Japan Biodegradable Food Service Disposables Market Size, Share, Trends and Forecast by Raw Material Type, Product Type, Distribution Channel, and Region, 2026-2034

Japan Biodegradable Food Service Disposables Market Summary:

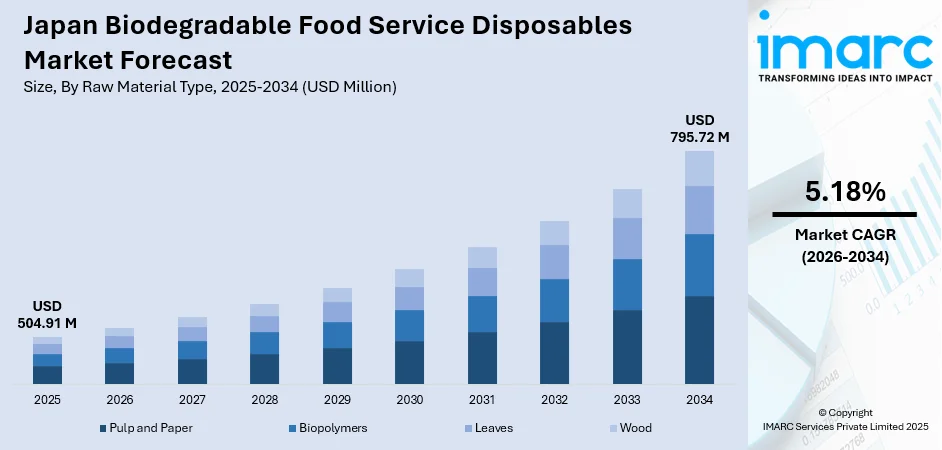

The Japan biodegradable food service disposables market size was valued at USD 504.91 Million in 2025 and is projected to reach USD 795.72 Million by 2034, growing at a compound annual growth rate of 5.18% from 2026-2034.

The market is driven by Japan's stringent environmental regulations and the growing shift toward sustainable packaging solutions. Increasing consumer awareness regarding plastic pollution and cultural emphasis on waste minimization are encouraging foodservice operators to adopt eco-friendly disposables. Government initiatives promoting responsible consumption and green transformation are accelerating the transition from conventional plastics to biodegradable alternatives, thereby expanding Japan biodegradable food service disposables market share.

Key Takeaways and Insights:

- By Raw Material Type: Pulp and paper dominates the market with a share of 45.36% in 2025, driven by widespread availability of sustainable forestry resources, cost-effective manufacturing processes, and superior compostability characteristics that align with Japan's environmental goals.

- By Product Type: Cups lead the market with a share of 35.43% in 2025, owing to expanding takeaway beverage culture, rising demand from coffee chains and quick-service restaurants, and development of heat-resistant biodegradable cup solutions.

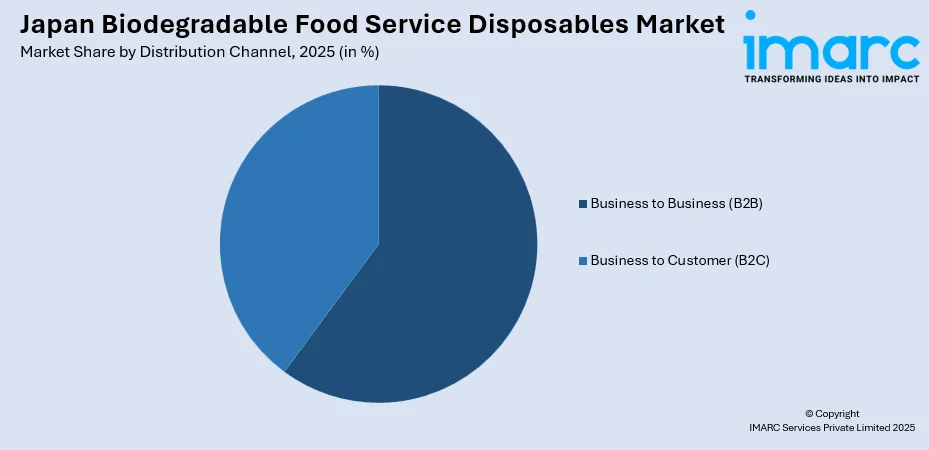

- By Distribution Channel: Business to business represents the largest segment with a market share of 60.28% in 2025, driven by bulk procurement requirements from restaurant chains, catering services, and institutional buyers seeking compliance with sustainability mandates.

- Key Players: The market is competitive, with key players emphasizing sustainable product innovation, improved performance, and reliable supply chains. Companies focus on catering to institutional and retail demand while strengthening distribution networks, brand presence, and compliance with environmental standards.

To get more information on this market Request Sample

The Japan biodegradable food service disposables market is experiencing robust expansion driven by a confluence of regulatory mandates, evolving consumer preferences, and technological innovations. Government policies aimed at reducing plastic waste and promoting circular economy principles are compelling foodservice operators across the country to transition toward sustainable alternatives. As per sources, in June 2025, Japan introduced the “positive list” system for food-contact packaging, mandating total migration testing for unspecified synthetic materials from June 2026, enhancing safety, sustainability, and alignment with international standards. Moreover, rising environmental consciousness among Japanese consumers, particularly younger demographics who prioritize eco-friendly brands, is creating substantial demand for biodegradable cups, plates, cutlery, and containers. Additionally, advancements in material science are enabling the production of biodegradable disposables with enhanced functionality, including improved heat resistance, moisture barriers, and structural durability. The cultural emphasis on cleanliness and responsible waste management further strengthens market adoption as businesses seek to align with societal values and regulatory expectations.

Japan Biodegradable Food Service Disposables Market Trends:

Expansion of Plant-Based Material Applications

Japanese manufacturers are increasingly exploring diverse plant-based raw materials beyond traditional pulp and paper sources. Agricultural residues such as rice husks, bamboo fibers, and sugarcane bagasse are gaining traction as sustainable feedstocks for producing biodegradable disposables. In 2023, Biomass Resin Holdings advanced RiceResin bioplastic from inedible rice, lowering CO2 emissions and enabling spoons, toys, and bags, while HEMIX from wood waste offered biodegradable, sustainable material solutions. Additionally, this diversification enables manufacturers to reduce dependency on single raw material sources while enhancing product functionality. The incorporation of locally sourced agricultural byproducts supports regional farming communities and reduces transportation-related environmental impacts. Furthermore, these alternative materials offer unique properties such as natural antibacterial characteristics and enhanced aesthetic appeal that differentiate products in competitive markets.

Integration with Food Delivery Ecosystem

The proliferation of food delivery services across Japan is creating substantial opportunities for biodegradable packaging solutions. As online food ordering platforms expand their reach and consumer base, the demand for sustainable delivery containers, utensils, and packaging materials continues to accelerate. Foodservice operators partnering with delivery aggregators are increasingly prioritizing eco-friendly packaging to meet consumer expectations and platform sustainability requirements. In June 2024, Uber Eats Japan launched its first Sustainable Packaging Guidelines, recommending biomass, recycled, and recyclable materials for member restaurants, promoting eco-friendly delivery containers and supporting sustainable food-service packaging. This trend is driving innovation in leak-proof, temperature-retaining biodegradable containers specifically designed for delivery applications. The symbiotic relationship between food delivery growth and sustainable packaging adoption is reshaping the disposables market landscape.

Emergence of Circular Economy Business Models

Japanese businesses are adopting circular economy principles that extend beyond simple biodegradability to encompass comprehensive waste management solutions. Foodservice operators are implementing take-back programs where used biodegradable disposables are collected, composted, and returned to agricultural applications. This closed-loop approach creates value from waste streams while demonstrating corporate environmental commitment. In February 2025, Refinverse, Mitsubishi Chemical, Toyo Seikan, Kewpie, Kasumi, and Kashima City launched Japan’s first closed-loop recycling project for salad dressing caps, creating a six-stage circular supply chain. Furthermore, partnerships between disposable manufacturers, foodservice chains, and composting facilities are establishing integrated supply chains that minimize environmental impact. These collaborative models are influencing product design considerations, encouraging development of disposables optimized for industrial composting processes and agricultural applications.

Market Outlook 2026-2034:

The Japan biodegradable food service disposables market is poised for sustained revenue growth throughout the forecast period as regulatory frameworks strengthen and consumer sustainability preferences deepen. Continued government investment in green transformation initiatives and environmental infrastructure will support market expansion. Revenue growth will be propelled by increasing adoption across restaurant chains, convenience stores, and institutional foodservice operations. Technological advancements improving product performance and manufacturing efficiency will enhance cost competitiveness against conventional alternatives. The expanding food delivery sector represents a significant revenue opportunity as platforms mandate sustainable packaging solutions. Strategic collaborations between material suppliers, manufacturers, and end-users will accelerate innovation and market penetration across diverse application segments. The market generated a revenue of USD 504.91 Million in 2025 and is projected to reach a revenue of USD 795.72 Million by 2034, growing at a compound annual growth rate of 5.18% from 2026-2034.

Japan Biodegradable Food Service Disposables Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Raw Material Type | Pulp and Paper | 45.36% |

| Product Type | Cups | 35.43% |

| Distribution Channel | Business to Business | 60.28% |

Raw Material Type Insights:

- Pulp and Paper

- Biopolymers

- Leaves

- Wood

The pulp and paper dominate with a market share of 45.36% of the total Japan biodegradable food service disposables market in 2025.

Pulp and paper remain the leading raw material in Japan’s biodegradable food service disposables market due to the country’s mature forestry sector and sophisticated paper manufacturing infrastructure. The material’s inherent biodegradability, affordability, and adaptability to current production systems make it a preferred choice for producers seeking environmentally responsible alternatives. Its versatility allows seamless integration into various applications, from disposable plates and trays to cups and packaging, without requiring extensive process modifications. In June 2024, Dai Nippon Printing (DNP) developed a high-barrier paper mono-material sheet achieving over 85% repulpability, enhancing recyclability while maintaining food-safe barrier properties for packaging.

Japanese manufacturers have advanced the development of specialized pulp and paper grades tailored for foodservice use, offering improved moisture resistance, durability, and structural stability. Compliance with sustainable forestry certification programs ensures that raw materials are responsibly sourced, reinforcing environmental stewardship. This focus on sustainability not only strengthens domestic supply chains but also enhances Japan’s export potential, enabling manufacturers to meet the rising regional demand for biodegradable and eco-friendly disposable products.

Product Type Insights:

- Cups

- Clamshells and Containers

- Plates

- Cutleries

- Others

The cups lead with a share of 35.43% of the total Japan biodegradable food service disposables market in 2025.

The cups segment leads Japan’s biodegradable food service disposables market, fueled by the country’s vibrant café culture and rising demand for takeaway beverages. Consumers increasingly seek premium coffee, specialty teas, and health drinks, creating a need for reliable, environmentally friendly solutions. For example, in December 2024, Kaneka’s biodegradable polymer Green Planet™ was adopted for Starbucks Japan straws, with nationwide rollout beginning March 2025, offering fully biomass-derived, compostable alternatives to conventional plastics. The convenience and sustainability of biodegradable cups resonate with both businesses and consumers, reinforcing their adoption across cafés, restaurants, and beverage chains while supporting Japan’s broader shift toward eco-conscious consumption patterns.

Product development in the cups segment emphasizes enhanced thermal insulation, leak resistance, and durability suitable for hot and cold beverages. Manufacturers are also incorporating customization options, including brand printing and design variations, allowing foodservice operators to combine sustainability with marketing appeal. These innovations not only meet functional requirements but also elevate customer experience, making biodegradable cups a preferred choice for business-to-business distribution channels, including cafés, hotels, and catering services seeking eco-friendly yet practical packaging solutions.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Business to Business (B2B)

- Business to Customer (B2C)

- Supermarkets and Hypermarkets

- Online Stores

- Others

The business to business exhibits a clear dominance with a 60.28% share of the total Japan biodegradable food service disposables market in 2025.

The business-to-business (B2B) channel leads Japan’s biodegradable food service disposables market, driven by bulk purchasing needs from restaurants, hotels, hospitals, and corporate cafeterias. In August 2025, compostable tableware adoption expanded beyond cafes to hospitals, airlines, schools, offices, stadiums, and festivals in Japan, with bagasse containers, PLA cups, and biodegradable cutlery widely implemented. Moreover, institutional buyers emphasize dependable supply chains, consistent product quality, and cost-effective solutions for large-volume orders. The channel’s dominance reflects the scale and regularity of institutional demand, making it critical for manufacturers to maintain operational efficiency and reliability while catering to diverse organizational requirements across the foodservice ecosystem.

B2B distribution in Japan is characterized by well-established networks and long-term procurement agreements, ensuring steady product availability and fostering strong client relationships. Manufacturers that provide extensive product portfolios, technical assistance, and verified sustainability certifications gain a strategic edge in securing enterprise accounts. These value-added services not only meet functional and environmental expectations but also enhance trust and loyalty among institutional buyers, reinforcing the prominence of the B2B channel in the nation’s biodegradable food service disposables landscape.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region represents the largest market owing to the concentration of population and foodservice establishments in Tokyo and surrounding prefectures. High consumer awareness, stringent municipal waste regulations, and presence of major restaurant chains drive substantial demand. Corporate headquarters and international businesses in this region demonstrate strong sustainability commitments influencing procurement decisions.

The Kansai region emerges as a significant market hub centered around Osaka, Kyoto, and Kobe metropolitan areas. Thriving tourism industry and extensive food culture create substantial demand for disposable foodservice products. Local government initiatives promoting sustainable business practices and cultural heritage preservation encourage adoption of eco-friendly alternatives among traditional and modern establishments.

The Chubu region demonstrates steady market growth driven by Nagoya's industrial economy and expanding foodservice sector. Manufacturing expertise and proximity to raw material suppliers support local production capabilities. Regional tourism destinations and business travel corridors generate consistent demand for biodegradable disposables across restaurants, hotels, and transportation hubs.

The Kyushu-Okinawa region exhibits growing market potential supported by expanding tourism and agricultural industries. Island geography heightens environmental awareness regarding waste management and ocean plastic pollution. Local emphasis on sustainable development and eco-tourism creates favorable conditions for biodegradable product adoption across hospitality and foodservice establishments.

The Tohoku region presents emerging opportunities driven by reconstruction efforts emphasizing sustainable development principles. Regional food festivals and agricultural tourism promote local cuisine requiring appropriate disposable solutions. Growing emphasis on environmental resilience following natural disasters encourages adoption of biodegradable alternatives aligned with community sustainability goals.

The Chugoku region demonstrates moderate market growth centered around Hiroshima and Okayama prefectures. Maritime industries and coastal tourism create awareness regarding marine plastic pollution, encouraging sustainable packaging adoption. Regional manufacturing capabilities and transportation infrastructure support distribution networks serving local foodservice establishments.

Hokkaido region exhibits market growth driven by extensive tourism industry and renowned food culture emphasizing fresh, local ingredients. Seasonal tourism peaks during summer and winter create fluctuating demand patterns. Environmental preservation priorities aligned with natural landscape conservation encourage sustainable business practices among hospitality operators and foodservice providers.

The Shikoku region presents niche market opportunities with growing emphasis on pilgrimage tourism and local food traditions. Smaller market size enables focused sustainability initiatives and community-driven adoption. Regional agricultural heritage supports exploration of locally sourced biodegradable materials derived from citrus, rice, and other indigenous crops.

Market Dynamics:

Growth Drivers:

Why is the Japan Biodegradable Food Service Disposables Market Growing?

Stringent Environmental Legislation and Policy Frameworks

Japan's comprehensive environmental legislation serves as a primary growth catalyst for the biodegradable disposables market. The Plastic Resource Circulation Act mandates systematic reduction, reuse, and recycling of plastic products, compelling foodservice operators to seek sustainable alternatives. Municipal governments across Japan are implementing localized regulations restricting single-use plastics in public spaces, restaurants, and retail establishments. Compliance requirements create mandatory demand as businesses face penalties for non-adherence. Government subsidies and incentive programs encouraging green procurement practices further accelerate market adoption. International commitments toward climate action goals and United Nations Sustainable Development Goals reinforce policy direction, ensuring sustained regulatory pressure supporting biodegradable product demand throughout the forecast period.

Evolving Consumer Preferences and Sustainability Consciousness

Shifting consumer attitudes toward environmental responsibility represent a fundamental market driver accelerating biodegradable disposable adoption. Japanese consumers increasingly evaluate businesses based on sustainability credentials, with purchasing decisions reflecting environmental values. Younger demographics demonstrate particularly strong preferences for eco-friendly brands, influencing foodservice operators to adopt biodegradable packaging as a competitive differentiator. Social media amplifies consumer expectations as environmentally conscious practices generate positive publicity while unsustainable alternatives attract criticism. Corporate sustainability reporting requirements encourage businesses to demonstrate measurable environmental improvements, with biodegradable packaging adoption providing quantifiable progress indicators. This consumer-driven demand creates market pull complementing regulatory push, establishing robust growth foundations across diverse foodservice segments. In November 2025, Japan’s METI announced new packaging certification rules requiring at least 15% recycled content and PVC-free, easily removable labels, encouraging companies to adopt biodegradable and recyclable materials.

Technological Advancements in Material Science and Manufacturing

Continuous innovation in biodegradable material development enhances product performance characteristics while improving manufacturing economics. Japanese research institutions and private enterprises invest substantially in developing advanced biopolymers, composite materials, and processing technologies. Novel materials derived from agricultural waste streams, marine biomass, and engineered polymers offer improved functionality including enhanced heat resistance, moisture barriers, and structural integrity comparable to conventional plastics. In 2024, Kanazawa University developed a robotic system for fully automated synthesis of 3,000 plant-based plastics annually, advancing circular design, promoting renewable materials, and contributing to solutions for microplastic pollution. Furthermore, manufacturing process innovations increase production efficiency, reduce energy consumption, and enable economies of scale that improve cost competitiveness. Quality improvements expand application possibilities across demanding foodservice requirements including microwave-safe containers, oil-resistant packaging, and extended shelf-life solutions, broadening market addressability and revenue potential.

Market Restraints:

What Challenges the Japan Biodegradable Food Service Disposables Market is Facing?

Higher Production Costs Compared to Conventional Alternatives

Biodegradable disposables typically command price premiums over conventional plastic alternatives due to specialized raw materials and manufacturing processes. Cost-sensitive foodservice operators, particularly small and medium enterprises, face margin pressures when transitioning to sustainable packaging. Limited economies of scale in biodegradable material supply chains contribute to elevated input costs that manufacturers pass to end-users. Price sensitivity among consumers limits operators' ability to recover additional costs through menu price adjustments.

Performance Limitations in Specific Applications

Certain foodservice applications require performance characteristics that biodegradable materials struggle to match consistently. High-temperature applications, extended moisture exposure, and demanding structural requirements may exceed current biodegradable product capabilities. Shelf-life limitations affect distribution logistics and inventory management for operators requiring extended storage periods. Performance inconsistencies across product batches can impact foodservice quality standards and operational reliability.

Inadequate Composting Infrastructure and End-of-Life Processing

Effective biodegradation requires appropriate disposal infrastructure that remains underdeveloped across many Japanese municipalities. Industrial composting facilities capable of processing biodegradable disposables are limited in availability and geographic coverage. Consumer confusion regarding proper disposal methods results in biodegradable products entering conventional waste streams, negating environmental benefits. The absence of standardized collection systems creates logistical complications for foodservice operators seeking closed-loop waste management solutions.

Competitive Landscape:

The Japan biodegradable food service disposables market exhibits a moderately fragmented competitive structure with established packaging manufacturers competing alongside specialized sustainable product providers. Market participants differentiate through material innovation, product portfolio breadth, and sustainability certifications. Large-scale manufacturers leverage production capabilities and distribution networks to serve institutional customers while smaller specialists target niche applications requiring customized solutions. Vertical integration strategies enable leading players to secure raw material supplies and control quality across production stages. Strategic partnerships between material suppliers, manufacturers, and foodservice chains accelerate market penetration. Research and development investments focusing on performance improvements and cost reduction remain critical competitive factors. International players contribute technology transfer and global best practices while domestic manufacturers emphasize local sourcing and cultural alignment.

Recent Developments:

- In April 2024, Kaneka Corporation’s biodegradable polymer Green Planet™ was adopted for JAL’s first reusable in-flight side dish containers. Made from 100% biomass-derived materials, the containers are lightweight, naturally colored, biodegradable in soil and seawater, and aim to replace petroleum-based plastics, reducing CO₂ emissions during flights.

Japan Biodegradable Food Service Disposables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Material Types Covered | Pulp and Paper, Biopolymers, Leaves, Wood |

| Product Types Covered | Cups, Clamshells and Containers, Plates, Cutleries, Others |

| Distribution Channels Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan biodegradable food service disposables market size was valued at USD 504.91 Million in 2025.

The Japan biodegradable food service disposables market is expected to grow at a compound annual growth rate of 5.18% from 2026-2034 to reach USD 795.72 Million by 2034.

Pulp and paper led the market, driven by the nation’s well-established forestry industry, advanced manufacturing technologies, strong sustainability initiatives, and superior biodegradability, making these products environmentally friendly and widely adopted across sectors.

Key factors driving the Japan biodegradable food service disposables market include stringent environmental regulations such as the Plastic Resource Circulation Act, rising consumer sustainability awareness, technological innovations in biodegradable materials, expanding food delivery services, and government initiatives supporting green transformation.

Major challenges include higher production costs compared to conventional plastics, performance limitations in demanding applications, inadequate composting infrastructure, limited consumer awareness regarding proper disposal methods, and supply chain constraints for specialized raw materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)