Japan Boiler Market Size, Share, Trends and Forecast by Boiler Type, End User, and Region, 2026-2034

Japan Boiler Market Summary:

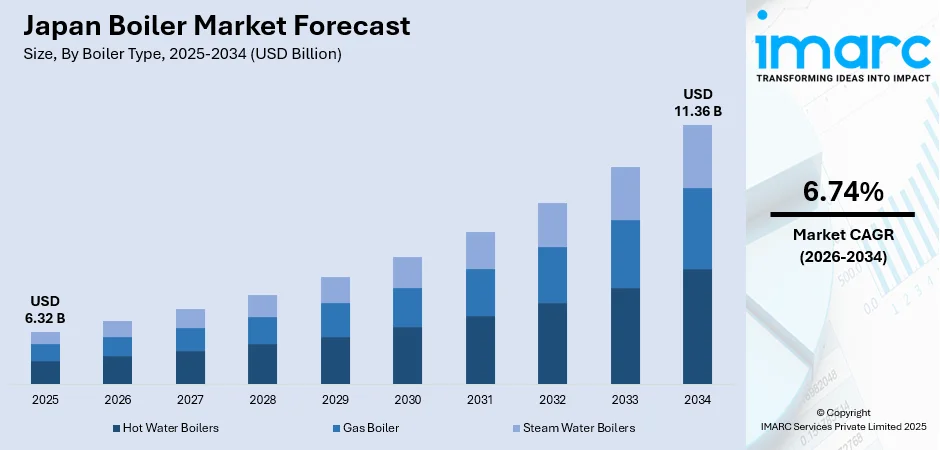

The Japan boiler market size was valued at USD 6.32 Billion in 2025 and is projected to reach USD 11.36 Billion by 2034, growing at a compound annual growth rate of 6.74% from 2026-2034.

The Japan boiler market is experiencing substantial growth driven by the country's commitment to achieving carbon neutrality by 2050 and the increasing adoption of energy-efficient heating solutions across industrial, commercial, and residential sectors. Rising demand for renewable energy-powered boilers, coupled with stringent environmental regulations promoting low-emission technologies, is accelerating market expansion. The modernization of aging industrial infrastructure and growing investments in hydrogen-based steam generation systems are transforming the thermal energy landscape, positioning Japan as a leader in sustainable boiler technology and innovation.

Key Takeaways and Insights:

- By Boiler Type: Hot water boilers dominate the market with a share of 44% in 2025, owing to their widespread application in industrial heating processes, food production, and pharmaceutical manufacturing. These systems offer superior thermal efficiency and consistent hot water supply essential for manufacturing operations.

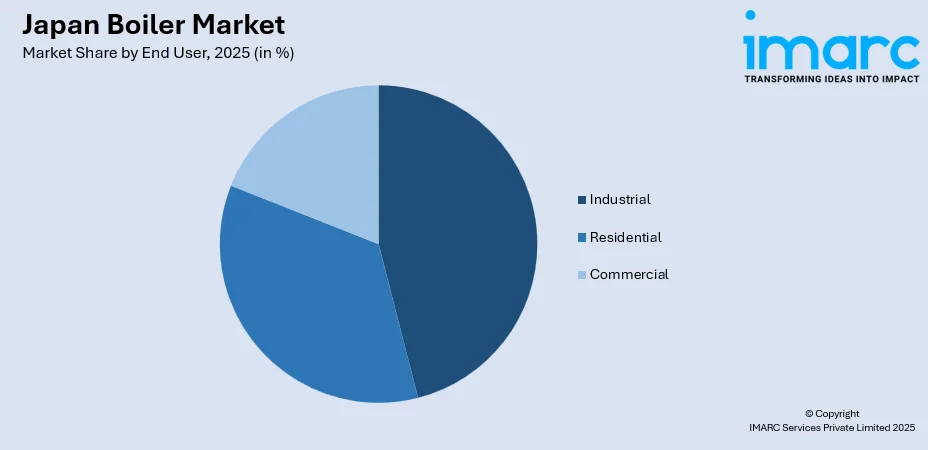

- By End User: Industrial leads the market with a share of 46% in 2025, driven by strong demand from chemical processing, food and beverage production, and metal fabrication industries requiring reliable steam and hot water for continuous manufacturing operations and process heating applications.

- By Region: Kanto Region comprises the largest region with 30% share in 2025, reflecting the concentration of Japan's industrial manufacturing facilities, commercial establishments, and population centers in Tokyo, Yokohama, and surrounding metropolitan areas.

- Key Players: Key players drive the Japan boiler market by expanding product portfolios, improving energy efficiency technologies, and strengthening nationwide distribution. Their investments in research and development, sustainability initiatives, and strategic partnerships boost market awareness, accelerate adoption, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The Japan boiler market is witnessing a transformative shift as industries and businesses prioritize decarbonization and operational efficiency. The government's Green Innovation Fund and the Hydrogen Society Promotion Act are catalyzing investments in next-generation boiler technologies, including hydrogen-fired and biomass-powered systems. Japanese manufacturers are increasingly adopting IoT-enabled smart boiler systems that enable predictive maintenance, real-time monitoring, and optimized fuel consumption. In July 2024, Nitto Denko Corporation completed Japan's first CO2 zero-emission factory at its Tohoku Plant in Miyagi Prefecture, featuring green hydrogen boilers that eliminate fossil fuel dependency for steam generation. This milestone demonstrates the industry's commitment to sustainable thermal energy solutions. The convergence of regulatory support, technological innovation, and corporate sustainability commitments is creating robust growth opportunities, with major industrial players investing in hybrid systems that combine traditional boiler technologies with renewable energy sources.

Japan Boiler Market Trends:

Integration of Renewable Energy Sources into Boiler Systems

The Japan boiler market is experiencing a significant trend toward integrating renewable energy sources, including hydrogen, biomass, and solar power, into boiler systems. As the country works toward its decarbonization goals, industries are increasingly adopting boilers powered by renewable fuels to reduce carbon emissions. Companies are developing hybrid systems that combine traditional boiler technologies with renewable energy sources to ensure consistent performance while advancing sustainability objectives, contributing to Japan boiler market growth.

Adoption of IoT-Enabled Smart Boiler Technologies

Smart boiler technologies featuring Internet of Things capabilities are gaining traction across Japan's industrial sector. These advanced systems enable predictive maintenance, real-time data analysis, automated combustion control, and performance optimization. The integration of digital monitoring systems reduces downtime, extends equipment lifespan, and minimizes operational costs. Japanese manufacturers are focusing on developing modular boiler systems with intelligent diagnostics to ensure regulatory compliance while delivering enhanced energy efficiency and operational safety.

Transition Toward Low-Emission Condensing Boiler Systems

Japanese industries are increasingly transitioning to condensing boilers and supercritical steam generators that offer superior thermal efficiency and reduced emissions. Government-mandated energy audits and efficiency assessments are encouraging companies to upgrade older boiler systems with modern alternatives that minimize fuel wastage and reduce nitrogen oxide and carbon emissions. This trend aligns with ISO 50001 energy management standards increasingly adopted by Japanese manufacturers seeking operational cost reductions and environmental compliance.

Market Outlook 2026-2034:

The Japan boiler market outlook remains positive, supported by increasing industrial modernization initiatives, government incentives for clean energy adoption, and growing demand for energy-efficient heating solutions. The market generated a revenue of USD 6.32 Billion in 2025 and is projected to reach a revenue of USD 11.36 Billion by 2034, growing at a compound annual growth rate of 6.74% from 2026-2034. The ongoing shift toward hydrogen-based boiler systems, integration of waste heat recovery technologies, and expansion of smart manufacturing practices will continue driving market expansion across industrial, commercial, and residential sectors throughout the forecast period.

Japan Boiler Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Boiler Type | Hot Water Boilers | 44% |

| End User | Industrial | 46% |

| Region | Kanto Region | 30% |

Boiler Type Insights:

- Hot Water Boilers

- Gas Boiler

- Steam Water Boilers

Hot water boilers dominate with a market share of 44% of the total Japan boiler market in 2025.

Hot water boilers represent the largest segment in Japan's boiler market, driven by their extensive application across industrial manufacturing, food processing, and pharmaceutical production facilities. These systems provide consistent hot water supply essential for cleaning, sanitation, and heating processes in factories, commercial buildings, and hospitals. The growing demand for condensing hot water boilers with enhanced thermal efficiency and lower fuel consumption is accelerating segment growth. Japanese manufacturers are increasingly adopting high-efficiency hot water boilers that meet stringent emission standards while delivering reliable performance.

The segment benefits from advancing technology integration, including digital controls and IoT-enabled monitoring systems that optimize water temperature regulation and reduce energy waste. Industrial facilities in Japan require hot water boilers capable of handling heavy loads and severe operating conditions while maintaining uninterrupted operation. The emphasis on energy conservation and sustainability is driving manufacturers to develop advanced hot water boiler systems with improved combustion efficiency. The food industry's requirement for consistent hot water in production processes continues strengthening demand across the country.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

Industrial leads with a share of 46% of the total Japan boiler market in 2025.

The industrial segment dominates Japan's boiler market, driven by sustained demand from chemical processing, food and beverage manufacturing, metal fabrication, and pharmaceutical production industries. These sectors require constant thermal energy for steam generation, process heating, and manufacturing operations, making reliable high-capacity boilers essential infrastructure. Japan's stringent environmental regulations and commitment to carbon neutrality are prompting industrial facilities to adopt cleaner, energy-efficient boiler systems. In May 2024, Daikin Industries and Miura Co., Ltd. announced a capital and business partnership to deliver integrated energy solutions for factories, combining air conditioning, steam boiler, and water treatment systems.

Industrial boiler demand is strengthening as manufacturers modernize aging equipment to meet current environmental standards and enhance operational performance. The chemical industry requires high-quality steam for manufacturing petrochemicals, industrial gases, and synthetic materials, while food processing facilities depend on boilers for fermentation, sterilization, and production processes. Japanese industries are increasingly investing in heat recovery systems and economizers that capture exhaust heat to improve thermal efficiency. Government incentives under Japan's Green Innovation Fund and decarbonization initiatives are reinforcing investments in next-generation industrial boiler systems.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region exhibits a clear dominance with a 30% share of the total Japan boiler market in 2025.

The Kanto Region leads Japan's boiler market, reflecting its position as the country's most highly developed, urbanized, and industrialized area. Tokyo and Yokohama form a single industrial complex with concentrated light and heavy industry along Tokyo Bay, serving as the nation's economic and manufacturing heartland. The region houses numerous manufacturing facilities, commercial establishments, research centers, and corporate headquarters requiring reliable thermal energy solutions for continuous operations.

Advanced robotics, IoT integration, and predictive maintenance technologies are being deployed across Kanto Region’s industrial facilities to enhance production efficiency and reduce operational costs. The concentration of chemical processing plants, food and beverage manufacturers, pharmaceutical production facilities, and electronics companies creates sustained demand for high-capacity boilers capable of delivering consistent steam and hot water supply. Commercial buildings, hospitals, educational institutions, and residential complexes throughout the metropolitan areas further contribute to regional boiler demand. The presence of leading boiler manufacturers and extensive service networks ensures rapid equipment maintenance and technical support, strengthening the region's dominance in Japan's thermal energy equipment market.

Market Dynamics:

Growth Drivers:

Why is the Japan Boiler Market Growing?

Government Decarbonization Initiatives and Policy Support

Japan's ambitious commitment to achieving carbon neutrality by 2050 is significantly driving boiler market growth through comprehensive policy frameworks and financial incentives. The government's Green Innovation Fund, Hydrogen Society Promotion Act, and Green Transformation Promotion Act are catalyzing investments in clean energy boiler technologies. In February 2025, Mitsubishi Corporation, Kirin Brewery, and partners announced the commencement of a green hydrogen demonstration project at Kirin's Brewery in Hokkaido, with construction scheduled to begin in April 2025. The initiative aims to replace 23% of steam boiler fuel with green hydrogen, reducing annual greenhouse gas emissions by 464 Tons. This project, featuring hydrogen-fired boilers developed by Miura Co., Ltd., demonstrates practical hydrogen integration in manufacturing processes and supports Japan's carbon neutrality targets through innovative industrial energy conversion.

Industrial Modernization and Infrastructure Investment

Japan's ongoing industrial modernization efforts are driving substantial demand for advanced boiler systems as manufacturers upgrade aging thermal infrastructure. The country's industrial sector, particularly manufacturing, chemicals, and food processing, requires continuous thermal energy, making boiler modernization essential for maintaining competitiveness and operational excellence. Industries across Japan are replacing outdated equipment with modern alternatives that deliver superior fuel efficiency, reduced emissions, and enhanced reliability. The emphasis on energy conservation and environmental responsibility is compelling facilities to adopt next-generation boilers featuring waste heat recovery, automated combustion control, and smart diagnostics to ensure regulatory compliance while optimizing operational efficiency. Manufacturers are prioritizing systems capable of dual-fuel operation, offering flexibility during global fuel price fluctuations and supply uncertainties. The integration of digital monitoring capabilities enables predictive maintenance scheduling, minimizes unplanned downtime, and extends equipment lifespan. Strategic investments in localized production capabilities and comprehensive service networks are strengthening technical support infrastructure, ensuring rapid response to maintenance requirements across Japan's diverse industrial regions.

Stringent Environmental Regulations and Emission Standards

Japan's rigorous environmental regulations are compelling industries to adopt cleaner, more efficient boiler systems that meet stringent emission standards. The Air Pollution Control Law and industry-specific regulations mandate compliance with strict limits on nitrogen oxide and carbon emissions, driving demand for low-emission boiler technologies. In April 2025, IHI Corporation announced that its ammonia co-firing demonstration at Hekinan Thermal Power Station received the 2024 Technology Award from The Combustion Society of Japan and the JSME Award from The Japan Society of Mechanical Engineers, recognizing successful demonstration of a 20% ammonia co-firing ratio in large-scale coal-fired boilers. Energy audits and government-mandated efficiency assessments are encouraging companies to replace older systems with modern alternatives featuring condensing technology and integrated pollution control systems.

Market Restraints:

What Challenges the Japan Boiler Market is Facing?

High Initial Investment and Installation Costs

The substantial upfront costs associated with advanced boiler systems, including hydrogen-ready and condensing technologies, present significant barriers for widespread adoption. Installation of new energy-efficient boilers requires considerable capital investment, specialized infrastructure modifications, and technical expertise. Small and medium-sized enterprises face particular challenges in financing boiler upgrades, limiting market penetration despite long-term operational savings.

Limited Hydrogen Infrastructure Development

Despite Japan's ambitious hydrogen strategy, the infrastructure supporting hydrogen-powered boiler systems remains underdeveloped. Limited hydrogen production capacity, storage facilities, and distribution networks create supply uncertainties that discourage industrial adoption. The current gap between green hydrogen supply and demand, combined with higher costs compared to conventional fuels, poses challenges for manufacturers seeking to transition to hydrogen-based thermal energy solutions.

Skilled Workforce Shortages and Technical Constraints

Japan's aging workforce and declining working-age population create difficulties in maintaining adequate technical expertise for boiler installation, operation, and maintenance. The shortage of qualified technicians impacts project timelines, equipment maintenance schedules, and operational efficiency. Advanced boiler technologies require specialized skills for optimal performance, and inadequate training can lead to suboptimal energy efficiency and increased safety risks.

Competitive Landscape:

The Japan boiler market is characterized by intense competition among domestic and international manufacturers focusing on technological innovation, energy efficiency, and sustainability. Leading companies are expanding product portfolios, investing in research and development, and forming strategic partnerships to strengthen market positioning. Manufacturers are emphasizing development of hydrogen-ready boilers, IoT-enabled smart systems, and condensing technologies to meet evolving customer demands. Strategic acquisitions and collaborations are enabling companies to combine expertise in thermal solutions, HVAC systems, and water treatment to deliver integrated factory energy management solutions. The competitive landscape continues evolving as players invest in localized production capabilities and nationwide service networks to ensure rapid response and comprehensive after-sales support across Japan's diverse industrial regions.

Japan Boiler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Boiler Types Covered | Hot Water Boilers, Gas Boiler, Steam Water Boilers |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan boiler market size was valued at USD 6.32 Billion in 2025.

The Japan boiler market is expected to grow at a compound annual growth rate of 6.74% from 2026-2034 to reach USD 11.36 Billion by 2034.

Hot water boilers dominated the market with a share of 44%, driven by extensive industrial applications in food processing, pharmaceutical manufacturing, and chemical production requiring consistent hot water supply.

Key factors driving the Japan boiler market include government decarbonization initiatives, industrial modernization efforts, stringent environmental regulations, growing adoption of hydrogen-based boiler systems, and increasing demand for energy-efficient heating solutions.

Major challenges include high initial investment costs for advanced boiler systems, limited hydrogen infrastructure development, skilled workforce shortages, supply chain constraints for specialized components, and competition from alternative heating technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)