Japan Auto Parts Aftermarket Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Auto Parts Aftermarket Market Overview:

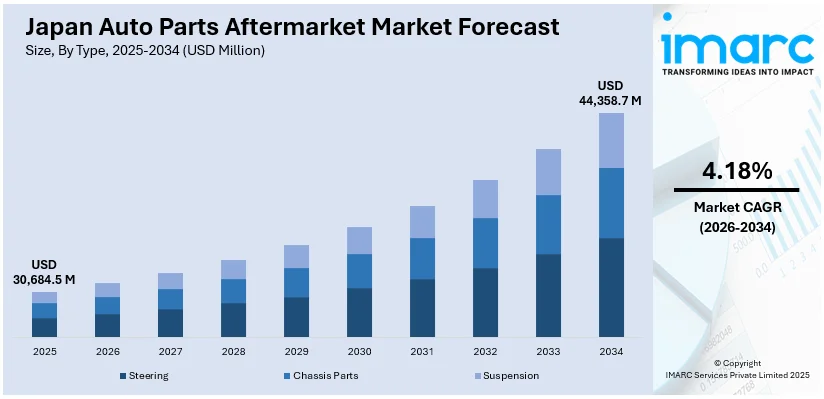

The Japan auto parts aftermarket market size reached USD 30,684.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 44,358.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.18% during 2026-2034. The market is propelled by growing vehicle maintenance and repair demand resulting from an aging vehicle population, technological advancements in vehicles, and growth of electric vehicles (EVs). Furthermore, consumer trends towards affordable, quality replacement parts and the rise in e-commerce are driving market expansion. Environmental issues are driving the need for green and sustainable products, and digitalization is improving the customer experience and optimizing business processes further driving the Japan auto parts aftermarket market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 30,684.5 Million |

|

Market Forecast in 2034

|

USD 44,358.7 Million |

| Market Growth Rate 2026-2034 | 4.18% |

Japan Auto Parts Aftermarket Market Trends:

Technological Integration and Demand for Advanced Components

Japan's automotive aftermarket is responding to the increasing presence of technologically sophisticated vehicles that are propelled by technologies such as advanced driver-assistance systems (ADAS), electric drivetrain, and connected cars. This has led to a need for specialized components such as sensors, electronic control units (ECUs), and high-capacity batteries. With increasingly complex vehicles, there is a growing demand for highly trained technicians and sophisticated diagnostic equipment to handle complex repairs. As a result, the aftermarkets sector is spending on expert training packages and the latest equipment to ensure these newer technologies are kept in good shape. Businesses are concentrating on ensuring their staff have the skills they need to work with electric vehicle (EV) parts, ADAS calibrations, and other newer systems. This indicates the industry's key position of keeping the performance, safety, and lifespan of contemporary cars improving as the latter keeps changing further impelling the Japan auto parts aftermarket market growth.

To get more information on this market Request Sample

Digitalization and E-Commerce Expansion

Digital transformation is at the root of change in Japan's auto parts aftermarket, with e-commerce taking center stage. Buyers are preferring online channels for auto parts and accessories, appreciating convenience, variety, and improved pricing. Accordingly, companies are strengthening their digital footprint through easy-to-use websites and mobile apps. Several are also embracing online-to-offline (O2O) services, enabling customers to order online and collect from a store. Besides, digital platforms for customer interaction and inventory management assist companies in remaining competitive. In 2024, Japan's vehicle parts online business raked in about USD 759 million, though growth has slowed from past years. This digital transformation provides a more enhanced shopping experience, addresses consumer needs, and provides insightful information to further business growth. For aftermarket companies, however, adopting digital technology is paramount to competing in a fast-changing environment.

Emphasis on Sustainability and Eco-Friendly Products

Sustainability is emerging as a priority in Japan's auto parts aftermarket, prompted by growing environmental consciousness and increasingly stringent regulations. Customers are becoming more interested in environmentally friendly solutions such as biodegradable lubricants, low-emission coatings, and remanufactured components to help minimize waste. To meet this demand, aftermarket firms are designing cleaner products to support Japan's overall environmental agenda. The growth of electric vehicles (EVs) is also transforming the industry, placing a demand for specialized parts and maintenance work. By becoming greener, companies are not just avoiding future regulatory headaches but also attracting planet-friendly shoppers. It increases customers' confidence, builds brand reputation, and saves them long-term customers. Sustainability programs also promote cost-effectiveness, which ultimately serves the business and its stakeholders as it shifts towards an eco-friendlier future.

Japan Auto Parts Aftermarket Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Steering

- Chassis Parts

- Suspension

The report has provided a detailed breakup and analysis of the market based on the type. This includes steering, chassis parts, and suspension.

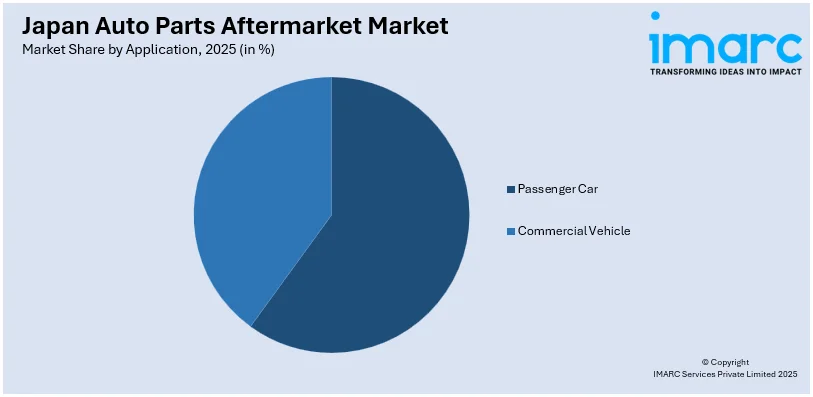

Application Insights:

Access the comprehensive market breakdown Request Sample

- Passenger Car

- Commercial Vehicle

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes passenger car and commercial vehicle.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/ Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Auto Parts Aftermarket Market News:

- In March 2025, DENSO became the first Japan-based company to earn EcoPass certification from Catena-X on February 14, 2025. The certification recognizes DENSO’s Digital Product Passport application, which supports secure data exchange across the automotive supply chain. This achievement aligns with global efforts towards carbon neutrality and circular economy initiatives. DENSO is also preparing for future regulations, developing a Battery Passport application in anticipation of the 2027 European Battery Regulation.

- In December 2024, HKS Co., Ltd. and Nippon Seiki Co., Ltd., through its Defi brand, are collaborating to launch advanced automotive aftermarket products, focusing on meter systems and precision instruments for electric vehicles (EVs). Leveraging HKS’ expertise in performance parts and Defi’s instrumentation technology, the partnership aims to offer innovative solutions. These new products will be unveiled at the 2025 Tokyo Auto Salon, held from January 10-12, at Makuhari Messe in Chiba.

Japan Auto Parts Aftermarket Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Steering, Chassis Parts, Suspension |

| Applications Covered | Passenger Car, Commercial Vehicle |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan auto parts aftermarket market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan auto parts aftermarket market on the basis of type?

- What is the breakup of the Japan auto parts aftermarket market on the basis of application?

- What is the breakup of the Japan auto parts aftermarket market on the basis of region?

- What are the various stages in the value chain of the Japan auto parts aftermarket market?

- What are the key driving factors and challenges in the Japan auto parts aftermarket?

- What is the structure of the Japan auto parts aftermarket market and who are the key players?

- What is the degree of competition in the Japan auto parts aftermarket market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan auto parts aftermarket market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan auto parts aftermarket market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan auto parts aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)