable income levels, the increasing influence of the automotive aftermarket, rising consumer preference for tire maintenance and services, the growing demand for specialty tires for off-road and agricultural usage, and the paradigm shift towards sustainable and eco-friendly tires.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.02 Billion |

| Market Forecast in 2033 | USD 6.12 Billion |

| Market Growth Rate (2025-2033) | 4.80% |

Italy Tire Market Trends:

Rising vehicle ownership among the masses

The Italian tire market is growing in the country mainly because of rising vehicle ownership brought about by improved financing opportunities and higher disposable incomes, which increase consumer mobility and economic growth. With vehicle ownership becoming more affordable to increasingly larger segments of the population, replacement tire demand increases, led by routine maintenance schedules for vehicles and also by an improving consumer focus on safety and performance. Furthermore, e-commerce has also revolutionized the buying habits of consumers, who can now obtain a broader assortment of tire products online, make comparisons, and make educated purchasing decisions, all of which enhance market growth further. The increased popularity of hybrid and electric cars, which use specialized tires for maximum performance and battery efficiency, also helps fuel the market. The growth in car ownership goes hand in hand with a rising demand for performance-oriented and safety-oriented tire technologies, especially as Italian consumers become increasingly aware of the long-term advantages of investing in good-quality tires. Such consumer consciousness is not just spurring sales volumes but also changing market choice toward more resilient and efficient tire choices.

Growing automotive industry

The expanding automotive sector is a major force behind the Italian tire market, as attested by the impressive growth in car production. Italian car production in 2023 stood at 542,000 units, representing a strong growth of 15% compared to the previous year. This increase in production not only demonstrates the strength of the automotive sector but also the resultant demand for tires. With automotive production being scaled up, demand for premium-quality tires increases at the same time. Every vehicle needs a set of tires customized to meet its unique performance and safety demands, thus contributing to a higher tire sales volume. The expansion of production is also followed by increased use of new technologies, like electric vehicles (EVs) and hybrid models, that again drive tire specifications and developments. Producers are meeting this need by creating specialized tires that are more fuel efficient, safe, and environmentally friendly. In addition, the growth of the automobile sector spurs ancillary industries, such as tire selling and maintenance. Growing car ownership encourages a healthy aftermarket for tires, where customers demand replacements and upgrades, generating additional sales.

Italy Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on design, end use, vehicle type, distribution channel and season.

Design Insights:

- Radial Market

- Bias Market

The report has provided a detailed breakup and analysis of the market based on the design. This includes radial market and bias market.

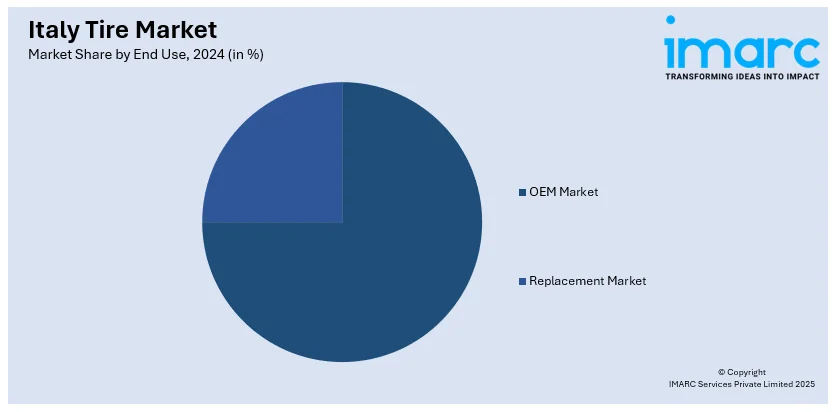

End Use Insights:

- OEM Market

- Replacement Market

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes OEM market, and replacement market.

Vehicle Type Insights:

- Passenger Cars

- Light Commercial Vehicles

- Medium and Heavy Commercial Vehicles

- Two Wheelers

- Three Wheelers

- Off-The-Road (OTR)

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes passenger cars, light commercial vehicles, medium and heavy commercial vehicles, two wheelers, three wheelers, and off-the-road (OTR).

Distribution Channel Insights:

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

Season Insights:

- All Season Tires

- Winter Tires

- Summer Tires

A detailed breakup and analysis of the market based on the season have also been provided in the report. This includes all season tires, winter tires, and summer tires.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Tire Market News:

- March 22, 2023: Pirelli introduced a new High Speed Testing Machine in its Milan R&D center, capable of testing tires at speeds up to 500 kph in controlled conditions. This equipment is designed to enhance tire safety for racing and high-performance road cars, including electric hypercars. It supplements existing machines that reach up to 450 kph, focusing on meeting the rigorous demands of motorsport and record-setting road car applications.

- December 4, 2023: Michelin introduced a new series of motorcycle tires, including the Michelin Power 6 for sport and daily riding, the Michelin Power GP 2 for both track and road use, and the Michelin Anakee Road for road-oriented motorcyclists. The three new tire models were unveiled at the EICMA trade show in Milan, Italy, in November.

Italy Tire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Designs Covered | Radial Market, Bias Market |

| End Uses Covered | OEM Market, Replacement Market |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Medium and Heavy Commercial Vehicles, Two Wheelers, Three Wheelers, Off-The-Road (OTR) |

| Distribution Channels Covered | Offline, Online |

| Seasons Covered | All Season Tires, Winter Tires, Summer Tires |

| Regions Covered | Northwest, Northeast, Central, South, and Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy tire market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy tire market on the basis of design?

- What is the breakup of the Italy tire market on the basis of end use?

- What is the breakup of the Italy tire market on the basis of vehicle type?

- What is the breakup of the Italy tire market on the basis of distribution channel?

- What is the breakup of the Italy tire market on the basis of season?

- What is the breakup of the Italy tire market on the basis of region?

- What are the various stages in the value chain of the Italy tire market?

- What are the key driving factors and challenges in the Italy tire market?

- What is the structure of the Italy tire market and who are the key players?

- What is the degree of competition in the Italy tire market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy tire market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)