Japan Blockchain Market Size, Share, Trends and Forecast by Component, Provider, Type, Deployment Mode, Organization Size, Vertical, and Region, 2026-2034

Japan Blockchain Market Overview:

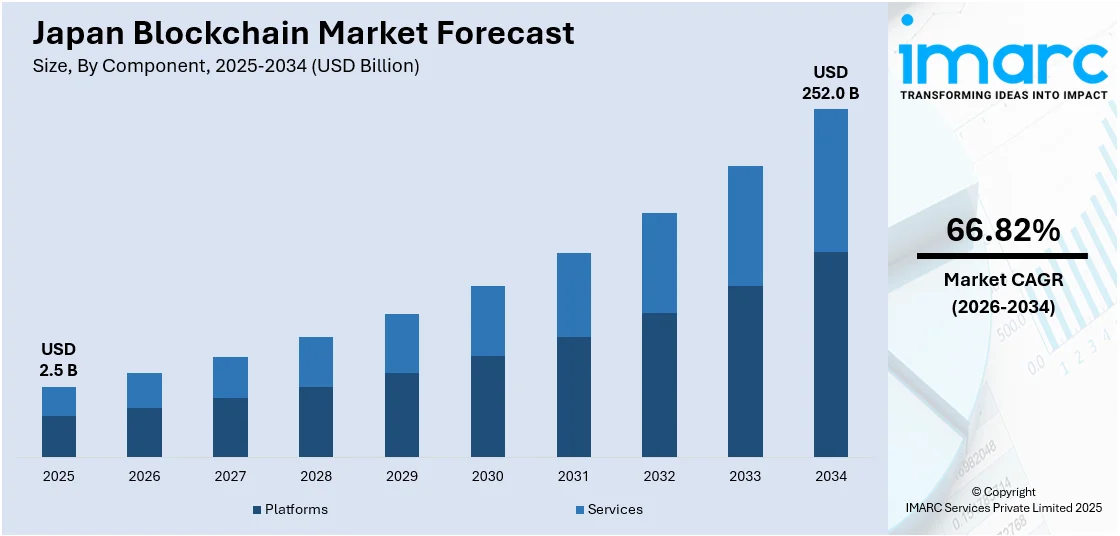

The Japan blockchain market size reached USD 2.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 252.0 Billion by 2034, exhibiting a growth rate (CAGR) of 66.82% during 2026-2034. The market is spurred by robust government backing and regulatory environments that encourage trust and blockchain technology adoption. Technological innovation, coupled with an emphasis on innovation in areas like finance, supply chain, and healthcare, continues to propel the growth of the market. Corporate investment and mass industry adoption are also playing a major role in the adoption of blockchain in major sectors, therefore augmenting the Japan blockchain market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.5 Billion |

| Market Forecast in 2034 | USD 252.0 Billion |

| Market Growth Rate 2026-2034 | 66.82% |

Japan Blockchain Market Trends:

Government Support and Regulation

Among the most influential factors driving the market is robust government support and regulation. Japan has consistently been a leader in the adoption and regulation of novel technologies, and blockchain is not different. The government of Japan has been progressive in acknowledging the potential of blockchain technology, with efforts being focused towards its promotion for development and integration into diverse industries. Japan's crypto market continues to expand, with 32 registered exchanges, 12 million accounts, and a total customer deposit balance of JPY 5 trillion. As of February 2025, the spot trading volume reached JPY 1.9 trillion (USD 13.1 billion), and 7.3% of individual investors own crypto-assets. Additionally, new regulations allow issuers to manage 50% of stablecoin reserves in low-risk assets, and tax reforms propose a flat 20% rate on crypto profits. The country's regulatory framework for cryptocurrencies, which was one of the first in the world, has provided a solid foundation for blockchain growth. By ensuring the security and transparency of blockchain-based transactions, Japan has created a favorable environment for businesses and startups to innovate using blockchain. Furthermore, Japan’s Financial Services Agency (FSA) has taken steps to provide clear guidelines on the use of blockchain in financial services, encouraging companies to explore the technology while adhering to legal standards. This proactive regulatory approach has not only helped establish trust in blockchain technology but also positioned Japan as a leader in blockchain adoption in Asia, driving the overall Japan blockchain market growth.

To get more information on this market Request Sample

Technological Advancements and Innovation

Japan’s reputation for technological innovation is a significant driver of the blockchain market. As one of the most technologically advanced countries, Japan is home to a thriving ecosystem of blockchain developers and technology companies. Many Japanese firms are experimenting with blockchain applications in industries such as finance, logistics, healthcare, and supply chain management. Blockchain provides transparent, secure, and efficient systems, that aligns with Japan’s demand for innovative technological solutions. Additionally, Japan’s focus on the development of Digital Yen and blockchain-based financial services is helping to drive innovation within the sector. The adoption of decentralized applications (dApps) and smart contracts is also gaining momentum, as businesses look for ways to improve automation, reduce fraud, and increase the security of digital transactions. Corporate investment and industry adoption play a pivotal role in the expansion of the blockchain market in Japan. Major corporations across various sectors have begun to recognize the value of blockchain technology for improving efficiency, transparency, and security in their operations. On March 24, 2025, Circle announced its expanded commitment to Japan by partnering with SBI Holdings to launch USDC on SBI VC Trade starting March 26, 2025. Additionally, Binance Japan, bitbank, and bitFlyer have committed to listing USDC in the near future, marking a significant step in their collaboration. As more companies in Japan embrace blockchain to streamline operations and enhance their services, the market will continue to experience significant technological innovation, further bolstering blockchain adoption across various industries.

Japan Blockchain Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on component, provider, type, deployment mode, organization size, and vertical.

Component Insights:

- Platforms

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes platforms and services (professional services and managed services).

Provider Insights:

- Application Provider

- Infrastructure Provider

- Middleware Provider

The report has provided a detailed breakup and analysis of the market based on the provider. This includes application provider, infrastructure provider, and middleware provider.

Type Insights:

- Public

- Private

- Hybrid

- Consortium

The report has provided a detailed breakup and analysis of the market based on the type. This includes public, private, hybrid, and consortium.

Deployment Mode Insights:

- On-Premises

- Cloud

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises, cloud, and hybrid.

Organization Size Insights:

- SMEs

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes SMEs and large enterprises.

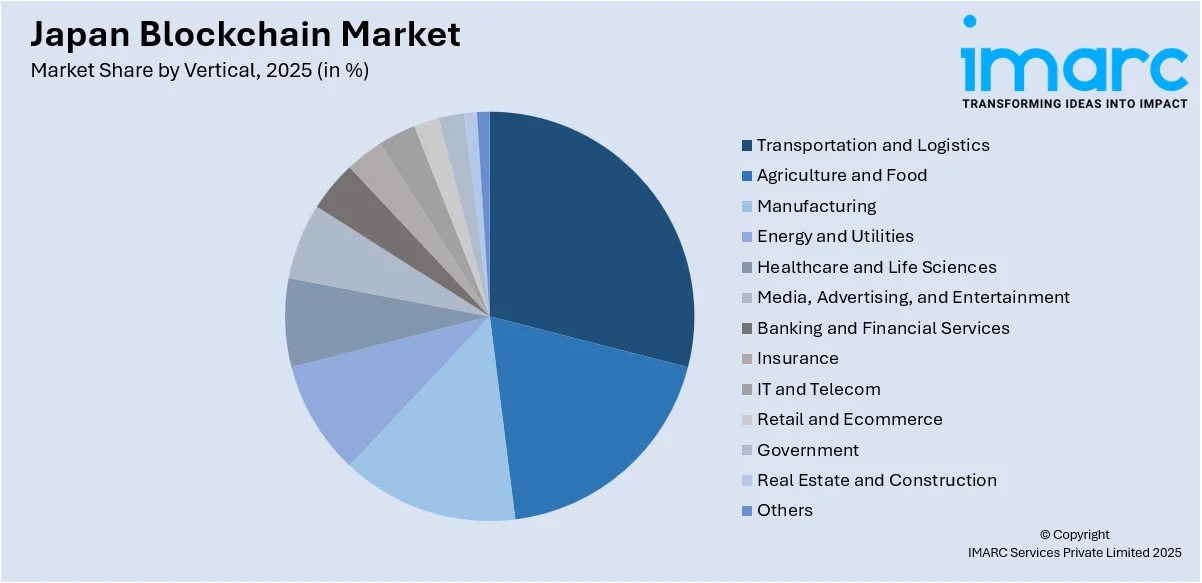

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Transportation and Logistics

- Agriculture and Food

- Manufacturing

- Energy and Utilities

- Healthcare and Life Sciences

- Media, Advertising, and Entertainment

- Banking and Financial Services

- Insurance

- IT and Telecom

- Retail and Ecommerce

- Government

- Real Estate and Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes transportation and logistics, agriculture and food, manufacturing, energy and utilities, healthcare and life sciences, media, advertising, and entertainment, banking and financial services, insurance, IT and telecom, retail and ecommerce, government, real estate and construction, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Blockchain Market News:

- On March 11, 2025, Japan's WAFUU.COM, a cross-border e-commerce platform, announced the integration of cryptocurrency payments. This move allows customers worldwide to purchase Japanese products using 16 different cryptocurrencies such as BTC, ETH, USDT, and others, facilitated by 83 wallets and 22 exchanges. This development enhances the shopping experience for global consumers by enabling faster and more secure payments. WAFUU.COM aims to bridge the gap between Japan's high-quality products and international markets while supporting over 70 countries with a seamless and borderless shopping experience.

- On March 17, 2025, BitTrade, a leading cryptocurrency exchange in Japan, announced the upcoming listing of UPCX (UPC), a blockchain-based open-source payment platform. Starting March 27, 2025, BitTrade will launch spot trading for UPCX, supported by 16 different cryptocurrencies. This listing is significant as UPCX has passed the rigorous compliance and security checks set by the Japanese Financial Services Agency (FSA). The partnership with BitTrade, one of only 16 licensed exchanges in Japan, will help UPCX expand its global market presence. UPCX aims to provide secure and transparent financial services with fast payments, decentralized exchanges, and customizable payment solutions.

Japan Blockchain Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Providers Covered | Application Provider, Infrastructure Provider, Middleware Provider |

| Types Covered | Public, Private, Hybrid, Consortium |

| Deployment Modes Covered | On-Premises, Cloud, Hybrid |

| Organization Sizes Covered | SMES, Large Enterprises |

| Verticals Covered | Transportation and Logistics, Agriculture and Food, Manufacturing, Energy and Utilities, Healthcare and Life Sciences, Media, Advertising, and Entertainment, Banking and Financial Services, Insurance, IT and Telecom, Retail and Ecommerce, Government, Real Estate and Construction, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan blockchain market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan blockchain market on the basis of component?

- What is the breakup of the Japan blockchain market on the basis of provider?

- What is the breakup of the Japan blockchain market on the basis of type?

- What is the breakup of the Japan blockchain market on the basis of deployment mode?

- What is the breakup of the Japan blockchain market on the basis of organization size?

- What is the breakup of the Japan blockchain market on the basis of vertical?

- What is the breakup of the Japan blockchain market on the basis of region?

- What are the various stages in the value chain of the Japan blockchain market?

- What are the key driving factors and challenges in the Japan blockchain market?

- What is the structure of the Japan blockchain market and who are the key players?

- What is the degree of competition in the Japan blockchain market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan blockchain market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan blockchain market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan blockchain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)