Japan Amino Acids Market Size, Share, Trends and Forecast by Type, Raw Material, Application, and Region, 2026-2034

Japan Amino Acids Market Summary:

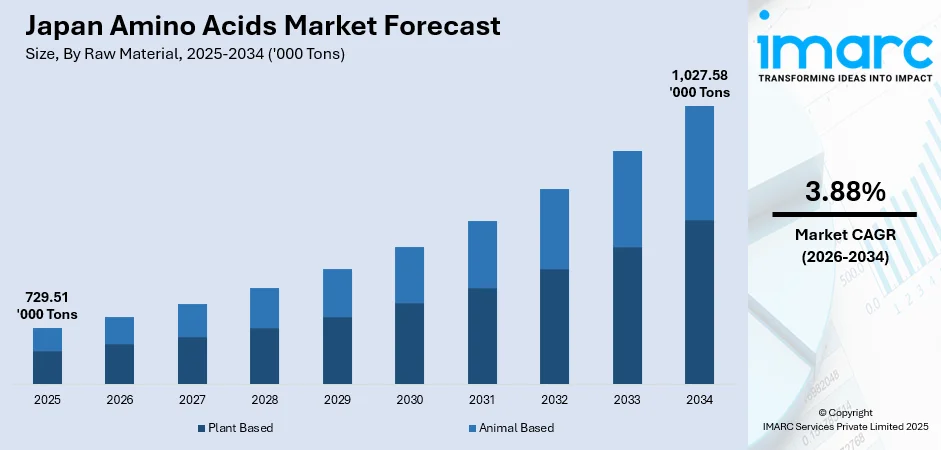

The Japan amino acids market size reached 729.51 Thousand Tons in 2025 and is projected to reach 1,027.58 Thousand Tons by 2034, growing at a compound annual growth rate of 3.88% from 2026-2034.

The Japan amino acids market is experiencing steady growth as demand strengthens across food, nutraceutical, pharmaceutical, and animal nutrition applications. Rising preference for high protein, plant-based, and functional wellness products is supporting greater amino acid incorporation in daily nutrition. Expanding use in clinical nutrition, sports supplements, and specialty medical formulations further contributes to market expansion. Continuous innovation in fermentation technology and growing focus on health-oriented diets continue to drive wider adoption across industries.

Key Takeaways and Insights:

- By Type: Glutamic acids dominates the market with a share of 43.44% in 2025, driven by widespread utilization in food and beverage applications as monosodium glutamate for umami flavor enhancement.

- By Raw Material: Plant based leads the market with a share of 88.43% in 2025, owing to increasing sustainability preferences and advanced fermentation technologies using agricultural substrates.

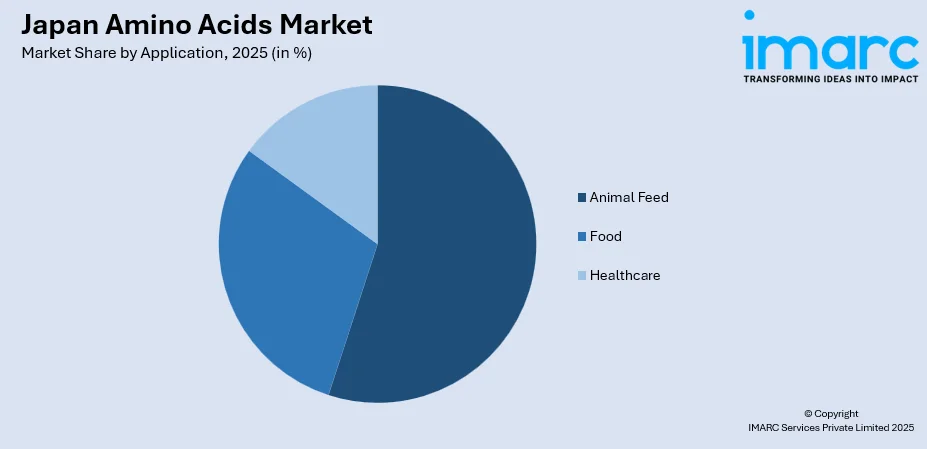

- By Application: Animal feed represents the largest segment with a market share of 52.36% in 2025, supported by growing livestock production requirements and focus on optimizing feed conversion efficiency.

- Key Players: The Japan amino acids market exhibits a concentrated competitive structure dominated by established biotechnology corporations with extensive fermentation expertise. Leading manufacturers leverage proprietary production technologies and integrated supply chains to maintain premium market positioning across pharmaceutical, food, and feed applications.

To get more information on this market Request Sample

The Japan amino acids market is experiencing robust growth driven by rising consumer focus on health, wellness, and high-quality nutrition. In October 2025, Sankyo Foods announced its plans to launch Genmai Gokochi, a series of microwavable GABA-enriched rice blends in Japan. Each blend features traditional ingredients and provides 100mg of GABA, amino acids, and nutrients aimed at enhancing mental wellness, sleep quality, and digestive health, addressing rising consumer demand for functional foods. Amino acids are increasingly used in functional foods, clinical nutrition, sports supplements, and beverages as consumers seek products that support muscle health, metabolism, and immunity. The pharmaceutical sector also contributes to demand as amino acids are widely utilized in infusion solutions, metabolic therapies, and medical nutrition formulations. In the food processing industry, amino acids enhance flavor, improve stability, and support formulation of plant-based and reduced-sodium products. Japan’s strong biotechnology capabilities and advancements in fermentation technology further improve production efficiency and purity levels, encouraging wider industrial use. Growing adoption in animal feed, expanding applications in cosmetics, and ongoing innovation in personalized nutrition continue to reinforce market growth, making amino acids a critical component across multiple high-value industries.

Japan Amino Acids Market Trends:

Plant-Based Nutrition Demand

Rising demand for plant-based nutrition is boosting amino acid usage in Japan as consumers prioritize cleaner dietary supplements and fortified foods. Japan plant-based protein market size reached USD 746.4 Million in 2025, and is projected to reach USD 1,393.2 Million by 2034, supporting stronger demand for high quality nutritional additives. Manufacturers are increasingly integrating amino acids into protein enriched snacks, beverages, and functional wellness products to enhance energy, recovery, and daily nutrition. This trend aligns with growing consumer preference for natural, sustainable, and performance focused dietary solutions.

Pharmaceutical and Clinical Nutrition Growth

Growing applications in pharmaceuticals and clinical nutrition are accelerating market expansion as amino acids are widely used in intravenous solutions, medical formulations, and treatments for metabolic disorders. In November 2024, Otsuka Pharmaceutical Factory announced its plans to launch "KIDPAREN® Injection". This amino acid and multivitamin injection provides high-calorie parenteral nutrition for patients with chronic kidney disease. The 1,050 mL kit efficiently meets dietary requirements while minimizing fluid intake, enhancing options for nutrition management in clinical settings. Japan’s rapidly aging population increases demand for products supporting muscle health, recovery, and immune function. Healthcare providers continue integrating amino acid-based therapies to improve patient outcomes and long term nutritional management.

Rising Adoption in Animal Feed

Increasing use of amino acids in animal feed is supporting higher livestock productivity across Japan’s poultry, swine, and aquaculture sectors. Producers rely on lysine, methionine, and threonine to enhance growth efficiency, improve feed conversion, and optimize balanced nutrition. In February 2025, Sumitomo Chemical expanded its methionine distribution partnership with ITOCHU, effective April 2025. This collaboration will see all methionine produced at Sumitomo's Ehime Work sold through ITOCHU's extensive global network, enhancing competitiveness and addressing rising demand in the livestock industry for high-quality feed additives. This trend reflects a shift toward sustainable feed strategies that reduce waste, support animal health, and improve overall production performance.

Market Outlook 2026-2034:

The Japan amino acids market is set for steady growth as demand rises from food, nutrition, pharmaceutical, and animal feed sectors. Increasing focus on plant-based, protein-enhanced, and functional health products is supporting higher amino acid incorporation across consumer applications. Expanding use in clinical nutrition, elderly care, and therapeutic formulations further strengthens market momentum. With continued innovation in fermentation technology, sustainable production methods, and advanced formulation capabilities, the market is expected to maintain a strong upward trajectory. The market reached 729.51 Thousand Tons in 2025 and is projected to reach 1,027.58 Thousand Tons by 2034, growing at a compound annual growth rate of 3.88% from 2026-2034.

Japan Amino Acids Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Glutamic Acids | 43.44% |

| Raw Material | Plant Based | 88.43% |

| Application | Animal Feed | 52.36% |

Type Insights:

- Glutamic Acids

- Lysine

- Methionine

- Threonine

- Phenylalanine

- Tryptophan

- Citrulline

- Glycine

- Glutamine

- Creatine

- Arginine

- Valine

- Leucine

- Iso-Leucine

- Proline

- Serine

- Tyrosine

- Others

The glutamic acids dominate with a market share of 43.44% of the total Japan amino acids market in 2025.

Glutamic acid holds the largest share in the Japan amino acids market, reflecting its strong integration across food processing, seasoning, and flavor enhancement applications. Its functional benefits support product innovation in ready meals, snacks, and processed food categories. Rising consumer demand for natural taste enhancers and clean label products further elevates the importance of glutamic acid, positioning it as a key ingredient across diverse manufacturing segments.

Growing adoption of glutamic acid in nutraceuticals and wellness formulations strengthens its market position, driven by increasing focus on cognitive support, metabolic health, and balanced nutrition. As Japanese consumers seek fortified dietary solutions, manufacturers are incorporating glutamic acid into supplements and functional beverages. Its versatility and compatibility with plant-based formulations further expand its usage across evolving health focused product lines.

Raw Material Insights:

- Plant Based

- Animal Based

The plant based leads with a share of 88.43% of the total Japan amino acids market in 2025.

Plant based raw materials dominate the Japan amino acids market as manufacturers increasingly prioritize sustainable, allergen friendly, and ethically sourced inputs. The growth of plant based production aligns with shifting consumer preferences toward cleaner nutritional profiles and minimally processed ingredients. In September 2025, Leaft Foods partnered with Lacto Japan to launch Rubisco Protein Isolate in Japan, a groundbreaking protein with superior amino acid profiles compared to whey. This clean-label ingredient can replace eggs and emulsifiers, aligning with Japan's high food standards and innovative market trends. This supports greater acceptance across food, beverage, personal care, and health product categories that rely on transparent sourcing.

Expanding adoption of plant based amino acids is also driven by their compatibility with vegan, vegetarian, and eco conscious formulations. Producers benefit from stable supply chains, improved extraction technologies, and reduced environmental impact associated with plant based manufacturing. As Japan’s food and wellness industries continue moving toward green production practices, plant sourced amino acids maintain a strong competitive edge.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Animal Feed

- Food

- Healthcare

The animal feed exhibits a clear dominance with a 52.36% share of the total Japan amino acids market in 2025.

The animal feed segment leads the Japan amino acids market due to increasing demand for high quality livestock nutrition that enhances growth performance and feed efficiency. Amino acids play a vital role in improving protein utilization and supporting overall animal health. This drives sustained adoption across poultry, swine, aquaculture, and dairy feed formulations, strengthening the segment’s market share.

Rising focus on cost effective feed management and optimized nutrient balance further supports the use of amino acids in commercial feed production. Producers rely on tailored amino acid blends to reduce feed conversion ratios and maintain consistent livestock output. The trend toward controlled nutrition and improved farm productivity continues to reinforce the dominance of the animal feed segment across Japan.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region continues to generate strong demand for amino acids due to its large food processing base and advanced healthcare sector. Expanding nutraceutical manufacturing and a high concentration of supplement brands further support consistent market consumption in the region.

Kansai/Kinki Region records steady adoption of amino acids supported by its well-developed pharmaceutical and fermentation industries. Growing functional food innovation and increasing consumer focus on wellness solutions contribute to stable market demand across urban and industrial clusters.

Central/Chubu Region shows sustained utilization of amino acids driven by its strong livestock, food manufacturing, and biotechnology activities. Rising interest in fortified products and expanding feed applications continue to support regional consumption patterns.

Kyushu-Okinawa Region reflects healthy demand fueled by its agricultural production, expanding animal nutrition requirements, and growing functional food processing activities. Increasing supplement usage and rising consumer focus on natural ingredients further enhance market uptake.

Tohoku Region maintains demand growth supported by its expanding livestock sector and increasing adoption of functional ingredients in food processing. Rising awareness of nutritional supplementation also contributes to stable amino acid consumption

Chugoku Region demonstrates consistent usage of amino acids driven by its established food manufacturing sector and growing interest in high-quality nutritional additives. Advancements in feed formulations further strengthen regional market demand.

Hokkaido Region continues to utilize amino acids across its large dairy and livestock industries, supported by ongoing improvements in feed efficiency and product quality. Growing demand for fortified foods also enhances regional consumption.

Shikoku Region records stable demand due to its agricultural activities and growing interest in value-added food products. Rising adoption of amino acids in feed and functional nutrition supports the region’s steady market uptake.

Market Dynamics:

Growth Drivers:

Why is the Japan Amino Acids Market Growing?

Sports-Nutrition Demand Growth

Rising popularity of sports-nutrition products is strongly boosting the Japan amino acids market as athletes and fitness focused consumers increasingly rely on amino acids for endurance, muscle repair, and performance enhancement. In October 2025, Tokyo's Lacto Japan partnered with New Zealand’s Leaft Foods to introduce Rubisco protein, a leaf-derived alternative with superior amino acid benefits to whey. This innovative protein, extracted from alfalfa, promises significant functional advantages and sustainability, and targets the growing demand for environmentally friendly food options in Japan. Formulations containing BCAAs, glutamine, and essential amino acids are gaining wider acceptance across powders, ready-to-drink beverages, gummies, and functional snacks. Growing interest in active lifestyles, combined with expanding fitness culture and product innovation, continues to drive consistent demand across retail, online, and specialty sports channels.

Fermentation-Technology Advancements

Advancements in fermentation-based production are strengthening the Japan amino acids market by delivering improved cost efficiency, higher purity, and enhanced sustainability. Modern biotechnological processes allow consistent large-scale output while reducing environmental impact and dependency on traditional raw materials. These improvements support broader adoption across food, pharmaceutical, and animal feed applications as manufacturers benefit from stable quality and reliable supply. Growing emphasis on eco-friendly production practices further increases interest in fermentation-derived amino acids across both domestic and export-driven industries.

Functional-Beverage Expansion

Expansion of fortified and functional beverages is accelerating amino acid adoption as manufacturers integrate essential and branched-chain amino acids to enhance nutritional value, flavour, and overall health appeal. Consumers are increasingly seeking beverages that support energy, muscle recovery, and cognitive wellness, prompting companies to diversify product lines. In November 2025, Kiyomizu Group launched SUPPON ENERGY DRINK, a wellness beverage featuring 333 mg of powdered extract from freshwater Suppon turtles. Rich in amino acids and traditional health benefits, the drink aims to enhance vitality and nourishment, making a historically valued food more accessible to modern consumers. Available in select stores and online. Ready-to-drink formats, enhanced hydration drinks, and protein-infused beverages are seeing strong traction, reinforcing amino acids as core functional ingredients in Japan’s evolving beverage landscape focused on convenience and better-for-you nutrition.

Market Restraints:

What Challenges the Japan Amino Acids Market is Facing?

High Initial Investment Requirements

High initial investment requirements remain a major restraint, as organizations must allocate significant capital for advanced equipment, technology integration, and workforce upskilling. These upfront costs are challenging for small and mid sized enterprises, which often operate with limited budgets. As a result, overall market adoption slows, reducing the speed at which new solutions can enter mainstream operations.

Regulatory Complexities

Regulatory complexities continue to hinder market growth, as evolving compliance standards demand continuous updates to operational frameworks, quality protocols, and documentation procedures. These frequent adjustments increase administrative workloads and require dedicated resources for monitoring regulatory shifts. Such requirements often delay implementation timelines, complicate expansion activities, and restrict the ability of companies to scale efficiently within the market.

Supply Chain Vulnerabilities

Supply chain vulnerabilities pose persistent challenges, as fluctuations in raw material availability and reliance on specific suppliers impact production continuity. Logistics inefficiencies further strain delivery schedules and increase operational uncertainties. These disruptions not only influence cost structures but also reduce pricing consistency, making it difficult for companies to maintain stable output levels and predictable market performance.

Competitive Landscape:

The competitive landscape of the market is shaped by steady innovation, capacity expansion, and continuous improvement in operational efficiency. Companies focus on strengthening product quality, enhancing process reliability, and optimizing cost structures to secure a stronger position. Competition is driven by investments in advanced technologies, strategic partnerships, and differentiated service offerings that improve customer value. Firms also prioritize supply chain resilience and localized manufacturing to reduce risks and maintain pricing stability. Overall, the market remains moderately consolidated, with participants competing on performance, adaptability, and long-term strategic capabilities.

Recent Developments:

- In July 2025, Kyowa Hakko Bio Co., Ltd. successfully completed the transfer of its Amino Acids and Human Milk Oligosaccharides business to a subsidiary of Meihua Holdings Group Co., Ltd.

- In April 2025, Ono Pharmaceutical entered a research collaboration with Jorna Therapeutics to develop RNA editing therapeutics using Jorna's AI-driven platform. Ono gains exclusive rights to drug candidates designed from amino acid sequences. This partnership aims to enhance drug development and provide innovative treatments for patients with unmet medical needs.

Japan Amino Acids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Glutamic Acids, Lysine, Methionine, Threonine, Phenylalanine, Tryptophan, Citrulline, Glycine, Glutamine, Creatine, Arginine, Valine, Leucine, Iso-Leucine, Proline, Serine, Tyrosine, Others |

| Raw Materials Covered | Plant Based, Animal Based |

| Applications Covered | Animal Feed, Food, Healthcare |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan amino acids market size reached 729.51 Thousand Tons in 2025.

The Japan amino acids market is expected to grow at a compound annual growth rate of 3.88% from 2026-2034 to reach 1,027.58 Thousand Tons by 2034.

Glutamic acids held the largest share of the Japan amino acids market, driven by its extensive use in food seasoning, flavor enhancement, and functional formulations, along with strong demand from the processed food and nutraceutical industries.

Key factors driving the Japan amino acids market include rising health awareness, strong demand for functional foods, expanding use in dietary supplements, growing applications in animal feed, and increasing preference for plant based, clean label, and high purity amino acid ingredients.

The Japan amino acids market faces challenges such as high production costs, raw material supply fluctuations, regulatory compliance complexities, and the need for advanced processing technologies, which create operational constraints and limit rapid expansion across key application segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)