Japan Brakes and Clutches Market Size, Share, Trends and Forecast by Technology, Product Type, Sales Channel, End Use Industry, and Region, 2026-2034

Japan Brakes and Clutches Market Summary:

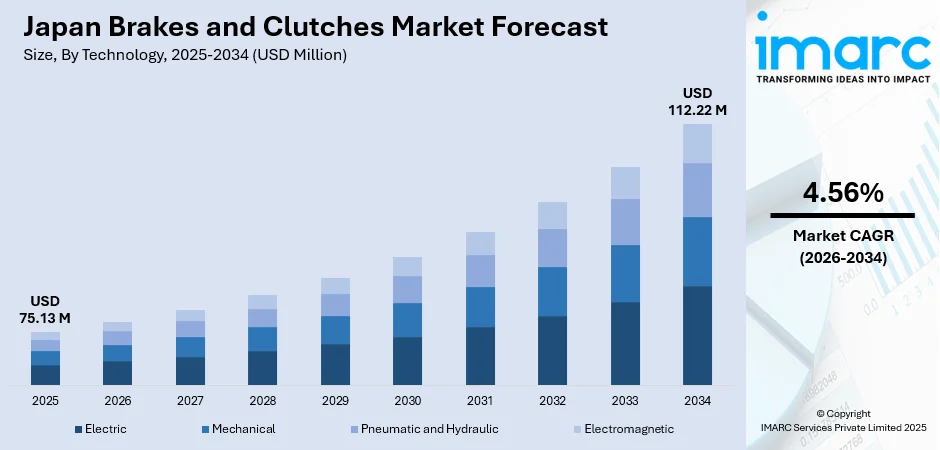

The Japan brakes and clutches market size was valued at USD 75.13 Million in 2025 and is projected to reach USD 112.22 Million by 2034, growing at a compound annual growth rate of 4.56% from 2026-2034.

The market is driven by rapid advancements in automotive technology, particularly the integration of sophisticated braking mechanisms in electric and hybrid vehicles. Rising demand for precision-engineered components across industrial applications, including mining, metallurgy, and construction sectors, further accelerates growth. Stringent safety regulations mandating reliable braking systems enhance adoption rates, while Japan's focus on technological innovation and manufacturing excellence continues to shape the Japan brakes and clutches market share.

Key Takeaways and Insights:

- By Technology: Pneumatic and hydraulic dominates the market with a share of 42% in 2025, driven by superior power transmission capabilities in heavy-duty industrial applications, widespread adoption in mining and metallurgy operations, and compatibility with Japan's advanced manufacturing infrastructure requiring precise motion control solutions.

- By Product Type: Dry leads the market with a share of 55% in 2025, owing to lower maintenance requirements, enhanced durability in high-temperature environments, cost-effectiveness in automotive and industrial machinery applications, and superior performance characteristics in Japan's diverse climatic conditions.

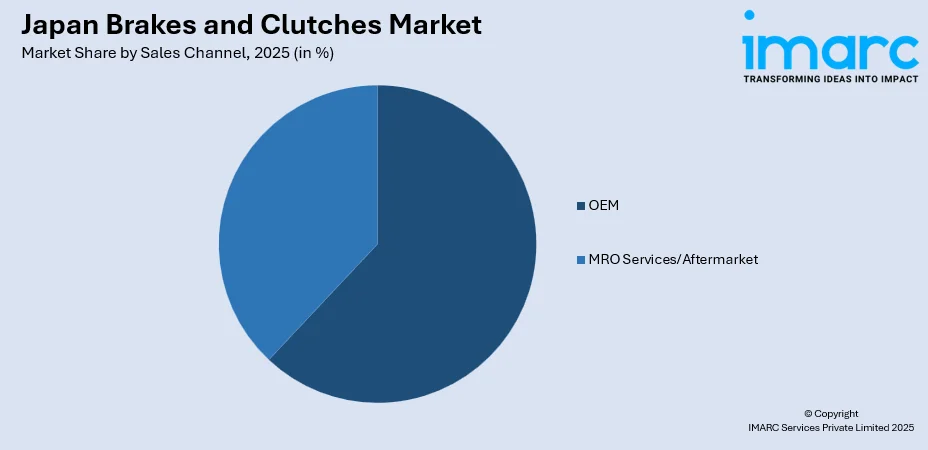

- By Sales Channel: OEM represents the largest segment with a market share of 62% in 2025, supported by strong partnerships between component manufacturers and leading automotive companies, integrated supply chain networks, and Japan's robust original equipment manufacturing ecosystem across vehicle production.

- By End Use Industry: Mining and metallurgy industry leads the market with a share of 28% in 2025, driven by extensive heavy machinery requirements in extraction operations, stringent safety compliance mandates, and continuous demand for high torque braking systems in material handling equipment.

- By Region: Kanto region dominates the market with a share of 32% in 2025, attributed to concentration of major automotive manufacturing facilities, presence of industrial headquarters in Tokyo metropolitan area, and well-established distribution networks supporting diverse end-use industries.

- Key Players: The market exhibits a consolidated competitive landscape, with established domestic manufacturers leveraging decades of engineering expertise alongside international suppliers. Leading participants focus on research and development investments, strategic collaborations with automotive original equipment manufacturers, and continuous product innovation to address evolving industrial requirements and maintain market positioning.

To get more information on this market Request Sample

The Japan brakes and clutches market is experiencing robust expansion driven by multiple interconnected factors. The nation's automotive industry continues to pioneer advanced braking technologies, including regenerative and electronic systems designed for next-generation vehicles. Industrial automation across manufacturing facilities demands precision-engineered clutches and brakes for machinery control and safety applications. Government regulations emphasizing workplace safety and vehicle performance standards compel industries to adopt high-quality braking components. Furthermore, Japan's position as a global leader in robotics and heavy machinery manufacturing creates sustained demand for specialized clutch and brake systems. As of July 2025, Japan’s automotive industry installed around 13,000 industrial robots in 2024, an 11% increase marking the highest level since 2020 (IFR). Moreover, the ongoing modernization of infrastructure projects and expansion of mining operations contribute additional growth momentum, while technological convergence between automotive and industrial applications opens new market opportunities.

Japan Brakes and Clutches Market Trends:

Integration of Smart Braking Technologies

Japanese manufacturers are increasingly incorporating intelligent braking systems featuring advanced sensor technologies and real-time monitoring capabilities. In 2025, ADVICS showcased a new cooperative regenerative braking system and electric disc brake at the Japan Mobility Show, advancing smart braking technologies for electrification and autonomous driving. Moreover, these smart braking solutions enable predictive maintenance, reducing unplanned downtime and extending component lifespan across industrial and automotive applications. The integration of artificial intelligence (AI) algorithms allows brakes and clutches to automatically adjust performance parameters based on operational conditions. This technological evolution represents a significant shift from traditional mechanical systems toward digitally enhanced components that communicate with broader vehicle and machinery control networks, enabling seamless integration with automated production environments and advanced driver assistance systems.

Advancement in Lightweight and High-Performance Materials

Material science innovations are transforming brake and clutch manufacturing in Japan, with manufacturers developing advanced composite materials and ceramic-based friction components. As per sources, in 2025, Yibin Jiyon showcased carbon ceramic brake discs at the Tokyo Automotive Parts Exhibition (IAAE), highlighting lightweight, high-performance braking technology for the automotive industry. Further, these next-generation materials offer superior heat dissipation, reduced weight, and enhanced durability compared to conventional alternatives. The automotive sector particularly benefits from lightweight braking components that contribute to improved fuel efficiency and vehicle performance. Industrial applications similarly advantage from materials capable of withstanding extreme operating conditions while maintaining consistent performance. Japanese research institutions and manufacturers collaborate extensively to develop proprietary material formulations that meet increasingly demanding specifications across diverse applications.

Expansion of Regenerative and Electromechanical Systems

The proliferation of electric and hybrid vehicles drives significant adoption of regenerative braking systems that recover kinetic energy during deceleration. Japanese automakers lead global development of sophisticated brake‑by‑wire technologies that eliminate traditional hydraulic components in favor of electromechanical actuation. As per sources, the Japan X‑by‑Wire systems market reached USD 1.3 Billion in 2025, reflecting strong industry adoption and investment in these advanced braking solutions, and is expected to expand further in the coming decade. Furthermore, these systems offer enhanced response times, reduced maintenance requirements, and seamless integration with vehicle energy management platforms. The technology extends beyond automotive applications into industrial machinery where energy recovery and precise motion control deliver operational efficiencies. Manufacturers continue investing in research to improve regenerative system efficiency and expand applications across commercial vehicles and heavy equipment.

Market Outlook 2026-2034:

The Japan brakes and clutches market is positioned for sustained revenue growth throughout the forecast period, supported by ongoing technological advancements and expanding industrial applications. Revenue generation will be driven by increasing adoption of advanced braking systems in electric vehicles, continued infrastructure development projects, and rising demand from the mining and metallurgy sectors. The market is expected to benefit from Japan's commitment to carbon neutrality initiatives, which encourage investment in energy-efficient braking technologies. Strategic partnerships between domestic manufacturers and international technology providers will further enhance market revenue potential. The market generated a revenue of USD 75.13 Million in 2025 and is projected to reach a revenue of USD 112.22 Million by 2034, growing at a compound annual growth rate of 4.56% from 2026-2034.

Japan Brakes and Clutches Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Technology | Pneumatic and Hydraulic | 42% |

| Product Type | Dry | 55% |

| Sales Channel | OEM | 62% |

| End Use Industry | Mining and Metallurgy Industry | 28% |

| Region | Kanto Region | 32% |

Technology Insights:

- Electric

- Mechanical

- Pneumatic and Hydraulic

- Electromagnetic

Pneumatic and hydraulic dominates with a market share of 42% of the total Japan brakes and clutches market in 2025.

Pneumatic and hydraulic braking technologies dominate the Japan market owing to their exceptional power transmission capabilities and reliability in demanding industrial environments. These systems deliver precise control essential for heavy machinery operations in mining, metallurgy, and construction sectors where safety and performance are paramount. The technology's ability to generate substantial braking force makes it indispensable for applications involving large loads and high-speed operations requiring immediate stopping power.

Japanese manufacturers have refined pneumatic and hydraulic brake designs over decades, achieving superior efficiency and durability compared to alternative technologies. As per sources, Akebono holds approximately 70% domestic market share for forklift drum brakes and over 50% share for rough terrain crane disc brakes in Japan. Moreover, the widespread availability of compressed air systems in industrial facilities favors pneumatic adoption, while hydraulic solutions offer advantages in applications requiring modulated braking responses. Both technologies benefit from established maintenance infrastructure and readily available replacement components, ensuring operational continuity across diverse industrial applications throughout Japan's manufacturing landscape.

Product Type Insights:

- Dry

- Oil Immersed

Dry leads with a share of 55% of the total Japan brakes and clutches market in 2025.

Dry maintain market leadership through their operational simplicity, lower maintenance requirements, and cost-effective performance across numerous applications. These components function without oil immersion, eliminating concerns related to fluid contamination and leakage while reducing operational complexity. The dry segment particularly excels in applications where clean operation is essential, including food processing equipment and cleanroom manufacturing environments prevalent in Japan's semiconductor industry.

The automotive sector represents a primary consumer of dry brake and clutch technologies, with manufacturers preferring these systems for their consistent performance across varying temperature conditions. Industrial machinery applications similarly benefit from dry component characteristics, including rapid engagement and disengagement capabilities essential for precision manufacturing operations. Japanese engineering expertise has enabled continuous improvement in dry friction materials, extending service intervals and enhancing overall system reliability for end users across multiple industry verticals. As per sources, Japan’s dry clutches market is projected to grow at a 1.6% CAGR, reflecting steady adoption in automotive and industrial applications.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- MRO Services/Aftermarket

OEM exhibits a clear dominance with a 62% share of the total Japan brakes and clutches market in 2025.

OEM dominate distribution owing to Japan's integrated automotive and industrial machinery supply chains. Close collaboration between brake and clutch manufacturers and vehicle producers ensures component specifications precisely match application requirements, optimizing system performance and reliability. OEM relationships facilitate just-in-time delivery systems that minimize inventory costs while ensuring production continuity for major manufacturers throughout Japan's industrial heartland.

The OEM channel benefits from long-term contractual relationships that provide revenue stability for component suppliers while enabling continuous product development aligned with evolving customer requirements. Quality assurance processes integrated within OEM supply chains ensure consistent component performance meeting stringent Japanese manufacturing standards. These established relationships also facilitate technology transfer and collaborative innovation efforts that advance brake and clutch capabilities across automotive, construction equipment, and industrial machinery segments. As of October 2025, Honda launched the CL250 E‑Clutch in Japan, featuring automated clutch operations with manual override, improved meter visibility, and enhanced rider comfort for motorcycles.

End Use Industry Insights:

- Mining and Metallurgy Industry

- Construction Industry

- Power Generation Industry

- Industrial Production

- Commercial

- Logistics and Material Handling Industry

The mining and metallurgy industry leads with a share of 28% of the total Japan brakes and clutches market in 2025.

Mining and metallurgy industry represent the largest end-use category for industrial brakes and clutches in Japan, driven by extensive heavy equipment requirements in extraction and processing facilities. These industries demand robust braking systems capable of controlling massive machinery under extreme operational conditions, including high temperatures, heavy loads, and continuous duty cycles. Safety regulations governing mining operations mandate reliable braking performance, driving investment in high-quality components from established manufacturers.

The sector's material handling requirements create substantial demand for specialized clutches and brakes designed for steel mills, foundries, and processing plants. Equipment including cranes, hoists, conveyors, and rolling mills depends on precision braking for operational safety and efficiency. Japanese manufacturers have developed application-specific solutions addressing unique challenges within mining and metallurgy environments, including resistance to dust, moisture, and thermal stress that characterize these demanding industrial settings. As per sources, in 2024, Ogura Clutch began using SUPWAT’s “WALL” AI platform to optimize its brake life prediction system, enhancing research efficiency and reliability in industrial brake and clutch development.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region dominates with a market share of 32% of the total Japan brakes and clutches market in 2025.

The Kanto region, encompassing Tokyo and surrounding prefectures, leads market consumption owing to its concentration of automotive manufacturing facilities, industrial headquarters, and distribution infrastructure. This economically dominant region hosts numerous vehicle production plants and component suppliers that collectively generate substantial brake and clutch demand. The presence of major corporate decision-makers in Kanto influences procurement patterns across national supply chains, reinforcing regional market leadership.

The regions advanced manufacturing ecosystem supports continuous innovation in brake and clutch technologies, with research facilities and technical universities contributing expertise to product development efforts. The region's transportation infrastructure enables efficient distribution throughout Japan, while proximity to international shipping ports facilitates export activities for domestic manufacturers. Industrial diversification within Kanto, spanning automotive, electronics, and heavy machinery sectors, creates varied demand patterns that support market resilience across economic cycles.

Market Dynamics:

Growth Drivers:

Why is the Japan Brakes and Clutches Market Growing?

Expansion of Electric and Hybrid Vehicle Production

Japan's automotive industry continues leading global development of electric and hybrid vehicles, creating substantial demand for specialized braking components designed for electrified powertrains. As per sources, Toyota announced plans to develop 15 electric vehicle models and achieve an annual production of one million EVs by 2027, highlighting the scale of Japan’s EV expansion. Moreover, regenerative braking systems essential for energy recovery in these vehicles require sophisticated engineering that Japanese manufacturers excel at providing. The transition toward sustainable transportation accelerates investment in advanced braking technologies that complement electric drivetrain characteristics, including smooth deceleration modulation and seamless integration with motor-generator systems. Government incentives supporting electric vehicle adoption further stimulate market growth by encouraging automotive manufacturers to expand production volumes. This technological shift represents a fundamental transformation in braking system requirements, driving innovation and creating new market segments for forward-thinking component suppliers.

Industrial Automation and Smart Manufacturing Adoption

The acceleration of industrial automation across Japanese manufacturing facilities drives increasing demand for precision brakes and clutches integrated with advanced control systems. Smart factory initiatives require braking components capable of communicating operational status and performance parameters to centralized management platforms. This connectivity enables predictive maintenance approaches that minimize production disruptions while optimizing component utilization. Robotics applications particularly demand reliable clutch and brake mechanisms for motion control in repetitive manufacturing tasks. The ongoing digitalization of industrial processes creates opportunities for manufacturers offering intelligent braking solutions compatible with Industry connectivity standards. Japanese manufacturers benefit from proximity to automation technology developers, facilitating collaborative product development efforts that address evolving industrial requirements.

Infrastructure Development and Mining Sector Investments

Ongoing infrastructure projects throughout Japan sustain demand for construction equipment equipped with heavy-duty braking systems. Government investment in transportation networks, urban development, and disaster resilience improvements requires extensive utilization of machinery dependent on reliable brake and clutch components. As per sources, in November 2025, Hitachi Construction Machinery launched the “LANDCROS Innovation Studios Mining Challenge,” inviting global startups to develop innovative solutions for smarter, sustainable mining equipment and operations. Further, the mining sector similarly contributes growth momentum through continuous operational requirements for extraction equipment, material handling systems, and processing machinery. Japan's pursuit of rare earth mineral resources for electronics and battery manufacturing drives mining technology investments that include advanced braking systems. These infrastructure and mining activities create stable demand foundations that complement automotive sector requirements, providing market diversification that supports sustained growth across economic cycles and varying industry conditions.

Market Restraints:

What Challenges the Japan Brakes and Clutches Market is Facing?

High Development and Manufacturing Costs

Advanced braking technologies require substantial research and development investments that increase overall product costs, potentially limiting adoption among price-sensitive customers. The sophisticated materials and precision manufacturing processes essential for high-performance components contribute to elevated pricing that may constrain market penetration in certain application segments. Smaller manufacturers face challenges competing with established players possessing economies of scale advantages.

Competition from Alternative Braking Technologies

Emerging braking technologies, including electromagnetic and electromechanical systems, present competitive challenges to traditional pneumatic and hydraulic solutions in certain applications. These alternatives offer advantages in specific operating environments that may attract customers seeking enhanced efficiency or reduced maintenance requirements. Market participants must continuously invest in product development to maintain competitive positioning against evolving technological alternatives.

Skilled Labor Shortages in Manufacturing

Japan's aging workforce and declining birth rates create challenges in maintaining skilled labor availability for precision manufacturing operations. Brake and clutch production requires specialized technical expertise that becomes increasingly difficult to source as experienced workers retire. This demographic pressure may constrain production capacity expansion and affect quality consistency, particularly among smaller manufacturers lacking resources for extensive training programs.

Competitive Landscape:

The Japan brakes and clutches market features a moderately consolidated competitive structure characterized by established domestic manufacturers maintaining significant market presence alongside international suppliers serving specialized applications. Leading participants differentiate through technological innovation, manufacturing quality, and comprehensive service networks that support customer operations. Strategic partnerships between component manufacturers and original equipment producers shape competitive dynamics, with long-term relationships providing stability while potentially limiting new entrant opportunities. Research and development investments represent primary competitive differentiators, as manufacturers pursue advanced materials, smart technologies, and application-specific solutions addressing evolving customer requirements. Distribution network coverage and after-sales service capabilities similarly influence competitive positioning, particularly in industrial applications where operational continuity depends on reliable component supply.

Recent Developments:

- In November 2024, NIDEK Mobility, a group company of NIDEK Co., Ltd., has developed the world's first electric clutch ECU for motorcycles. The system allows automatic clutch control, enabling riders to switch between manual and automatic modes, reducing gear-change effort and enhancing riding safety and convenience.

Japan Brakes and Clutches Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Electric, Mechanical, Pneumatic and Hydraulic, Electromagnetic |

| Product Types Covered | Dry, Oil Immersed |

| Sales Channels Covered | OEM, MRO Services/Aftermarket |

| End Use Industries Covered | Mining and Metallurgy Industry, Construction Industry, Power Generation Industry, Industrial Production, Commercial, Logistics and Material Handling Industry |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan brakes and clutches market size was valued at USD 75.13 Million in 2025.

The Japan brakes and clutches market is expected to grow at a compound annual growth rate of 4.56% from 2026-2034 to reach USD 112.22 Million by 2034.

Pneumatic and hydraulic held the largest share, driven by their widespread adoption in industrial machinery, automotive applications, and heavy equipment, offering reliability, precise control, and compatibility with advanced manufacturing systems.

Key factors driving the Japan brakes and clutches market include expansion of electric and hybrid vehicle production, industrial automation adoption, infrastructure development investments, stringent safety regulations, and continuous technological innovation in braking systems.

Major challenges include high development and manufacturing costs for advanced technologies, competition from alternative braking systems, skilled labor shortages due to demographic pressures, raw material price volatility, and integration complexities with emerging vehicle architectures.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)