Japan Alcohol Free Perfumes Market Size, Share, Trends and Forecast by Product Type, Gender, Price Range, Distribution Channel, End User, and Region, 2026-2034

Japan Alcohol Free Perfumes Market Summary:

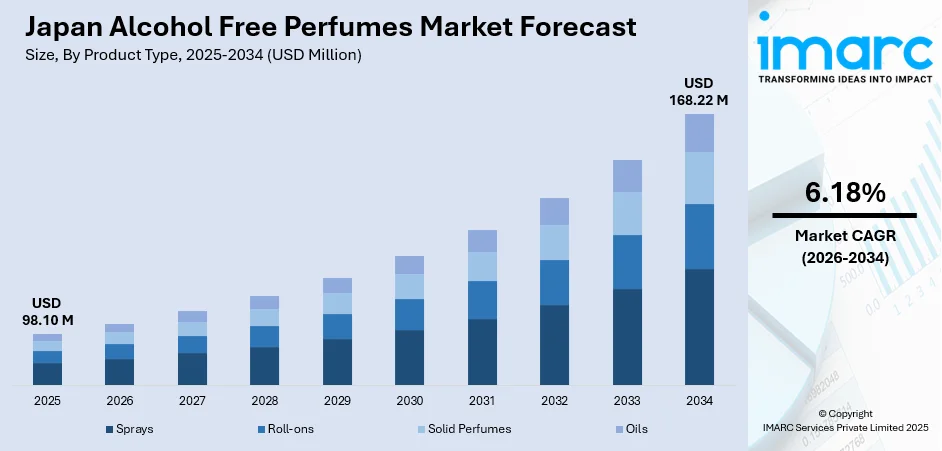

The Japan alcohol free perfumes market size was valued at USD 98.10 Million in 2025 and is projected to reach USD 168.22 Million by 2034, growing at a compound annual growth rate of 6.18% from 2026-2034.

The Japan alcohol free perfumes market is experiencing significant growth driven by increasing consumer preference for skin-friendly and natural fragrance alternatives. Rising awareness of sensitive skin concerns, coupled with the cultural emphasis on wellness and self-care rituals, is accelerating demand for gentle formulations. The growing influence of aromatherapy practices, preference for subtle yet long-lasting scents, and expanding availability across retail channels are collectively shaping the positive market trajectory and enhancing Japan alcohol free perfumes market share.

Key Takeaways and Insights:

- By Product Type: Sprays dominate the market with a share of 57.6% in 2025, driven by their convenience, ease of application, and ability to deliver consistent fragrance distribution.

- By Gender: Women lead the market with a share of 58.7% in 2025, reflecting strong female consumer preference for gentle, skin-safe fragrance options.

- By Price Range: Premium segment represents the largest share with 46.9% in 2025, indicating consumer willingness to invest in high-quality, natural ingredient formulations.

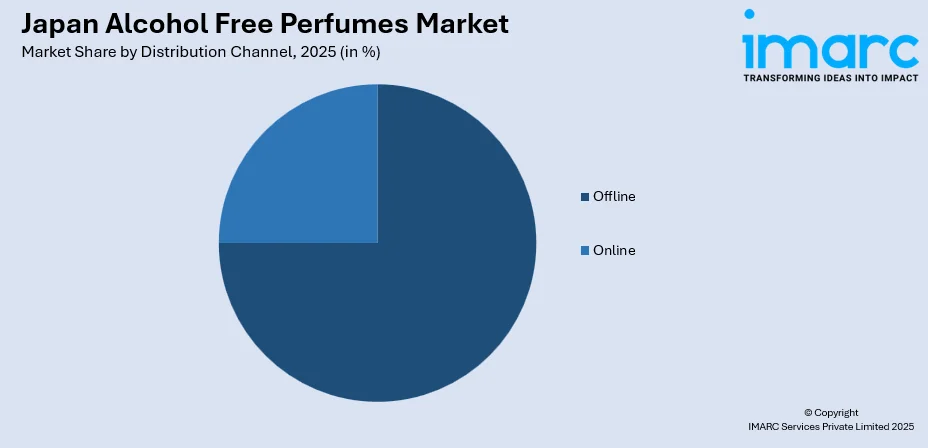

- By Distribution Channel: Offline channels dominate with 75.0% market share in 2025, as consumers value in-store testing experiences and expert consultations.

- By End User: Personal use leads the market with 84.9% share in 2025, highlighting individual consumption as the primary demand driver.

- By Region: Kanto Region holds the largest share with 33.2% in 2025, driven by Tokyo's concentration of premium retail outlets and trend-conscious consumers.

- Key Players: The Japan alcohol free perfumes market exhibits a moderately competitive landscape characterized by the presence of both established domestic beauty conglomerates and international premium fragrance houses. Key players are focusing on product innovation, sustainable packaging, and leveraging traditional Japanese ingredients to differentiate their offerings.

To get more information on this market Request Sample

The Japanese alcohol free perfumes market is witnessing transformative growth as consumers increasingly prioritize skin health alongside olfactory experiences. The intersection of traditional wellness philosophies with modern fragrance technology has created a unique market environment. Japanese consumers demonstrate a strong affinity for subtle, sophisticated scents that complement rather than overpower, aligning perfectly with alcohol free formulations. These innovations exemplify the global premium brands' strategic entry into the alcohol free segment, recognizing the significant growth potential in the Japanese market where consumers increasingly seek fragrances that serve both aesthetic and wellness purposes.

Japan Alcohol Free Perfumes Market Trends:

Rising Integration of Aromatherapy and Wellness Concepts

The convergence of aromatherapy with personal fragrance is fundamentally reshaping consumer expectations in the Japanese alcohol free perfumes market. Consumers increasingly seek multi-functional products that deliver emotional and psychological benefits beyond traditional scent applications. Fragrances incorporating essential oils such as lavender, yuzu, hinoki, and sandalwood are gaining popularity for their stress-relieving and mood-enhancing properties. The Japan aromatherapy market is projected to exhibit a CAGR of 7.03% during 2026-2034, reflecting the growing demand for wellness-oriented fragrance solutions

Growing Demand for Personalization and AI-Driven Scent Discovery

Personalization has emerged as a defining trend in Japan's fragrance industry, with brands leveraging advanced technologies to create bespoke experiences. Digital platforms now enable consumers to receive tailored fragrance recommendations based on individual preferences, lifestyle factors, and desired emotional responses. This technological innovation caters to Japanese consumers' appreciation for customization and individuality while reducing reliance on traditional sampling methods. Virtual consultations and interactive scent profiling tools enhance accessibility for consumers seeking unique signature scents aligned with their personal identities.

Expansion of Natural and Traditional Japanese Ingredient Formulations

The Japanese market is witnessing increased incorporation of traditional and locally-sourced ingredients into alcohol-free fragrance formulations. Limited-edition sets featuring traditional Japanese elements such as sakura, matcha, and incense resonate strongly with consumers who value cultural authenticity and seasonal connections. These formulations celebrate Japan's rich botanical heritage while delivering gentle, skin-compatible scent experiences. The subtle nature of alcohol-free perfumes complements these delicate ingredients perfectly, allowing nuanced aromatic profiles to unfold naturally without overpowering the senses.

Market Outlook 2026-2034:

The Japan alcohol free perfumes market is poised for sustained expansion as consumer preferences continue shifting toward skin-friendly and wellness-oriented fragrance alternatives. The market's growth trajectory will be supported by ongoing innovation in oil-based and water-based formulation technologies, expanding retail presence across department stores and specialty boutiques, and the entry of premium international brands seeking to capture health-conscious Japanese consumers. The integration of traditional Japanese wellness concepts with modern fragrance science will create distinct competitive advantages for brands that successfully blend heritage with innovation. The market generated a revenue of USD 98.10 Million in 2025 and is projected to reach a revenue of USD 168.22 Million by 2034, growing at a compound annual growth rate of 6.18% from 2026-2034.

Japan Alcohol Free Perfumes Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Sprays | 57.6% |

| Gender | Women | 58.7% |

| Price Range | Premium | 46.9% |

| Distribution Channel | Offline | 75.0% |

| End User | Personal Use | 84.9% |

| Region | Kanto Region | 33.2% |

Product Type Insights:

- Sprays

- Roll-ons

- Solid Perfumes

- Oils

The sprays segment dominates with a market share of 57.6% of the total Japan alcohol free perfumes market in 2025.

Spray-format alcohol free perfumes have established clear market leadership in Japan due to their user-friendly application and consistent fragrance delivery. The spray mechanism allows for even distribution across skin and clothing surfaces, providing controlled dosage that appeals to Japanese consumers who prefer subtle, non-overwhelming scents. Technological advancements in water-based and oil-based spray formulations have significantly improved longevity and projection, addressing previous limitations of alcohol free alternatives.

The preference for sprays aligns with Japanese consumer behavior patterns emphasizing convenience and hygiene in personal care routines. Spray mechanisms enable precise application control, allowing users to achieve desired fragrance intensity without direct skin contact during the dispensing process. This format also supports layering techniques popular among Japanese consumers who prefer building subtle scent profiles throughout the day. The portability of spray bottles accommodates on-the-go lifestyles prevalent in urban centers, while their sealed delivery systems maintain product freshness and purity over extended usage periods.

Gender Insights:

- Men

- Women

- Unisex

The women segment leads with a share of 58.7% of the total Japan alcohol free perfumes market in 2025.

Female consumers in Japan demonstrate heightened awareness regarding skin sensitivity and fragrance ingredient safety, driving substantial demand for alcohol free perfume alternatives. The segment's dominance reflects cultural emphasis on skincare-integrated beauty routines where fragrance products are expected to complement rather than compromise skin health. Japanese women particularly favor delicate floral and citrus notes that align with preferences for clean, subtle scent profiles characteristic of local beauty standards.

The women's segment benefits from extensive product innovation specifically targeting female consumer preferences for multi-functional fragrance-skincare hybrids. The female population was 63,569 thousand in 2024, demonstrating strong purchasing power in premium fragrance categories. Brands have successfully captured this demographic with their alcohol free solid perfume sticks featuring elegant animal-motif packaging and gentle formulations designed for sensitive skin applications. The emphasis on gentle, nourishing formulations resonates particularly well with consumers who view fragrance application as an extension of their daily self-care rituals. Marketing strategies emphasizing skin compatibility, moisturizing benefits, and dermatologically-tested claims effectively address female consumers' heightened awareness about ingredient safety and long-term skin health considerations.

Price Range Insights:

- Premium

- Mid-range

- Economy

The premium segment represents the largest category with 46.9% share of the total Japan alcohol free perfumes market in 2025.

Japanese consumers exhibit strong willingness to invest in premium alcohol free perfumes that deliver superior ingredient quality, sophisticated formulations, and elegant packaging aesthetics. The premium segment benefits from Japan's established luxury consumption culture and appreciation for artisanal craftsmanship in personal care products. High-end alcohol free fragrances command premium pricing through associations with natural essential oils, sustainable sourcing practices, and exclusive brand positioning.

The premium segment's growth trajectory is reinforced by international luxury brands entering the Japanese alcohol free market with innovative propositions. The Japan luxury perfume market size is expected to reach USD 1,235.76 Million by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033.Department stores like Isetan Shinjuku and Ginza 6 have expanded dedicated floor space for premium niche fragrances, creating immersive retail environments that justify premium price positioning.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

The offline segment dominates with 75.0% share of the total Japan alcohol free perfumes market in 2025.

Offline retail channels maintain substantial market leadership in Japan's alcohol free perfumes segment due to the critical importance of sensory evaluation in fragrance purchasing decisions. Japanese consumers place high value on in-person testing experiences, expert consultations, and the tactile engagement offered by physical retail environments. Department stores and specialty boutiques provide curated experiences that build consumer confidence in alcohol free formulations.

The offline channel's dominance is reinforced by sophisticated retail innovations enhancing the customer journey. Specialty retailers like Nose Shop in Azabudai Hills mall employ knowledgeable advisors who guide consumers through alcohol-free fragrance selections, creating differentiated shopping experiences that online channels cannot replicate. Department stores offer curated fragrance corners where consumers can explore multiple brands within carefully designed sensory environments that minimize scent interference between products. The tactile experience of handling elegant packaging, testing textures of solid perfumes, and receiving personalized consultations builds consumer confidence in alcohol-free formulations. These immersive retail experiences transform fragrance purchasing from simple transactions into memorable occasions, fostering brand loyalty and encouraging premium product exploration that drives higher average transaction values across physical retail locations.

End User Insights:

- Personal Use

- Gifting

The personal use segment exhibits clear dominance with 84.9% share of the total Japan alcohol free perfumes market in 2025.

Individual consumer purchases drive the overwhelming majority of Japan's alcohol free perfumes market, reflecting the product category's primary positioning as a personal care and self-expression item. Personal use demand is fueled by growing consumer consciousness regarding skincare compatibility, daily wellness routines, and the desire for fragrances suitable for sensitive skin types. The segment benefits from Japan's strong gifting culture, with alcohol free perfumes increasingly selected for personal occasions.

Personal use consumption patterns demonstrate clear alignment with broader self-care trends in Japanese society. The Japan beauty and personal care market is expected to reach USD 45,741.8 Million by 2033, exhibiting a growth rate (CAGR) of 4.30% during 2025-2033, with fragrance products representing a growing category within personal care routines. Japanese consumers increasingly view alcohol free perfumes as essential components of holistic wellness practices, integrating fragrance application into mindfulness-oriented daily rituals.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region holds the largest share with 33.2% of the total Japan alcohol free perfumes market in 2025.

The Kanto Region, encompassing Tokyo and surrounding prefectures, dominates the market due to high concentration of premium retail outlets, trend-conscious urban consumers, and substantial disposable incomes. Tokyo serves as the primary launch destination for international fragrance brands and hosts flagship boutiques driving market innovation. The metropolitan area's dense population of young professionals and affluent consumers creates sustained demand for sophisticated fragrance options. Leading department stores including Isetan Shinjuku and Ginza Mitsukoshi dedicate extensive floor space to curated fragrance selections featuring alcohol-free alternatives.

The region benefits from exceptional retail infrastructure connecting consumers with diverse alcohol-free perfume offerings through specialty boutiques, luxury shopping complexes, and concept stores. Kanto's position as Japan's cultural and fashion capital ensures rapid adoption of emerging fragrance trends, with consumers demonstrating openness to innovative formulations and novel scent profiles. The concentration of corporate headquarters and professional workplaces drives demand for subtle, skin-friendly fragrances suitable for office environments. Additionally, robust transportation networks facilitate convenient access to premium shopping destinations throughout the greater Tokyo metropolitan area.

Market Dynamics:

Growth Drivers:

Why is the Japan Alcohol Free Perfumes Market Growing?

Increasing Consumer Awareness about Skin Sensitivity and Health-Conscious Beauty Choices

Japanese consumers demonstrate heightened consciousness regarding potential skin irritation from alcohol-based fragrance formulations, driving substantial shifts toward gentler alternatives. The growing prevalence of sensitive skin concerns among Japan's population has elevated demand for non-irritating personal care products across all beauty categories. Female respondents in Japan actively seek natural and organic beauty products, reflecting broader trends toward ingredient transparency and safety prioritization (Source: Credence Research). This health-oriented consumer behavior creates sustained demand growth for alcohol free perfumes that deliver fragrance experiences without compromising skin integrity or triggering sensitivities.

Rising Influence of Wellness Culture and Aromatherapy Integration

The deep-rooted emphasis on wellness and mindfulness in Japanese culture has created fertile ground for alcohol free perfumes positioned as holistic self-care products. Consumers increasingly seek fragrances that provide emotional and psychological benefits beyond traditional scent application, aligning with aromatherapy principles embedded in Japanese cultural practices. The Japan essential oils market size is expected to reach USD 785.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.78% during 2025-2033. This aromatherapy market expansion demonstrates consumer receptivity to therapeutic fragrance applications, directly benefiting alcohol free perfume formulations that effectively deliver essential oil benefits through gentle, skin-compatible carriers.

Innovation in Formulation Technologies and Product Development

Technological advancements in alcohol free fragrance formulations have significantly improved product performance, addressing historical concerns regarding longevity and projection. Advanced oil-in-water technologies, encapsulation methods, and botanical carrier innovations enable alcohol free perfumes to deliver comparable or superior scent experiences to traditional formulations. Such investment in research and development by premium brands signals industry confidence in the alcohol free segment's growth potential and accelerates consumer adoption through enhanced product quality and performance.

Market Restraints:

What Challenges the Japan Alcohol Free Perfumes Market is Facing?

Higher Production Costs and Premium Pricing Barriers

Alcohol-free perfume formulations typically require more expensive carrier ingredients and complex manufacturing processes compared to conventional alcohol-based alternatives. These elevated production costs translate into higher retail prices that may limit market accessibility for price-sensitive consumer segments. The premium positioning of many alcohol free perfumes, while attractive to affluent consumers, creates adoption barriers among broader market demographics seeking affordable fragrance options.

Limited Consumer Awareness and Education Requirements

Despite growing interest in skin-friendly beauty products, significant portions of Japanese consumers remain unfamiliar with alcohol free perfume benefits and applications. Consumer education requirements regarding formulation differences, proper application techniques, and expected performance characteristics represent ongoing market challenges. Brands must invest substantially in marketing communications and retail training to bridge knowledge gaps and drive informed purchasing decisions.

Performance Perception Challenges Compared to Traditional Formulations

Historical associations between alcohol content and fragrance intensity continue influencing consumer perceptions regarding alcohol free perfume performance capabilities. Some consumers retain skepticism about alcohol free formulations' ability to deliver adequate longevity, projection, and scent complexity comparable to traditional perfumes. Overcoming these entrenched perceptions requires consistent product quality delivery and positive consumer experience accumulation over time.

Competitive Landscape:

The Japan alcohol free perfumes market exhibits a moderately fragmented competitive structure featuring established domestic beauty conglomerates alongside international premium fragrance houses. Several Japanese companies leverage deep understanding of local consumer preferences and extensive retail distribution networks. International luxury brands are increasingly targeting the Japanese alcohol free segment through specialized product launches and strategic retail partnerships. Competition centers on formulation innovation, ingredient quality, sustainable packaging, and experiential retail activations. Smaller niche players and emerging Japanese fragrance houses differentiate through artisanal positioning, traditional ingredient incorporation, and personalized service offerings that appeal to discerning consumers seeking unique scent experiences.

Recent Developments:

- July 2024: French fragrance house Matière Première debuted in Japan, featuring nine Eau de Parfums and complementary body care products available at major retailers including Isetan Shinjuku and Ginza Mitsukoshi.

Japan Alcohol Free Perfumes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sprays, Roll-ons, Solid Perfumes, Oils |

| Genders Covered | Men, Women, Unisex |

| Price Ranges Covered | Premium, Mid-Range, Economy |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Personal Use, Gifting |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan alcohol free perfumes market size was valued at USD 98.10 Million in 2025.

The Japan alcohol free perfumes market is expected to grow at a compound annual growth rate of 6.18% from 2026-2034 to reach USD 168.22 Million by 2034.

Sprays dominate the Japan alcohol free perfumes market with a 57.6% share in 2025, driven by their convenience of application, consistent fragrance delivery, and compatibility with Japanese consumer preferences for subtle, controlled scent distribution that allows for precise dosage and versatile usage occasions.

Key factors driving the Japan alcohol free perfumes market include increasing consumer awareness of skin sensitivity issues, rising integration of aromatherapy concepts into personal fragrances, significant innovation in alcohol free formulation technologies, growing preference for wellness-oriented beauty products, and expanding availability through premium retail channels.

Major challenges include higher production costs resulting in premium pricing that limits broader market accessibility, limited consumer awareness requiring substantial education investments, performance perception barriers compared to traditional alcohol-based formulations, and intense competition from established conventional perfume categories with stronger consumer familiarity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)