Japan Aluminum Extrusion Market Size, Share, Trends and Forecast by Product Type, Alloy Type, End-Use Industry, and Region, 2026-2034

Japan Aluminum Extrusion Market Summary:

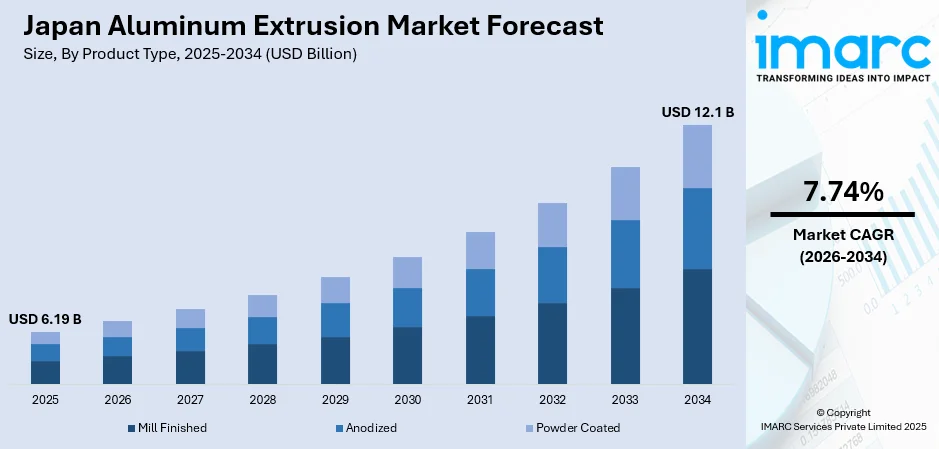

The Japan aluminum extrusion market size was valued at USD 6.19 Billion in 2025 and is projected to reach USD 12.1 Billion by 2034, growing at a compound annual growth rate of 7.74% from 2026-2034.

The Japan aluminum extrusion market is experiencing robust growth driven by accelerating demand for lightweight materials across the automotive and construction sectors. The country's emphasis on electric vehicle adoption, stringent emission regulations, and urban redevelopment initiatives is reshaping material preferences toward aluminum solutions. Technological innovations in alloy development, rising focus on recyclability, and expanding applications in energy-efficient building systems are strengthening the Japan aluminum extrusion market share.

Key Takeaways and Insights:

- By Product Type: Mill finished dominates the market with a share of 53% in 2025, owing to its widespread application in construction frameworks, automotive components, and industrial equipment where cost-effectiveness and versatility are prioritized.

- By Alloy Type: 6000 series aluminum alloy leads the market with a share of 57% in 2025, driven by its excellent combination of strength, formability, and corrosion resistance, making it ideal for structural and automotive applications.

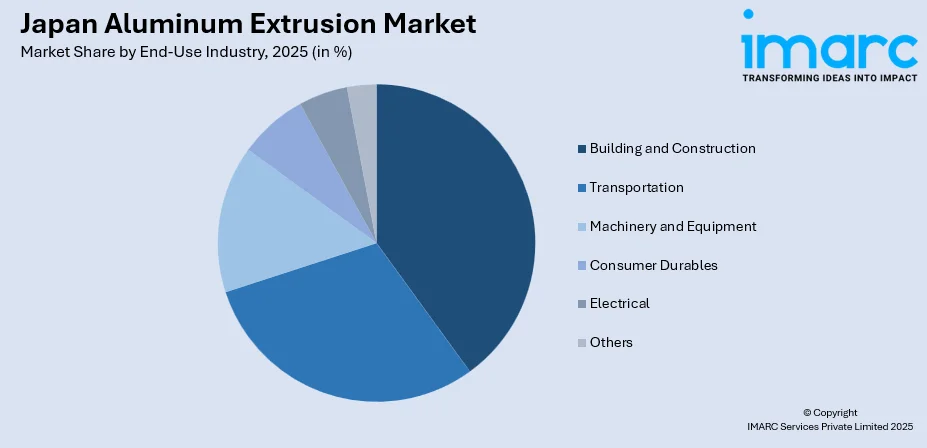

- By End-Use Industry: Building and construction represents the largest segment with a market share of 39% in 2025, supported by urban renewal projects and disaster-resilient infrastructure development across major metropolitan areas.

- Key Players: The Japan aluminum extrusion market exhibits a moderately consolidated competitive structure, with leading manufacturers focusing on technological innovation, sustainable material development, strategic partnerships with automotive OEMs, and capacity expansion to strengthen market positioning and meet evolving industry requirements.

To get more information on this market Request Sample

The Japan aluminum extrusion market is advancing as manufacturers integrate sustainable practices and precision engineering capabilities to serve diverse industrial applications. The automotive sector's transition toward electric mobility is creating substantial demand for lightweight aluminum components in battery enclosures, chassis systems, and structural reinforcements. Construction activities centered on urban redevelopment and earthquake-resistant infrastructure are driving consumption of architectural aluminum profiles for curtain walls, window frames, and support structures. For instance, in May 2024, Kobe Steel announced the integration of green aluminum materials into its aluminum extrusion and suspension products supplied to Nissan Motor for mass-produced vehicles in Japanese and North American markets. This strategic initiative reflects the industry's commitment to reducing lifecycle carbon emissions while maintaining performance standards. The focus on material innovation, combined with Japan's advanced manufacturing ecosystem, positions the market for sustained expansion across transportation, construction, and industrial machinery sectors.

Japan Aluminum Extrusion Market Trends:

Accelerating Adoption of Low-Carbon Aluminum Solutions

Japanese aluminum manufacturers are intensifying efforts to develop and commercialize low-carbon aluminum products in response to decarbonization mandates and customer sustainability requirements. The integration of green aluminum materials produced using renewable energy sources and recycled content is gaining traction across automotive and construction applications. For instance, starting January 2, 2025, Platts, a division of S&P Global Commodity Insights, launched daily assessments of low-carbon aluminum premiums for Japan and Asia, accompanied by comprehensive all-in calculations derived from spot and quarterly contract prices. This initiative reflects the growing regional interest in transparent pricing for sustainable aluminum products. This shift toward sustainable aluminum solutions is driving the Japan aluminum extrusion market growth while enabling end-users to meet corporate carbon neutrality commitments.

Integration of Advanced Extrusion Technologies for Complex Profiles

The demand for highly precise aluminum extrusions with intricate shapes is growing as the automotive and electronics sectors seek tailored solutions for specialized applications. Japanese extrusion manufacturers are focusing on advanced die designs, multi-chamber extrusion techniques, and tight-tolerance production processes to create complex profiles for components such as electric vehicle battery enclosures, crash management systems, and thermal management solutions. These investments enable companies to deliver customized, high-performance materials that meet evolving requirements across transportation and industrial markets.

Rising Demand for Disaster-Resilient Building Materials

Following natural disasters, there is an increasing emphasis on infrastructure resilience, driving the use of aluminum extrusions in construction projects requiring strength and durability. Aluminum’s combination of high strength-to-weight ratio, corrosion resistance, and long lifespan makes it ideal for seismic-resistant structures and coastal developments exposed to harsh conditions. This trend is encouraging the adoption of modern building materials that integrate safety, structural integrity, and energy efficiency, supporting the creation of resilient, long-lasting infrastructure. The Japan earthquake resistant building materials market size reached USD 1,990.01 Million in 2024. Looking forward, the market is expected to reach USD 3,181.01 Million by 2033, exhibiting a growth rate (CAGR) of 5.35% during 2025-2033.

Market Outlook 2026-2034:

The Japan aluminum extrusion market is positioned for substantial expansion over the forecast period, supported by structural demand drivers across automotive lightweighting, infrastructure modernization, and sustainable construction initiatives. The government's updated decarbonization plan, targeting over seventy percent greenhouse gas emission reduction by 2040, is accelerating material substitution toward recyclable aluminum solutions across manufacturing and construction sectors. Continued investment in electric vehicle production facilities and urban redevelopment projects in Tokyo, Osaka, and other metropolitan areas will sustain demand for precision-extruded aluminum components. The market generated a revenue of USD 6.19 Billion in 2025 and is projected to reach a revenue of USD 12.1 Billion by 2034, growing at a compound annual growth rate of 7.74% from 2026-2034.

Japan Aluminum Extrusion Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Mill Finished | 53% |

| Alloy Type | 6000 Series Aluminum Alloy | 57% |

| End-Use Industry | Building and Construction | 39% |

Product Type Insights:

- Mill Finished

- Anodized

- Powder Coated

The mill finished segment dominates with a market share of 53% of the total Japan aluminum extrusion market in 2025.

Mill finished aluminum extrusions maintain their dominant position owing to their cost-effectiveness, versatility, and suitability for subsequent surface treatments. These products serve as the foundation for diverse applications across construction frameworks, automotive structural components, and industrial machinery, where functional performance takes precedence over aesthetic considerations. The segment benefits from strong demand in the building sector, where mill-finished profiles are utilized for internal structural elements, support systems, and components requiring additional finishing processes.

Japanese manufacturers have refined their production capabilities to deliver consistent quality and dimensional accuracy, enabling efficient downstream processing. The transportation industry's requirements for lightweight structural materials and the industrial sector's demand for custom profiles continue to support segment expansion, with mill finished products offering manufacturers flexibility in secondary processing options including anodizing, powder coating, and specialized surface treatments.

Alloy Type Insights:

- 1000 Series Aluminum Alloy

- 2000 Series Aluminum Alloy

- 3000 Series Aluminum Alloy

- 5000 Series Aluminum Alloy

- 6000 Series Aluminum Alloy

- 7000 Series Aluminum Alloy

The 6000 series aluminum alloy segment leads with a share of 57% of the total Japan aluminum extrusion market in 2025.

The 6000 series aluminum alloys have established dominance in the Japan aluminum extrusion market due to their exceptional balance of mechanical properties, formability, and surface finish quality. These magnesium-silicon alloys offer excellent extrudability, enabling the production of complex profiles with tight tolerances required by automotive and architectural applications. The alloy series provides medium-to-high strength characteristics combined with good corrosion resistance, making it particularly suitable for structural components exposed to environmental conditions.

Japanese automotive manufacturers increasingly specify 6000 series alloys for vehicle body structures, bumper reinforcements, and chassis components where the combination of strength and weight reduction is critical for meeting fuel efficiency and emission standards. The construction sector relies on these alloys for window frames, curtain wall systems, and architectural profiles where anodizing compatibility and aesthetic appeal are essential requirements.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Transportation

- Machinery and Equipment

- Consumer Durables

- Electrical

- Others

The building and construction segment holds the largest share at 39% of the total Japan aluminum extrusion market in 2025.

The building and construction sector continues to drive substantial demand for aluminum extrusions in Japan, supported by ongoing urban redevelopment programs and infrastructure modernization initiatives. Aluminum profiles are extensively utilized in curtain wall systems, window and door frames, roofing components, and structural support systems across residential, commercial, and industrial construction projects. The material's inherent properties including corrosion resistance, dimensional stability, and design flexibility make it particularly suited for Japan's demanding construction requirements.

Urban renewal projects in metropolitan centers including Tokyo, Osaka, and Nagoya are incorporating energy-efficient building materials, with extruded aluminum increasingly specified for facades and architectural elements. The country's focus on disaster-resilient infrastructure following seismic events has elevated demand for aluminum structural components that can enhance building integrity while maintaining lightweight characteristics conducive to earthquake resistance.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

In the Kanto region, robust industrial diversity, including automotive parts, electronics manufacturing, and urban construction, fuels aluminum extrusion demand. The concentration of OEMs and suppliers around Tokyo and surrounding prefectures drives demand for lightweight, corrosion‑resistant profiles in vehicles and infrastructure. Growth in EV components and high‑precision industrial applications also supports extrusion uptake, backed by urban redevelopment and sustainability trends.

Kansai’s strong machinery, automotive, and electrical equipment industries underpin aluminum extrusion usage. Osaka, Kyoto, and Hyōgo’s manufacturing clusters rely on extruded components for energy‑efficient products, industrial systems, and structural frames. Infrastructure modernization projects and construction growth also heighten demand for aluminum profiles, as manufacturers seek materials that combine durability, sustainability, and design flexibility.

Central Japan, including Aichi and Nagoya, is a major automotive manufacturing hub where lightweight materials are critical for fuel efficiency and emissions reduction. Aluminum extrusions are integral in vehicle bodies, battery enclosures, and structural components. The region’s heavy industrial base and extensive supply chains further support demand for extruded products in machinery, transport, and construction sectors.

In Kyushu‑Okinawa, expanding automotive and semiconductor facilities are key drivers for aluminum extrusion demand. The region’s growing production of vehicles and electronic equipment creates a need for lightweight, heat‑dissipating extruded components. Infrastructure development and industrial diversification, especially in Fukuoka and surrounding prefectures, also contribute to the adoption of aluminum profiles in construction and fabrication projects.

Tohoku’s aluminum extrusion demand is supported by heavy industry, specialized manufacturing, and reconstruction initiatives following prior natural disasters. Extruded profiles are used in industrial machinery, transportation equipment, and building materials that emphasize resilience and lightweight strength. Government‑led infrastructure enhancements and regional industrial revitalization help sustain long‑term demand for high‑performance aluminum components.

Chugoku’s industrial base, including electronics, machinery, and transport equipment, boosts extrusion product usage. Hiroshima and Okayama factories produce automotive and industrial systems reliant on extruded aluminum for lightweight structures. Construction projects and infrastructure improvements also drive local demand for durable, corrosion‑resistant aluminum profiles in architectural and structural applications.

Hokkaido’s market demand stems from agricultural machinery, construction, and regional industrial facilities where corrosion‑resistant and lightweight extrusions are valued. The region’s unique climate and infrastructure needs encourage the use of materials that withstand environmental stresses. Growth in logistical and industrial equipment sectors further supports the adoption of aluminum profiles in local manufacturing and building projects.

In Shikoku, regional manufacturing, especially metals, machinery, and chemical processing, drives demand for aluminum extrusions. Local industrial clusters use extruded components for energy‑efficient equipment and fabrication. Infrastructure projects, including commercial buildings and transport facilities, further expand the need for aluminum profiles that offer durability, sustainability, and design flexibility in smaller but growing markets.

Market Dynamics:

Growth Drivers:

Why is the Japan Aluminum Extrusion Market Growing?

Expanding Electric Vehicle Production and Automotive Lightweighting Initiatives

The Japanese automotive industry's accelerating transition toward electric mobility is creating substantial demand for aluminum extrusions across vehicle platforms. Electric vehicles require lightweight materials to offset battery weight and maximize driving range, positioning aluminum as a critical material for body structures, battery enclosures, and chassis components. Japanese automakers are increasingly incorporating extruded aluminum profiles in crash management systems, door reinforcements, and structural frameworks where the material's high strength-to-weight ratio delivers measurable performance benefits. According to industry projections, electric vehicles are expected to increase their share of Japan's domestic vehicle sales progressively through the coming decade, sustaining long-term demand for precision-extruded aluminum components. The Japan electric vehicles market size reached USD 53.8 Billion in 2024. Looking forward, the market is expected to reach USD 969.6 Billion by 2033, exhibiting a growth rate (CAGR) of 36% during 2025-2033. Automotive suppliers are investing in advanced extrusion technologies capable of producing complex multi-chamber profiles that meet evolving safety and performance requirements while enabling efficient assembly processes.

Government Decarbonization Policies and Sustainability Mandates

Japan's commitment to achieving carbon neutrality by 2050 is driving material substitution across industrial sectors, with aluminum gaining preference over traditional ferrous materials due to its recyclability and lower lifecycle carbon footprint. The government's updated decarbonization plan targets reducing greenhouse gas emissions by 73% from 2013 levels by 2040, creating policy-level momentum for sustainable material integration. Stringent emission standards for vehicles and buildings are compelling manufacturers and developers to adopt aluminum solutions that contribute to compliance objectives. The aluminum industry's emphasis on recycling infrastructure and green aluminum production methods aligns with national sustainability priorities, enhancing the material's appeal to environmentally conscious end-users. Manufacturers are responding by developing low-carbon aluminum products that enable customers to achieve sustainability certifications and meet corporate environmental commitments.

Urban Redevelopment and Infrastructure Modernization Programs

Japan's sustained focus on urban renewal, disaster-prevention infrastructure, and resilience planning is generating consistent demand for aluminum extrusions in construction applications. The country's susceptibility to earthquakes and extreme weather events has elevated the importance of building materials that can enhance structural integrity while maintaining lightweight characteristics. Aluminum extrusions are increasingly specified for curtain wall systems, support structures, and architectural framing in urban renewal projects across Tokyo, Osaka, and other major metropolitan areas. The construction industry's adoption of energy-efficient building standards is driving demand for aluminum window and door systems that contribute to thermal performance objectives. Infrastructure assessments have identified tens of thousands of structures requiring reinforcement or renovation, creating a multi-year pipeline of projects that will sustain aluminum consumption in the construction sector.

Market Restraints:

What Challenges the Japan Aluminum Extrusion Market is Facing?

Raw Material Price Volatility and Supply Chain Uncertainties

Fluctuations in global aluminum prices and raw material availability present ongoing challenges for Japanese extrusion manufacturers seeking to maintain stable pricing and production planning. Aluminum billet costs experienced notable increases in recent periods, impacting production economics and requiring manufacturers to balance cost pressures against competitive pricing requirements. Supply chain disruptions and geopolitical factors influencing global commodity markets create procurement challenges that can affect manufacturing schedules and inventory management.

Energy-Intensive Production Processes and Rising Utility Costs

The aluminum extrusion process requires substantial energy inputs for billet heating, extrusion operations, and subsequent thermal treatments, making manufacturers vulnerable to energy price fluctuations. Energy costs constitute a significant proportion of total production expenses, and Japan's evolving energy landscape following policy shifts has introduced additional cost considerations for industrial producers. Manufacturers are compelled to invest in energy efficiency improvements and explore alternative energy sources to maintain competitiveness.

Trade Policy Impacts and Export Market Constraints

International trade policies and tariff structures affecting aluminum products have impacted the competitiveness of Japanese exports, particularly to major markets where tariffs on semi-finished aluminum products remain in effect. Leading Japanese aluminum suppliers have experienced constrained export volumes and margin pressures in certain international markets, prompting strategic adjustments toward domestic demand utilization and alternative export destinations. Smaller industry participants face particular challenges in adapting to trade policy dynamics.

Competitive Landscape:

The Japan aluminum extrusion market exhibits a moderately consolidated competitive structure characterized by established domestic manufacturers competing alongside specialized regional players. Leading companies are differentiating through technological innovation in alloy development, sustainable product offerings, and customized engineering solutions for demanding automotive and construction applications. Strategic partnerships between aluminum producers and major automotive OEMs are strengthening supply chain relationships and enabling collaborative product development initiatives. Market participants are investing in production capacity enhancements, quality management systems, and research capabilities to address evolving customer requirements across end-use industries. The competitive environment is increasingly influenced by sustainability credentials, with manufacturers emphasizing low-carbon aluminum offerings and recycling capabilities to meet customer environmental objectives.

Japan Aluminum Extrusion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mill Finished, Anodized, Powder Coated |

| Alloy Types Covered | 1000 Series Aluminum Alloy, 2000 Series Aluminum Alloy, 3000 Series Aluminum Alloy, 5000 Series Aluminum Alloy, 6000 Series Aluminum Alloy, 7000 Series Aluminum Alloy |

| End-Use Industries Covered | Building and Construction, Transportation, Machinery and Equipment, Consumer Durables, Electrical, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan aluminum extrusion market size was valued at USD 6.19 Billion in 2025.

The Japan aluminum extrusion market is expected to grow at a compound annual growth rate of 7.74% from 2026-2034 to reach USD 12.1 Billion by 2034.

Mill finished products held the largest revenue share at 53% in 2025, driven by their cost-effectiveness, versatility across construction and automotive applications, and compatibility with subsequent surface treatment processes required by end-users.

Key factors driving the Japan aluminum extrusion market include expanding electric vehicle production requiring lightweight materials, government decarbonization policies promoting sustainable material adoption, urban redevelopment and infrastructure modernization programs, and increasing demand for energy-efficient building systems.

Major challenges include raw material price volatility affecting production economics, energy-intensive manufacturing processes amid rising utility costs, trade policy impacts constraining export competitiveness in certain markets, and supply chain uncertainties influencing procurement and inventory management.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)