Japan Automotive Safety Systems Market Size, Share, Trends and Forecast by System Type, Vehicle Type, End User, and Region, 2026-2034

Japan Automotive Safety Systems Market Overview:

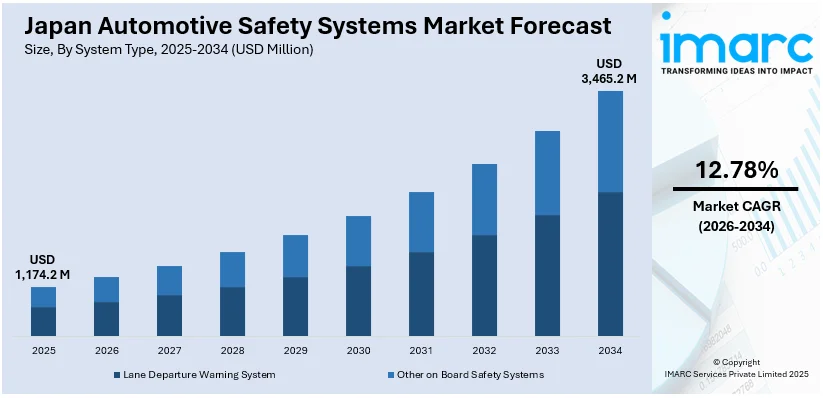

The Japan automotive safety systems market size reached USD 1,174.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,465.2 Million by 2034, exhibiting a growth rate (CAGR) of 12.78% during 2026-2034. The Japanese government is instituting tough safety regulations and car evaluation programs aimed at reducing road injuries and traffic fatalities. This, along with the growing awareness and demand for vehicle safety, is offering a favorable market outlook. Apart from this, the heightened integration of advanced technologies, such as radar sensors and artificial intelligence (AI)-based driver monitoring systems, is expanding the Japan automotive safety systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,174.2 Million |

| Market Forecast in 2034 | USD 3,465.2 Million |

| Market Growth Rate 2026-2034 | 12.78% |

Japan Automotive Safety Systems Market Trends:

Strengthening Government Regulations and Safety Mandates

The Japanese government is instituting tough safety regulations and car evaluation programs aimed at reducing road injuries and traffic fatalities. With initiatives such as the Japan New Car Assessment Program (JNCAP), regulators are encouraging car manufacturers to equip their vehicles with advanced safety technologies, such as lane departure warning (LDW), autonomous emergency braking (AEB), and adaptive cruise control (ACC). Regulatory agencies are also making it compulsory to include features like electronic stability control (ESC) and pedestrian detection systems in passenger and commercial vehicles. For example, in 2025, the Japanese government announced its plans to make new models of vehicles come equipped with devices to prevent pedal misapplication from September 2028. The Ministry of Land, Infrastructure, Transport and Tourism will update the ministerial ordinance under the Road Transport Vehicle Act and mandate the installation of them on all automatic vehicles. All these legislative moves are driving compliance-driven demand across the industry. Car manufacturers are reacting by incorporating these safety units as standard features, not only in high-end models but in all segments. As the government continues to bring local vehicle safety standards in line with global requirements, it is further inducing producers to invest in new safety solutions, thus increasing the scope and sophistication of safety technology employed in Japan's auto industry.

To get more information on this market Request Sample

Growing Awareness and Demand for Vehicle Safety

Individuals in Japan are increasingly valuing safety features in their buying decision, which is significantly influencing automotive design and technology deployment. Increasing public awareness about the need for safety systems like airbags, collision avoidance systems, and driver monitoring is driven by media reports, educational efforts, and real-world crash statistics. As people are becoming more educated, they are preferring cars that come with the most advanced active and passive safety features. The trend is motivating car manufacturers to keep improving their products to keep pace with changing expectations. Japanese car buyers are also favoring cars with advanced driver assistance systems (ADAS) even in small and mid-size segments. This change in behavior is encouraging carmakers to not only improve the safety record of current models but also to introduce new safety-based features. In 2024, The Automated Driving Alliance, a joint initiative between Bosch and Volkswagen subsidiary CARIAD, began testing their automated driving systems in Japan. First Volkswagen ID. Buzz cars will begin test driving in Japan around mid of October 2024. The cars were utilized for testing jointly developed software stack, which with Bosch and CARIAD made another step towards creating assisted and automated functions ready for volume production, and therefore accessible to the wide mass of customers.

Accelerating Integration of Advanced Technologies in Vehicles

Automotive companies in Japan are increasingly integrating advanced technologies such as radar sensors and artificial intelligence (AI)-based driver monitoring systems into their cars to support road safety and customer experience. The continuous integration of such technologies is greatly enhancing the performance of active safety systems like traffic sign recognition, automatic emergency braking, and lane-keeping assist, thereby impelling the Japan automotive safety systems market growth. Development of autonomous driving platforms and connected vehicles is also facilitating the deployment of safety subsystems that depend on real-time data analysis and vehicle-to-everything (V2X) communication. Japanese automakers and Tier 1 players are spending aggressively on research and development (R&D) to remain competitive, with collaborations between technology companies and automakers gaining momentum. As cars get smarter and more networked, safety systems are transforming into holistic ecosystems that aim to avoid accidents instead of just reducing their effects. This technology-driven transformation is constantly changing the face of automotive safety in Japan, making it more adaptive, predictive, and integrated into vehicle architecture as a whole.

Japan Automotive Safety Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on system type, vehicle type, and end user.

System Type Insights:

- Lane Departure Warning System

- Other on Board Safety Systems

The report has provided a detailed breakup and analysis of the market based on the system type. This includes lane departure warning system and other on board safety systems.

Vehicle Type Insights:

- Passenger Car

- Commercial Vehicle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger car and commercial vehicle.

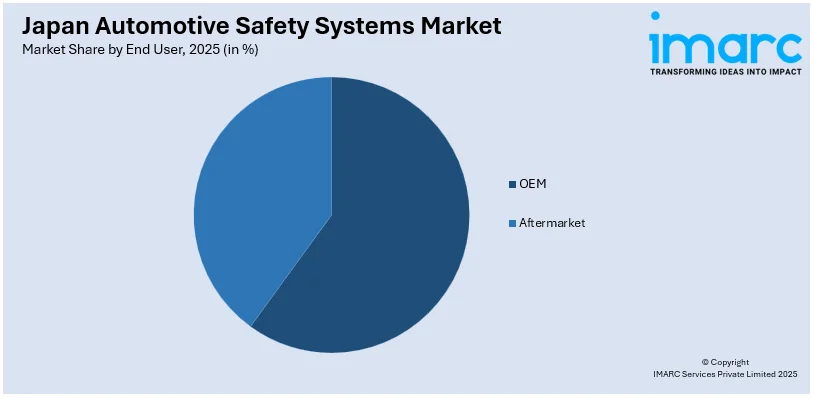

End User Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Automotive Safety Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Lane Departure Warning System, Other on Board Safety Systems |

| Vehicle Types Covered | Passenger Car, Commercial Vehicle |

| End Users Covered | OEM, Aftermarket |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan automotive safety systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan automotive safety systems market on the basis of system type?

- What is the breakup of the Japan automotive safety systems market on the basis of vehicle type?

- What is the breakup of the Japan automotive safety systems market on the basis of end user?

- What is the breakup of the Japan automotive safety systems market on the basis of region?

- What are the various stages in the value chain of the Japan automotive safety systems market?

- What are the key driving factors and challenges in the Japan automotive safety systems market?

- What is the structure of the Japan automotive safety systems market and who are the key players?

- What is the degree of competition in the Japan automotive safety systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan automotive safety systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan automotive safety systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan automotive safety systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)