Japan Burglar Alarm Market Size, Share, Trends and Forecast by Component, Application, and Region, 2026-2034

Japan Burglar Alarm Market Summary:

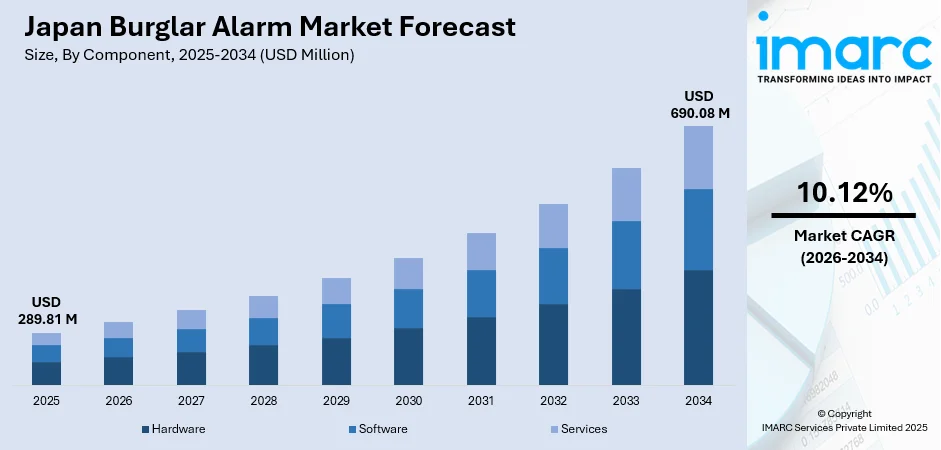

The Japan burglar alarm market size was valued at USD 289.81 Million in 2025 and is projected to reach USD 690.08 Million by 2034, growing at a compound annual growth rate of 10.12% from 2026-2034.

The Japan burglar alarm market is experiencing robust growth, driven by the nation's demographic shifts including an expanding elderly population requiring enhanced safety solutions and rising dual-income households leaving properties unattended. Rapid urbanization, increasing security awareness, and technological advancements in smart home integration are further propelling demand. Government initiatives promoting smart city development and the integration of artificial intelligence with traditional security systems continue to strengthen the Japan burglar alarm market share.

Key Takeaways and Insights:

-

By Component: Hardware dominates the market with a share of 63% in 2025, driven by strong demand for sensors, central monitoring receivers, and motion detection devices essential for comprehensive security coverage.

-

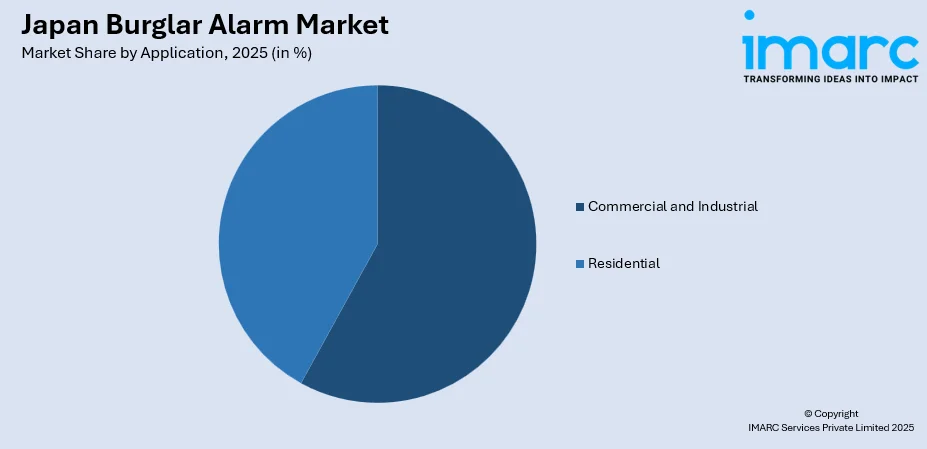

By Application: Commercial and industrial leads the market with a share of 58% in 2025, owing to heightened security requirements across office buildings, retail establishments, manufacturing facilities, and critical infrastructure.

-

By Region: Kanto Region represents the largest segment with a market share of 35% in 2025, attributed to Tokyo's concentration of commercial establishments, corporate headquarters, and high-density residential developments.

-

Key Players: The Japan burglar alarm market exhibits moderate to high competitive intensity, characterized by the presence of established domestic security providers and international technology companies. Leading players are focusing on AI integration, cloud-based monitoring, and IoT-enabled solutions to differentiate their offerings and capture market share.

To get more information on this market Request Sample

The market is witnessing a significant transformation driven by technological convergence, where traditional alarm systems are increasingly integrating with smart home ecosystems and cloud-based platforms. Japan's aging society creates substantial demand for security solutions that provide both intrusion detection and emergency assistance features. Rising crime rates have heightened consumer awareness and willingness to invest in burglar alarm systems for property protection. In August 2024, SwitchBot announced the launch of its Outdoor Security Camera 2K featuring AI-Powered Motion Detection and 106dB alarm, exemplifying the market's shift toward intelligent, interconnected security solutions. The commercial sector's increasing adoption of multi-zone detection systems with advanced analytics for asset protection continues to drive market expansion across Japan's major economic centers.

Japan Burglar Alarm Market Trends:

Integration of Artificial Intelligence and Machine Learning

The adoption of artificial intelligence and machine learning technologies is transforming burglar alarm systems across Japan. Modern security solutions now incorporate AI-driven threat detection capabilities that analyze behavioral patterns and distinguish between genuine intrusions and false alarms. SECOM, Japan's leading security provider, announced the development of the SECOM DRONE XX in October 2023, utilizing AI for patrol and intrusion monitoring, representing Japan's first AI-powered security drone. These intelligent systems reduce false alarm rates while enabling predictive security measures that anticipate potential threats.

Cloud-Based Monitoring and Remote Access Solutions

Cloud-based security platforms are gaining significant traction in Japan's burglar alarm market, enabling users to monitor and control their systems remotely through smartphone applications. The shift toward cloud-managed alarms facilitates real-time notifications, video surveillance integration, and centralized management of multiple properties. In May 2023, SECOM invested USD 192 Million into Eagle Eye Networks and Brivo, both cloud-based security solutions providers, signaling the industry's commitment to cloud-first security architectures. These platforms offer scalability advantages and seamless integration with existing building management systems, particularly appealing to commercial clients managing diverse facility portfolios.

Smart Home Ecosystem Integration

Burglar alarm systems are increasingly integrating with broader smart home ecosystems, enabling seamless connectivity with surveillance cameras, smart locks, and lighting controls. Japan's smart home security market demonstrates growing consumer preference for unified security platforms that offer centralized management capabilities. The Matter protocol and similar interoperability standards are shortening adoption learning curves and enabling consumers to build comprehensive, customizable security ecosystems combining products from multiple manufacturers without compatibility concerns.

Market Outlook 2026-2034:

The Japan burglar alarm market outlook remains highly positive, supported by sustained technological innovation, favorable demographic trends, and increasing security consciousness among residential and commercial end-users. The convergence of physical security with cyber security is creating new market opportunities as organizations seek integrated protection solutions. Government initiatives promoting smart city development and critical infrastructure protection continue to catalyze market expansion. Wireless alarm systems are gaining market share due to their installation flexibility and reduced infrastructure requirements. The market generated a revenue of USD 289.81 Million in 2025 and is projected to reach a revenue of USD 690.08 Million by 2034, growing at a compound annual growth rate of 10.12% from 2026-2034.

Japan Burglar Alarm Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Hardware |

63% |

|

Application |

Commercial and Industrial |

58% |

|

Region |

Kanto Region |

35% |

Component Insights:

- Hardware

- Central Monitoring Receiver

- Remote Terminal Unit

- Alarm Sensors

- Motion Detection Sensors

- Door/Window Sensors

- Software

- Services

The hardware dominates with a market share of 63% of the total Japan burglar alarm market in 2025.

The hardware segment maintains market leadership due to the fundamental requirement for physical detection devices in all burglar alarm installations. Central monitoring receivers, sensors, and alarm units form the core infrastructure enabling intrusion detection and alert generation. Japan's preference for reliable, high-quality hardware components manufactured to stringent standards drives demand for premium detection equipment. The integration of advanced sensor technologies, including infrared, microwave, and acoustic sensors, enhances detection accuracy while minimizing false alarms that have historically challenged residential and commercial installations.

Hardware innovation continues to shape market dynamics as manufacturers incorporate wireless connectivity, extended battery life, and weather-resistant designs. The Japan smart home security system market, projected to reach USD 8.2 Billion by 2034, exhibiting a growth rate (CAGR) of 8.27% during 2026-2034, demonstrates the substantial growth potential for security hardware. Motion detection sensors and door/window sensors remain essential components, with advanced models now featuring AI-enhanced detection algorithms capable of distinguishing between human intruders and environmental factors. The hardware segment benefits from replacement cycles as older analog systems transition to digital platforms with enhanced capabilities.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial and Industrial

- Residential

The commercial and industrial segment leads with a share of 58% of the total Japan burglar alarm market in 2025.

Commercial and industrial applications dominate the market driven by stringent security requirements across retail establishments, corporate offices, manufacturing facilities, and warehouses. Insurance mandates and regulatory compliance requirements encourage commercial property owners to implement comprehensive burglar alarm systems. Multi-zone detection capabilities, seamless integration with access control systems, and round-the-clock professional monitoring services effectively address the complex and evolving security needs of diverse business environments throughout Japan.

According to the National Police Agency, there were 4,161 cases of metal cable theft from photovoltaic (PV) systems in the first half of 2024, which is 1.5 times more than the theft rate in 2023. The majority of these events occurred in the Kanto region. This trend accelerates industrial adoption of perimeter security, intrusion detection, and asset protection systems. Commercial properties benefit from bundled security solutions that integrate burglar alarms with CCTV surveillance and access control, creating comprehensive protection frameworks. Service contracts and system maintenance agreements generate recurring revenue streams while ensuring optimal system performance across commercial installations.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region holds the largest share at 35% of the total Japan burglar alarm market in 2025.

The Kanto Region maintains market leadership driven by Tokyo's status as Japan's economic, commercial, and governmental center. The region accounts for approximately 45% of Japan's GDP and hosts over 680,000 business establishments in Tokyo alone, creating substantial demand for commercial security solutions. The Greater Tokyo Area's population generates significant residential security requirements, while foreign companies in Japan headquarter in Tokyo, driving international-standard security implementations. High-density urban development and premium property values incentivize property owners to invest in comprehensive burglar alarm systems for asset protection.

The concentration of financial institutions, technology companies, and critical infrastructure in the Kanto region necessitates advanced security measures. Tokyo's ranking as the world's safest city in multiple international surveys reflects both the effectiveness of security measures and ongoing investment in protective technologies. The region benefits from proximity to major security solution providers and system integrators, enabling rapid deployment and responsive maintenance services. Infrastructure development projects and continuous commercial construction activity sustain demand for new security system installations throughout the region.

Market Dynamics:

Growth Drivers:

Why is the Japan Burglar Alarm Market Growing?

Rising Crime Rates and Security Awareness

The steady increase in reported crimes across Japan is significantly driving burglar alarm market growth. Theft is directly correlating with heightened demand for intrusion detection systems. The 2024 white paper on crime published by Japan's Ministry of Justice highlighted that robbery cases reached 1,361 incidents in 2023, further emphasizing the need for preventive security measures. This reversal of crime trends has fundamentally shifted public perception, with increasing numbers of households and businesses recognizing burglar alarm systems as essential rather than optional investments for property protection.

Demographic Shifts and Aging Population

Japan's demographic transformation creates substantial and sustained demand for burglar alarm systems with integrated safety features. The elderly population reached 36.19 million as of September 2025, representing a record 29.4% of the total population according to Japan's Ministry of Internal Affairs and Communications. Elderly individuals living alone, particularly in rural areas, are more vulnerable and seek security systems providing both intrusion detection and emergency alert capabilities. Security systems designed for elderly users increasingly incorporate panic buttons, fall detection, and health monitoring features, expanding the market beyond traditional intrusion prevention.

Technological Advancement and Smart Home Integration

Rapid technological advancement is transforming burglar alarm systems from standalone devices into integrated components of comprehensive smart home ecosystems. Japan smart homes market size is expected to reach USD 22.6 Billion by 2033, exhibiting a growth rate (CAGR) of 10.80% during 2025-2033, with security solutions representing a significant segment growing at over ten percent annually. The Japanese government has committed substantial funding to smart city development projects integrating IoT technologies for enhanced urban security management. Cloud-based platforms enable remote system management, real-time notifications, and integration with voice assistants and mobile applications. AI-driven features including facial recognition, behavior analysis, and predictive threat detection are elevating system capabilities beyond simple intrusion alerts. Wireless technology adoption has accelerated as approximately forty-five percent of new global installations in 2024 utilized wireless systems, reducing installation complexity and expanding addressable markets.

Market Restraints:

What Challenges the Japan Burglar Alarm Market is Facing?

High Installation and Operational Costs

The substantial upfront investment required for comprehensive burglar alarm systems remains a significant barrier to wider adoption. Multi-room smart security systems are stretching household budgets and limiting mass uptake outside major metropolitan areas. Ongoing monitoring service subscriptions and maintenance expenses add to total cost of ownership.

Legacy System Integration Challenges

Approximately forty-five percent of Japan's current housing stock predates mainstream broadband infrastructure, requiring smart security devices to bridge analog intercoms, proprietary alarm wiring, and standalone control systems. Retrofitting older properties with modern burglar alarm systems often requires costly infrastructure upgrades and specialized installation expertise.

Privacy and Data Security Concerns

The increasing integration of IoT devices and cloud-based monitoring raises legitimate concerns about data privacy and cybersecurity vulnerabilities. Japan's Personal Information Protection Commission reported rising data breach incidents, creating consumer hesitation toward connected security solutions. Organizations face stringent regulations and potential penalties for security failures.

Competitive Landscape:

The Japan burglar alarm market exhibits a moderately consolidated competitive structure dominated by established domestic security service providers with expanding international technology partnerships. Several companies are also making investments in AI-driven solutions and cloud-based platforms, which reinforces its competitive position the industry. Competition intensifies as international smart home technology providers enter the market and domestic electronics manufacturers expand security product portfolios. Strategic acquisitions, technology partnerships, and service bundling strategies characterize competitive dynamics as players seek to capture growth opportunities in both residential and commercial segments.

Recent Developments:

-

May 2024: Qsee Technology announced its expansion into the Japanese market, introducing innovative smart home solutions and advanced security systems through collaboration with retailer UNIQ STYLE, aiming to establish partnerships with local businesses.

Japan Burglar Alarm Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Commercial and Industrial, Residential |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan burglar alarm market size was valued at USD 289.81 Million in 2025.

The Japan burglar alarm market is expected to grow at a compound annual growth rate of 10.12% from 2026-2034 to reach USD 690.08 Million by 2034.

The hardware segment dominated the market with a 63% share in 2025, driven by strong demand for sensors, central monitoring receivers, and motion detection devices that form the essential infrastructure for comprehensive security systems.

Key factors driving the Japan burglar alarm market include rising crime rates, demographic shifts with elderly population, technological advancement in AI and IoT integration, and smart home ecosystem expansion.

Major challenges include high installation and operational costs limiting mass adoption, legacy system integration difficulties in older housing stock, data privacy and cybersecurity concerns with connected devices, and the need for specialized installation expertise.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)