Japan Automotive Hydraulic Actuators Market Size, Share, Trends and Forecast by Vehicle Type, Application Type, and Region, 2026-2034

Japan Automotive Hydraulic Actuators Market Overview:

The Japan automotive hydraulic actuators market size reached USD 3.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 7.2 Million by 2034, exhibiting a growth rate (CAGR) of 7.23% during 2026-2034. Rising customer demand for improved vehicle performance and safety, technological breakthroughs in automation and electric vehicles (EVs), and the growing need for fuel-efficient and emission-reducing technology are some of the factors propelling the market. The market is also expanding as a result of strict government limits on vehicle emissions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.8 Million |

| Market Forecast in 2034 | USD 7.2 Million |

| Market Growth Rate (2026-2034) | 7.23% |

Japan Automotive Hydraulic Actuators Market Trends:

Adoption of Electric Vehicles (EVs) and Hybrid Technology

The growing shift towards electric and hybrid vehicles in Japan is significantly influencing the automotive hydraulic actuators market. For instance, industry reports state that in 2023, Japan sold 11.9 million electric vehicles, marking an 8% increase from 2022. EVs made up 12.63% of total car registrations, with 3.45 million new EVs registered. Hybrid electric vehicles (HEVs) led the market with 11.5 million units sold, followed by 207,865 plug-in hybrids (PHEVs) and 165,083 battery electric vehicles (BEVs). The need for hydraulic actuators integrated with EV and hybrid systems is growing as automakers place a higher priority on creating more environmentally friendly and energy-efficient automobiles. These actuators are essential for precisely controlling parts like the steering, suspension, and braking systems. Automakers are integrating sophisticated hydraulic actuators into EV systems in an effort to improve overall performance and efficiency while upholding safety regulations. The market for hydraulic actuators in EVs and hybrids is expected to expand as manufacturers comply with environmental goals as a result of Japan's commitment to lowering carbon emissions.

Advancements in Autonomous Vehicle Technology

Advanced automotive hydraulic actuators are being more widely used as a result of Japan's continuous advancements in autonomous car technology. Hydraulic actuators are crucial for providing smooth, quick, and dependable operation since self-driving cars need high precision for a number of operations, including adaptive steering, braking, and suspension. By guaranteeing accurate changes in real time, these actuators aid in maximizing the vehicle's performance, which is essential for safety and autonomous navigation. Automotive manufacturers are progressively incorporating hydraulic actuators to improve the car's overall control systems, as Japan is a leader in autonomous vehicle technology. For instance, in September 2023, Marelli, with significant presence in Japan, unveiled a new range of smart actuators for EVs at the Battery Show North America 2023. These actuators simplify complex vehicle functions, helping manufacturers reduce integration complexity in both mechanical and electronic systems. Designed for hybrid and full EV transmission control, as well as battery EV thermal management, they offer modular, scalable, and customizable solutions. Features include compact size, lightweight design, and cybersecurity readiness. This trend highlights the growing need for hydraulic actuators in next-generation vehicles, supporting innovations in automated driving and improving passenger comfort and safety.

Japan Automotive Hydraulic Actuators Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on vehicle type and application type.

Vehicle Type Insights:

.webp)

- Passenger Car

- Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car and commercial vehicle.

Application Type Insights:

- Throttle Actuator

- Seat Adjustment Actuator

- Brake Actuator

- Closure Actuator

- Others

A detailed breakup and analysis of the market based on the application type have also been provided in the report. This includes throttle actuator, seat adjustment actuator, brake actuator, closure actuator, and others.

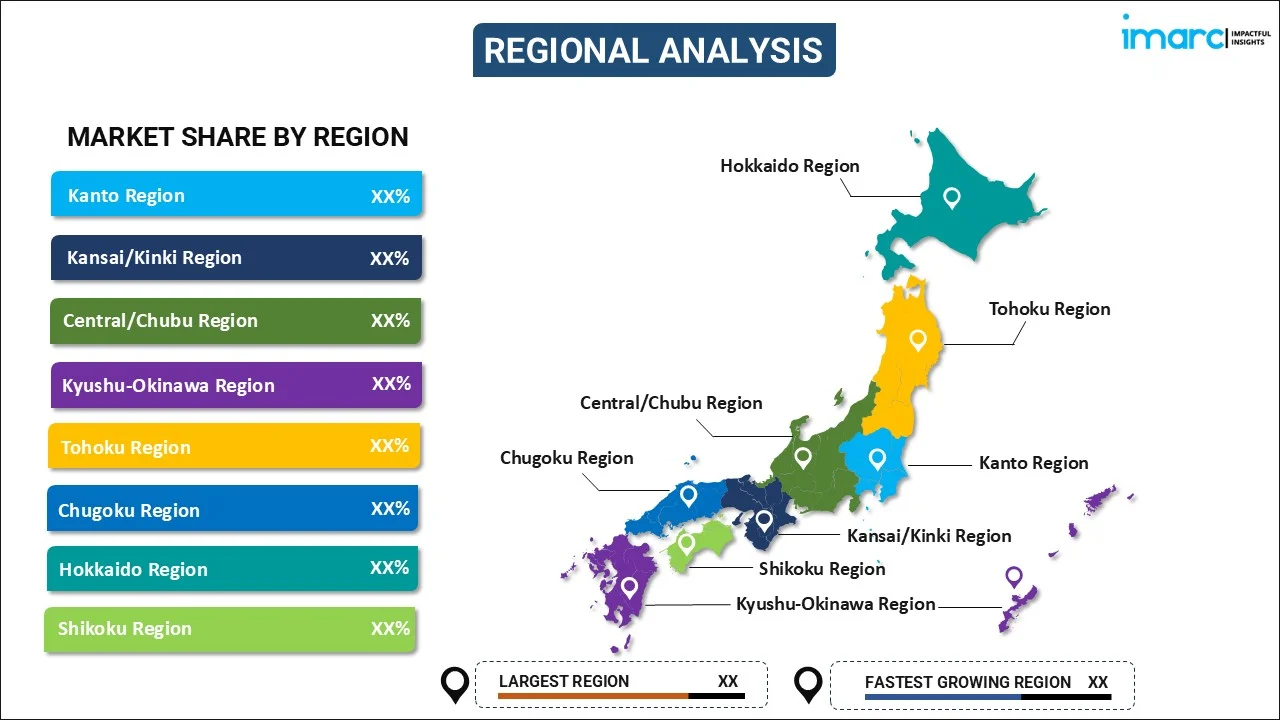

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Automotive Hydraulic Actuators Market News:

- In January 2025, AISIN, a Japanese corporation that develops and produces components and systems for the automotive industry, in collaboration with BluE Nexus Corporation and DENSO, developed the eAxle for Suzuki's first mass-produced battery electric vehicle (BEV), the e VITARA. The eAxle features a compact design with high power density, dynamic performance, and loss reduction technology for efficient electrical consumption. Manufactured in India, the eAxle will support Suzuki’s global BEV rollout. The collaboration aims to enhance electric vehicle electrification, leveraging the strengths of AISIN, DENSO, and BluE, contributing to the development of cost-effective and efficient products for a carbon-neutral future.

- In May 2024, Schaeffler Japan, specializing in motion technology for e-mobility, powertrain, chassis, bearings, and industrial applications, presented its latest advancements at the Automotive Engineering Exposition 2024 YOKOHAMA. The exhibition featured innovations in electric mobility, hydrogen fuel cells, and advanced transmission systems. Schaeffler classified its products into six motion families, namely guiding, transmitting, generating, driving, energizing, and sustaining motion.

Japan Automotive Hydraulic Actuators Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| Application Types Covered | Throttle Actuator, Seat Adjustment Actuator, Brake Actuator, Closure Actuator, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan automotive hydraulic actuators market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan automotive hydraulic actuators market on the basis of vehicle type?

- What is the breakup of the Japan automotive hydraulic actuators market on the basis of application type?

- What are the various stages in the value chain of the Japan automotive hydraulic actuators market?

- What are the key driving factors and challenges in the Japan automotive hydraulic actuators market?

- What is the structure of the Japan automotive hydraulic actuators market and who are the key players?

- What is the degree of competition in the Japan automotive hydraulic actuators market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan automotive hydraulic actuators market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan automotive hydraulic actuators market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan automotive hydraulic actuators industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)