Japan Automotive Paints and Coatings Market Size, Share, Trends and Forecast by Resin Type, Technology, Layer, Application, and Region, 2026-2034

Japan Automotive Paints and Coatings Market Overview:

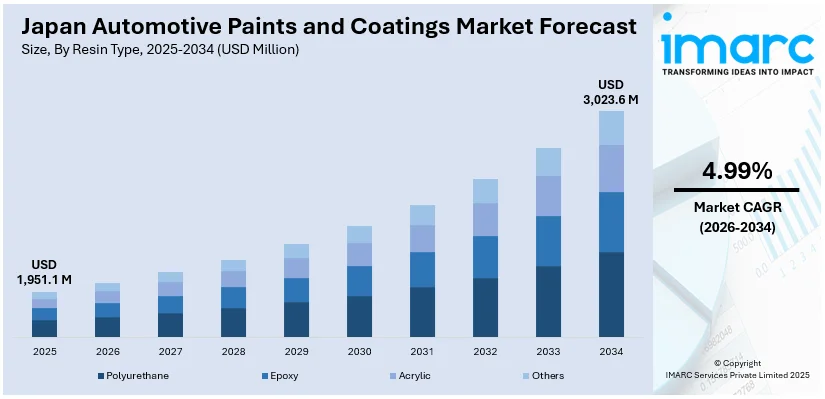

The Japan automotive paints and coatings market size reached USD 1,951.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,023.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.99% during 2026-2034. Advancements in electric vehicle technologies, increased use of lightweight automotive materials, growing demand for thermal management coatings, prioritization of energy-efficient solutions, development of multifunctional nanocoatings, rising adoption of self-healing coatings, strong consumer emphasis on aesthetic preservation, smart material innovations, collaborative R&D initiatives, and growing focus on sustainable automotive surface solutions are some of the factors positively impacting the Japan automotive paints and coatings market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,951.1 Million |

| Market Forecast in 2034 | USD 3,023.6 Million |

| Market Growth Rate 2026-2034 | 4.99% |

Japan Automotive Paints and Coatings Market Trends:

Advancements in Electric Vehicle Technologies and Lightweight Materials

Japan’s leadership in electric vehicle (EV) technologies and the growing use of lightweight automotive materials are significant drivers for the market. With Japan aggressively promoting EV adoption as part of its carbon neutrality goals, automotive manufacturers are transitioning to new vehicle architectures that demand specialized coatings. Among major Japan automotive paints and coatings market trends is the heightened demand for coatings engineered specifically for electric vehicles’ unique thermal management needs. On 3rd March 2025, Nippon Paint Automotive Coatings Co., Ltd. (NPAC) and Uchihamakasei Corp. jointly developed Japan’s first in-mold coating (IMC) technology for large thermoplastic automotive exteriors, integrating resin molding and coating into a single process to streamline production and reduce CO₂ emissions by 60%. This innovation, using NPAC's newly formulated solvent-free paints, also achieves a 99% reduction in VOC emissions while offering superior surface smoothness, precise design replication, and enhanced durability compared to conventional spray coatings. The Japan automotive paints and coatings market forecast identifies strong interest in heat-reflective, insulating, and electrostatic discharge-resistant coatings, all of which are vital to protecting sensitive EV battery components and optimizing vehicle energy efficiency. Manufacturers are also prioritizing coatings that offer weight reduction advantages, supporting improved vehicle range without compromising on structural integrity. This trend is driving increased research and development investments in nanocoatings, multifunctional paints, and specialized primer systems tailored to lightweight vehicle bodies. Automotive coatings in Japan are evolving to meet broader requirements beyond mere aesthetics, including functionality, energy conservation, and regulatory compliance. These complex demands are reshaping product design strategies and fostering cross-sector collaboration among chemical manufacturers, automotive OEMs, and material science researchers.

To get more information on this market Request Sample

Demand for High-Performance, Self-Healing, and Smart Coating Systems

The increasing demand for high-performance, self-healing, and smart coating systems is another major force propelling Japan’s automotive paints and coatings sector. Innovations in self-healing polymers, anti-fouling surfaces, and responsive color-change technologies are rapidly gaining traction within the automotive market. The Japan automotive paints and coatings market growth reflects strong interest in such technologies, especially for luxury and high-end vehicle segments where maintaining pristine exterior conditions is highly valued. Furthermore, smart coatings offering benefits such as dirt repellency, hydrophobicity, temperature regulation, enhanced UV resistance, and self-cleaning capabilities are finding broader application in both consumer and commercial vehicle categories. Industry analysts reviewing market trends emphasize that superior surface performance, integration of intelligent functionalities, and innovative material science integration are now fundamental to competitive advantage. The Japan automotive paints and coatings market outlook remains strongly positive, with advancements in smart, sustainable, and self-sustaining coating technologies positioned at the core of Japan’s automotive sector evolution. Manufacturers are introducing coatings capable of repairing minor scratches and abrasions automatically, significantly reducing the need for aftermarket touch-ups. On 6th August 2024, Nissan, in collaboration with Radi-Cool, is trialing a metamaterial-based "cool paint" that lowers a vehicle’s exterior surface temperature by up to 21.6°F and the cabin temperature by up to 9°F, helping reduce air-conditioning energy usage. Tested at Tokyo’s Haneda Airport, the paint reflects near-infrared rays and emits electromagnetic waves to minimize heat absorption, aiming to enhance efficiency, particularly in electric vehicles. Ongoing investments in smart materials research is reinforcing Japan’s competitive position in next-generation automotive coatings. Collaborative projects between automotive OEMs, chemical engineering firms, and nanotechnology research institutes are resulting in coatings with unprecedented functional characteristics.

Japan Automotive Paints and Coatings Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on resin type, technology, layer, and application.

Resin Type Insights:

- Polyurethane

- Epoxy

- Acrylic

- Others

The report has provided a detailed breakup and analysis of the market based on the resin type. This includes polyurethane, epoxy, acrylic, and others.

Technology Insights:

- Solvent-borne

- Water-borne

- Powder

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes solvent-borne, water-borne, powder, and others.

Layer Insights:

- E-coat

- Primer

- Base Coat

- Clear Coat

The report has provided a detailed breakup and analysis of the market based on the layer. This includes e-coat, primer, base coat, and clear coat.

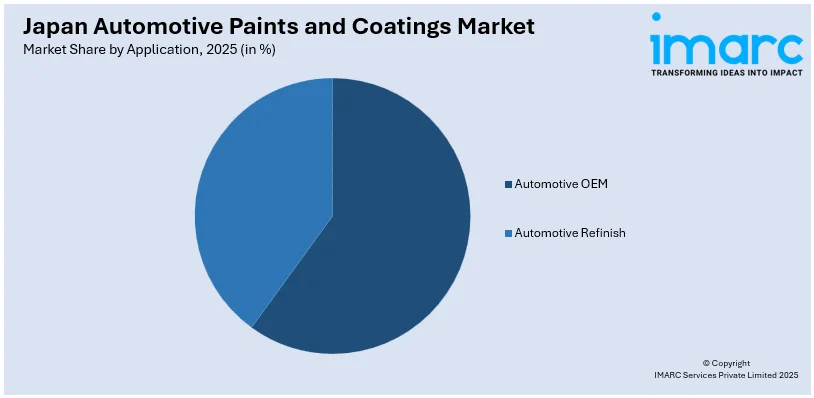

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive OEM

- Automotive Refinish

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive OEM and automotive refinish.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Automotive Paints and Coatings Market News:

- February 28, 2025: Yamaha Motor Co., Ltd., a Japanese automobile manufacturer, launched the motorcycle industry's first carbon-neutral paint line, CN1, at its Iwata Main Factory, achieving full electrification of pre-treatment, painting, baking, and drying processes. Developed with a paint manufacturer to enable lower temperature applications, the CN1 line reduces carbon emissions, enhances production flexibility, and introduces new aesthetic possibilities for motorcycle coatings. This milestone reflects the growing emphasis in Japan's automotive paints and coatings sector on sustainability, advanced materials, and manufacturing innovation.

Japan Automotive Paints and Coatings Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Polyurethane, Epoxy, Acrylic, Others |

| Technologies Covered | Solvent-borne, Water-borne, Powder, Others |

| Layers Covered | E-coat, Primer, Base Coat, Clear Coat |

| Applications Covered | Automotive OEM, Automotive Refinish |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan automotive paints and coatings market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan automotive paints and coatings market on the basis of resin type?

- What is the breakup of the Japan automotive paints and coatings market on the basis of technology?

- What is the breakup of the Japan automotive paints and coatings market on the basis of layer?

- • What is the breakup of the Japan automotive paints and coatings market on the basis of application?

- What is the breakup of the Japan automotive paints and coatings market on the basis of region?

- What are the various stages in the value chain of the Japan automotive paints and coatings market?

- What are the key driving factors and challenges in the Japan automotive paints and coatings market?

- What is the structure of the Japan automotive paints and coatings market and who are the key players?

- What is the degree of competition in the Japan automotive paints and coatings market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan automotive paints and coatings market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan automotive paints and coatings market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan automotive paints and coatings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)