Japan Automotive Aftermarket Accessories Market Size, Share, Trends and Forecast by Product Type, Vehicle Type, Sales Channel, End User, and Region, 2026-2034

Japan Automotive Aftermarket Accessories Market Summary:

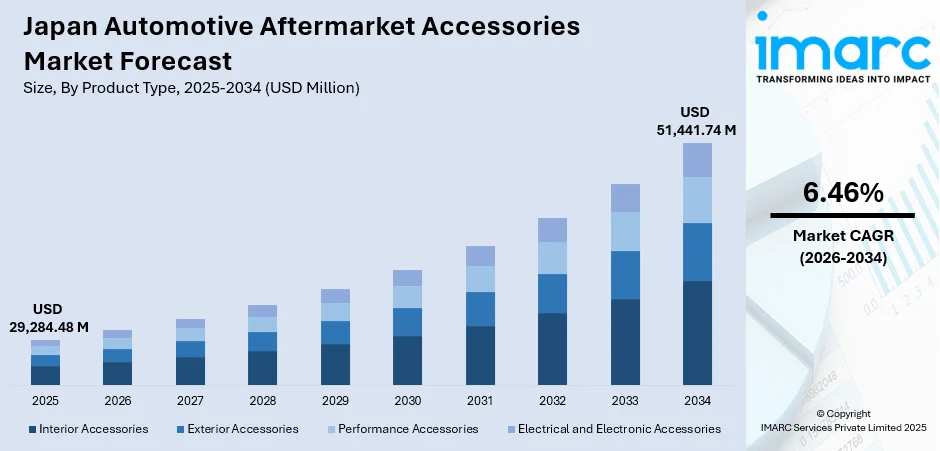

The Japan automotive aftermarket accessories market market size was valued at USD 29,284.48 Million in 2025 and is projected to reach USD 51,441.74 Million by 2034, growing at a compound annual growth rate of 6.46% from 2026-2034.

The Japan automotive aftermarket accessories market is experiencing growth driven by higher user interest in vehicle personalization, increasing adoption of advanced in-car technologies, and rising demand for comfort, safety, and convenience features. As vehicles remain in service longer, owners are investing more in upgrades, replacement components, and performance-enhancing accessories. Growth in electric and hybrid vehicle ownership is also catalyzing the demand for specialized accessories and digital enhancements. Additionally, expanding e-commerce channels and improved product availability are making aftermarket solutions more accessible, further supporting the market growth across diverse user segments.

Key Takeaways and Insights:

- By Product Type: Exterior accessories dominate the market with a share of 38.2% in 2025, driven by strong user preference for body kits, spoilers, wind deflectors, and aesthetic enhancements that enable vehicle personalization and self-expression.

- By Vehicle Type: Passenger cars lead the market with a share of 62.9% in 2025, prevalence of passenger vehicles in Japan's automotive landscape, representing the primary platform for aftermarket modifications.

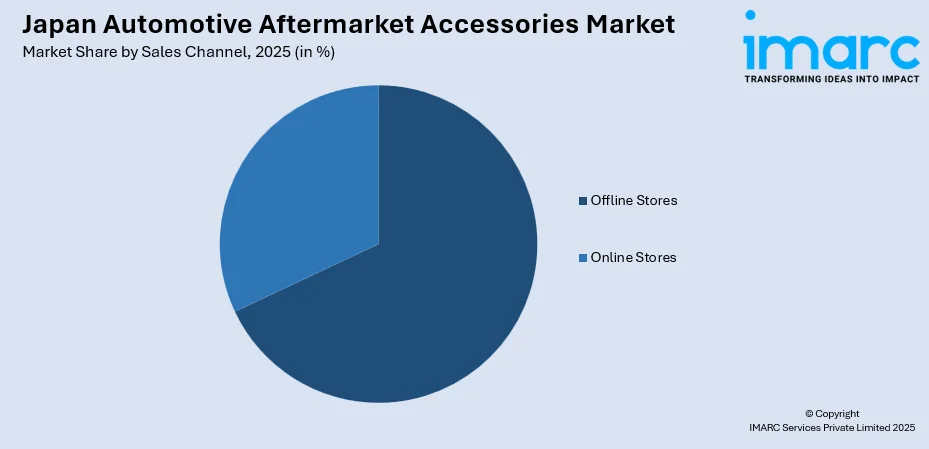

- By Sales Channel: Offline stores represent the largest segment with a market share of 68.2% in 2025, reflecting the buyer preference for physical retail experiences, expert consultation, and professional installation services.

- By End User: Individual consumers dominate the market with a share of 59.8% in 2025, underscoring the personal nature of vehicle accessorization and customization decisions in Japan's enthusiast-driven market.

- By Region: Kanto Region dominate the market with a share of 36.7% in 2025, driven by the concentration of Japan's population in the Tokyo metropolitan area, superior retail infrastructure, and vibrant car culture centered around iconic locations.

- Key Players: The Japan automotive aftermarket accessories market exhibits moderate to highly competitive intensity, with specialized accessory manufacturers and comprehensive automotive retailers competing alongside international brands across premium and value segments.

To get more information on this market Request Sample

The automotive aftermarket accessories market in Japan is experiencing growth driven by rising user preference for vehicle customization, expanding interest in advanced infotainment and driver-assistance features, and increasing demand for comfort and convenience enhancements. As vehicle ownership cycles lengthen, more drivers are investing in upgrades to maintain performance, improve aesthetics, and extend usability. The shift toward electric and hybrid vehicles is also influencing accessory demand, with people seeking specialized components, charging-related add-ons, and digital features tailored to next-generation mobility. Growth in e-commerce platforms is broadening access to a wider range of aftermarket products, enabling faster comparison, easier purchasing, and improved availability. The growth of the accessories market, driven by expanding used-car sales and a focus on safety, is supported by the significant value of the pre-owned segment, with the Japan used car market size valued at USD 70.9 Billion in 2025, according to the IMARC Group. Together, these factors contribute to a dynamic aftermarket ecosystem that caters to evolving user expectations and technological advancements across Japan’s automotive landscape.

Japan Automotive Aftermarket Accessories Market Trends:

Rise of E-Commerce and Online Accessory Retail

Japan’s expanding e-commerce ecosystem is influencing the automotive aftermarket accessories market by improving product accessibility and enabling buyers to compare options, assess reviews, and complete purchases with greater convenience. Digital platforms broaden the reach of both major brands and niche manufacturers, offering extensive selections, competitive pricing, and rapid delivery services. This shift in purchasing behavior is supported by national retail trends, as highlighted by Ministry of Economy, Trade and Industry (METI) 2025 report. It stated that Japan’s B2C e-commerce market grew to 26.1 trillion yen in 2024, while the BtoB segment reached 514.4 trillion yen, showing the prominence of online retail. As online shopping becomes more integrated into daily individual habits, digital channels continue to contribute to the aftermarket accessory demand.

Growing Purchasing Power

The Japan automotive aftermarket accessories market growth is increasingly supported by rising individual purchasing capacity, enabling greater investment in vehicle personalization and non-essential upgrades. As financial flexibility improves, interest in comfort features, technology add-ons, and stylistic enhancements continues to strengthen. This trend is reflected in national expenditure data by the Japan’s Statistics Bureau, which shows that the average monthly consumption expenditure per household in 2024 amounted to 300,243 yen. With expanding discretionary budgets, buyers are more willing to explore diverse accessory options, reinforcing steady demand across the aftermarket landscape.

Increasing Adoption of Electric and Hybrid Vehicles

The transition toward electric and hybrid mobility is generating a broader set of aftermarket requirements, including charging accessories, battery optimization components, aerodynamic enhancements, and products specifically engineered for EV architectures. This need is intensifying as model availability expands, with JATO reporting an increase in Japan’s battery electric vehicle offerings from 10 in 2019 to 61 by 2025. As people increasingly seek comfort, convenience, and performance-focused enhancements for electrified vehicles, aftermarket suppliers are diversifying their portfolios and developing solutions tailored to EV platforms. This evolution is reinforcing market growth and driving the demand beyond traditional automotive accessories.

Market Outlook 2026-2034:

The Japan automotive aftermarket accessories market shows notable growth potential, supported by increasing individual interest in vehicle personalization and rising adoption of advanced in-car technologies that enhance comfort, safety, and convenience. Demand is further driven by longer vehicle ownership cycles and expanding availability of specialized accessories across digital channels. The market generated a revenue of USD 29,284.48 Million in 2025 and is projected to reach a revenue of USD 51,441.74 Million by 2034, growing at a compound annual growth rate of 6.46% from 2026-2034.

Japan Automotive Aftermarket Accessories Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Exterior Accessories | 38.2% |

| Vehicle Type | Passenger Cars | 62.9% |

| Sales Channel | Offline Stores | 68.2% |

| End User | Individual Consumers | 59.8% |

| Region | Kanto Region | 36.7% |

Product Type Insights:

- Interior Accessories

- Seat Covers

- Floor Mats and Carpets

- Dashboard Accessories

- Steering Covers

- Others

- Exterior Accessories

- Body Kits

- Spoilers and Skirts

- Wind Deflectors

- Roof Racks

- Others

- Performance Accessories

- Exhaust Systems

- Air Filters

- Suspension Kits

- Turbochargers

- Others

- Electrical and Electronic Accessories

- Car Audio Systems

- Lighting

- Navigation and Infotainment Systems

- Parking Assist Systems

- Others

Exterior accessories dominate with a market share of 38.2% of the total Japan automotive aftermarket accessories market in 2025.

Exterior accessories dominate the market, as individuals place strong value on visual customization that enhances individuality and vehicle presence. Demand for body kits, spoilers, decals, and aerodynamic components reflects a deep-rooted culture of automotive styling.

This segment remains strong as manufacturers and retailers continuously introduce new designs tailored to compact cars, sedans, and performance models. Exterior upgrades are also widely embraced due to their ease of installation and immediate aesthetic impact, reinforcing their leading market share.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

Passenger cars lead with a market share of 62.9% of the total Japan automotive aftermarket accessories market in 2025.

Passenger cars lead the market due to their notable share in Japan’s vehicle population, making them the primary platform for customization. Owners frequently invest in accessories to improve comfort, appearance, and daily usability.

The consistent demand generated by passenger cars for functional and aesthetic aftermarket products is largely driven by the segment's high ownership density, a trend underscored by the fact that Kei cars alone accounted for 33.4% of all passenger car sales in the first half of 2025, according to JATO.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Stores

- Offline Stores

Offline stores exhibit a clear dominance with a 68.2% share of the total Japan automotive aftermarket accessories market in 2025.

Offline stores hold the biggest market share because buyers prefer hands-on product evaluation, expert guidance, and assured quality before making purchase decisions. Physical stores offer installation services that are highly valued for complex accessories.

These locations also foster trust, particularly for performance-related and electrical components. The availability of specialist workshops and branded outlets further supports strong offline engagement across the aftermarket ecosystem.

End User Insights:

- Individual Consumers

- Automotive Repair and Service Centers

Individual consumers dominate with a market share of 59.8% of the total Japan automotive aftermarket accessories market in 2025.

Individual consumers represent the largest segment, reflecting the personal and discretionary nature of vehicle accessorization in Japan. Drivers invest in upgrades that align with lifestyle, preferences, and aesthetic choices.

Enthusiast culture, combined with high interest in maintaining vehicle value and comfort, reinforces continued consumer-driven demand. Customization trends in cities and among younger demographics further strengthen this segment.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region leads with a market share of 36.7% of the total Japan automotive aftermarket accessories market in 2025.

Kanto Region dominates the market owing to its dense population, high vehicle ownership, and concentration of retail outlets and automotive service providers. Strong user purchasing power contributes to the steady aftermarket spending.

The region’s vibrant car culture, active modification communities, and extensive urban commuting patterns also support the market demand. Proximity to major distributors and service hubs further strengthens its leading market position.

Market Dynamics:

Growth Drivers:

Why is the Japan Automotive Aftermarket Accessories Market Growing?

Expansion of Automotive Customization Culture Through Large-Scale Events

Japan’s automotive aftermarket accessories market is gaining momentum as national events and exhibitions strengthen public engagement with vehicle customization and innovation. These platforms stimulate consumer interest, encourage brand–customer interaction, and accelerate awareness of new accessory categories. This trend is reinforced by major showcases such as the Tokyo Auto Salon 2025, held at Makuhari Messe in Chiba, which presented custom vehicles, aftermarket components, and live demonstrations to both industry professionals and the general public. As such events grow in scale and visibility, they foster greater demand for personalization and performance upgrades, supporting sustained growth of the aftermarket sector.

Rising Aging Population Increasing Demand for Accessibility Accessories

Japan’s aging demographic is shaping aftermarket demand by increasing the need for accessibility-oriented automotive accessories that support comfort, ease of movement, and safer driving for senior users. This shift becomes more pronounced as the senior population expands. By 2024, Japan recorded 36.25 million people aged 65 and older, representing nearly one-third of its total population. As older drivers seek ergonomic seating, improved visibility aids, and supportive interior components, aftermarket suppliers are responding with specialized products that enhance usability and reduce physical strain. This demographic trend supports steady long-term growth as vehicle adaptations for senior mobility become an essential purchasing priority.

Rise of Automotive Electronics and Smart Accessories

Advancements in automotive electronics are catalyzing the demand for smart aftermarket accessories that improve convenience, safety, and digital connectivity. People are upgrading older vehicles with navigation systems, parking assistance devices, sensors, infotainment features, and smartphone-compatible components to achieve a more modern driving experience. This shift is reinforced by the scale of electronic adoption. As per the IMARC Group, the Japan automotive electronics market size reached USD 21,382.87 Million in 2025, highlighting the growing integration of digital systems. As these technologies become more affordable and easier to install, their uptake expands across multiple vehicle categories, directly supporting the growth in aftermarket accessory sales.

Market Restraints:

What Challenges the Japan Automotive Aftermarket Accessories Market is Facing?

Rising Complexity of Vehicle Electronics

Modern vehicles incorporate increasingly sophisticated electronic architectures, making aftermarket integration more challenging. Accessories must align with advanced control systems, onboard diagnostics, and software-driven functions, requiring higher technical precision. This complexity raises development costs and limits compatibility, reducing the number of accessories that can be seamlessly installed without affecting vehicle performance or warranty conditions.

Strict Regulatory and Safety Compliance Requirements

Japan’s rigorous automotive safety and performance regulations impose strict compliance standards on aftermarket products. Certification protocols, installation guidelines, and material requirements increase production and testing costs. These constraints restrict flexibility for manufacturers, slow product rollouts, and limit the availability of accessories that meet both legal and technical criteria across diverse vehicle models.

Rising Material and Manufacturing Costs

Global supply chain disruptions and inflationary pressures elevate manufacturing costs for aftermarket accessories, creating challenges for maintaining competitive pricing while preserving quality standards expected by individuals. Rising raw material costs, energy expenses, and logistics charges pressure profit margins across the value chain, requiring manufacturers and retailers to optimize operations, adjust product mixes, or implement price increases that may dampen user demand for discretionary accessories.

Competitive Landscape:

The Japan automotive aftermarket accessories market exhibits moderate to highly competitive intensity characterized by the presence of specialized domestic manufacturers, comprehensive automotive retailers, and international brands competing across price segments and product categories. Market dynamics reflect strategic positioning, ranging from premium, innovation-driven offerings emphasizing quality and brand heritage to value-oriented products targeting cost-conscious clients. The competitive landscape is increasingly shaped by e-commerce capabilities, omnichannel integration, and strategic acquisitions that expand retail footprints and product portfolios. Established manufacturers benefit from strong brand recognition, quality reputations, and distribution relationships, while newer entrants leverage digital marketing and specialized product focus to capture niche segments.

Recent Developments:

-

In March 2024, the 21st International Auto Aftermarket EXPO 2024, took place from March 5-7, at Tokyo Big Sight, Japan, featuring automotive parts and accessories. The exhibition included a wide range of items like auto detailing, body works, collision repair, electrical components, and car cleaning products, alongside innovations in EV accessories and car maintenance systems.

Japan Automotive Aftermarket Accessories Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers |

| Sales Channels Covered | Online Stores, Offline Stores |

| End Users Covered | Individual Consumers, Automotive Repair and Service Centers |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan automotive aftermarket accessories market size was valued at USD 29,284.48 Million in 2025.

The Japan automotive aftermarket accessories market is expected to grow at a compound annual growth rate of 6.46% from 2026-2034 to reach USD 51,441.74 Million by 2034.

Exterior accessories dominated the market with a 38.2% revenue share in 2025, driven by strong user preference for body kits, spoilers, wind deflectors, and aesthetic enhancements that enable vehicle personalization and self-expression in Japan's vibrant car culture.

Key factors driving the Japan automotive aftermarket accessories market include the rising individual purchasing power, allowing people to spend more on personalization and comfort upgrades. For instance, the average monthly consumption expenditure per household in 2024 amounted to 300,243 yen, indicating stronger discretionary budgets that are driving greater interest in diverse automotive accessories.

Rising vehicle electronics complexity, strict regulatory requirements, and increasing material and manufacturing costs are collectively constraining Japan’s aftermarket accessories market. These factors raise development expenses, limit product compatibility, slow certification processes, and pressure profit margins, making it harder for manufacturers to deliver affordable, compliant, and easily installable accessories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)