Japan Agricultural Equipment Market Size, Share, Trends and Forecast by Equipment, Application, and Region, 2025-2033

Japan Agricultural Equipment Market Overview:

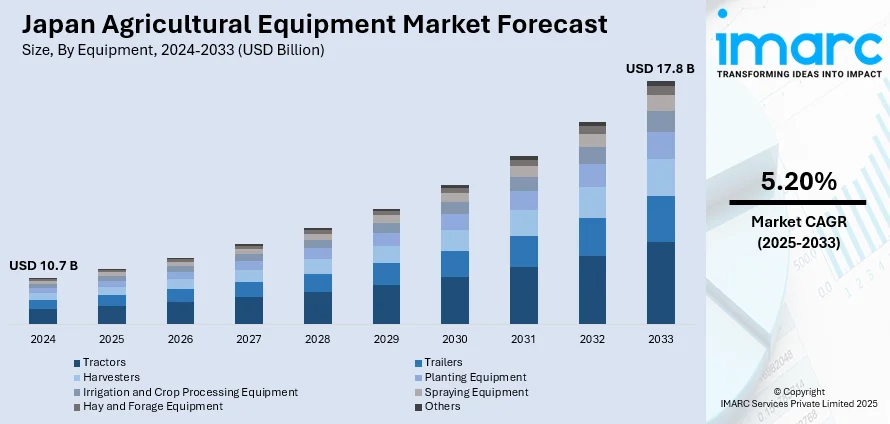

The Japan agricultural equipment market size reached USD 10.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by labor shortages due to an aging farming population, prompting the adoption of automation and smart technologies like AI and IoT. Government support through subsidies and policies encourages modernization, while environmental concerns push demand for sustainable, energy-efficient agricultural machinery.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.7 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Market Growth Rate 2025-2033 | 5.20% |

Japan Agricultural Equipment Market Trends:

Technological Advancements

The integration of advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), and precision farming is fueling the Japan agricultural equipment market share. Such technologies boost agricultural yield as they enable better tracking of crops and soil exploration, along with resource management systems. Through GPS guidance, along with automated equipment and drones, farmers enhance their operations to produce higher harvests and minimize resource usage. Additionally, the adoption of robotics, including autonomous tractors and harvesters, is helping to address labor shortages and improve efficiency. Technological advancements also promote sustainability by reducing water usage, pesticide application, and fuel consumption, aligning with eco-friendly agricultural practices. For instance, in October 2024, NIPPON EXPRESS HOLDINGS, INC. (President: Satoshi Horikiri) obtained a share in AGRIST Inc. (President: Junichi Saito, hereafter "AGRIST") through the NX Global Innovation Fund, and on September 30, finalized a capital and business partnership agreement with AGRIST, a company focused on the development and sale of AI- and robot-driven smart agriculture technologies.

Environmental Sustainability and Eco-friendly Practices

The Japan agricultural equipment market growth is also fueled by the increasing adoption of machinery designed to minimize environmental impact in the agricultural sector, as Japan prioritizes environmental sustainability. There is an increasing demand for eco-friendly, energy-efficient equipment that reduces carbon footprints, fuel consumption, and harmful emissions. Tractors, harvesters, and other machines are being designed to operate more efficiently, with advanced systems that minimize soil compaction, reduce water wastage, and use fewer chemicals. Furthermore, Japan's commitment to reducing agricultural pollution and promoting sustainable farming practices is driving innovation in agricultural machinery. These eco-conscious trends encourage the market for environmentally friendly farming equipment to expand, which creates a positive impact on the Japan agricultural equipment market outlook. For instance, in January 2025, BASF Japan introduced xarvio HEALTHY FIELDS, a novel outcomes-driven service from xarvio Digital Farming Solutions that changes current agricultural methods. This will be Japan's inaugural outcome-focused agricultural service targeted at farmers engaged in water-efficient dry direct-seeding rice cultivation. With xarvio HEALTHY FIELDS, BASF oversees and ensures effective weed management results, a significant hurdle in this farming approach.

Japan Agricultural Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on equipment and application.

Equipment Insights:

- Tractors

- Trailers

- Harvesters

- Planting Equipment

- Irrigation and Crop Processing Equipment

- Spraying Equipment

- Hay and Forage Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes tractors, trailers, harvesters, planting equipment, irrigation and crop processing equipment, spraying equipment, hay and forage equipment, and others.

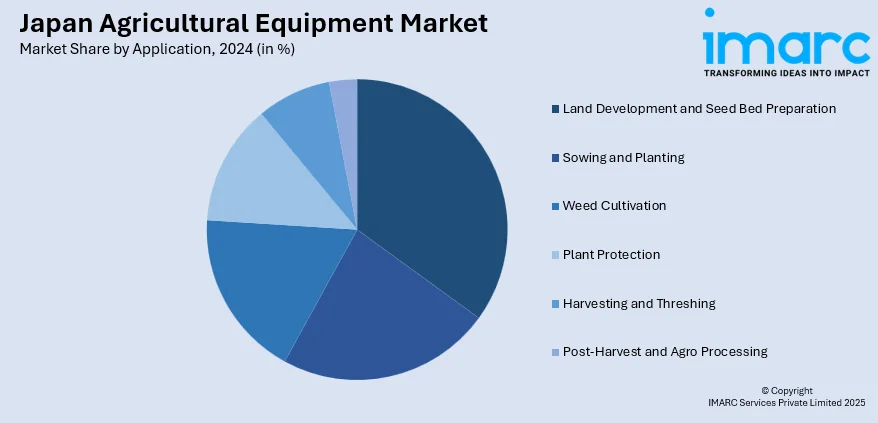

Application Insights:

- Land Development and Seed Bed Preparation

- Sowing and Planting

- Weed Cultivation

- Plant Protection

- Harvesting and Threshing

- Post-Harvest and Agro Processing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes land development and seed bed preparation, sowing and planting, weed cultivation, plant protection, harvesting and threshing, and post-harvest and agro processing.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Agricultural Equipment Market News:

- In March 2025, Japanese agricultural machinery manufacturer Kubota intends to enhance its manufacturing in India, with the goal of increasing exports to Africa and lowering expenses in Southeast Asia. The firm is currently choosing a location for a new facility in India as it aims to double its tractor manufacturing capacity and market presence by 2030 in the South Asian nation.

- In June 2024, Mitsubishi Mahindra Agricultural Machinery Co., Ltd. (referred to as MAM), with Toru Saito as its Chief Executive Officer, entered into a distribution agreement with CNH, a leading global provider of equipment and services, for its Case IH agricultural machinery in Japan.

Japan Agricultural Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipments Covered | Tractors, Trailers, Harvesters, Planting Equipment, Irrigation and Crop Processing Equipment, Spraying Equipment, Hay and Forage Equipment, Others |

| Applications Covered | Land Development and Seed Bed Preparation, Sowing and Planting, Weed Cultivation, Plant Protection, Harvesting and Threshing, Post-Harvest and Agro Processing |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan agricultural equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan agricultural equipment market on the basis of equipment?

- What is the breakup of the Japan agricultural equipment market on the basis of application?

- What is the breakup of the Japan agricultural equipment market on the basis of region?

- What are the various stages in the value chain of the Japan agricultural equipment market?

- What are the key driving factors and challenges in the Japan agricultural equipment market?

- What is the structure of the Japan agricultural equipment market and who are the key players?

- What is the degree of competition in the Japan agricultural equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan agricultural equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan agricultural equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan agricultural equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)