Japan Automated Assembly Line Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Japan Automated Assembly Line Market Summary:

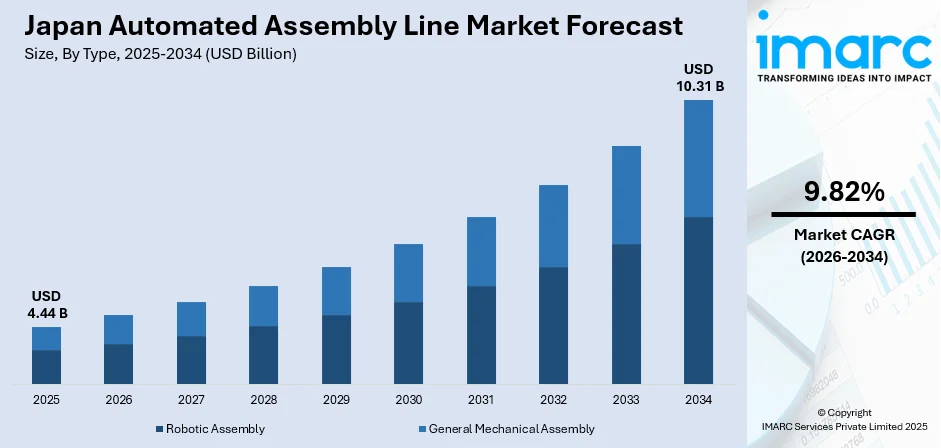

The Japan automated assembly line market size was valued at USD 4.44 Billion in 2025 and is projected to reach USD 10.31 Billion by 2034, growing at a compound annual growth rate of 9.82% from 2026-2034.

The Japan automated assembly line market is expanding rapidly as manufacturers integrate advanced robotics and artificial intelligence into production processes. Persistent labor shortages driven by demographic shifts, combined with the need for enhanced precision and operational efficiency, are accelerating adoption across key industries. Government initiatives promoting Industry 4.0 technologies, substantial investments in smart factory infrastructure, and the ongoing restructuring of automotive production for electric vehicles are collectively strengthening the Japan automated assembly line market share.

Key Takeaways and Insights:

- By Type: Robotic assembly dominates the market with a share of 62.6% in 2025, driven by continuous advancements in articulated and collaborative robots enabling high-precision manufacturing across automotive and electronics sectors.

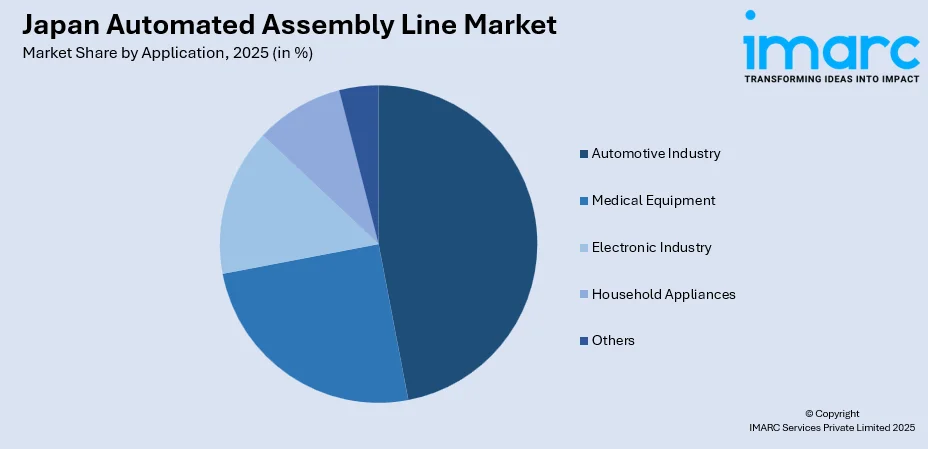

- By Application: Automotive industry leads the market with a share of 47.5% in 2025, supported by major automakers restructuring production lines for electric vehicle manufacturing and adopting advanced automation for battery assembly processes.

- By Region: Kanto region holds the largest market share at 34.2% in 2025, anchored by Tokyo's concentration of manufacturing headquarters, advanced industrial infrastructure, and proximity to major electronics and automotive production facilities.

- Key Players: The Japan automated assembly line market exhibits strong competitive intensity, with leading robotics manufacturers leveraging decades of engineering expertise to deliver precision automation solutions across diverse industrial applications.

To get more information on this market Request Sample

Japan remains a global leader in manufacturing automation, supported by its highly advanced engineering capabilities and long-standing expertise in precision technology. The country's advanced technological infrastructure and commitment to precision engineering continue to attract significant investments in next-generation assembly solutions. In September 2024, DENSO Corporation announced a JPY 69 billion (approximately USD 460 million) investment to construct a new manufacturing facility in Nishio City, featuring next-generation digital and automation technologies designed to enable 24-hour unmanned operations for electrification and advanced driver assistance system components. The convergence of demographic pressures, technological innovation, and strategic government support positions Japan's automated assembly line sector for sustained expansion through the forecast period.

Japan Automated Assembly Line Market Trends:

Integration of Artificial Intelligence and Machine Learning

Japanese manufacturers are increasingly embedding artificial intelligence capabilities into robotic assembly systems to enhance operational flexibility and decision-making. Advanced machine learning algorithms enable robots to adapt to variable production scenarios, optimize cycle times, and perform predictive maintenance. In May 2025, VMS Solutions expanded operations into Japan, offering AI-driven production planning solutions leveraging digital twin technology to help manufacturers reduce cycle times by over 30%. This technological integration is accelerating Japan automated assembly line market growth.

Rising Adoption of Collaborative Robots

Collaborative robots designed to work safely alongside human operators are gaining significant traction in Japanese manufacturing facilities. These systems offer flexibility for small and medium enterprises that face spatial and financial constraints while addressing persistent workforce shortages. In September 2024, Kawasaki Heavy Industries launched its CL Series collaborative robots featuring payload capacities from 3 to 10 kilograms, developed in partnership with Neura Robotics to deliver industrial-scale performance while maintaining human-robot collaboration safety standards.

Digital Twin and IoT-Enabled Smart Factories

The deployment of Internet of Things sensors and digital twin technologies is transforming Japanese assembly facilities into interconnected smart factories. Real-time monitoring, predictive analytics, and virtual simulation capabilities are enabling manufacturers to optimize production workflows and minimize downtime. In February 2025, Yokogawa Electric Corporation has introduced the upgraded OpreX Collaborative Information Server, designed to improve application integration and external system connectivity. The platform supports enhanced production management and facilitates remote monitoring, allowing for faster, more informed decision-making across operations.

Market Outlook 2026-2034:

The Japan automated assembly line market is positioned for robust expansion as manufacturers continue investing in automation to address structural labor constraints and maintain global competitiveness. The integration of advanced robotics, artificial intelligence, and smart factory technologies will reshape production capabilities across automotive, electronics, and precision manufacturing sectors. The market generated a revenue of USD 4.44 Billion in 2025 and is projected to reach a revenue of USD 10.31 Billion by 2034, growing at a compound annual growth rate of 9.82% from 2026-2034.

Japan Automated Assembly Line Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Robotic Assembly | 62.6% |

| Application | Automotive Industry | 47.5% |

| Region | Kanto Region | 34.2% |

Type Insights:

- Robotic Assembly

- General Mechanical Assembly

Robotic assembly dominates the market with a share of 62.6% of the total Japan automated assembly line market in 2025.

The robotic assembly segment continues to lead the market as Japanese manufacturers prioritize precision, speed, and flexibility in production operations. Advanced articulated robots capable of performing complex tasks including welding, painting, and component assembly are increasingly deployed across manufacturing facilities. In 2024, Japan’s automotive sector integrated around 13,000 industrial robots, marking a notable increase from the prior year and reaching the highest installation level observed since 2020, according to the International Federation of Robotics.

Japanese robotics manufacturers continue to advance robotic capabilities through integration with artificial intelligence, vision systems, and force sensors. These technological enhancements enable robots to handle variable workpieces, perform quality inspections, and adapt to changing production requirements with minimal human intervention. The ongoing shift toward electric vehicle production is further accelerating investments in robotic assembly systems designed for battery pack manufacturing and motor component integration.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Automotive Industry

- Medical Equipment

- Electronic Industry

- Household Appliances

- Others

The automotive industry leads the market with a share of 47.5% of the total Japan automated assembly line market in 2025.

Japan's automotive sector remains the primary driver of automated assembly line adoption, with major manufacturers restructuring production facilities to accommodate electric and hybrid vehicle manufacturing. In 2023, the sector’s robot density climbed to 1,531 units per 10,000 workers, placing Japan fourth worldwide, following Slovenia, South Korea, and Switzerland. Automakers are investing heavily in flexible automation systems capable of handling diversified powertrain portfolios including battery electric, fuel cell, and hydrogen combustion technologies.

The transition to electrified vehicles is transforming assembly requirements, with battery pack production and electric motor integration demanding new automation capabilities. Japanese automakers are deploying advanced robotic systems for precision welding, adhesive application, and quality inspection processes critical to electric vehicle manufacturing. This restructuring of automotive production represents approximately 25% of all robot installations annually in Japan.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region holds the largest share at 34.2% of the total Japan automated assembly line market in 2025.

The Kanto region, encompassing Tokyo and six surrounding prefectures with approximately 43 million residents, serves as Japan's economic and industrial heartland. The region accounts for roughly 45% of Japan's GDP and hosts major manufacturing headquarters along with an extensive industrial belt developed along the Tokyo Bay coastal strip. Electronics, steelmaking, and automotive component manufacturers concentrated in this region are leading adopters of advanced assembly automation technologies.

The concentration of corporate headquarters, research institutions, and technology suppliers in the Kanto region creates a robust ecosystem for automation innovation. Over 70% of foreign companies operating in Japan maintain headquarters in Tokyo, facilitating technology transfer and collaboration in advanced manufacturing solutions. The region's well-developed infrastructure and access to skilled talent continue to attract significant investments in next-generation assembly line technologies.

Market Dynamics:

Growth Drivers:

Why is the Japan Automated Assembly Line Market Growing?

Aging Workforce and Severe Labor Shortages

Japan faces one of the most acute labor shortages among developed nations, with demographic pressures fundamentally reshaping manufacturing operations. The country's senior population has reached a record 36.25 million, with individuals aged 65 and older comprising nearly 30% of the total population. Two-thirds of Japanese companies report that worker shortfalls are seriously or fairly seriously affecting their business operations. The number of bankruptcies caused by labor shortages surged 32% in 2024 to a record 342 cases. Projections indicate Japan will face a shortage of 11 million workers by 2040, making automation an operational imperative rather than a strategic choice. This demographic reality is driving unprecedented investments in automated assembly systems to maintain production continuity.

Government Support Through Society 5.0 Initiative

The Japanese government actively promotes automation adoption through comprehensive policy frameworks including the Society 5.0 initiative, which aims to create a fully connected society with robotics playing essential roles across manufacturing, healthcare, and infrastructure sectors. The government has allocated substantial funding including approximately USD 440 million, on robotics-related projects from 2020 to 2025 as part of the Moonshot Research and Development Program. Financial incentives, research and development support, and collaborative frameworks between industry and academia are accelerating the integration of smart technologies into manufacturing processes. Additionally, Japan's commitment to sustainability is driving the adoption of energy-efficient automated solutions to meet stricter regulatory standards.

Automotive Industry Restructuring for Electric Vehicle Production

The Japanese automotive industry is undergoing significant restructuring to adapt to alternative powertrains, creating substantial demand for new assembly line configurations. Most major automakers intend to expand their range of battery and fuel cell electric vehicles while developing hydrogen-fueled combustion engines. This diversified powertrain portfolio requires flexible production technology capable of handling multiple vehicle types on shared assembly lines. In July 2025, the International Federation of Robotics reported that Japan's automotive industry achieved its highest robot installation levels in five years, with approximately 13,000 industrial robots deployed. The automotive sector accounts for approximately 25% of all robot installations annually in Japan, underscoring the industry's critical role in driving automation investments.

Market Restraints:

What Challenges the Japan Automated Assembly Line Market is Facing?

High Initial Investment Costs for Small and Medium Enterprises

The considerable upfront expense required for advanced automation systems poses a major challenge for small and medium-sized enterprises, which make up most businesses in Japan. Fully automated production lines involve high setup costs and ongoing maintenance, along with specialized training, further increasing total ownership expenses. Many smaller companies with limited financial resources remain cautious about adopting full-scale automation, even though they recognize its potential long-term benefits.

Integration Challenges with Legacy Systems

Many Japanese manufacturing facilities still operate using older infrastructure that predates modern digital and automation standards. Retrofitting these existing production lines with advanced robotics while maintaining smooth operations is complex, creating implementation difficulties and extending deployment timelines. This reliance on legacy systems slows the adoption of new technologies and constrains the overall expansion of automation in the industry.

Skilled Workforce Shortage for Robot Operation and Maintenance

Although automation helps address general labor shortages, it increases demand for highly skilled personnel capable of programming, operating, and maintaining sophisticated robotic systems. The limited availability of professionals with expertise in areas such as artificial intelligence and automation technologies restricts the growth of the automation market, as companies struggle to develop the internal talent required to support these advanced systems.

Competitive Landscape:

The Japan automated assembly line market exhibits strong competitive intensity among established robotics and automation technology providers. Leading companies leverage decades of engineering expertise and substantial research and development investments to deliver precision automation solutions. Key market participants are focusing on integrating artificial intelligence capabilities, expanding collaborative robot portfolios, and developing energy-efficient solutions. Strategic partnerships between robotics manufacturers, technology providers, and end-user industries are accelerating innovation cycles. Companies are increasingly offering comprehensive automation ecosystems combining hardware, software, and aftermarket services to capture recurring revenue streams and strengthen customer relationships across diverse industrial applications.

Recent Developments:

- September 2024: OMRON Corporation launched the TM25S collaborative robot featuring a 25-kilogram payload capacity and 1,900-millimeter reach with a compact design, ideal for palletizing, mobile manipulation, and welding applications with easy integration into existing manufacturing workflows.

Japan Automated Assembly Line Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Robotic Assembly, General Mechanical Assembly |

| Applications Covered | Automotive Industry, Medical Equipment, Electronic Industry, Household Appliances, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan automated assembly line market size was valued at USD 4.44 Billion in 2025.

The Japan automated assembly line market is expected to grow at a compound annual growth rate of 9.82% from 2026-2034 to reach USD 10.31 Billion by 2034.

Robotic assembly holds the largest share at 62.6%, driven by continuous advancements in articulated and collaborative robots enabling high-precision manufacturing across automotive, electronics, and machinery industries in Japan.

Key factors driving the Japan automated assembly line market include severe labor shortages due to demographic changes, government support through Society 5.0 initiatives, automotive industry restructuring for electric vehicles, and technological advancements in robotics and artificial intelligence.

Major challenges include high initial investment costs particularly for small and medium enterprises, integration difficulties with legacy manufacturing systems, shortage of skilled technicians for robot operation and maintenance, and competitive pressure from lower-cost automation suppliers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)