Japan Bio Agriculture Market Size, Share, Trends and Forecast by Segment and Region, 2026-2034

Japan Bio Agriculture Market Summary:

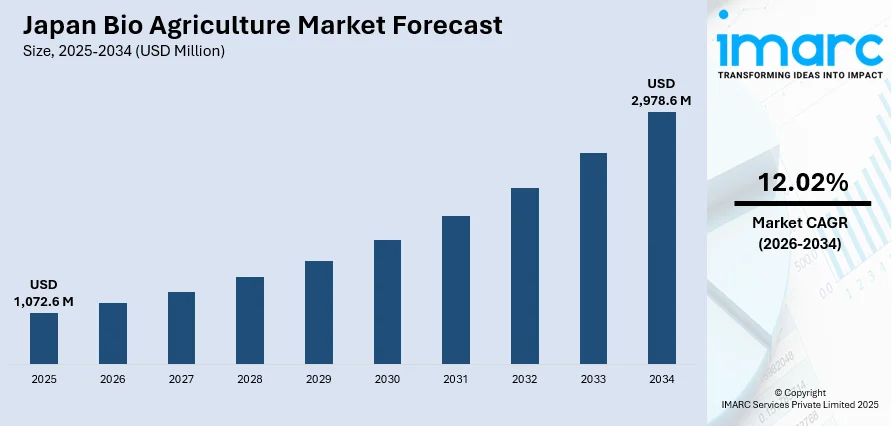

The Japan bio agriculture market size was valued at USD 1,072.6 Million in 2025 and is projected to reach USD 2,978.6 Million by 2034, growing at a compound annual growth rate of 12.02% from 2026-2034.

The Japan bio agriculture market is experiencing robust growth driven by increasing consumer demand for organic and sustainably produced food products, government initiatives promoting sustainable farming practices under the MIDORI Strategy, and rising awareness of environmental impacts from conventional agricultural practices. The country's commitment to reducing chemical pesticide use and expanding organic farming acreage is catalyzing adoption of biofertilizers, biopesticides, and transgenic crop technologies across diverse regional markets. Japanese agricultural stakeholders are increasingly recognizing the importance of transitioning toward environmentally responsible farming methodologies that preserve soil health, protect biodiversity, and ensure long-term food security. Technological advancements in precision agriculture and biotechnology further support market expansion by enhancing biological product efficacy and reducing application costs. These converging factors position Japan as a regional leader in sustainable agriculture transformation within the Asia-Pacific bio agriculture market.

Key Takeaways and Insights:

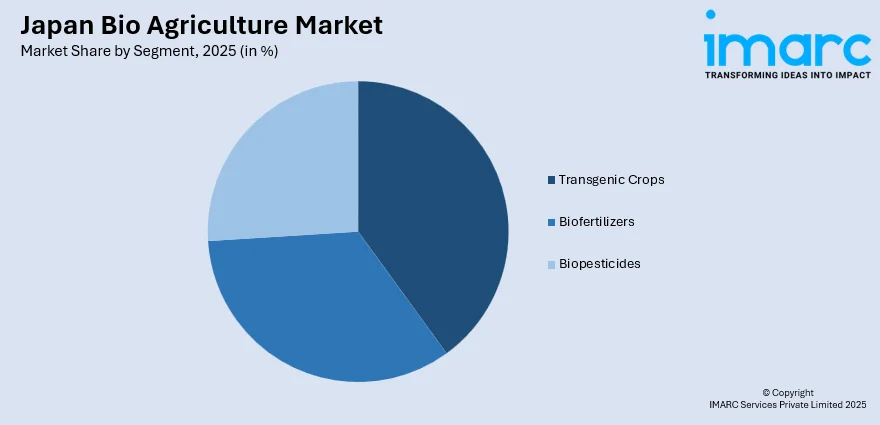

- By Segment: Transgenic crops dominate the market with a share of 40% in 2025, driven by Japan's reliance on imported genetically modified crops for food processing and animal feed applications.

- Key Players: The Japan bio agriculture market exhibits moderate to high competitive intensity, with multinational corporations competing alongside domestic agricultural cooperatives and regional manufacturers across sustainable farming product segments.

To get more information on this market Request Sample

The Japan bio agriculture market is undergoing significant transformation as the country navigates the balance between maintaining agricultural productivity and achieving environmental sustainability goals. Japan's agricultural sector faces unique challenges including an aging farming population, limited arable land, and high production costs, which have accelerated the adoption of bio-based agricultural solutions. The government's formulation of the MIDORI Strategy for Sustainable Food Systems has established ambitious targets including zero carbon emissions from fossil fuel combustion in agriculture by 2050, creating substantial market opportunities for biological alternatives. In June 2024, Japan's Ministry of Agriculture, Forestry and Fisheries (MAFF) partnered with the International Rice Research Institute to advance sustainable rice production technologies, demonstrating the government's commitment to integrating biological solutions into mainstream agricultural practices. The market is further supported by technological innovations in precision agriculture, with companies deploying AI-driven monitoring systems and drone-based application technologies to optimize biological input usage across diverse crop cultivation scenarios.

Japan Bio Agriculture Market Trends:

Integration of Smart Agriculture Technologies with Biological Solutions

Japanese agricultural stakeholders are increasingly combining precision farming technologies with biological inputs to maximize efficacy and minimize environmental impact. The deployment of Internet of Things-enabled sensors, drones for targeted biopesticide application, and artificial intelligence algorithms for crop health monitoring is revolutionizing biological product utilization. In August 2024, the Japan and Vietnam partnered to enhance digital transformation in agricultural methods, establishing an electronic agricultural extension system enabling rapid information transfer between farming agencies and farmers regarding optimal biological input applications.

Expansion of Genome-Edited Agricultural Products

Japan has emerged as a pioneer in commercializing genome-edited food products, with regulatory frameworks established exempting certain gene-edited crops from rigorous genetically modified organism approval processes. The country introduced the world's first commercially available gene-edited tomato with enhanced nutritional properties and subsequently approved gene-edited fish products for consumer markets. These streamlined regulatory pathways encourage domestic biotechnology innovation and product development. As of October 2024, the Government of Japan has approved 205 products for environmental safety including 157 approvals for domestic cultivation, with seven gene-edited products completing notification processes.

Rising Consumer Demand for Residue-Free and Organic Produce

Japanese consumers demonstrate heightened awareness regarding food safety and environmental sustainability, driving substantial demand for agricultural products grown with biological inputs. Widespread market acceptance of organic food is made possible by the traditional Japanese culinary philosophy, which emphasizes purity, freshness, and little processing. Urban consumers and younger generations increasingly prioritize health-conscious and environmentally responsible food choices, creating strong demand pull for crops cultivated using biopesticides, biofertilizers, and sustainable farming methodologies. This consumer shift is expanding organic product availability across supermarkets, specialty stores, and e-commerce retail channels nationwide.

Market Outlook 2026-2034:

The Japan bio agriculture market outlook remains positive as government policies, technological innovation, and shifting consumer preferences converge to create favorable growth conditions. The MIDORI Strategy's ambitious targets for chemical pesticide reduction and organic farming expansion will necessitate substantial adoption of biological alternatives across all agricultural segments. Investment in agri-food technology is accelerating, with Japan's share of Asian agrifoodtech investment jumping to 13% in 2025 from 6.1 percent in 2024, positioning the country as the third-largest agrifoodtech funder in Asia. The market generated a revenue of USD 1,072.6 Million in 2025 and is projected to reach a revenue of USD 2,978.6 Million by 2034, growing at a compound annual growth rate of 12.02% from 2026-2034.

Japan Bio Agriculture Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Segment | Transgenic Crops | 40% |

Segment Insights:

Access the comprehensive market breakdown Request Sample

- Transgenic Crops

- Biofertilizers

- Biopesticides

The transgenic crops dominate with a market share of 40% of the total Japan bio agriculture market in 2025.

Japan maintains its position as a major importer of genetically modified crops despite minimal domestic cultivation, with the country relying heavily on imported corn, soybeans, and canola supplies comprising predominantly genetically modified varieties. These imports from the United States, Canada, Brazil, and Argentina support food processing, animal feed production, and industrial applications across the supply chain. As of September 2024, the Government of Japan has approved 334 genetically modified products for food use, demonstrating the country's robust regulatory framework for biotechnology products.

The transgenic crops segment benefits from Japan's strategic reliance on imported genetically modified inputs. Japanese regulatory authorities maintain science-based and transparent approval processes ensuring product safety and environmental protection. The Ministry of Agriculture, Forestry and Fisheries conducts regular annual surveys confirming no cross-contamination between genetically modified and non-genetically modified crops in cultivation sites, reinforcing consumer confidence in biotechnology safety management protocols.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region, encompassing Tokyo and surrounding prefectures, leads Japan's bio agriculture market through its technological hub status and high adoption of smart greenhouses and vertical farming solutions suited for limited urban spaces.

The Kansai/Kinki Region centered around Osaka integrates smart agriculture technologies to support diverse farming practices, benefiting from strong industrial infrastructure and research institutions advancing biological agricultural solutions.

The Central/Chubu Region features significant agricultural activity combining traditional farming with modern bio-based inputs, leveraging proximity to major transportation networks for efficient distribution of biological agricultural products.

The Kyushu-Okinawa Region demonstrates strong growth in bio agriculture driven by subtropical climate conditions favorable for diverse crop cultivation and increasing adoption of biopesticides for pest management.

The Tohoku Region represents a significant agricultural production area focusing on rice cultivation and implementing biological solutions for sustainable crop protection and soil health improvement programs.

The Chugoku Region maintains moderate bio agriculture market presence with emphasis on fruit and vegetable production utilizing biofertilizers and integrated pest management approaches for quality enhancement.

The Hokkaido Region's extensive agricultural land supports large-scale bio agriculture operations with dairy farmers increasingly adopting carbon farming practices and biological soil amendments for sustainable production methods.

The Shikoku Region focuses on specialty crop cultivation including citrus and vegetables, with growing implementation of biopesticide applications and organic farming certification programs across agricultural cooperatives.

Market Dynamics:

Growth Drivers:

Why is the Japan Bio Agriculture Market Growing?

Government Policy Support and Regulatory Initiatives

The Japanese government has implemented comprehensive policy frameworks supporting bio agriculture market expansion through the MIDORI Strategy for Sustainable Food Systems launched in May 2021. This strategy establishes ambitious targets including 50% reduction in risk-weighted chemical pesticide use, 30% reduction in chemical fertilizer application, and expansion of organic farming to 1 million hectares, representing 25% of total farmland by 2050. The Ministry of Agriculture, Forestry and Fisheries provides farm-level extension services and subsidies on biological product sales and direct production, creating favorable market conditions for biofertilizers and biopesticides.

Rising Environmental Awareness and Consumer Health Consciousness

Japanese consumers demonstrate increasing concern regarding environmental sustainability, food safety, and health impacts of chemical pesticide residues in agricultural products. The growing preference for organic and residue-free produce has created substantial demand pull for crops grown using biological inputs, with surveys indicating strong consumer willingness to pay premium prices for sustainably produced food. Japan organic food market size is anticipated to reach USD 3.9 Billion by 2033, exhibiting a growth rate (CAGR) of 9.7% during 2025-2033, reflects deepening consumer commitment to environmentally responsible food choices. The traditional Japanese culinary philosophy emphasizing purity, seasonality, and minimal processing aligns naturally with organic food values, facilitating market acceptance of bio-based agricultural products across urban and rural consumer segments.

Technological Advancements in Biotechnology and Precision Agriculture

Continuous technological innovation in biotechnology, genetic engineering, and precision agriculture is driving development of biological solutions with improved efficacy and specificity. Advancements including strain improvement using genomic tools, nanotechnology-based microbial inoculants, and AI-driven pest monitoring platforms enhance biological product performance while reducing application costs. In 2024, the Japanese government passed the Act on Promoting the Utilization of Smart Agricultural Technology, establishing accreditation frameworks for novel production techniques and advancing smart farming innovations that integrate biological inputs with digital monitoring systems across agricultural operations.

Market Restraints:

What Challenges the Japan Bio Agriculture Market is Facing?

High Implementation Costs and Limited Arable Land

Japan's mountainous terrain severely limits arable land availability, creating intense competition between agricultural and urban land usage requirements. The high implementation costs associated with biological products, organic certification processes, and sustainable farming technologies constrain widespread adoption among small and medium-sized farming operations. These financial barriers prevent many traditional farmers from transitioning to bio-based agricultural practices despite government incentive programs.

Aging Agricultural Workforce and Labor Shortages

Japan faces significant demographic challenges in the agricultural sector with an aging farming population and rapidly shrinking rural workforce. The average farmer age exceeds sixty-five years, limiting human resources available to adopt new biological farming practices and advanced technologies. Despite environmental benefits offered by bio agriculture solutions, labor constraints impede implementation and scaling of sustainable farming methodologies across regional markets.

Consumer Perception and Market Education Requirements

Public skepticism regarding genetically modified organisms and biotechnology products persists among Japanese consumers despite comprehensive government safety data and regulatory approvals demonstrating product safety. Building market acceptance for biological agricultural solutions requires continued substantial investment in consumer education initiatives, transparent communication strategies, and public awareness campaigns addressing misconceptions about modern biotechnology applications in sustainable food production systems.

Competitive Landscape:

The Japan bio agriculture market exhibits moderate to high competitive intensity characterized by the presence of multinational chemical and agricultural corporations alongside domestic players and regional agricultural cooperatives. Major international companies dominate market share through strategic product portfolios spanning biopesticides, biofertilizers, and biotechnology solutions. These established players leverage extensive research and development capabilities, global distribution networks, and strong brand recognition to maintain competitive positions. Domestic manufacturers and agricultural cooperatives compete through localized product offerings, direct farmer relationships, and specialized solutions tailored to regional cultivation requirements. The competitive landscape is evolving with increasing collaboration between traditional agrochemical companies and biotechnology startups to develop innovative biological solutions meeting sustainability targets.

Recent Developments:

- January 2025: Hitachi, Iwamizawa City, and Iseki & Co., Ltd. launched a proof-of-concept test integrating attachable-detachable AC/DC batteries into Iseki's electric farming equipment, focusing on renewable energy production at agricultural sites to reduce fuel costs and enhance decarbonization efforts.

- October 2024: NX Group invested in AGRIST, a developer of AI and robot-driven smart agriculture technology, to address challenges in agri-food systems in Japan and globally, supporting integration of advanced technologies with sustainable agricultural practices.

Japan Bio Agriculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Transgenic Crops, Biofertilizers, Biopesticides |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan bio agriculture market size was valued at USD 1,072.6 Million in 2025.

The Japan bio agriculture market is expected to grow at a compound annual growth rate of 12.02% from 2026-2034 to reach USD 2,978.6 Million by 2034.

The transgenic crops segment dominated the Japan bio agriculture market with approximately 40% revenue share in 2025, driven by Japan's substantial reliance on imported genetically modified crops for food processing, animal feed production, and industrial applications across the supply chain.

Key factors driving the Japan bio agriculture market include government policy support through the MIDORI Strategy, rising consumer demand for organic and residue-free produce, technological advancements in precision agriculture and biotechnology, and increasing environmental awareness among agricultural stakeholders.

Major challenges include high implementation costs for biological products, limited arable land availability, aging agricultural workforce, labor shortages in rural areas, stringent organic certification requirements, and ongoing consumer education needs regarding biotechnology safety and benefits.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)