Japan 3D Printing Market Size, Share, Trends and Forecast by Technology, Process, Material, Offering, Application, End User, and Region, 2026-2034

Japan 3D Printing Market Size and Share:

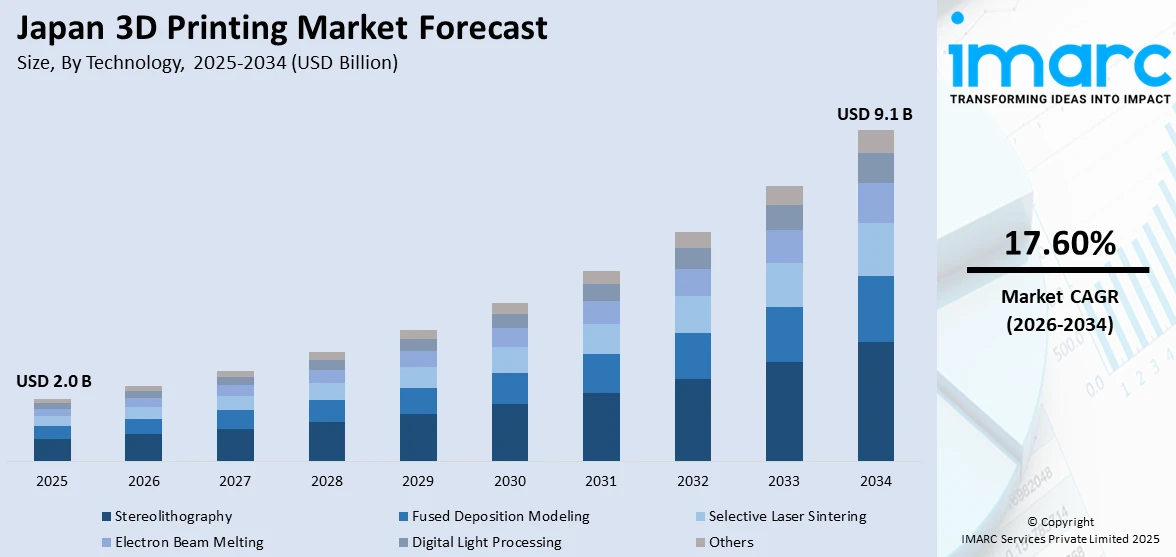

The Japan 3D printing market size was valued at USD 2.0 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 9.1 Billion by 2034, exhibiting a CAGR of 17.60% from 2026-2034. The market is experiencing significant growth, driven by advancements in additive manufacturing, increasing industrial applications, and innovations in eco-friendly materials. Strong government support and demand for customized, high-precision components further enhance its adoption across key sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.0 Billion |

| Market Forecast in 2034 | USD 9.1 Billion |

| Market Growth Rate (2026-2034) | 17.60% |

Japan’s 3D printing market is advancing due to significant technological innovations in materials and printing techniques. Japanese companies are investing heavily in developing high-precision 3D printers and expanding material options, including metals, ceramics, and bio-materials. This progress caters to industries such as automotive and healthcare, which demand customized and complex component production. For instance, in February 2024, Nippon Express Holdings, through its NX Global Innovation Fund, invested in Instalimb, a Japanese startup offering affordable 3D-printed prosthetic legs using AI technology. This investment supports Instalimb’s expansion in Asia and emerging markets, addressing social challenges by improving access to high-quality prosthetics and promoting sustainable societal development. Moreover, the integration of AI and IoT in 3D printing processes enhances efficiency and product quality, making it a preferred solution for rapid prototyping and manufacturing.

To get more information on this market Request Sample

The Japanese government is actively supporting the adoption of 3D printing through funding, subsidies, and research collaborations. These initiatives aim to strengthen advanced manufacturing capabilities and enhance global competitiveness. Programs encouraging the integration of additive manufacturing in small and medium-sized enterprises (SMEs) are particularly impactful, enabling innovation in sectors like electronics and robotics. Additionally, partnerships between public institutions and private companies are fostering the development of cutting-edge 3D printing technologies, further accelerating market expansion. For instance, in November 2024, the Development Bank of Japan (DBJ) invested in Alloyed Limited, a UK-based startup specializing in alloy development and metal 3D printing. This investment supports Alloyed’s materials informatics (MI) technology and business expansion in Japan and the UK, aligning with DBJ’s focus on technological innovation and fostering collaborations to modernize Japan’s metallurgy and manufacturing sectors.

Japan 3D Printing Market Trends:

Expansion of Metal 3D Printing Applications

Japan is witnessing an extensive demand for metal 3D printing due to its applications in high-performance sectors such as aerospace, automotive, and manufacturing. Increasing investments through companies in advanced additive manufacturing technologies is playing a vital role to create lightweight, durable, and intricate components. For instance, in September 2024, Los Angeles-based additive manufacturing company 3DEO secured a USD 3.5 million investment from Japan's Mizuho Bank under its Transition Investment Facility. This funding aims to support 3DEO’s integration of AI-driven design, Intelligent Layering, and Design for Additive Manufacturing (DfAM), emphasizing innovation and sustainable production. These advancements align closely with Japan’s commitment to precision engineering and environmentally sustainable practices, further driving the adoption of metal 3D printing.

Increased Use of 3D Printing in Healthcare

Healthcare applications of 3D printing are expanding rapidly in Japan, particularly for custom prosthetics, dental implants, and surgical tools. For instance, in May 2024, UNIDO, in collaboration with Government of Japan, launched the "Emergency Assistance for 3D-Printed Prosthetics and Job Creation in Ukraine" project. This initiative trains Ukrainian prosthetists, equips facilities with advanced 3D printing technologies, and delivers high-quality prosthetics to conflict-affected individuals. It aims to enhance mobility, create sustainable job opportunities, and support socio-economic growth in Ukraine. The technology's ability to create patient-specific solutions enhances treatment efficiency. Collaborations between medical institutions and 3D printing firms are further driving innovation, making healthcare one of the fastest-growing segments in the market.

Rising Adoption of Eco-Friendly Materials

Japanese manufacturers are prioritizing the use of eco-friendly and recyclable materials in 3D printing, reflecting the nation’s commitment to sustainability, and reducing environmental impact. For instance, in October 2024, Asahi Kasei, a Japanese technology firm, partnered with Italy's Aquafil S.p.A. to develop a novel 3D printing material combining Aquafil’s ECONYL Polymer, a recycled polyamide 6 (PA6), and Asahi Kasei’s cellulose nanofiber (CNF). This high-strength, formable compound targets automotive and aeronautical applications. Such innovations in bio-based and biodegradable materials are gaining momentum, providing greener alternatives for industries aiming to meet global sustainability goals. Moreover, these advancements highlight Japan’s leadership in integrating sustainability into advanced manufacturing technologies.

Japan 3D Printing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Japan 3D printing market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on technology, process, material, offering, application, and end user.

Analysis by Technology:

- Stereolithography

- Fused Deposition Modeling

- Selective Laser Sintering

- Electron Beam Melting

- Digital Light Processing

- Others

Stereolithography (SLA) is widely used in the 3D printing industry due, to its accuracy and smooth surface finishes which make it ideal for medical purposes. Using UV light to solidify resin layer by layer allows SLAs to excel in creating designs with precision. Different sectors such, as healthcare and automotive industries as consumer goods utilize this technology for manufacturing dental models and prototypes.

Fused deposition modeling (FDM) represents a cost-efficient and multifaceted technology (widely) utilized within Japan's 3D printing market. This method entails extruding melted thermoplastic material layer by layer to fabricate functional parts and prototypes. Various sectors, like consumer electronics, education and manufacturing greatly profit from FDM, for producing lightweight components. Moreover, Japanese businesses focus on eco materials and refining FDM techniques to support sustainability goals.

Selective laser sintering (SLS) an innovative technology, in Japans printing sector with focus on industrial and high performance uses uses lasers for fusing materials like polymers and metals layer by layer. resulting in the creation of robust and intricate components for industries such, as aerospace automotive and healthcare that benefit from SLS for developing prototypes and final products. The continuous improvements, in the variety of materials and the effectiveness of processes have broadened its usage in Japan.

Electron beam melting (EBM) plays a role, in Japans aerospace and medical sectors for crafting metal components of top-quality standards utilizing an electron beam to liquefy powdered metal under vacuum conditions which results in parts, with exceptional mechanical characteristics. EBM is particularly suited for fabricating turbine blades, implants and other crucial components demanding accuracy and toughness. Japanese firms are turning to EBM to tackle manufacturing hurdles and boost productivity in crafting top notch parts.

Digital light processing (DLP) has become increasingly popular in the 3D printing industry, in Japan for tasks that demand details and sharp resolution like crafting models and personalized jewelry items. This technique involves the use of a projector to solidify layers of resin swiftly and accurately. Various sectors such as healthcare and consumer products find value in DLP technology for creating designs and achieving surface finishes. Japanese companies are enhancing DLP systems to broaden material options and enhance production speed to solidify its expanding presence, in the market.

Analysis by Process:

- Binder Jetting

- Directed Energy Deposition

- Material Extrusion

- Material Jetting

- Power Bed Fusion

- Sheet Lamination

- Vat Photopolymerization

Binder jetting is becoming increasingly popular in the 3D printing industry, in Japan for making metal and ceramic parts with accuracy and efficiency. This method includes bonding materials together using a binder which allows for the creation of lightweight and cost-efficient components used in automotive and aerospace sectors. One of the advantages of binder jetting is its capability to produce geometries without requiring additional support structures making it highly attractive, for prototyping and small-scale manufacturing. Japanese companies are investing in research to improve compatibility and speed up production processes to expand its usage across industries.

Directed energy deposition (DED) is a prominent 3D printing process in Japan’s aerospace and automotive sectors for creating and repairing high-performance metal components. This technique uses focused thermal energy to melt and deposit material, enabling the production of large, complex parts. Japanese companies utilize DED for its precision and efficiency in metal part manufacturing, particularly in applications requiring customized designs and structural repairs. Advancements in DED technology is further driving its adoption, highlighting its importance in Japan’s additive manufacturing landscape.

In Japans printing sector material extrusion is a technique used for various purposes such, as prototyping and making consumer goods efficiently by layer by layer deposition of melted material – particularly effective for crafting plastic components that meet specific design requirements and preferences of both large manufacturers and small to medium sized enterprises (SMEs). The increasing interest in biodegradable materials is driving advancements in this field, within Japans manufacturing landscape that prioritizes sustainability.

Material jetting is a high-precision 3D printing process valued in Japan’s healthcare and consumer goods industries. By depositing droplets of material onto a build platform, this process achieves fine details and smooth surface finishes, making it ideal for dental models, jewelry, and customized prototypes. Japanese companies are advancing material jetting technologies to improve accuracy and material efficiency. Its capability to work with multiple materials in a single print further boosts its adoption for applications requiring intricate designs and detailed textures.

Powder bed fusion (PBF) is widely utilized in Japan 3D printing market, particularly in aerospace, automotive, and healthcare industries. This process employs a laser or electron beam to selectively melt powdered materials, layer by layer, creating intricate, high-strength components. PBF supports the production of lightweight and durable parts, aligning with Japan’s emphasis on precision engineering. Ongoing advancements in material compatibility and process efficiency are further driving its adoption across industrial applications.

Sheet lamination is a specialized 3D printing process in Japan, used for producing cost-effective, layered objects from materials like paper, plastic, or metal. The process involves bonding thin sheets of material to create lightweight and durable components. Japanese manufacturers utilize this method for applications in packaging, industrial design, and prototyping. Its lower energy consumption and material cost make it a sustainable option, aligning with Japan’s commitment to environmentally friendly manufacturing solutions.

Vat photopolymerization is a key process in Japan healthcare and dental industries for producing high-precision components such as prosthetics, implants, and surgical models. This method uses UV light to cure liquid resin layer by layer, offering exceptional detail and smooth finishes. Japanese companies are advancing this process to improve resin properties and expand its applications. Its ability to create complex geometries with minimal material waste makes Vat Photopolymerization a critical contributor to Japan’s high-quality, precision-driven 3D printing market.

Analysis by Material:

- Photopolymers

- Plastics

- Metals and Ceramics

- Others

Photopolymers are a key material in Japan 3D printing market, widely used in industries such as healthcare and consumer goods for creating highly detailed and accurate prototypes. These materials, which harden under UV light, enable precision in applications like dental devices and jewelry molds. Japanese manufacturers focus on developing advanced photopolymer formulations to enhance durability and flexibility, meeting diverse industrial needs. The growing adoption of photopolymers highlights their importance in achieving high-quality outputs in rapid prototyping and small-batch production.

Plastics are a cornerstone of Japan 3D printing market, valued for their adaptability and cost-efficiency in applications across automotive, electronics, and healthcare industries. Common materials like ABS, PLA, and nylon are widely used for prototyping and functional part manufacturing. Japanese companies are prioritizing innovations in biodegradable and recyclable plastics to meet sustainability objectives. The growing demand for lightweight, durable, and customizable solutions ensures the continued expansion of this material segment in Japan’s additive manufacturing ecosystem.

Metals and ceramics represent high-performance materials in Japan 3D printing market, primarily used in aerospace, automotive, and healthcare sectors. Metal materials like titanium, aluminum, and stainless steel are crucial for creating lightweight and durable components, while ceramics excel in high-temperature applications. Japanese manufacturers leverage advanced technologies like Powder Bed Fusion (PBF) and Directed Energy Deposition (DED) to optimize these materials for precision engineering. The focus on developing sustainable and high-strength metal and ceramic options underscores their importance in industrial-grade 3D printing.

Analysis by Offering:

- Printer

- Material

- Software

- Service

The printer forms the foundation of Japan 3D printing market, encompassing a wide range of equipment, from desktop models to industrial-grade machines. Japanese manufacturers invest heavily in advanced technologies such as metal and multi-material printers to cater to diverse industries, including automotive and healthcare. The focus on precision, durability, and efficiency drives innovation in printer design and functionality. This segment plays a critical role in enabling businesses to adopt 3D printing technology for prototyping, tooling, and functional part manufacturing.

The material is a key driver in Japan 3D printing market, with a growing emphasis on sustainable and high-performance options. Materials such as metals, polymers, ceramics, and eco-friendly composites are widely used in applications spanning aerospace, automotive, and healthcare. Japanese manufacturers actively develop recyclable and bio-based materials to meet global sustainability goals. This segment supports the production of lightweight, durable, and complex parts, making it integral to the growth and diversification of 3D printing applications.

Software is an essential component of Japan 3D printing ecosystem, enabling efficient design, modeling, and optimization processes. Advanced software solutions integrate AI and materials informatics to enhance precision and customization. Japanese companies and research institutions collaborate to develop tools that streamline workflows, improve production quality, and reduce costs. The adoption of simulation and real-time monitoring software supports innovation in additive manufacturing across industries such as aerospace, healthcare, and consumer products.

The service in Japan 3D printing market addresses the growing demand for outsourced expertise, maintenance, and custom production. Companies offer comprehensive solutions, including design assistance, prototyping, and manufacturing support. Managed services, like Ricoh’s All-In 3D Print, provide businesses with end-to-end 3D printing solutions without the need for in-house resources. This segment’s growth reflects the increasing reliance on professional 3D printing services to accelerate adoption and improve production efficiency across various industries.

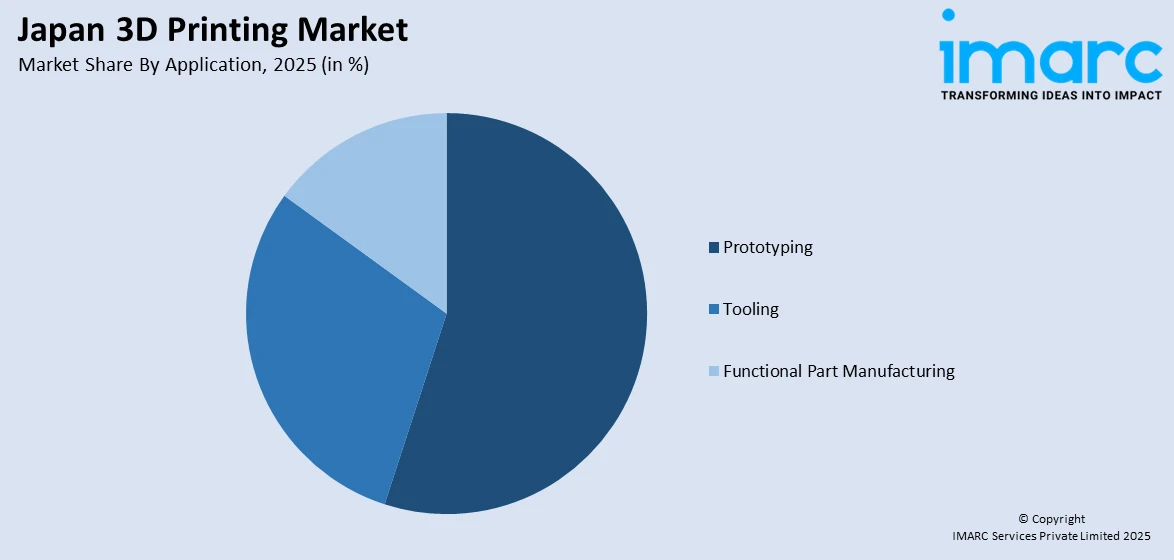

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Prototyping

- Tooling

- Functional Part Manufacturing

Prototyping is a primary application driving the Japan 3D printing market, enabling rapid and cost-effective development of product models across industries. Additive manufacturing allows for high-precision prototyping with intricate designs that traditional methods struggle to achieve. It accelerates innovation cycles in automotive, aerospace, and consumer electronics, reducing time-to-market while optimizing design processes. The flexibility of 3D printing technology empowers companies to test and refine prototypes efficiently, supporting Japan’s focus on high-quality, precision-engineered products.

The tooling significantly benefits from 3D printing in Japan, offering efficient production of custom molds, jigs, and fixtures. Additive manufacturing reduces lead times and costs associated with traditional tooling methods while enabling intricate designs for complex tools. Industries such as automotive, electronics, and aerospace rely on 3D-printed tooling to improve manufacturing efficiency and precision. The ability to create lightweight and durable tools supports the country’s emphasis on sustainable and advanced production processes.

Functional part manufacturing is a growing application in Japan 3D printing market, addressing the need for end-use parts in industries like healthcare, aerospace, and automotive. Additive manufacturing produces lightweight, high-performance components with reduced material waste. It enables customization and small-batch production, meeting specific industry demands. Japanese manufacturers increasingly adopt 3D printing for functional parts to enhance efficiency, durability, and sustainability, aligning with global trends toward advanced manufacturing practices.

Analysis by End User:

- Consumer Products

- Machinery

- Healthcare

- Aerospace

- Automobile

- Others

The consumer products in Japan 3D printing market leverages additive manufacturing for customized, innovative, and cost-efficient production. Companies use 3D printing to create prototypes, fashion accessories, and home goods with high precision and speed. The demand for personalized products, such as wearable technology and decorative items, drives growth in this segment. As 3D printing technology evolves, its use in consumer product design and production is expanding, enabling quicker product development cycles, and meeting market demands for unique, sustainable, and aesthetically appealing products.

The machinery in Japan extensively adopts 3D printing to enhance production efficiency and reduce lead times for complex components. Additive manufacturing enables the creation of intricate parts that traditional methods struggle to produce, supporting innovation in industrial equipment and tools. With a strong focus on precision engineering, Japanese manufacturers use 3D printing to improve machine performance and durability. This sector benefits from the flexibility and customization offered by additive manufacturing, making it a critical segment in the country’s 3D printing market.

The healthcare is a key driver of the Japan 3D printing market, with applications in prosthetics, dental implants, surgical tools, and bioprinting. Additive manufacturing provides highly customized solutions, improving patient outcomes and reducing production costs. Japanese companies and medical institutions are at the forefront of integrating 3D printing with advanced technologies, such as AI and materials informatics, to create patient-specific devices. The growing need for innovative and accessible healthcare solutions positions this segment as a significant contributor to market expansion.

The aerospace industry in Japan utilizes 3D printing for lightweight, high-strength components that meet rigorous performance and safety standards. Additive manufacturing is essential for producing complex geometries and reducing material waste, which aligns with the industry’s focus on sustainability. Leading aerospace companies collaborate with 3D printing firms to streamline production processes and accelerate innovation. This segment’s emphasis on precision and efficiency makes it a key area of growth within Japan’s 3D printing market, particularly for producing turbine blades, engine parts, and structural components.

The automobile industry in Japan is a major adopter of 3D printing, leveraging it for rapid prototyping, lightweighting, and component customization. Additive manufacturing enables cost-effective production of complex parts, supporting advancements in electric and autonomous vehicles. Japanese automotive giants invest in 3D printing technology to optimize design flexibility and reduce time-to-market. The focus on sustainability and energy efficiency further drives the adoption of 3D printing for innovative materials and production processes, positioning the automobile segment as a vital contributor to the market.

Regional Analysis:

- Kanto Region

- Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, home to Tokyo, is Japan’s economic and industrial hub, driving a significant portion of the 3D printing market. With a concentration of technology companies, research institutions, and industrial manufacturers, the region fosters innovation in additive manufacturing. Industries such as automotive, aerospace, and electronics benefit from advanced 3D printing applications. Tokyo’s universities and R&D facilities further support material innovation and prototyping, strengthening the region's leadership in Japan’s 3D printing market. Demand is driven by precision engineering and the integration of sustainable manufacturing technologies.

The Kinki region, centered around Osaka, is a vital industrial and commercial area contributing to the growth of Japan 3D printing market. Known for its robust manufacturing base, the region excels in automotive, robotics, and precision engineering. Osaka's commitment to fostering innovation, supported by collaborative efforts between universities and private enterprises, drives the adoption of 3D printing for prototyping and production. The region's focus on developing eco-friendly materials and efficient production processes aligns with Japan’s national sustainability goals, further bolstering the market.

The Chubu region, housing Nagoya, is a leading center for Japan’s automotive and aerospace industries, fueling demand for metal 3D printing and high-precision applications. The region benefits from its strong manufacturing base and technological expertise, enabling advancements in additive manufacturing processes. Chubu’s industrial clusters encourage collaboration between manufacturers and technology providers, driving innovation in material development and production capabilities. As a hub for heavy industries, the region plays a critical role in expanding Japan’s 3D printing market, particularly for high-performance components.

The Kyushu and Okinawa region is emerging as a growing market for 3D printing, driven by advancements in medical technology, sustainable materials, and manufacturing. With a focus on electronics and healthcare applications, the region leverages additive manufacturing to produce innovative products such as custom prosthetics and precision components. Universities and research institutions in the region contribute to advancements in 3D printing materials and techniques. Kyushu’s emphasis on renewable energy and sustainable practices supports the development of eco-friendly 3D printing solutions.

The Tohoku region, known for its focus on heavy industries and manufacturing, is gradually adopting 3D printing technologies to enhance production efficiency. Industries in the region leverage additive manufacturing for rapid prototyping and creating customized industrial components. With government initiatives promoting regional revitalization and technological development, Tohoku is emerging as a key area for 3D printing adoption. Universities and R&D centers in the region are pivotal in driving innovation in materials and processes, supporting the broader goals of sustainable manufacturing.

The Chugoku region, home to Hiroshima, is a significant contributor to the 3D printing market in Japan, particularly in the automotive and shipbuilding industries. Companies in the region are adopting additive manufacturing to reduce production times and costs while ensuring high-quality output. The region’s industrial landscape is complemented by academic and research partnerships that drive technological advancements. Chugoku's focus on precision engineering and sustainability positions it as a growing hub for 3D printing applications, particularly in large-scale manufacturing.

The Hokkaido region, known for its strong agricultural and food processing industries, is exploring the use of 3D printing for unique applications, such as customized tools and equipment. Emerging interest in medical and healthcare applications is also driving adoption in the region. Hokkaido’s academic institutions are actively researching eco-friendly materials for additive manufacturing, aligning with Japan’s sustainability goals. Although its market share is smaller compared to industrial hubs, Hokkaido’s strategic focus on innovation positions it as a potential growth area for 3D printing technologies.

The Shikoku region, with its emphasis on small and medium-sized enterprises (SMEs), is gradually integrating 3D printing technologies to improve manufacturing efficiency and product customization. The region’s industries, including agriculture, construction, and healthcare, benefit from additive manufacturing solutions tailored to specific needs. Local initiatives and collaborations with universities support R&D in sustainable 3D printing materials. Shikoku’s commitment to fostering innovation among SMEs positions the region as an emerging player in Japan’s expanding 3D printing market.

Competitive Landscape:

The Japan 3D printing market is characterized by intense competition among domestic and international players striving for technological leadership. Major Japanese companies are investing in innovative 3D printing technologies, including high-precision machines and advanced materials, to stay competitive in the market and drive growth. For instance, in October 2024, Obayashi Corporation unveiled Japan’s first 3D-printed earthquake-proof building, named 3dpod. The structure adheres to Japan’s stringent seismic standards without traditional reinforcements. The 3dpod uses advanced 3D printing for all above-ground structural components, integrating insulation and radiant systems. This method reduces construction time, labor, CO2 emissions, and material waste. A robotic printer completed the project on-site, showcasing sustainability and innovation. Obayashi aims to expand 3D printing applications in the architecture, engineering, and construction (AEC) industry, addressing skilled labor shortages and creating resilient, eco-friendly structures for seismic regions. The market also includes emerging startups offering specialized services and niche applications. Moreover, collaborations between industry leaders and academic institutions are fostering R&D advancements. With growing demand across sectors, market players are focusing on product differentiation, cost optimization, and strategic alliances to maintain competitive advantage in this rapidly evolving landscape.

The report provides a comprehensive analysis of the competitive landscape in the Japan 3D printing market with detailed profiles of all major companies.

Latest News and Developments:

-

In May 2024, Sodick, a Japanese manufacturer of EDM equipment and 3D printers, acquired a 9.5% stake in Prima Additive, an Italian metal 3D printer producer, renowned for its PBF and DED metal 3D printing technologies. This partnership focuses on leveraging Prima Additive’s advanced expertise and strong European network to expand applications in aerospace, automotive, and jewelry industries, and enhance competitiveness in key markets, including Japan, Europe, and the United States.

Japan 3D Printing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Stereolithography, Fused Deposition Modeling, Selective Laser Sintering, Electron Beam Melting, Digital Light Processing, Others |

| Processes Covered | Binder Jetting, Directed Energy Deposition, Material Extrusion, Material Jetting, Power Bed Fusion, Sheet Lamination, Vat Photopolymerization |

| Materials Covered | Photopolymers, Plastics, Metals and Ceramics, Others |

| Offerings Covered | Printer, Material, Software, Service |

| Applications Covered | Prototyping, Tooling, Functional Part Manufacturing |

| End Users Covered | Consumer Products, Machinery, Healthcare, Aerospace, Automobile, Others |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu/Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan 3D printing market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Japan 3D printing market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan 3D printing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

3D printing refers to the use of additive manufacturing technologies within Japan to create three-dimensional objects layer by layer from digital designs. Additionally, widely applied in industries such as automotive, aerospace, healthcare, and consumer goods, it enables rapid prototyping, customized production, and efficient manufacturing of complex, high-quality components.

The Japan 3D printing market was valued at USD 2.0 Billion in 2025.

IMARC estimates the Japan 3D printing market to exhibit a CAGR of 17.60% during 2026-2034.

The Japan 3D printing market is driven by advancements in additive manufacturing technologies, increasing adoption across industries like automotive, healthcare, and aerospace, and the focus on sustainable, recyclable materials. Moreover, government support for innovation, rising demand for customization, and cost-efficient production methods further fuel market growth and industrial adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)