Japan Blankets and Quilts Market Size, Share, Trends and Forecast by Product Type, Material, Application, Distribution Channel, and Region, 2026-2034

Japan Blankets and Quilts Market Summary:

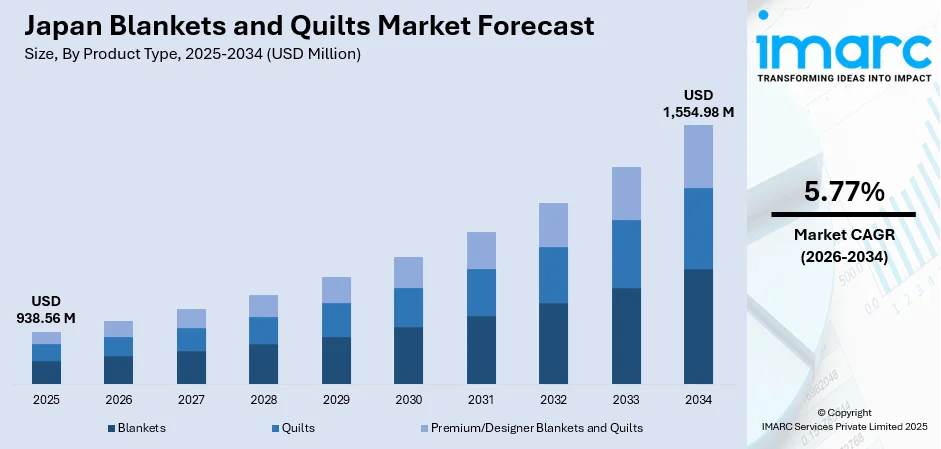

The Japan blankets and quilts market size was valued at USD 938.56 Million in 2025 and is projected to reach USD 1,554.98 Million by 2034, growing at a compound annual growth rate of 5.77% from 2026-2034.

The Japan blankets and quilts market is driven by growing consumer interest in home comfort and aesthetics, particularly as urban living and home-based lifestyles gain prominence. Japanese consumers increasingly seek quality bedding that provides warmth while enhancing interior décor, prompting manufacturers to innovate with diverse product ranges. The aging population, now comprising over 29.3% of the total population, emphasizes comfort and ease-of-use in home textiles, further strengthening the Japan blankets and quilts market share.

Key Takeaways and Insights:

- By Product Type: Blankets dominate the market with a share of 45% in 2025, driven by their versatility for year-round use and strong seasonal demand during cold winters.

- By Material: Synthetic fibers lead the market with a share of 40% in 2025, owing to their durability, affordability, and easy-care properties that appeal to busy urban consumers.

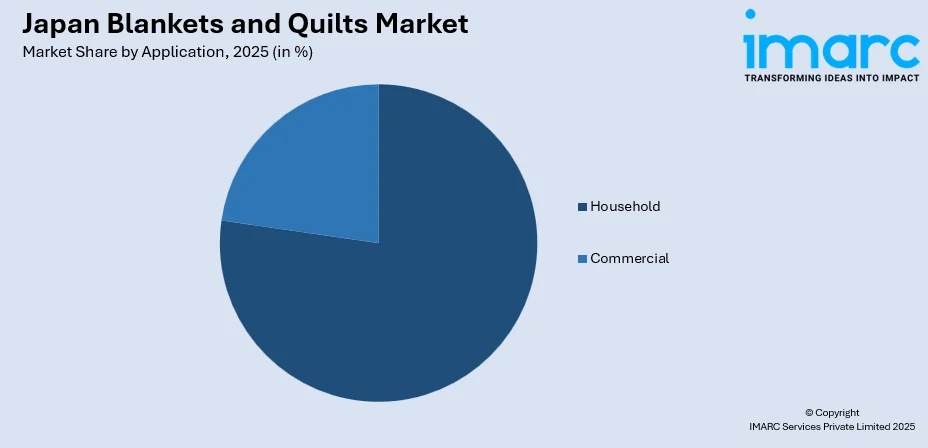

- By Application: Household represents the largest segment with a market share of 68% in 2025, reflecting the dominance of residential consumers seeking comfortable and aesthetically pleasing bedding.

- By Distribution Channel: Offline dominates the largest share at 60% in 2025, supported by Japan's well-established network of department stores, specialty shops, and home furnishing retailers.

- Key Players: Japan’s blankets and quilts market is dominated by various established brands, while several lifestyle names attract modern consumers. Smaller producers differentiate via eco‑friendly materials, traditional designs, or performance fabrics, and increasing online retail intensifies competition.

To get more information on this market Request Sample

The Japan blankets and quilts market continues to evolve as consumers increasingly prioritize quality, sustainability, and innovation in bedding products. The country’s distinct seasonal climate, particularly cold winters, sustains consistent demand for warm and cozy blankets and quilts. Cultural influences shape consumer choices, with a strong appreciation for both minimalist aesthetics and traditional design elements. Overall, the market is trending toward premium, practical, and innovative bedding offerings that combine comfort, functionality, and thoughtful design.

Japan Blankets and Quilts Market Trends:

Focus on Sustainable and Eco-Friendly Materials

Consumer demand in Japan for blankets and quilts made from sustainable and eco-friendly materials is accelerating. As environmental awareness grows, shoppers actively seek products crafted from organic cotton, bamboo fibers, and recycled materials. The Japan bamboo fiber market size reached USD 375.49 Million in 2025. The market is projected to reach USD 984.84 Million by 2034, exhibiting a growth rate (CAGR) of 11.31% during 2026-2034. The 2025 Recycled Polyester Challenge targets 45% recycled content, prompting domestic mills to trial bottle-to-fiber conversions, transforming manufacturing practices across the industry.

Integration of Smart Technology in Bedding Products

The adoption of smart technology in bedding products is an emerging trend in the Japanese market. Consumers are showing growing interest in blankets and quilts that offer advanced features such as temperature regulation, moisture-wicking, and integrated sleep monitoring. For instance, Nishikawa emphasizes sleep science, pairing connected sensors with MuAtsu mattresses and driving strong sales following a major advertising campaign. This continuous innovation is playing a key role in supporting growth in the Japan blankets and quilts market.

Emphasis on Traditional and Cultural Designs

Traditional and cultural motifs continue to enjoy patronage in Japan's blanket and quilt industry. Japanese consumers value heritage designs and motifs in home fabrics, blending cultural aesthetics with modern functionality. This trend influences both domestic manufacturers and international brands seeking to appeal to regional tastes. Nitori's N Warm product line, which features moisture-to-heat technology and culturally appealing designs, sold out rapidly during winter 2024, demonstrating strong consumer preference for products that balance innovation with traditional comfort.

Market Outlook 2026-2034:

The outlook for the Japan blankets and quilts market remains positive, supported by continued consumer emphasis on home comfort, the needs of an aging population, and increasing adoption of e-commerce. The online retail channel is expanding steadily, with growing penetration in household goods, making it an increasingly important distribution avenue for blankets and quilts. Producers are likely to maintain their focus on eco-friendly materials and advanced smart bedding solutions to address shifting consumer demands and preferences. The market generated a revenue of USD 938.56 Million in 2025 and is projected to reach a revenue of USD 1554.98 Million by 2034, growing at a compound annual growth rate of 5.77% from 2026-2034.

Japan Blankets and Quilts Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Blankets | 45% |

| Material | Synthetic Fibers | 40% |

| Application | Household | 68% |

| Distribution Channel | Offline | 60% |

Product Type Insights:

- Blankets

- Quilts

- Traditional

- All-Season

- Winter-Specific

- Premium/Designer Blankets and Quilts

The blankets segment dominates with a market share of 45% of the total Japan blankets and quilts market in 2025.

Blankets continue to be essential household items in Japan, valued for their seasonal versatility and ability to provide warmth during cold winters. Consumers see blankets as key to creating cozy and comfortable home environments, driving consistent seasonal demand. Innovative designs, such as moisture-to-heat technology blankets, have gained popularity by offering added functionality. Products that combine comfort, convenience, and creative features are particularly appealing, reflecting consumer interest in bedding solutions that enhance both warmth and lifestyle experiences.

The blanket segment also benefits from Japan’s strong gifting culture, with blankets being popular choices for holidays and special occasions. Lightweight and versatile designs serve multiple purposes, functioning as throws, picnic blankets, or additional layers for sleeping. The ongoing trend of layered bedding in Japanese home décor encourages consumers to purchase diverse blanket varieties to achieve different aesthetic and functional looks. This combination of practical use and decorative appeal continues to support steady demand and growth in the market.

Material Insights:

- Natural Fibers

- Synthetic Fibers

- Blended Fabrics

Synthetic fibers lead the market with a share of 40% of the total Japan blankets and quilts market in 2025.

Synthetic fibers dominate the Japan blankets and quilts market, accounting for a significant portion of overall sales. Their popularity stems from durability, affordability, and ease of maintenance, making them ideal for urban households seeking practical bedding solutions. These fibers withstand frequent washing while maintaining shape and softness, offering convenience without compromising comfort. Their versatility allows manufacturers to create a wide range of designs, textures, and weights suitable for different seasons and consumer preferences.

The market for synthetic blankets and quilts is further supported by sustainability initiatives. Industry efforts, such as the Recycled Polyester Challenge, encourage the use of recycled content in production, prompting domestic mills to experiment with bottle-to-fiber conversions for eco-friendly synthetic manufacturing. This focus on sustainable practices aligns with consumer interest in environmentally responsible products, enhancing the appeal of synthetic bedding while ensuring that manufacturers can meet both functional and ecological demands in Japan’s competitive blankets and quilts market.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Household

- Commercial

The household segment exhibits clear dominance with a 68% share of the total Japan blankets and quilts market in 2025.

Residential buyers drive the Japan blankets and quilts market, with aging singles and couples prioritizing compact, lightweight, and low-maintenance goods. Surveys indicate that a significant portion of residents already own functional apparel and show strong interest in sleep-support textiles, reflecting growing consumer demand for products that enhance comfort and well-being. Japanese homes, averaging 92 square meters, increasingly favor space-efficient bedding solutions that combine comfort with practical storage options.

The segment continues to lead the market, reflecting strong consumer focus on comfort, convenience, and home aesthetics. Families and individuals increasingly seek bedding that balances warmth, durability, and ease of maintenance, while also complementing interior décor. Seasonal variations and the popularity of layered bedding further support demand for diverse blanket and quilt options. Additionally, rising interest in sustainable and technologically enhanced textiles, such as moisture-wicking or temperature-regulating fabrics, is driving innovation and adoption within the residential market.

Distribution Channel Insights:

- Online

- Offline

Offline channels hold the largest share at 60% of the total Japan blankets and quilts market in 2025.

Japan has a well-established network of physical stores, including department stores, specialty bedding shops, furniture outlets, and home goods retailers. Consumers value the ability to physically inspect products before purchase, particularly for tactile items like blankets and quilts. Major retailers like Nitori operate over 500 stores across Japan, combining extensive store networks with omnichannel strategies.

The online distribution channel is experiencing rapid growth, fueled by increasing consumer adoption of e-commerce for household goods. Manufacturers and retailers are leveraging digital marketing strategies and convenient home delivery services to reach wider audiences, enhance customer convenience, and drive sales. The shift toward online purchasing reflects changing consumer preferences for easy access to a variety of bedding options, allowing brands to expand their market presence and strengthen engagement with tech-savvy shoppers.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region, including Tokyo, sees strong demand due to high urban population density and rising disposable incomes. Consumers prioritize home comfort and convenience, driving interest in functional, easy-care blankets and quilts. E-commerce adoption is high, allowing urban households to access a wide variety of premium and innovative bedding products. Seasonal temperature variations also increase demand for versatile and layered bedding solutions.

In Kansai, major cities like Osaka and Kyoto contribute to a consistent demand for blankets and quilts. Consumers value comfort and home aesthetics, driving interest in stylish, lightweight, and multifunctional bedding. The region’s affluent population is increasingly drawn to products with enhanced functionality, such as moisture-wicking or temperature-regulating textiles, while traditional gifting practices further support steady market growth.

The Central/Chubu region experiences strong demand due to a mix of urban centers and colder inland areas, which heightens the need for warm, functional bedding. Consumers seek durable, easy-care blankets suitable for frequent use. Lifestyle trends emphasizing layered bedding and modern home décor drive the adoption of diverse textile varieties, while interest in sustainable and eco-friendly materials is also rising among environmentally conscious households.

The warmer climate of Kyushu and Okinawa shapes demand toward lightweight, breathable, and versatile blankets and quilts. Consumers prefer products that balance comfort and cooling properties, suitable for year-round use. Rising disposable incomes and lifestyle-focused retail channels encourage purchases of functional and aesthetically appealing bedding, while seasonal variations and tourism-driven hospitality demand also contribute to market growth.

Tohoku, known for cold winters, sees high demand for thermal and insulating blankets and quilts. Consumers prioritize warmth, durability, and easy maintenance to cope with prolonged low temperatures. Regional households often invest in high-quality bedding that supports layered sleeping arrangements, while local retailers and e-commerce channels help meet the demand for both traditional and innovative textile solutions.

In Chugoku, demand is driven by urban and suburban households seeking functional, comfortable bedding suitable for both family use and gifting. Consumers show interest in soft, lightweight, and easy-care blankets, while growing e-commerce adoption allows access to premium and technologically enhanced textiles. Seasonal temperature changes further boost demand for versatile bedding solutions suitable for all-year comfort.

Hokkaido’s harsh, snowy winters create strong demand for heavy, insulating blankets and quilts. Consumers prioritize warmth, durability, and high-quality materials, often seeking multifunctional bedding that combines comfort with performance. Layered bedding trends are popular, and functional textiles such as moisture-wicking or thermal blankets gain traction. Retailers and e-commerce platforms cater to regional needs with a focus on winter-specific, premium bedding solutions.

Shikoku experiences moderate seasonal variations, supporting demand for lightweight yet comfortable blankets and quilts. Consumers value versatility and easy-care textiles suitable for everyday use and occasional layered arrangements. Lifestyle trends toward home décor and comfort-focused products drive interest in stylish, multifunctional bedding, while online and local retail channels facilitate access to innovative blankets that combine practicality with aesthetic appeal.

Market Dynamics:

Growth Drivers:

Why is the Japan Blankets and Quilts Market Growing?

Growing Aging Population Driving Demand for Comfort-Focused Bedding

Japan's aging population is a major driver influencing market trends. The elderly population in Japan reached 36.25 million in September 2024, representing an all-time high of 29.3% of the total population. Aging consumers prioritize comfort, simplicity, and ease-of-use in their bedding, affecting product development. Consequently, demand is increasing for blankets and quilts that are soft, skin-friendly, and easy to manage. Fabrics like cotton and hypoallergenic materials are in greater demand, while older adults seek functional advantages such as lightweight construction and easier-to-manage materials for those with declining strength or mobility. The Ministry of Health, Labour and Welfare has implemented guidelines for long-term care facilities emphasizing appropriate bedding for elderly residents.

Rising Focus on Home Comfort and Interior Aesthetics

The growing interest from consumers in home comfort and appearance is driving the market forward. With the rise of home-based lifestyles in urban centers, there is increasing demand for quality bedding that is both functional and aesthetically pleasing. Japanese consumers seek blankets and quilts that provide warmth while enhancing their home décor, prompting manufacturers to offer diverse product ranges. Western home décor trends have influenced Japanese consumers, leading to increased acceptance and demand for coordinated bedding products as essential components of modern home furnishing. The Japan home textile market size reached USD 6.0 Billion in 2025. Looking forward, the market is expected to reach USD 8.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.59% during 2026-2034, reflecting sustained consumer investment in home comfort products.

Expansion of E-Commerce and Digital Retail Channels

The growth of e-commerce platforms and digital retail channels is transforming how Japanese consumers shop for bedding products. The Japan e-commerce market size reached USD 258.0 Billion in 2024. Looking forward, the market is expected to reach USD 692.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.02% during 2025-2033. Online shopping offers convenience, accessibility, and vast product selection, allowing consumers to explore and purchase blankets and quilts from home. Major retailers like Nitori leverage Google searches to direct users to their apps, using algorithmic merchandising and personalized follow-up communications. This digital transformation enables manufacturers to reach broader audiences and implement data-driven marketing strategies.

Market Restraints:

What Challenges the Japan Blankets and Quilts Market is Facing?

Labor Shortage and Aging Workforce in Textile Industry

The textile industry in Japan faces severe labor shortages as the country experiences an aging population and declining number of young workers entering the industry. The Japan Textile Workers Union reported that the average age of textile workers increased to 52 years in 2023. Domestic mid-tier producers face rising cost per unit due to labor constraints, while the lack of new talent exacerbates challenges in keeping pace with technological advancements and market demands.

High Production and Manufacturing Costs

Rising manufacturing and labor costs squeeze profit margins for blanket and quilt manufacturers. Japan's Ministry of Economy, Trade, and Industry reported in 2024 that wages in the manufacturing sector rose by 4.2%, making it difficult for local manufacturers to compete with lower-cost production hubs in Southeast Asia. Additionally, raw material price fluctuations affect market stability and may compel manufacturers to pass costs to consumers through higher prices.

Competition from Low-Cost Imports

Increasing competition from imported products, particularly from China, Indonesia, and Vietnam, poses challenges for domestic manufacturers. Imports offer similar functionality at lower prices, making them attractive alternatives for budget-conscious consumers. Domestic producers counter by highlighting Japan-quality stitching and heritage weaving, but face ongoing pressure from international competitors leveraging algorithmic merchandising on specialized apps.

Competitive Landscape:

The blankets and quilts market in Japan is driven by consumer demand for comfort, seasonal warmth, and stylish home décor. Leading companies maintain strong positions through brand recognition, extensive retail networks, and continuous product innovation. Lifestyle-focused brands appeal to trend-conscious consumers with minimalist, fashionable bedding that combines aesthetics and functionality. Smaller producers differentiate themselves through eco-friendly materials, traditional designs, or performance-enhancing features like moisture-wicking and temperature-regulating fabrics. The growth of online retail and demand for convenient, space-efficient bedding has intensified competition, encouraging innovation in design, materials, and distribution strategies to attract and retain customers.

Recent Developments:

- October 2024: Nitori launched its N Warm Smartphone Blanket featuring moisture-to-heat technology, priced between JPY 3,990 and JPY 5,990. The blanket quickly sold out and was praised for its exceptional warmth and comfort, with innovative N Warm material that converts body moisture into heat, leading to enhanced product features for the 2024 winter season.

Japan Blankets and Quilts Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Materials Covered | Natural Fibers, Synthetic Fibers, Blended Fabrics |

| Applications Covered | Household, Commercial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan blankets and quilts market size was valued at USD 938.56 Million in 2025.

The Japan blankets and quilts market is expected to grow at a compound annual growth rate of 5.77% from 2026-2034 to reach USD 1,554.98 Million by 2034.

Blankets dominate the largest revenue share at 45%, driven by their versatility for year-round use, strong seasonal demand during cold winters, and popularity as gifts during holidays and special occasions across Japan.

Key factors driving the Japan blankets and quilts market include a growing aging population seeking comfortable bedding, rising focus on home comfort and interior aesthetics, expansion of e-commerce platforms, and increasing adoption of sustainable and smart bedding technologies.

Major challenges include severe labor shortages and an aging workforce in the textile industry, high production and manufacturing costs driven by wage increases, and growing competition from low-cost imports from Southeast Asian countries.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)