Japan Blenders and Mixers Market Size, Share, Trends and Forecast by Product Type, Capacity, Speed Settings, Features, and Region, 2026-2034

Japan Blenders and Mixers Market Summary:

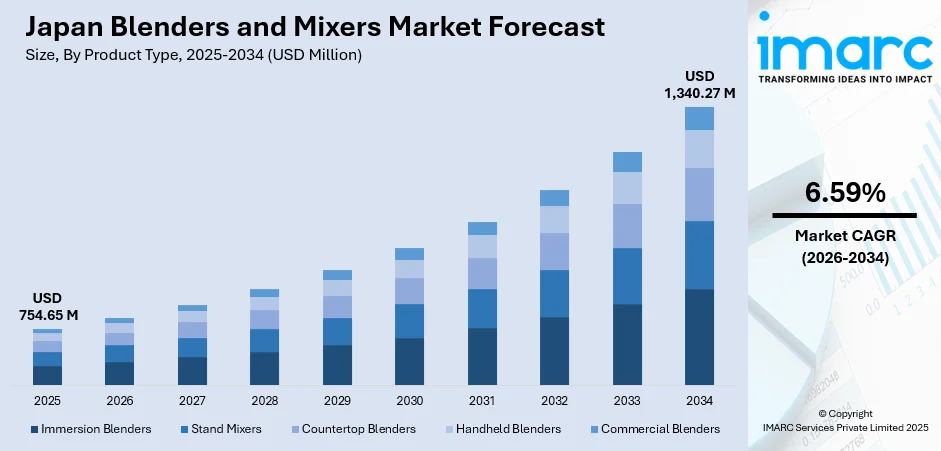

The Japan blenders and mixers market size was valued at USD 754.65 Million in 2025 and is projected to reach USD 1,340.27 Million by 2034, growing at a compound annual growth rate of 6.59% from 2026-2034.

The market expansion stems from escalating health consciousness among Japanese consumers driving the demand for fresh smoothies and nutrient-dense beverages, coupled with rapid urbanization necessitating compact multifunctional appliances suitable for space-constrained urban households. Government initiatives promoting energy-efficient kitchen solutions through substantial rebate programs further accelerate adoption, while technological innovations incorporating smart connectivity features and advanced blending mechanisms enhance user convenience and product appeal across residential and commercial segments, collectively propelling the Japan blenders and mixers market share.

Key Takeaways and Insights:

- By Product Type: Countertop blenders dominate the market with a share of 37% in 2025, driven by versatile functionality accommodating diverse culinary applications from smoothie preparation to soup blending.

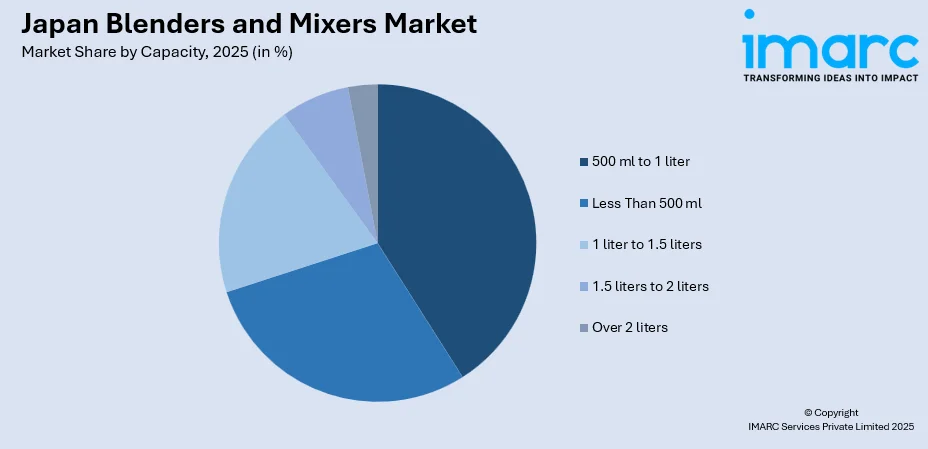

- By Capacity: 500 ml to 1 liter leads the market with a share of 41% in 2025, propelled by optimal portion sizing for single-person and small household consumption patterns prevalent in urban Japanese demographics.

- By Speed Settings: 2-5 speeds represent the largest segment with a market share of 48% in 2025, reflecting consumer demand for sufficient blending versatility without overwhelming operational complexity.

- By Features: Pulse function dominates the market with a share of 43% in 2025, driven by enhanced user control over blending consistency for specialized culinary applications.

- By Region: Kanto Region dominates with a share of 36% in 2025, supported by Tokyo metropolitan area's concentrated affluent consumer base with elevated discretionary spending capacity.

- Key Players: The Japan blenders and mixers market exhibits moderate competitive intensity, with multinational appliance corporations competing alongside domestic manufacturers across diverse price segments. They are launching various innovative mixers with advanced features to fulfil the requirements of users.

To get more information on this market Request Sample

The Japanese blenders and mixers market demonstrates robust growth trajectory underpinned by converging demographic, technological, and policy factors reshaping kitchen appliance consumption patterns. Urban concentration exceeding ninety-two percent of the national population intensifies demand for space-optimized multifunctional appliances, while aging demographics and nuclear household proliferation drive preference for user-friendly automated solutions. Health and wellness trends catalyze adoption of appliances facilitating fresh juice and smoothie preparation, with consumers increasingly prioritizing nutrient retention and ingredient quality control over commercial alternatives. Technological advancement manifests through integration of intelligent features including preset blending programs, noise reduction mechanisms, and enhanced motor efficiency delivering superior performance within compact form factors. Government sustainability initiatives provide powerful market stimulus, exemplified by the Tokyo Metropolitan Government's July 2024 launch of the Tokyo Zero Emission Point Project offering substantial rebates for energy-efficient appliance purchases, with incentive amounts escalating from JPY 26,000 to JPY 80,000 by October 2024. Manufacturers respond through product innovation emphasizing energy conservation, recyclable materials, and smart connectivity, positioning blenders and mixers as essential components of modern Japanese kitchen ecosystems rather than discretionary purchases.

Japan Blenders and Mixers Market Trends:

Compact Space-Saving Multifunctional Appliance Designs

Japanese blender manufacturers prioritize miniaturization and multifunctionality responding to severe urban space constraints, with product development emphasizing slim footprints, stackable component designs, and consolidated capabilities spanning blending, grinding, and food processing within singular units. Metropolitan households increasingly favor appliances combining juice extraction, smoothie preparation, and ingredient pulverization functionalities while occupying minimal counter real estate, driving manufacturers toward vertical form factors and modular attachment systems. This design evolution reflects architectural realities of Japanese urban dwellings where kitchen dimensions average significantly smaller than Western counterparts, necessitating appliances delivering maximum utility within constrained spatial allocations, with contemporary models incorporating collapsible elements and integrated storage solutions addressing these endemic space challenges. In 2024, Japanese Kitchenware Company, Tiger Corporation announced the launch of its latest innovation in the U.S., the TIGER EDGE, a revolutionary enhancement to its varied product range. The TIGER EDGE stems from careful planning and design, showcasing its unique and exclusive 45-degree diagonal drive technology that offers exceptional blending capabilities, giving it a distinct edge over traditional blenders.

Smart Technology Integration and Connectivity Features

Advanced blender models increasingly incorporate Internet of Things (IoT) connectivity enabling smartphone application control, voice-activated operation through virtual assistants, and automated blending programs optimizing ingredient processing based on recipe databases and nutritional parameters. Consumer electronics manufacturers leverage existing smart home ecosystem penetration to position blenders as interconnected kitchen components, with features encompassing remote operation scheduling, ingredient quantity recommendations, and maintenance alerts transmitted via mobile interfaces. Integration extends beyond operational control to encompass data analytics tracking usage patterns, nutritional intake monitoring, and personalized recipe suggestions aligned with dietary preferences, transforming traditional mechanical appliances into intelligent kitchen assistants responding dynamically to user behaviors and health objectives within broader digital home management systems. IMARC Group predicts that the Japan smart homes market is projected to attain USD 22.6 Billion by 2033.

Energy Efficiency and Sustainable Manufacturing Practices

Environmental sustainability considerations increasingly influence product development, with manufacturers incorporating energy-efficient motors, recyclable materials, and extended product longevity addressing consumer environmental awareness and government efficiency mandates. Industry leaders demonstrate commitment through enhanced recycling technologies enabling incorporation of recovered materials into new production, with major manufacturers achieving forty percent recycled content in recent appliance lines through advanced material processing and quality enhancement techniques. In 2024, the Japanese government has reiterated its firm dedication to green technology and sustainability, vowing to attain carbon neutrality by 2050 and to eliminate plastic waste in the oceans. The country is already at the forefront globally in producing bioplastics and hydrogen energy. People’s purchasing decisions reflect heightened sustainability awareness, with government rebate programs specifically targeting energy-efficient appliance adoption and retailers prominently featuring efficiency ratings alongside traditional performance specifications.

Market Outlook 2026-2034:

The Japan blenders and mixers market trajectory through 2033 anticipates sustained expansion driven by demographic evolution, technological innovation, and policy reinforcement converging to elevate appliance adoption across residential and commercial segments. The market generated a revenue of USD 754.65 Million in 2025 and is projected to reach a revenue of USD 1,340.27 Million by 2034, growing at a compound annual growth rate of 6.59% from 2026-2034. Government energy efficiency initiatives providing substantial consumer rebates continue stimulating replacement cycles, while smart technology integration attracts tech-savvy demographics seeking connected kitchen ecosystems.

Japan Blenders and Mixers Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Countertop Blenders | 37% |

| Capacity | 500 ml to 1 liter | 41% |

| Speed Settings | 2-5 Speeds | 48% |

| Features | Pulse Function | 43% |

| Region | Kanto Region | 36% |

Product Type Insights:

- Immersion Blenders

- Stand Mixers

- Countertop Blenders

- Handheld Blenders

- Commercial Blenders

Countertop blenders dominate with a market share of 37% of the total Japan blenders and mixers market in 2025.

Countertop blenders command dominant market positioning through superior versatility accommodating diverse culinary applications spanning smoothie preparation, soup pureeing, sauce emulsification, and ingredient grinding within unified appliance frameworks. Design architecture emphasizes stability through weighted bases, elevated motor power ratings typically exceeding six hundred watts enabling robust ice crushing and frozen ingredient processing, and generous container capacities between one and two liters suitable for family-sized portion preparation.

Moreover, consumer preference gravitates toward countertop configurations balancing operational power with aesthetic kitchen integration, with premium models incorporating noise reduction technologies, preset automatic programs, and self-cleaning functionalities enhancing user convenience. Manufacturers differentiate through blade geometry innovations, material quality emphasizing durability and food safety compliance, and control interface sophistication ranging from basic rotary dials to digital touchscreen displays with connectivity features. Key market players are also coming up with energy efficient models to complement government policies. The Japanese government's electricity and gas subsidies planned for January to March 2026, intended to address increasing prices, are now set to rise beyond 3,000 yen (approximately $19) for an average household in January. Sources familiar with the government indicated that the original plan included a subsidy exceeding 2,000 yen (approximately $13) for both January and February. Nonetheless, the government intends to raise the amount further to lighten the load on families. A suggestion to increase the February subsidy has surfaced, and talks are in progress.

Capacity Insights:

Access the comprehensive market breakdown Request Sample

- Less Than 500 ml

- 500 ml to 1 liter

- 1 liter to 1.5 liters

- 1.5 liters to 2 liters

- Over 2 liters

The 500 ml to 1 liter leads with a share of 41% of the total Japan blenders and mixers market in 2025.

Mid-range capacity specifications between five hundred milliliters and one liter achieve optimal balance between portion sizing adequacy and appliance compactness, addressing predominant single-person and small household demographics characterizing contemporary Japanese residential patterns. Container dimensions accommodate daily smoothie and juice preparation requirements without excessive ingredient waste or refrigerated storage complications, while physical footprints remain compatible with limited counter and cabinet space allocations typical of urban kitchen configurations. Manufacturing efficiency benefits from standardized production scales enabling competitive pricing strategies, with material costs and motor specifications scaled appropriately for moderate volume processing without premium pricing associated with larger capacity units.

Mid-range capacity configurations also serve portable personal blender applications emphasizing individual serving convenience and travel compatibility. Larger capacity ranges extending beyond one liter address family household requirements and commercial foodservice applications, with incremental volume increases correlating with enhanced motor power specifications, reinforced container construction, and elevated price positioning reflecting advanced engineering requirements for consistent performance across expanded ingredient volumes. Moreover, the rise in health consciousness among the masses is encouraging more people to have smoothies. This is further urging people to buy blenders with efficient and compact features. Suntory survey in 2024 showed that anxiety, fatigue, and bad skin conditions were the most common health issues for Japanese aged 18 to 34. These conditions collectively urged people to adopt healthy lifestyles and consume nutritious food.

Speed Settings Insights:

- Single Speed

- 2-5 Speeds

- 6-10 Speeds

- 10+ Speeds

The 2-5 speeds exhibit a clear dominance with a 48% share of the total Japan blenders and mixers market in 2025.

Mid-tier speed configurations incorporating two to five discrete settings achieve market dominance through balanced operational versatility without overwhelming interface complexity, enabling users to modulate blending intensity across common culinary applications from gentle stirring to robust ice crushing without excessive control granularity. Manufacturing cost efficiencies associated with simplified speed control mechanisms facilitate competitive pricing strategies positioning these models within accessible mid-range price points appealing to mass market consumers prioritizing functional adequacy over premium feature sets.

Speed variation sufficiency covers standard residential blending requirements including smoothie preparation, vegetable pureeing, and ingredient chopping, with consumer research indicating limited utilization of extended speed ranges beyond five settings in typical household usage patterns, validating manufacturer focus on this optimal specification balance. Mid-tier speed configurations address budget-conscious segments and minimalist design preferences emphasizing operational simplicity. Extended speed ranges exceeding six settings appeal to culinary enthusiasts demanding precise consistency control and premium positioning through feature sophistication, with ten-plus speed configurations typically reserved for professional-grade commercial models serving specialized foodservice applications requiring maximum operational flexibility across diverse ingredient processing requirements.

Features Insights:

- Digital Display

- Pulse Function

- Ice Crushing

- Self-Cleaning

Pulse function leads with a share of 43% of the total Japan blenders and mixers market in 2025.

Pulse functionality emerges as dominant feature specification through enhanced user control enabling intermittent power bursts optimizing ingredient consistency management across specialized culinary applications requiring graduated texture modification rather than continuous blending operations. Operational effectiveness manifests particularly in processing stubborn ingredients including frozen fruits, hard vegetables, and nut preparations where sustained blending risks over-processing while pulse activation delivers controlled consistency refinement.

Widespread adoption across product categories from entry-level to premium models reflects manufacturing standardization and consumer expectation normalization positioning pulse capability as baseline rather than premium feature, with control implementation spanning simple manual button activation to programmable automated pulse sequences in advanced models. Moreover, self-cleaning features deliver convenience premium through automated cleaning cycles reducing manual maintenance requirements, with implementation ranging from simple water-detergent blending programs to advanced sonic cleaning mechanisms in premium segments.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto region exhibits a clear dominance with a 36% share of the total Japan blenders and mixers market in 2025.

Kanto Region dominates through Tokyo metropolitan concentration delivering substantial consumer base with elevated purchasing power, sophisticated retail infrastructure facilitating premium product distribution, and cultural health consciousness trends driving appliance adoption rates exceeding national averages. Metropolitan density generates continuous replacement demand as affluent households upgrade appliances aligned with evolving aesthetic preferences and technological advancements, while extensive commercial foodservice sector encompassing cafes, juice bars, and restaurants sustains robust institutional procurement volumes. Regional characteristics including compact urban living spaces intensify demand for space-efficient multifunctional designs, with consumer preferences gravitating toward premium positioning reflecting disposable income availability and quality prioritization over budget considerations, collectively establishing Kanto as strategic priority market for manufacturer distribution and marketing resource allocation.

Market Dynamics:

Growth Drivers:

Why is the Japan Blenders and Mixers Market Growing?

Rising Health Consciousness and Wellness Lifestyle Adoption

Japanese consumer health awareness escalation fundamentally reshapes dietary patterns and kitchen appliance consumption behaviors, with increasing populations prioritizing nutrient-dense fresh food preparation over processed commercial alternatives and viewing blenders as essential tools facilitating healthier lifestyle choices. Demographic trends reveal growing adoption of smoothie consumption, plant-based dietary integration, and fresh juice preparation as daily nutritional practices, with appliances enabling home-based fresh ingredient processing delivering superior nutrient retention and ingredient quality control compared to retail beverage purchases. Market research demonstrates correlation between health consciousness intensification and blender ownership rates, with metropolitan areas exhibiting highest penetration reflecting urban professional demographics prioritizing wellness investments and preventive health practices through dietary optimization, positioning blenders as lifestyle enablers rather than discretionary kitchen accessories. The online survey carried out by Eli Lilly Japan K.K. and Mitsubishi Tanabe Pharma Corp. in November 2024 collected responses from 1,600 participants, comprising individuals with obesity, healthcare professionals, and members of the public. When inquired about accountability for obesity, 87% of individuals with the condition stated it is a "personal responsibility," while 63% of them felt it is "entirely the individual's responsibility."

Urbanization and Space-Constrained Household Demographics

Accelerating Japanese urbanization concentrating populations within metropolitan centers generates distinctive appliance requirements emphasizing compact multifunctional designs optimized for limited residential space allocations characteristic of urban dwelling units. Urban concentration exceeding 92% of national population residing in major cities intensifies demand for space-efficient kitchen solutions, with manufacturers responding through vertical form factors, collapsible components, and integrated storage designs maximizing utility within minimal counter and cabinet footprints. Nuclear household proliferation and single-person demographic growth drive preference for smaller capacity appliances suited to individual or couple consumption patterns while maintaining operational capabilities spanning juice extraction, smoothie preparation, and ingredient processing within unified compact platforms.

Government Energy Efficiency Initiatives and Sustainability Programs

Governmental policy frameworks promoting energy-efficient appliance adoption through substantial consumer rebate programs deliver powerful market stimulus accelerating replacement cycles and elevating purchase consideration among cost-conscious demographics. Tokyo Metropolitan Government's 2024 launch of the Tokyo Zero Emission Point Project exemplifies policy intervention effectiveness, offering residents purchasing qualifying energy-efficient appliances through registered retailers on-the-spot discount access and accumulated points redeemable for additional purchases, with rebate amounts escalating from twenty-six thousand yen to eighty thousand yen by October 2024 demonstrating program expansion responding to adoption success. Nationwide initiatives including the Sustainable Open Innovation Initiative reimburse up to fifty percent of incremental costs for registered high-efficiency units, dramatically improving payback periods and reducing financial barriers discouraging older appliance replacement.

Market Restraints:

What Challenges the Japan Blenders and Mixers Market is Facing?

High Premium Product Costs and Price Sensitivity

Premium blender models featuring advanced technological specifications including smart connectivity, multiple speed settings, and enhanced motor power command elevated price points potentially exceeding budget allocations for cost-conscious consumer segments, particularly affecting younger demographics and rural populations with constrained discretionary spending capacity. Manufacturing costs associated with quality motor components, durable blade assemblies, and sophisticated control electronics translate to retail pricing potentially deterring purchase consideration despite functional superiority over budget alternatives, creating market segmentation dividing affluent urban consumers willing to invest in premium features from price-sensitive segments prioritizing basic functionality at accessible entry points.

Traditional Cooking Method Preferences and Cultural Resistance

Certain consumer segments maintain strong preferences for traditional manual food preparation techniques viewing them as culturally authentic and suitable for Japanese culinary practices, with mechanical appliances perceived as unnecessary modernization compromising ingredient treatment quality or traditional recipe authenticity. Older demographic cohorts particularly demonstrate resistance toward automated appliance adoption, preferring familiar manual preparation methods accumulated through generational knowledge transfer and cultural practice continuation, creating market penetration barriers within aging population segments representing substantial demographic proportion. Traditional Japanese cuisine emphasis on ingredient integrity and manual technique mastery generates philosophical resistance positioning blenders as potentially disruptive to culinary artistry rather than beneficial efficiency tools.

Limited Kitchen Space and Maintenance Complexity Concerns

Severe spatial constraints characterizing Japanese urban kitchens create hesitation toward non-essential appliance acquisitions occupying precious counter or storage space, with consumers carefully evaluating utilization frequency justifying spatial allocation before purchase commitment. Maintenance requirements including blade cleaning, gasket replacement, and motor servicing introduce complexity discouraging regular usage particularly for models with multiple detachable components requiring individual cleaning attention, with inconvenient maintenance potentially relegating appliances to storage rather than active kitchen integration. Compact kitchen configurations limit concurrent appliance usage creating workflow disruptions when blender operation necessitates temporary displacement of other essential preparation tools, generating usage friction potentially undermining adoption enthusiasm despite initial purchase interest and reducing actual utilization frequencies below anticipated levels.

Competitive Landscape:

The Japan blenders and mixers market demonstrates moderate competitive intensity characterized by established domestic appliance manufacturers leveraging extensive distribution networks and brand recognition competing against international consumer electronics corporations pursuing market share expansion through technological differentiation and premium positioning strategies. Market structure exhibits tiered segmentation with premium brands emphasizing advanced features including smart connectivity, noise reduction technologies, and enhanced motor efficiency commanding elevated price points, while mid-tier manufacturers focus on functional reliability and competitive pricing appealing to mass market consumers prioritizing value optimization. Distribution channel dynamics favor retail partnerships with major electronics chains providing prominent shelf positioning and promotional support, complemented by expanding e-commerce penetration enabling direct consumer engagement and detailed product comparison facilitating informed purchase decisions across diverse brand offerings.

Japan Blenders and Mixers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Immersion Blenders, Stand Mixers, Countertop Blenders, Handheld Blenders, Commercial Blenders |

| Capacities Covered | Less Than 500 ml, 500 ml to 1 Liter, 1 Liter to 1.5 Liters,1.5 Liters to 2 Liters, Over 2 Liters |

| Speed Settings Covered | Single Speed, 2-5 Speeds, 6-10 Speeds, 10+ Speeds |

| Features Covered | Digital Display, Pulse Function, Ice Crushing, Self-Cleaning |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan blenders and mixers market size was valued at USD 754.65 Million in 2025.

The Japan blenders and mixers market is expected to grow at a compound annual growth rate of 6.59% from 2026-2034 to reach USD 1,340.27 Million by 2034.

Countertop blenders dominated the market with 37% share, driven by superior functional versatility accommodating diverse culinary applications, optimal capacity specifications suitable for family-sized preparations, and consumer preference for counter-stable configurations balancing operational power with aesthetic kitchen integration.

Key factors driving the Japan blenders and mixers market include escalating health consciousness among consumers driving demand for fresh nutrient-dense beverages, rapid urbanization necessitating compact multifunctional appliances suitable for space-constrained households, government energy efficiency initiatives providing substantial purchase rebates accelerating adoption cycles, and technological innovations incorporating smart connectivity features enhancing user convenience and product appeal across residential and commercial segments.

Major challenges include high premium product costs potentially exceeding budget allocations for cost-conscious consumer segments, traditional cooking method preferences among certain demographics viewing mechanical appliances as culturally disruptive to authentic culinary practices, limited kitchen space creating hesitation toward non-essential appliance acquisitions, and maintenance complexity concerns discouraging regular usage particularly for models with multiple detachable components requiring individual cleaning attention.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)