Japan Building Facade Market Size, Share, Trends and Forecast by Material Type, Product Type, Application, End User, and Region, 2026-2034

Japan Building Facade Market Summary:

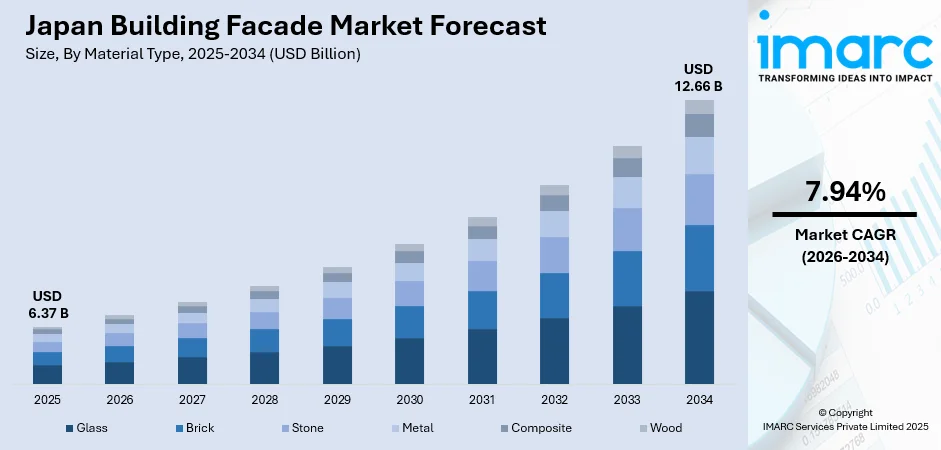

The Japan building facade market size was valued at USD 6.37 Billion in 2025 and is projected to reach USD 12.66 Billion by 2034, growing at a compound annual growth rate of 7.94% from 2026-2034.

The market is propelled by Japan's ambitious carbon neutrality goals, which are accelerating the adoption of energy-efficient facade solutions across commercial and residential sectors. Stringent environmental regulations and government incentive programs are encouraging developers to invest in sustainable exterior systems that optimize thermal performance and natural lighting. The emphasis on earthquake-resistant construction methodologies and the rising trend of customizable architectural aesthetics are further contributing to the expansion of the market share.

Key Takeaways and Insights:

-

By Material Type: Glass dominates the market with a share of 30% in 2025, driven by the growing demand for high-performance glazing solutions that offer superior thermal insulation, solar control, and aesthetic appeal for modern commercial and residential structures.

-

By Product Type: Cladding systems lead the market with a share of 25% in 2025, reflecting their versatility in meeting diverse architectural requirements, ease of installation, and compatibility with various building designs across Japan's construction landscape.

-

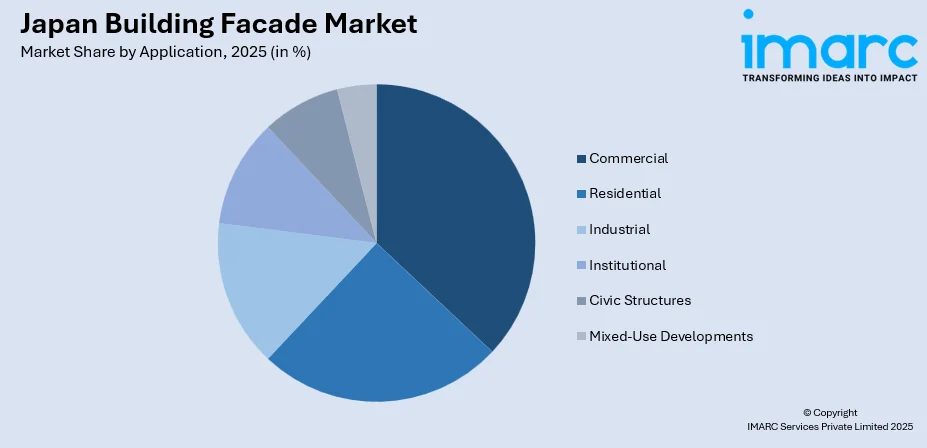

By Application: Commercial comprises the largest segment with a market share of 30% in 2025, underpinned by extensive urban redevelopment projects in metropolitan areas and the continued expansion of office complexes, retail centers, and mixed-use developments.

-

By End User: Construction companies exhibit a clear dominance with a 30% share in 2025, attributable to their integral role in executing large-scale building projects and their increasing focus on incorporating advanced facade technologies.

-

By Region: Kanto Region represents the largest region with a 35% share in 2025, driven by the concentration of mega-construction projects in Tokyo and surrounding prefectures, coupled with significant investments in urban infrastructure modernization.

-

Key Players: Key players are driving the market expansion in Japan by investing in research and development (R&D) activities for innovative materials, expanding sustainable product portfolios, and strengthening partnerships with architects and construction firms. Their focus on earthquake-resistant technologies and energy-efficient solutions ensures market leadership and addresses evolving regulatory requirements.

To get more information on this market Request Sample

The Japan building facade market shows a positive outlook driven by rising urban redevelopment, stringent energy-efficiency standards, and growing demand for high-performance exterior materials. As cities modernize aging infrastructure, developers increasingly adopt advanced façade systems that enhance insulation, durability, and seismic resilience. Sustainability goals are encouraging the use of eco-friendly cladding, solar-integrated façades, and smart materials that improve building efficiency while reducing lifecycle costs. Japan’s commercial construction sector continues to expand, supported by investments in offices, mixed-use developments, and hospitality projects, which prioritize modern architectural aesthetics. In July 2025, Royal Minor Hotels Ltd. (Royal Minor) announced the inaugural management contract signing of an Anantara project in Japan, in partnership with List Development Co., Ltd. (LD), to create Anantara Karuizawa Retreat. Set to debut in 2030, the newly constructed Anantara property will offer 51 accommodations, including suites and branded residences, on a tranquil 10-acre wooded site overlooking Mount Asama in Karuizawa, Nagano Prefecture, Japan.

Japan Building Facade Market Trends:

Growing Emphasis on Sustainable and Energy-Efficient Facade Systems

Japan's commitment to achieving carbon neutrality by 2050 is significantly influencing facade material selection and design preferences across the construction sector. Developers and architects are increasingly adopting high-performance glass, photovoltaic-integrated panels, and thermally insulated cladding systems to minimize energy consumption. In April 2024, Obayashi Corporation began deploying battery-powered backhoes at construction sites across Japan, targeting a 46.2% reduction in carbon dioxide emissions by 2030, compared to 2019 baseline levels. This initiative demonstrated the construction industry's broader commitment to sustainable practices extending throughout building envelope installation activities.

Rising Demand for Earthquake-Resistant Facade Solutions

Given Japan's location in a seismically active zone, the market is witnessing heightened demand for facade systems engineered to withstand seismic events while maintaining structural integrity. Advanced technologies, including seismic isolation mechanisms, vibration-control dampers, and flexible cladding attachments, are being integrated into building exteriors. The Mori JP Tower, Japan's tallest skyscraper completed in 2023 at 325.2 meters, incorporates high-strength concrete-filled steel tubes and specialized dampers designed to remain operational during earthquakes. The modern skyscraper features a glazed facade and a design intended to reflect the shape and symmetry of a lotus blossom. This trend reflects the market's prioritization of safety-focused facade engineering.

Adoption of Smart and Customizable Facade Designs

The preference for visually distinctive and technologically advanced facade designs is reshaping market dynamics, particularly in commercial and mixed-use developments. Parametric design software and three-dimensional printing technologies are enabling architects to create complex, customized patterns previously unachievable through conventional methods. Internet of Things (IoT)-enabled smart facades featuring real-time energy monitoring sensors are gaining traction, aligning with Japan's smart city initiatives. As per IMARC Group, the Japan IoT market size reached USD 60,477.6 Million in 2024. Retail and commercial environments increasingly leverage unique facade designs as marketing tools to attract consumers and enhance brand identity.

Market Outlook 2026-2034:

The Japan building facade market is positioned for robust expansion, as construction activities accelerate across the commercial, residential, and institutional sectors. Government policies promoting green building standards and seismic retrofitting are expected to sustain demand for advanced facade solutions. The market generated a revenue of USD 6.37 Billion in 2025 and is projected to reach a revenue of USD 12.66 Billion by 2034, growing at a compound annual growth rate of 7.94% from 2026-2034. Urban redevelopment initiatives in Tokyo, Osaka, and Nagoya, combined with preparations for major infrastructure projects, will continue to drive investments in innovative facade technologies that balance aesthetic requirements with functional performance.

Japan Building Facade Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Material Type |

Glass |

30% |

|

Product Type |

Cladding Systems |

25% |

|

Application |

Commercial |

30% |

|

End User |

Construction Companies |

30% |

|

Region |

Kanto Region |

35% |

Material Type Insights:

- Glass

- Brick

- Stone

- Metal

- Composite

- Wood

Glass dominates with a market share of 30% of the total Japan building facade market in 2025.

Glass facades have become integral to modern Japanese architecture, offering unparalleled versatility in balancing natural light transmission with thermal efficiency. High-performance glazing solutions, including low-emissivity and solar-control variants, are increasingly specified for commercial towers and institutional buildings seeking to meet stringent energy codes.

The preference for glass facades extends beyond functional considerations to encompass aesthetic aspirations for transparency and visual connectivity between interior and exterior environments. Double-glazed and triple-glazed configurations provide superior thermal insulation essential for Japan's varied climate zones, reducing operational costs throughout building lifecycles. The segment's growth is further supported by developments in smart glazing technologies that automatically adjust light transmission based on environmental conditions. The expansion of retail channels is further reinforcing the dominance of the segment in the market.

Product Type Insights:

- Prefabricated Facades

- Modular Facades

- Cladding Systems

- Unitized Systems

- Rain Screen Systems

- Custom Designs

Cladding systems lead with a share of 25% of the total Japan building facade market in 2025.

Cladding systems offer exceptional flexibility in material selection and installation methodologies, making them suitable for diverse architectural applications ranging from residential developments to large-scale commercial complexes. These systems provide effective weather protection, thermal insulation, and aesthetic customization while accommodating Japan's stringent seismic requirements through engineered attachment mechanisms.

The adoption of cladding systems continues to expand, as construction firms seek solutions that reduce on-site labor requirements while maintaining quality standards. Factory-finished cladding panels ensure consistent performance and appearance, addressing challenges posed by Japan's construction workforce shortages. The segment benefits from innovations in lightweight composite materials that simplify installation procedures while enhancing structural performance under seismic stress conditions. The growing emphasis on energy-efficient buildings further boosts the use of insulated cladding, while architects increasingly favor modern façade aesthetics that support customization.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

- Institutional

- Civic Structures

- Mixed-Use Developments

Commercial represents the leading segment with a 30% share of the total Japan building facade market in 2025.

Commercial construction drives significant facade demand through continuous development of office towers, retail centers, shopping complexes, and hospitality facilities across Japan's metropolitan regions. As per IMARC Group, the Japan commercial construction market size reached USD 224.3 Billion in 2025.

Urban redevelopment projects exemplify the sector's investment in distinctive exterior solutions that enhance brand identity and attract tenants. The commercial segment's specifications typically prioritize high-performance materials capable of meeting energy efficiency standards while delivering visual impact. The expansion of logistics facilities and data centers, responding to e-commerce growth and digital transformation trends, contributes additional demand for industrial-grade facade systems. Mixed-use developments combining commercial, residential, and recreational functions require versatile facade solutions that address varying performance requirements within unified architectural compositions.

End User Insights:

- Architects and Designers

- Construction Companies

- Real Estate Developers

- Building Owners and Managers

- Government and Regulatory Bodies

- Consultants and Engineers

Construction companies exhibit a clear dominance with a 30% share of the total Japan building facade market in 2025.

Major construction firms act as the primary purchasers, integrators, and installers of façade systems across Japan’s commercial, institutional, and residential development landscape. These companies operate highly specialized divisions dedicated to exterior envelope engineering, enabling precise compliance with stringent seismic safety standards, evolving energy-efficiency regulations, and fire-resistance requirements. Their experience with large-scale urban redevelopment projects places them at the center of façade procurement decisions.

In Japan, construction companies are increasingly collaborating with façade manufacturers, engineering consultants, and material suppliers to co-develop integrated solutions tailored to the technical and aesthetic demands of modern buildings. Their expertise in harmonizing façade installation with structural systems and insulation layers ensures long-term durability and performance. As Japan is shifting towards design-build and engineering, procurement, and construction (EPC) delivery models, construction firms gain greater influence over product specification and system design.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region comprises the largest region with a 35% share of the total Japan building facade market in 2025.

The Kanto Region, anchored by Tokyo metropolitan area, commands market leadership through concentrated construction activity spanning commercial high-rises, residential towers, and infrastructure developments. In Q3 2024, construction commenced on a mixed-use complex in Tokyo featuring four towers and 1,100,000 square meters of floor space, representing one of Japan's largest building projects. The region's early adoption of building information modeling (BMI) technologies and net-zero building codes positions it as a national trendsetter for facade innovation, attracting significant investments in advanced exterior systems.

Government expenditures supporting seismic retrofitting of expressways and municipal buildings further extend facade market opportunities within Kanto. The concentration of Japan's financial, commercial, and governmental functions ensures continued demand for premium facade solutions meeting international standards. Real estate development patterns favor vertical expansion and space-efficient designs that rely heavily on glass and cladding systems to maximize natural light penetration while optimizing floor area utilization.

Market Dynamics:

Growth Drivers:

Why is the Japan Building Facade Market Growing?

Government Initiatives Supporting Carbon Neutrality and Sustainable Construction

Japan's national commitment to achieving carbon neutrality by 2050 has catalyzed significant investments in energy-efficient building technologies, including advanced facade systems. The Green Building Program administered by government agencies provides subsidies and tax benefits for developments incorporating sustainable exterior solutions, such as high-performance glazing and photovoltaic-integrated cladding. The Ministry of Economy, Trade and Industry has actively promoted collaborations between Japanese and foreign companies in the construction and facade sectors. These policy frameworks create favorable conditions for facade manufacturers introducing environmentally responsible products, stimulating market growth through regulatory compliance requirements and financial incentives. Additionally, continuous updates to green building standards encourage faster adoption of next-generation facade materials. The growing public demand for low-carbon infrastructure further reinforces the market’s long-term expansion.

Accelerating Urban Redevelopment and Infrastructure Investment

Major metropolitan areas, including Tokyo, Osaka, and Nagoya, are experiencing unprecedented construction activities driven by urban renewal initiatives and infrastructure modernization programs. In fiscal year 2023, Japan's public construction investment reached 25.3 Trillion Yen, marking notable growth and supporting expansion across building sectors. Redevelopment initiatives in dense metropolitan areas require high-performance facade systems that improve seismic resilience, thermal efficiency, and long-term durability. Government-backed infrastructure programs, including transit hub renovations, smart-city projects, and mixed-use district revitalization, fuel demand for innovative exterior solutions that balance design flexibility with construction efficiency. As older buildings undergo reconstruction or façade retrofitting, developers increasingly prioritize materials that reduce maintenance costs, support environmental targets, and enhance visual appeal. This surge in redevelopment activities creates consistent demand for advanced curtain walls, ventilated facades, and modular cladding systems, strengthening market growth across both commercial and residential segments.

Technological Advancements in Facade Materials and Systems

Continuous innovations in facade technologies are expanding application possibilities and driving market adoption across building categories. Smart facade systems, incorporating IoT sensors for real-time energy monitoring, electrochromic glass enabling automatic light adjustment, and building-integrated photovoltaics, generating on-site renewable energy represent technological advancements attracting developer interest. Parametric design software and advanced manufacturing techniques, including three-dimensional printing, are enabling customized facade configurations previously unachievable through conventional methods. These technological developments enhance facade functionality while creating differentiation opportunities for manufacturers investing in R&D capabilities. Additionally, rapid prototyping tools are shortening product development cycles, allowing faster adaptation to project-specific demands. The growing digital twin adoption is improving predictive maintenance and lifecycle optimization. Overall, these capabilities are elevating performance expectations across the Japan building facade market.

Market Restraints:

What Challenges the Japan Building Facade Market is Facing?

Persistent Labor Shortages in Construction Industry

Japan's construction sector is facing chronic workforce constraints, as aging demographics reduce available skilled labor for facade installation and related activities. This shortage extends project timelines and increases labor costs, potentially limiting facade adoption rates despite strong underlying demand. Construction companies are responding through increased automation and prefabrication strategies, though implementation requires significant capital investment.

Rising Material Costs and Supply Chain Volatility

Global supply chain disruptions and commodity price fluctuations have elevated costs for aluminum, glass, and other essential facade materials. These increases squeeze project margins, particularly for developments operating under fixed-bid contracts established before price escalations occurred. Smaller facade contractors with limited financial resources struggle to absorb cost volatility, accelerating industry consolidation.

Complexity of Regulatory Compliance Across Prefectures

Varying building codes and energy efficiency standards across Japan's prefectures create compliance challenges for facade manufacturers and installers operating nationwide. Projects must navigate differing requirements for seismic performance, fire resistance, and thermal efficiency, potentially increasing design costs and certification timelines. This regulatory fragmentation complicates product standardization efforts and market entry strategies.

Competitive Landscape:

The Japan building facade market exhibits moderate fragmentation, with established domestic manufacturers competing alongside international suppliers for project specifications. Major Japanese glass producers, construction material companies, and specialized facade fabricators maintain strong market positions through technical expertise and established relationships with architects and contractors. Competition increasingly centers on sustainability credentials, with companies differentiating through low-carbon product offerings and circular economy initiatives. Strategic partnerships between Japanese firms and foreign technology providers are expanding, facilitating knowledge transfer and access to advanced facade solutions developed for global markets.

Recent Developments:

-

In January 2025, Sumitomo Group unveiled the completed facade of the Sumitomo Pavilion at a press preview in Japan. Steered by the principle of ‘valuing each life, one tree at a time’ and making certain that no wood was wasted, the pavilion was built from about 1,000 trees sourced from the ‘Sumitomo Forest,’ which belongs to Sumitomo Group. The pavilion's roof was made from Japanese cypress, reflecting the group's commitment to environmental responsibility and zero-waste construction principles.

Japan Building Facade Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Glass, Brick, Stone, Metal, Composite, Wood |

| Product Types Covered | Prefabricated Facades, Modular Facades, Cladding Systems, Unitized Systems, Rain Screen Systems, Custom Designs |

| Applications Covered | Residential, Commercial, Industrial, Institutional, Civic Structures, Mixed-Use Developments |

| End Users Covered | Architects and Designers, Construction Companies, Real Estate Developers, Building Owners and Managers, Government and Regulatory Bodies, Consultants and Engineers |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan building facade market size was valued at USD 6.37 Billion in 2025.

The Japan building facade market is expected to grow at a compound annual growth rate of 7.94% from 2026-2034 to reach USD 12.66 Billion by 2034.

Glass dominated the market with a share of 30%, driven by its versatility in providing thermal efficiency, natural light optimization, and aesthetic appeal for modern commercial and residential construction projects.

Key factors driving the Japan building facade market include government initiatives supporting carbon neutrality, accelerating urban redevelopment projects, rising demand for earthquake-resistant solutions, technological advancements in smart facade systems, and increasing focus on sustainable construction practices.

Major challenges include persistent labor shortages in the construction industry, rising material costs and supply chain volatility, regulatory complexity across prefectures, seismic compliance requirements, aging building stock requiring retrofitting, and the need for specialized installation expertise for advanced facade technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)