Japan Automotive Paint Market Size, Share, Trends and Forecast by Application, Type, Vehicle Type, Finish Type, and Region, 2026-2034

Japan Automotive Paint Market Summary:

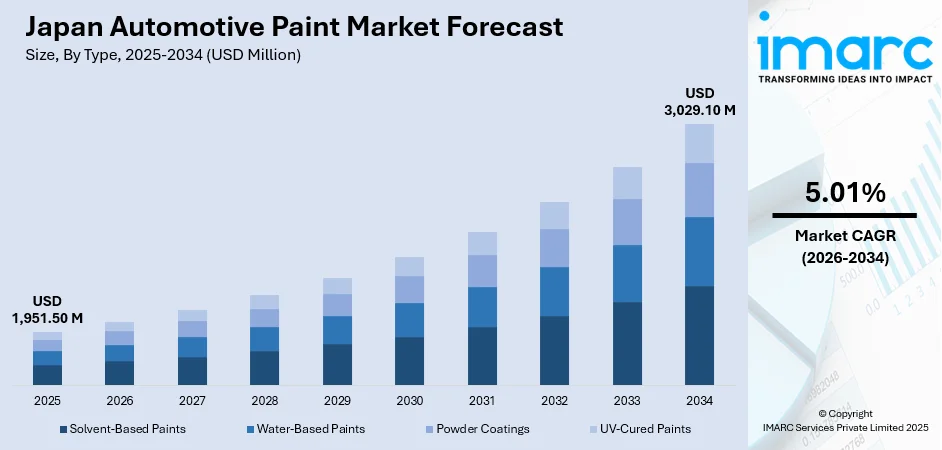

The Japan automotive paint market size was valued at USD 1,951.50 Million in 2025 and is projected to reach USD 3,029.10 Million by 2034, growing at a compound annual growth rate of 5.01% from 2026-2034.

The market is driven by the robust automobile manufacturing sector, increasing vehicle production volumes, and growing demand for premium surface finishes that enhance vehicle aesthetics and durability. Stringent environmental regulations are accelerating the adoption of eco-friendly coating solutions, while technological advancements in paint formulations support superior corrosion resistance and color retention. Rising consumer preferences for customized vehicle appearances and the expansion of aftermarket refinishing services further contribute to sustained demand, collectively shaping the Japan automotive paint market share.

Key Takeaways and Insights:

-

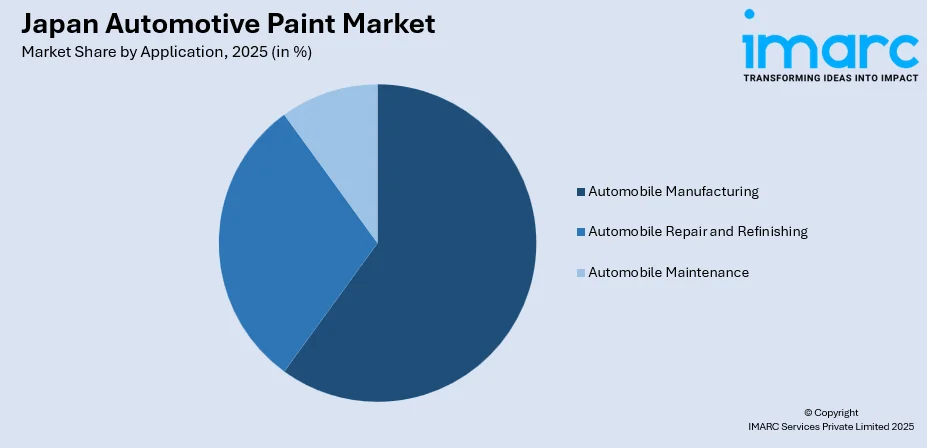

By Application: Automobile manufacturing leads the market with a share of 60% in 2025, driven by Japan’s strong vehicle production, OEM partnerships, high-volume assembly, and consistent coating supply requirements.

-

By Type: Water‑based paints dominate the market with a share of 35% in 2025, owing to strict VOC regulations, eco-friendly production adoption, environmental compliance, and growing automaker preference for sustainable coatings.

-

By Vehicle Type: Passenger cars represent the largest segment with a market share of 50% in 2025, driven by high domestic production volumes, demand for premium finishes, and OEM coating requirements across luxury models segments.

-

By Finish Type: Gloss finish dominates the market with a share of 45% in 2025, owing to consumer preference for high-shine aesthetics, visual appeal, and widespread use across economy and premium vehicle categories.

-

By Region: Kanto region dominates the market with a share of 34% in 2025, driven by the concentration of major automotive manufacturing facilities, extensive supplier networks, and proximity to key OEM headquarters facilitating streamlined coating operations.

-

Key Players: The Japan automotive paint market exhibits a well-established competitive structure, characterized by technologically advanced coating manufacturers competing through product innovation, sustainable formulation development, and strategic partnerships with domestic automotive OEMs across various vehicle segments.

To get more information on this market Request Sample

The Japan automotive paint market is experiencing sustained growth fueled by the country's prominent position in global automotive manufacturing. Increasing vehicle production volumes across domestic assembly facilities generate consistent demand for high-performance coating solutions that meet stringent quality standards. Environmental consciousness among consumers and regulatory bodies drives the adoption of low-emission, eco-friendly paint formulations that reduce volatile organic compound releases. As per sources, in 2025, Nippon Paint Automotive Coatings and Uchihamakasei announced Japan’s first in-mold coating technology for automotive exteriors, cutting VOC emissions and CO₂ while integrating molding and painting processes efficiently. Moreover, technological innovations in coating chemistry enable superior durability, color stability, and weather resistance, enhancing vehicle longevity and aesthetic appeal. The expanding aftermarket segment, driven by vehicle maintenance requirements and customization preferences, further supports market expansion. Additionally, growing emphasis on lightweight vehicle components necessitates specialized coating applications that provide adequate protection without adding weight.

Japan Automotive Paint Market Trends:

Shift Toward Sustainable and Eco-Friendly Coating Solutions

The automotive paint industry in Japan is witnessing a significant transition toward environmentally sustainable coating technologies. Manufacturers are increasingly investing in waterborne and powder coating formulations that minimize harmful emissions during application processes. This shift is driven by tightening environmental regulations and growing corporate sustainability commitments within the automotive sector. Paint producers are developing advanced bio-based resins and renewable raw material alternatives that reduce carbon footprints while maintaining performance standards. The focus on circular economy principles encourages recyclable coating systems and waste reduction initiatives throughout the supply chain.

Integration of Advanced Color-Shifting and Effect Pigments

Japanese automotive paint manufacturers are pioneering sophisticated color technologies that create dynamic visual effects on vehicle surfaces. Multi-chromatic pigments that shift hues depending on viewing angles are gaining popularity among premium vehicle segments. In May 2025, Nippon Paint Automotive Coatings unveiled its “PATH” 2025 Concept Color in Japan, highlighting industry innovation in advanced automotive paint technologies and future colorshift formulations. Further, special effect coatings incorporating metallic flakes, pearlescent particles, and matte finishes enable distinctive vehicle appearances that appeal to design-conscious consumers. Research investments focus on developing unique color formulations that differentiate vehicle models and strengthen brand identity. These innovations support automotive manufacturers in creating memorable visual impressions that enhance market competitiveness.

Adoption of Smart and Functional Coating Technologies

The market is experiencing growing interest in functional coatings that offer capabilities beyond traditional aesthetic protection. Self-healing paint technologies capable of repairing minor scratches automatically are advancing toward commercial viability. Further, hydrophobic and oleophobic coating systems that repel water, and contaminants simplify vehicle maintenance while preserving surface quality. Anti-microbial paint formulations are gaining attention for interior applications, addressing hygiene considerations in vehicle cabins. Thermal-regulating coatings that reflect solar radiation help reduce cabin temperatures, supporting energy efficiency in climate control systems.

Market Outlook 2026-2034:

The Japan automotive paint market is positioned for steady revenue expansion throughout the forecast period, supported by continuous automotive production activities and evolving coating technology requirements. Market revenue growth will be driven by increasing demand for environmentally compliant formulations, premium finish applications, and aftermarket refinishing services. Technological advancements in coating durability and aesthetic capabilities will create new revenue opportunities across OEM and aftermarket segments. Strategic investments in sustainable manufacturing processes and innovative product development will shape competitive dynamics and market revenue trajectories through the forecast period. The market generated a revenue of USD 1,951.50 Million in 2025 and is projected to reach a revenue of USD 3,029.10 Million by 2034, growing at a compound annual growth rate of 5.01% from 2026-2034.

Japan Automotive Paint Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Application |

Automobile Manufacturing |

60% |

|

Type |

Water‑Based Paints |

35% |

|

Vehicle Type |

Passenger Cars |

50% |

|

Finish Type |

Gloss Finish |

45% |

|

Region |

Kanto Region |

34% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automobile Manufacturing

- Automobile Repair and Refinishing

- Automobile Maintenance

Automobile manufacturing dominates with a market share of 60% of the total Japan automotive paint market in 2025.

The automobile manufacturing commands the dominant position within the Japan automotive paint market, reflecting the country's extensive vehicle production infrastructure and established coating supply chains. Original equipment manufacturers require consistent, high-volume paint supplies that meet exacting quality specifications for exterior and interior vehicle surfaces. Advanced application technologies including robotic spray systems and electrostatic coating processes ensure uniform coverage and minimize material waste across production facilities. In October 2025, Toyoda Gosei and Kansai Paint developed Japan’s first in-mould coating for large automotive exterior parts, enabling seamless finishes, enhanced durability, and 60% lower CO₂ emissions.

This segment benefits from long-term contractual relationships between paint suppliers and automotive manufacturers that guarantee stable demand volumes. Coating specifications evolve continuously to address new substrate materials, design requirements, and performance expectations. The integration of digital color matching systems and automated quality control processes enhances production efficiency while maintaining finish consistency across vehicle batches and manufacturing locations.

Type Insights:

- Solvent-Based Paints

- Water-Based Paints

- Powder Coatings

- UV-Cured Paints

Water‑based paints lead with a share of 35% of the total Japan automotive paint market in 2025.

Water-based paints have achieved dominant market position driven by stringent regulatory requirements limiting solvent emissions from coating operations. These environmentally preferable products utilize water as the primary carrier medium, significantly reducing volatile organic compound releases during application and curing processes. Advanced resin technologies enable water-based formulations to deliver performance characteristics comparable to conventional solvent-based alternatives, including excellent adhesion, durability, and color retention properties.

Manufacturers continue investing in water-based technology improvements that address historical limitations including extended drying times and humidity sensitivity during application. New formulation approaches incorporate hybrid resin systems and advanced additive packages that enhance film formation and surface properties. The growing availability of water-based primers, basecoats, and clearcoats enables comprehensive coating systems that satisfy environmental requirements throughout the painting process. As per sources, in June 2025, Rock Paint promoted its water-based automotive paints, including primers and clear coats, at the Auto Service Show in Tokyo, highlighting growing adoption and improved application performance.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Motorcycles

- Heavy-Duty Vehicles

Passenger cars exhibit a clear dominance with a 50% share of the total Japan automotive paint market in 2025.

Passenger car maintains leading market position reflecting Japan's substantial domestic automobile production focused on personal transportation vehicles. Coating requirements span diverse vehicle categories from compact economy models to luxury sedans, each demanding specific color options, finish qualities, and durability standards. High consumer expectations for exterior appearance quality drive continuous improvements in paint performance and aesthetic characteristics across passenger vehicle applications.

This segment experiences evolving coating specifications as vehicle designs incorporate new materials including aluminum body panels and composite components requiring specialized primer and adhesion technologies. Color trends in passenger vehicles shift regularly, necessitating flexible coating supply capabilities and rapid color development processes. Premium finish options including metallic, pearlescent, and matte coatings expand product differentiation opportunities across passenger car market segments.

Finish Type Insights:

- Matte Finish

- Gloss Finish

- Satin Finish

- Metallic Finish

Gloss finish dominates with a market share of 45% of the total Japan automotive paint market in 2025.

Gloss finish maintains dominant market position based on enduring consumer preference for high-shine vehicle appearances that convey quality and care. These formulations deliver mirror-like surface reflectivity that enhances color depth and visual impact, representing traditional aesthetic standards in automotive finishing. Advanced clearcoat technologies provide enhanced gloss retention and resistance to environmental degradation including ultraviolet exposure and chemical contamination.

Manufacturers continue refining gloss finish formulations to address durability challenges while maintaining optical clarity and surface smoothness over extended vehicle service life. Scratch-resistant clearcoat additives and self-leveling properties improve finish longevity and reduce appearance degradation from normal use. The gloss segment benefits from established consumer familiarity and broad application across vehicle price categories from entry-level to premium models.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto region dominates with a market share of 34% of the total Japan automotive paint market in 2025.

Kanto region maintains dominant market position reflecting the concentration of major automotive manufacturing operations and supporting industrial infrastructure within this economically significant territory. Proximity to corporate headquarters of leading automobile manufacturers facilitates close collaboration between coating suppliers and OEM engineering teams on new product development and specification requirements. Extensive transportation networks enable efficient distribution of coating materials to production facilities throughout the region.

This regional concentration supports sophisticated coating technology development through access to research institutions, skilled workforce populations, and specialized equipment suppliers. The presence of multiple automotive manufacturing facilities creates competitive dynamics that encourage coating innovation and service excellence. Regional economic strength and industrial density generate sustained demand for automotive paint products across OEM production and aftermarket refinishing applications.

Market Dynamics:

Growth Drivers:

Why is the Japan Automotive Paint Market Growing?

Robust Domestic Automotive Manufacturing Base

Japan's position as a global automotive manufacturing leader provides fundamental support for sustained automotive paint market growth. Furthermore, the country hosts extensive vehicle production facilities operated by internationally recognized automobile manufacturers with established reputations for quality and reliability. Consistent production volumes across passenger vehicles, commercial trucks, and specialty vehicles generate substantial coating material demand throughout the year. Manufacturing excellence traditions prevalent in Japanese industry extend to coating operations, driving continuous quality improvements and process optimization initiatives. The automotive sector's economic importance ensures ongoing investment in production capacity maintenance and modernization that supports paint market stability. Strong export orientation of Japanese vehicle manufacturers creates additional coating demand for vehicles destined for international markets with diverse regulatory and aesthetic requirements.

Stringent Environmental Regulations Driving Technology Advancement

Japan's rigorous environmental protection framework accelerates automotive paint market evolution toward cleaner, more sustainable coating technologies. Regulatory requirements limiting volatile organic compound emissions from manufacturing operations compel paint producers to develop compliant formulations that meet tightening standards. According to sources, in February 2025, Yamaha Motor launched the CN1 carbonneutral painting line at its Iwata factory, enabling all-electric motorcycle fuel tank coating and advancing low-carbon automotive paint processes. Moreover, these regulations drive research investments in waterborne, high-solids, and powder coating technologies that reduce environmental impacts while maintaining performance capabilities. Compliance requirements create market opportunities for innovative coating solutions that address regulatory needs while satisfying automotive manufacturer quality expectations. Environmental consciousness extends beyond regulatory compliance to corporate sustainability commitments that influence coating material selection decisions. Progressive regulatory frameworks position Japan as a leader in sustainable coating technology development with potential for international technology transfer.

Growing Demand for Premium Vehicle Finishes

Rising consumer expectations for vehicle aesthetic quality and distinctive appearances drive automotive paint market growth in premium coating segments. Japanese consumers demonstrate strong preferences for high-quality exterior finishes that reflect attention to detail and ownership pride. Market demand extends beyond basic color coverage to sophisticated finish effects including metallic, pearlescent, and specialty coatings that differentiate vehicles from standard offerings. Premium finish requirements create opportunities for advanced coating technologies that deliver superior color depth, surface smoothness, and environmental durability. Customization trends encourage expanded color palette availability and specialty finish options that enable personal expression through vehicle appearance. According to sources, BASF released its Automotive OEM Coatings Color Report 2024, highlighting rising consumer preference for warmer yellows, beiges, and diverse palettes across the Asia-Pacific automotive market. Furthermore, the aftermarket refinishing segment benefits from consumer willingness to invest in appearance restoration and customization services that maintain or enhance vehicle aesthetic value.

Market Restraints:

What Challenges the Japan Automotive Paint Market is Facing?

High Raw Material Cost Volatility

The automotive paint market faces challenges from fluctuating prices of key raw materials including resins, pigments, and specialty additives essential for coating formulations. Supply chain disruptions and commodity market variations create pricing uncertainties that complicate long-term planning and contract negotiations. Raw material cost pressures squeeze manufacturer margins and may necessitate price adjustments that affect market demand dynamics.

Complex Regulatory Compliance Requirements

Evolving environmental and safety regulations impose substantial compliance burdens on coating manufacturers and users. Meeting diverse regulatory requirements across different jurisdictions requires significant technical and administrative resources. Compliance complexity increases product development timelines and costs while creating potential market access barriers for smaller participants.

Technical Challenges in New Substrate Coating

The automotive industry's transition toward lightweight materials including advanced composites and multi-material assemblies creates coating application challenges. New substrate materials may require specialized surface preparation, primer systems, and application techniques that differ from traditional steel body coating processes. Developing compatible coating solutions for emerging materials demands research investments and technical expertise.

Competitive Landscape:

The Japan automotive paint market demonstrates a mature competitive structure characterized by established relationships between coating manufacturers and automotive OEMs built over decades of collaborative development. Market participants compete through technological innovation, product quality consistency, and comprehensive technical service capabilities that support customer manufacturing operations. Competition extends across formulation performance, environmental compliance, color development speed, and supply chain reliability dimensions that collectively influence customer procurement decisions. Industry participants invest substantially in research and development activities focused on sustainable coating technologies, advanced finish effects, and functional coating capabilities that address evolving market requirements. Strategic positioning emphasizes long-term partnership value and continuous improvement commitments that strengthen customer relationships. Regional and global supply capabilities enable market participants to support Japanese automotive manufacturers' domestic and international production requirements through coordinated coating supply networks.

Recent Developments:

-

In July 2024, Nippon Paint Industrial Coatings provided Target Line® Paint for Osaka Metro’s autonomous driving trials from March 2024 to April 2025, aiding Level 4 certification for the 2025 Osaka-Kansai Expo. The paint ensures stable navigation for electric buses, even in GPS-challenged areas like Yumemai Bridge, enhancing safety and efficiency.

Japan Automotive Paint Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Application Covered | Automobile Manufacturing, Automobile Repair and Refinishing, Automobile Maintenance |

| Type Covered | Solvent-Based Paints, Water-Based Paints, Powder Coatings, UV-Cured Paints |

| Vehicle Type Covered | Passenger Cars, Commercial Vehicles, Motorcycles, Heavy-Duty Vehicles |

| Finish Type Covered | Matte Finish, Gloss Finish, Satin Finish, Metallic Finish |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan automotive paint market size was valued at USD 1,951.50 Million in 2025.

The Japan automotive paint market is expected to grow at a compound annual growth rate of 5.01% from 2026-2034 to reach USD 3,029.10 Million by 2034.

Automobile manufacturing held the largest market share, driven by Japan’s extensive vehicle production infrastructure, long-standing OEM partnerships, advanced manufacturing capabilities, and steady, high-volume coating demand from domestic passenger and commercial vehicle assembly facilities nationwide operations.

Key factors driving the Japan automotive paint market include strong domestic automotive manufacturing activity, strict environmental regulations encouraging sustainable, low-VOC coatings, rising consumer demand for premium and durable vehicle finishes, and continuous technological advancements in automotive coating applications nationwide.

Major challenges include raw material cost volatility affecting production economics, complex regulatory compliance requirements across environmental and safety domains, technical difficulties in coating new lightweight substrates, and intense competition requiring continuous innovation investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)