Japan Artisanal Bread Market Size, Share, Trends and Forecast by Type, Ingredients, Distribution Channel, and Region, 2026-2034

Japan Artisanal Bread Market Summary:

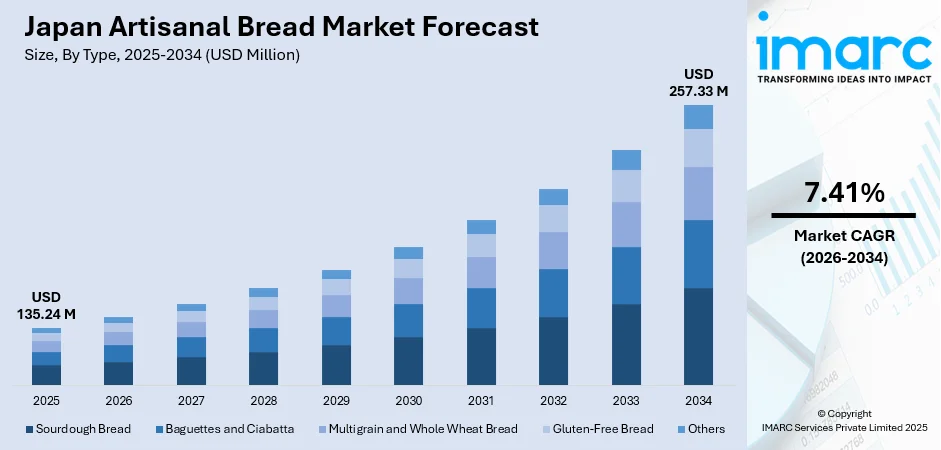

The Japan artisanal bread market size was valued at USD 135.24 Million in 2025 and is projected to reach USD 257.33 Million by 2034, growing at a compound annual growth rate of 7.41% from 2026-2034.

The Japan artisanal bread market is experiencing robust expansion driven by increasing health consciousness among consumers and a cultural appreciation for quality craftsmanship. Rising demand for nutrient-dense, functional breads fortified with probiotics, ancient grains, and plant-based proteins is reshaping consumer preferences. Premiumization continues to accelerate growth as artisanal bakeries leverage regional ingredients and seasonal flavors to justify higher price points. Social media amplification of visually distinctive bread designs attracts younger demographics, while experiential offerings such as baking workshops enhance brand engagement, further augmenting the Japan artisanal bread market share.

Key Takeaways and Insights:

- By Type: Sourdough bread dominates the market with a share of 28% in 2025, driven by growing consumer preference for naturally fermented, gut-friendly bread options.

- By Ingredients: Organic flour-based breads leads the market with a share of 40% in 2025, reflecting heightened demand for clean-label, pesticide-free bakery products.

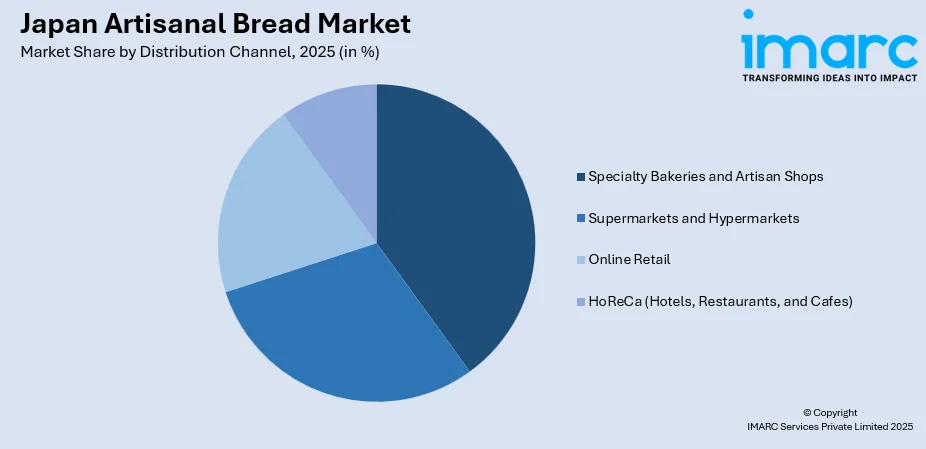

- By Distribution Channel: Specialty bakeries and artisan shops represents the largest segment with a market share of 38% in 2025, as consumers seek premium, handcrafted bread experiences.

- Key Players: The Japan artisanal bread market features a competitive landscape comprising established bakery conglomerates and premium artisan operators. Companies are focusing on product innovation, regional ingredient sourcing, and experiential retail concepts to capture market share. Strategic partnerships and collaborations with local producers enhance brand differentiation and consumer loyalty.

To get more information on this market Request Sample

Japan's artisanal bread market is characterized by a sophisticated consumer base that values authenticity, craftsmanship, and nutritional benefits. The market benefits from strong retail infrastructure, including specialty bakeries, department store food halls, and expanding e-commerce platforms. High-end establishments have set new standards of expertise, offering premium fresh loaves that attract both local crowds and international gourmands. Japan's functional food market stimulates innovation through policies such as Foods with Function Claims (FFCs), which encourage research and development investments. An examination of 15 top companies indicated that those with greater engagement with FFCs tend to undertake in-house clinical trials, leading to increased product differentiation and enhanced market appeal. The proliferation of artisan bakers specializing in naturally leavened sourdough and wholewheat breads from Hokkaido to Okinawa underscores the market's depth and consumer enthusiasm for quality baked goods.

Japan Artisanal Bread Market Trends:

Social Media Amplification and Experiential Consumption

Social media plays a crucial role in driving consumer engagement and foot traffic to artisanal bakeries. Visually appealing bread designs such as intricate braided loaves or character-shaped pastries generate significant online engagement among younger demographics. Early 2025 witnessed 97 million social media users representing 78.6% of its population in Japan, with internet penetration reaching 88.2%. Experiential consumption has emerged as a key market driver, with customers valuing the storytelling behind handmade bread, prompting bakeries to offer workshops, behind-the-scenes tours, and interactive baking sessions that foster brand loyalty.

Rising Demand for Health-Conscious and Functional Artisanal Bread

Japanese consumers are increasingly prioritizing wellness, leading bakeries to incorporate nutrient-rich ingredients including whole grains, seeds, and fermented doughs. Ancient grains such as spelt, rye, and quinoa are gaining popularity due to their high fiber and protein content, appealing to consumers seeking digestive health benefits and sustained energy. Functional breads fortified with probiotics, collagen, or plant-based proteins cater to health-focused buyers, including fitness enthusiasts and Japan's aging population seeking foods that support overall wellbeing. The shift toward low-sugar and gluten-free varieties is also accelerating, driven by dietary restrictions and lifestyle considerations. Artisanal bakeries are experimenting with natural sweeteners such as honey and rice malt, as well as alternative flours including almond and buckwheat, aligning with Japan's growing health-conscious culture where clean-label and organic certifications increasingly influence purchasing decisions.

Premiumization and Regional Ingredient Integration

Consumers are increasingly willing to pay premium prices for unique, high-quality artisanal products that emphasize regional authenticity and cultural heritage. Limited-edition seasonal breads, such as sakura-infused or matcha-flavored loaves, attract customers seeking exclusivity and meaningful cultural connections. Artisanal bakeries are elevating their offerings through collaborations with local producers, incorporating regional specialties including Hokkaido milk and Okinawan brown sugar to enhance flavor profiles and differentiate their products. This approach reflects Japan's broader shift toward mindful consumption, where the artistry and heritage behind bread-making enhance its perceived value. Consumers appreciate the storytelling behind handmade bread, valuing transparency regarding ingredient sourcing and production methods. By emphasizing tradition, craftsmanship, and provenance, artisanal bakeries foster deeper brand loyalty among discerning customers who prioritize quality over convenience.

Market Outlook 2026-2034:

The Japan artisanal bread market outlook remains positive, supported by sustained consumer interest in premium, health-oriented baked goods and continuous product innovation. Investment in advanced bakery processing equipment is enhancing production efficiency while maintaining artisanal quality standards. The growing trend of convenience store bakeries, exemplified by 7-Eleven's planned 10 billion yen investment to install in-store ovens across approximately half of its 20,000 Japan locations, indicates expanding accessibility of freshly baked artisanal products. The market generated a revenue of USD 135.24 Million in 2025 and is projected to reach a revenue of USD 257.33 Million by 2034, growing at a compound annual growth rate of 7.41% from 2026-2034.

Japan Artisanal Bread Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Sourdough Bread | 28% |

| Ingredients | Organic Flour-Based Breads | 40% |

| Distribution Channel | Specialty Bakeries and Artisan Shops | 38% |

Type Insights:

- Sourdough Bread

- Baguettes and Ciabatta

- Multigrain and Whole Wheat Bread

- Gluten-Free Bread

- Others

Sourdough bread dominates with a market share of 28% of the total Japan artisanal bread market in 2025.

Sourdough bread has witnessed remarkable growth in Japan, driven by increasing consumer recognition of its digestive health benefits and distinctive flavor profile. The long fermentation process using natural wild yeast and bacteria enhances the bread's nutritional value, making it particularly appealing to health-conscious consumers. Japanese artisan bakers have developed expertise in naturally leavened wholewheat sourdough, offering consumers flavorful, nourishing golden-brown loaves that command premium prices. The popularity of sourdough bread reflects Japan's broader wellness culture, where consumers increasingly seek authentic, clean-label products with minimal artificial additives.

Ingredients Insights:

- Organic Flour-Based Breads

- Grain and Seed Mix Breads

- Dairy-Free and Vegan Options

Organic flour-based breads lead with a share of 40% of the total Japan artisanal bread market in 2025.

Organic flour-based breads have emerged as the dominant ingredient segment in Japan's artisanal bread market, reflecting consumer preference for clean-label products free from synthetic additives and pesticides. Investment in research and development by leading food companies supports product innovation, enhancing the availability of diverse organic bread offerings. Strict government food safety regulations and initiatives promoting organic agriculture have fostered consumer trust and catalyzed market expansion. Health-oriented buyers increasingly expect organic flour-based breads to be additive and preservative-free, driving demand for non-GMO and certified organic flour varieties.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Bakeries and Artisan Shops

- Online Retail

- HoReCa (Hotels, Restaurants, and Cafes)

Specialty bakeries and artisan shops exhibits a clear dominance with a 38% share of the total Japan artisanal bread market in 2025.

Specialty bakeries and artisan shops have established themselves as the preferred distribution channel for Japanese consumers seeking premium, handcrafted bread. These establishments offer unique advantages including freshness, personalized service, and the opportunity to experience the artistry and heritage of bread-making firsthand. In urban areas, specialty bakeries function as community hubs where consumers gather and engage with bakers, fostering strong brand loyalty. High-end artisan bakeries focus on producing premium-quality bread using locally sourced ingredients, offering unique flavors and varieties that appeal to discerning customers seeking elevated culinary experiences.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region, anchored by Tokyo and Yokohama, represents Japan's largest artisanal bread market driven by high consumer spending power and sophisticated culinary preferences. Premium bakeries are establishing new standards of expertise. Urban consumers demonstrate strong willingness to pay premium prices for unique, handcrafted bread with distinctive flavor profiles.

The Kansai/Kinki Region, encompassing Osaka, Kyoto, and Kobe, constitutes a significant artisanal bread market characterized by a rich culinary heritage and discerning consumer base. Establishments like Le Sucre-Coeur in Kishibe, Osaka have evolved from modest beginnings to become regional leaders in quality bread and pastries. The region's traditional food culture supports demand for premium, authentically crafted bakery products.

The Central/Chubu Region, including Nagoya and surrounding prefectures, presents a growing market for artisanal bread driven by increasing urbanization and expanding retail infrastructure. Consumers demonstrate rising interest in health-conscious bakery options including whole grain and organic flour-based breads. The region benefits from strategic geographic positioning that facilitates efficient distribution networks connecting major metropolitan areas across Japan.

The Kyushu-Okinawa Region offers distinctive artisanal bread market opportunities through unique regional ingredients such as Okinawan brown sugar and local citrus varieties. Bakeries incorporate these specialties to create differentiated products that appeal to consumers seeking cultural authenticity. The region's tourism industry further supports demand for premium artisanal offerings, with visitors seeking authentic local culinary experiences and specialty food souvenirs.

The Tohoku Region in northern Honshu represents an emerging market for artisanal bread, with consumer preferences gradually shifting toward premium, health-oriented bakery products. Local bakeries are developing offerings featuring regional grains and ingredients to differentiate their products. The region's agricultural heritage supports sourcing of quality wheat and specialty ingredients, while community-focused artisan operations foster strong consumer loyalty.

The Chugoku Region, including Hiroshima and Okayama, demonstrates steady growth in artisanal bread consumption driven by increasing health awareness and appreciation for handcrafted products. Local bakeries emphasize traditional baking techniques while incorporating regional ingredients to appeal to consumer preferences for authenticity. The region's moderate population density supports specialty bakeries that serve as community gathering spaces fostering brand engagement.

The Hokkaido Region contributes distinctively to Japan's artisanal bread market through its premium dairy products and wheat production. Hokkaido milk is prized by artisanal bakeries nationwide for enhancing flavor profiles in shokupan and specialty breads. The region's domestic wheat cultivation addresses consumer interest in locally sourced ingredients, while its reputation for agricultural quality positions Hokkaido-origin products as premium offerings.

The Shikoku Region presents a niche market for artisanal bread characterized by traditional consumer preferences and growing interest in premium bakery products. Local artisan bakeries focus on quality craftsmanship and personalized service to build consumer relationships. The region's citrus production provides distinctive flavoring ingredients that bakeries incorporate into seasonal and specialty bread offerings appealing to regional tastes.

Market Dynamics:

Growth Drivers:

Why is the Japan Artisanal Bread Market Growing?

Rising Health Consciousness and Functional Food Demand

Increasing health awareness among Japanese consumers is fundamentally reshaping demand patterns in the artisanal bread market. With Japan's aging population, there is growing demand for foods that support digestive health, weight control, and overall wellness. Consumers are actively seeking breads made with whole grains, seeds, and fermented doughs that offer enhanced nutritional profiles. Japan's functional food market stimulates innovation through regulatory frameworks such as Foods with Function Claims (FFCs) that encourage investment in research and development. This policy environment enables artisanal bakeries to develop and market breads fortified with probiotics, collagen, and plant-based proteins, thereby expanding their appeal to health-focused demographics.

Premiumization and Cultural Appreciation for Craftsmanship

Japanese consumers demonstrate a strong willingness to pay premium prices for products that reflect quality, authenticity, and artisanal heritage. This cultural appreciation for craftsmanship drives demand for handmade breads produced using traditional techniques and locally sourced ingredients. Artisanal bakeries are developing limited-edition seasonal breads, incorporating regional specialties such as Hokkaido milk and matcha, and offering experiential retail concepts that enhance perceived product value. Consumers increasingly value transparency regarding ingredient sourcing and production methods, seeking meaningful connections with the bakers and stories behind their bread. This preference for mindful consumption fosters deeper brand loyalty among discerning customers who prioritize quality, tradition, and provenance over convenience.

Expansion of Distribution Channels and Retail Infrastructure

The expansion of retail distribution channels is significantly enhancing consumer access to artisanal bread products across Japan. Convenience stores, which operate over 70,000 locations stocking freshly baked bread with localized flavors, represent a major growth avenue. In March 2025, Japanese broadcaster NHK reported that 7-Eleven is considering a 10 billion yen investment to install and expand in-store cooking equipment, including ovens capable of baking fresh bread across approximately half of its 20,000 convenience stores in Japan. E-commerce platforms are also gaining traction, with online grocery sales facilitating wider distribution of artisanal bread products. Strategic partnerships with food delivery platforms further enhance accessibility, enabling artisan bakeries to reach consumers beyond their immediate geographic locations.

Market Restraints:

What Challenges the Japan Artisanal Bread Market is Facing?

High Production and Ingredient Costs

Artisanal bread production requires premium ingredients, specialized equipment, and skilled labor, resulting in higher production costs compared to mass-produced alternatives. Sourcing organic, non-GMO, and specialty ingredients presents ongoing challenges in cost management. Inflationary pressures coupled with currency fluctuations impact ingredient costs and pricing strategies, potentially limiting market accessibility for price-sensitive consumers.

Wheat Import Dependency and Supply Chain Vulnerabilities

Japan relies heavily on imports for its wheat consumption, creating significant supply chain vulnerabilities. Dependence on international wheat supplies exposes the market to price volatility and potential disruptions from global trade fluctuations, weather events, and geopolitical factors. This broader reliance on imported raw materials remains a structural challenge for the artisanal bread industry seeking stable ingredient sourcing.

Competition from Conventional and Convenience Bakery Products

The artisanal bread segment faces intense competition from conventional bakery products and convenience store offerings that compete on price and accessibility. Major manufacturers command substantial domestic packaged bakery sales, presenting formidable competition for artisan producers. Alternative diet trends may also shift consumer demand away from traditional wheat-based artisanal breads, challenging market growth prospects.

Competitive Landscape:

The Japan artisanal bread market features a diverse competitive landscape comprising established bakery conglomerates, regional specialty bakeries, and premium artisan operators. Companies compete through product innovation, quality differentiation, and strategic partnerships to capture market share. Industry participants are increasingly focusing on sourcing local and organic ingredients, collaborating with renowned chefs, and introducing limited-edition products to capture consumer interest. High-end establishments have established premium positioning through specialized offerings that emphasize craftsmanship and authenticity. Strategic collaborations between manufacturers demonstrate industry efforts to leverage complementary capabilities, expand distribution networks, and strengthen market reach across diverse consumer segments.

Japan Artisanal Bread Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Sourdough Bread, Baguettes and Ciabatta, Multigrain and Whole Wheat Bread, Gluten-Free Bread, Others |

| Ingredients Covered | Organic Flour-Based Breads, Grain and Seed Mix Breads, Dairy-Free and Vegan Options |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Bakeries and Artisan Shops, Online Retail, HoReCa (Hotels, Restaurants, and Cafes) |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan artisanal bread market size was valued at USD 135.24 Million in 2025.

The Japan artisanal bread market is expected to grow at a compound annual growth rate of 7.41% from 2026-2034 to reach USD 257.33 Million by 2034.

Sourdough bread holds the largest type segment share at 28%, driven by growing consumer preference for naturally fermented breads offering digestive health benefits, distinctive flavor profiles, and clean-label credentials that appeal to health-conscious Japanese consumers.

Key factors driving the Japan artisanal bread market include rising health consciousness among consumers, cultural appreciation for craftsmanship and premium products, expanding distribution channels, innovation in functional and organic ingredients, and growing social media engagement that amplifies artisanal brand visibility.

Major challenges include high production and ingredient costs, dependence on imported wheat supplies creating supply chain vulnerabilities, intense competition from conventional bakery products, and potential demand shifts from alternative diet trends such as low-carb and gluten-free regimens.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)