Japan Agriculture Equipment Market Expected to Reach USD 13.50 Billion by 2033 - IMARC Group

Japan Agriculture Equipment Market Statistics, Outlook and Regional Analysis 2025-2033

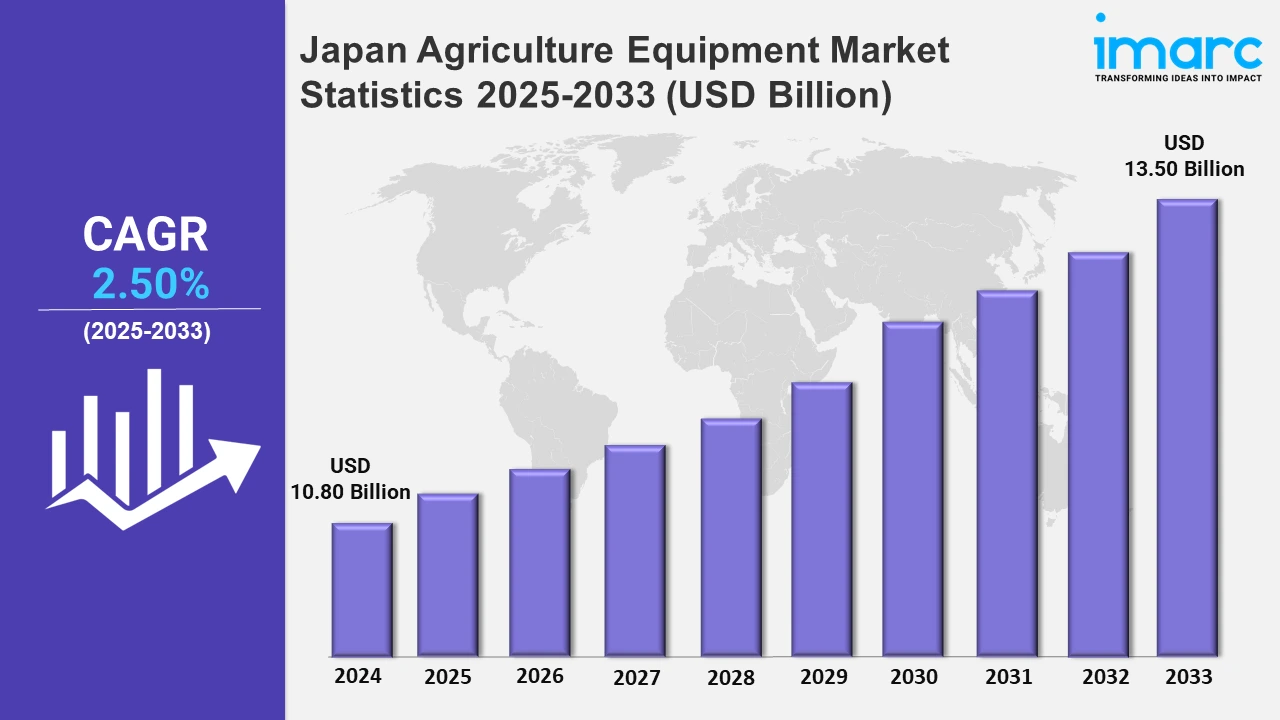

The Japan agriculture equipment market size was valued at USD 10.80 Billion in 2024, and it is expected to reach USD 13.50 Billion by 2033, exhibiting a growth rate (CAGR) of 2.50% from 2025 to 2033.

To get more information on this market, Request Sample

The emphasis on standardizing components, automating processes, and incorporating electricity is transforming equipment design in agriculture, construction, and maritime industries. These inventions focus on sustainability and efficiency, reflecting the increased need for environmentally friendly and technologically innovative solutions. For example, in November 2024, Yanmar Holdings Co., Ltd. launched a strategic initiative grounded in intrinsic design.

Moreover, recent developments in robotic harvesting technologies improve efficiency and precision, addressing workforce shortages and growing prices. Enhanced designs with higher speeds and AI-powered precision provide producers with practical and user-friendly solutions for safe and productive agricultural operations. For instance, in September 2024, Inaho Inc. unveiled updates to its tomato harvesting robot, featuring twice the harvesting speed, improved AI for greater accuracy, and a 17% slimmer design for enhanced usability. This innovation addresses labor shortages and rising costs, ensuring safe harvesting. Furthermore, Japan's agricultural equipment manufacturers are focused on energy efficiency and precise technology to satisfy sustainability goals and increase output. This trend is consistent with the growing demand for upgraded equipment that promotes sustainable agricultural practices and reduces operational expenses. Additionally, the Japan agriculture equipment industry offers huge income prospects as farmers select high-performance and long-lasting gear to replace conventional models prone to wear and tear. For example, modern GPS-enabled tractors are being adopted more widely in Japan due to their precision and fuel economy. Kubota Corporation, a prominent manufacturer, has produced tractors with advanced navigation systems that improve field operations and minimize fuel use. These tractors not only increase production but also promote sustainable practices by reducing environmental effects, demonstrating Japan's emphasis on merging technology and agriculture to handle current farming concerns.

Japan Agriculture Equipment Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Kanto region, Kansai/Kinki region, Central/ Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Diversification of crops in various regions of Japan is extensively expanding the growth of the market.

Kanto Region Agriculture Equipment Market Trends:

The Kanto region puts importance on precision farming to maximize output on limited farmland. Kubota Corporation, headquartered in Tokyo, develops GPS-enabled tractors that increase soil preparation, planting, and harvesting efficiency while using less fuel. This innovative equipment meets Kanto's demand for sustainable agricultural solutions in heavily populated regions. By incorporating technology into traditional farming, the area demonstrates its dedication to tackling land constraints and encouraging ecologically responsible agricultural methods.

Kansai/Kinki Region Agriculture Equipment Market Trends:

Urban farming ideas are changing agriculture in Kansai/Kinki. Panasonic, located in Osaka, pioneered indoor farming systems that use LED lights and automation. These systems generate large amounts of fresh produce year-round, satisfying the need for local food in cities. Kansai/Kinki exhibits its commitment to sustainable and effective agricultural practices by using technology to cultivate crops in confined surroundings.

Central/Chubu Region Agriculture Equipment Market Trends:

Central/Chubu promotes autonomous agricultural machinery to overcome workforce shortages. Komatsu Ltd., located in Nagoya, has deployed self-driving tractors and robotic harvesters to expedite field operations. These tools minimize manual effort, increase output, and assure accurate agricultural procedures. The region's usage of automation generally demonstrates its commitment to modernizing conventional agriculture, encouraging efficiency, and increasing productivity to fulfill rising food production demands while dealing with workforce shortages.

Kyushu-Okinawa Region Agriculture Equipment Market Trends:

Kyushu-Okinawa is a leader in renewable energy use in the agriculture sector. Iseki & Co., Ltd., in partnership with Iwamizawa City, developed electric agricultural equipment powered by removable AC/DC batteries. This idea lowers fuel costs and promotes decarbonization. By incorporating renewable energy solutions into agriculture, Kyushu-Okinawa enhances sustainable farming practices and positions itself as an innovator in environmentally friendly agricultural technologies.

Tohoku Region Agriculture Equipment Market Trends:

Tohoku develops agricultural robots to boost its rice growing sector. Yanmar Holdings, located in Sendai, has deployed robotic devices to automate planting and harvesting tasks. These technologies solve workforce shortages caused by the region's aging population while maintaining high efficiency. Tohoku's emphasis on incorporating robots into traditional farming shows its dedication to preserving fundamental agricultural techniques while fulfilling rising food demand with contemporary technologies.

Chugoku Region Agriculture Equipment Market Trends:

Chugoku promotes effective irrigation systems to save water and increase crop production. Toray Industries, located in Hiroshima, develops advanced drip irrigation technology that improves agricultural water efficiency. These devices are particularly useful in locations with limited water supplies. Chugoku's use of sustainable irrigation methods displays its dedication to enhancing agricultural efficiency while addressing environmental issues, assuring the region's long-term survival.

Hokkaido Region Agriculture Equipment Market Trends:

Hokkaido excels in large-scale farming automation, responding to its vast agricultural areas. CLAAS Japan, based in Sapporo, offers high-capacity combined harvesters with extensive automated features. These devices expedite grain harvesting procedures, resulting in efficient and high-volume outputs. Hokkaido's emphasis on mechanical farming reinforces its position as a significant agricultural area, emphasizing the necessity of technology in managing large-scale food production effectively.

Shikoku Region Agriculture Equipment Market Trends:

Shikoku performs well in agricultural equipment designed for citrus production, a major commodity in the region. Kubota Corporation, situated in Ehime, has created citrus harvesting and processing devices that increase output while minimizing the need for manual labor. This emphasis on specialist equipment guarantees constant and high-quality results. Shikoku demonstrates how tailored farming solutions may meet individual agricultural demands, therefore supporting sustainable practices and the region's agricultural sector.

Top Companies Leading in the Japan Agriculture Equipment Industry

The competitive landscape highlights an increasing emphasis on sustainable solutions, unique post-harvest technologies, and specialized equipment for high-value crops, which supports the market's transition toward more sustainability, efficiency, and technical innovation. Market players prioritize creating energy-efficient, sustainable, and intelligent farming technologies to meet the increasing need for modernized agricultural practices. In January 2025, Iwamizawa City, Hitachi, and Iseki & Co., Ltd. initiated a proof-of-concept test featuring attachable-detachable AC/DC batteries for Iseki’s electric farming devices. The project emphasizes renewable energy utilization at agricultural sites to lower fuel expenses, promote decarbonization, and foster sustainable regional industries.

Japan Agriculture Equipment Market Segmentation Coverage

- Based on the equipment type, the market has been classified into agriculture tractor, harvesting equipment, irrigation and crop processing equipment, agriculture spraying and handling equipment, soil preparation and cultivation equipment, and others. Agriculture tractors are multipurpose tools for plowing, planting, and transporting. Harvesting equipment makes crop gathering more efficient, lowering post-harvest losses and labor costs. Irrigation and crop processing equipment save water and improve crop quality. Agriculture spraying and handling equipment enhance material handling and pesticide application. Soil preparation and cultivation equipment, such as tillers and plows, increase land productivity.

- Based on the application, the market has been categorized into land development, threshing and harvesting, plant protection, and after agro-processing. Land development equipment improves soil preparation and field leveling. Threshing and harvesting devices make crop collecting more efficient. Plant protection equipment, such as sprayers, provides effective pest and disease management. After agro-processing, machinery facilitates post-harvest processes such as cleaning, sorting, and packing, allowing farmers to increase production while maintaining crop quality for market readiness.

- Based on the sales channel, the market has been divided into original equipment manufacturers (OEMs) and aftermarket. Original equipment manufacturers (OEMs) dominate the segment, as they provide new and modern machines with warranties and support. They also ensure the machinery's long-term performance and durability.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 10.80 Billion |

| Market Forecast in 2033 | USD 13.50 Billion |

| Market Growth Rate 2025-2033 | 2.50% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Agriculture Tractor, Harvesting Equipment, Irrigation and Crop Processing Equipment, Agriculture Spraying and Handling Equipment, Soil Preparation and Cultivation Equipment, Others |

| Applications Covered | Land Development, Threshing and Harvesting, Plant Protection, After Agro Processing |

| Sales Channels Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Agriculture Equipment Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)