Japan Car Leasing Market Size, Share, Trends and Forecast by Type, Lease Type, Service Provider Type, Tenure, and Region, 2026-2034

Japan Car Leasing Market Overview:

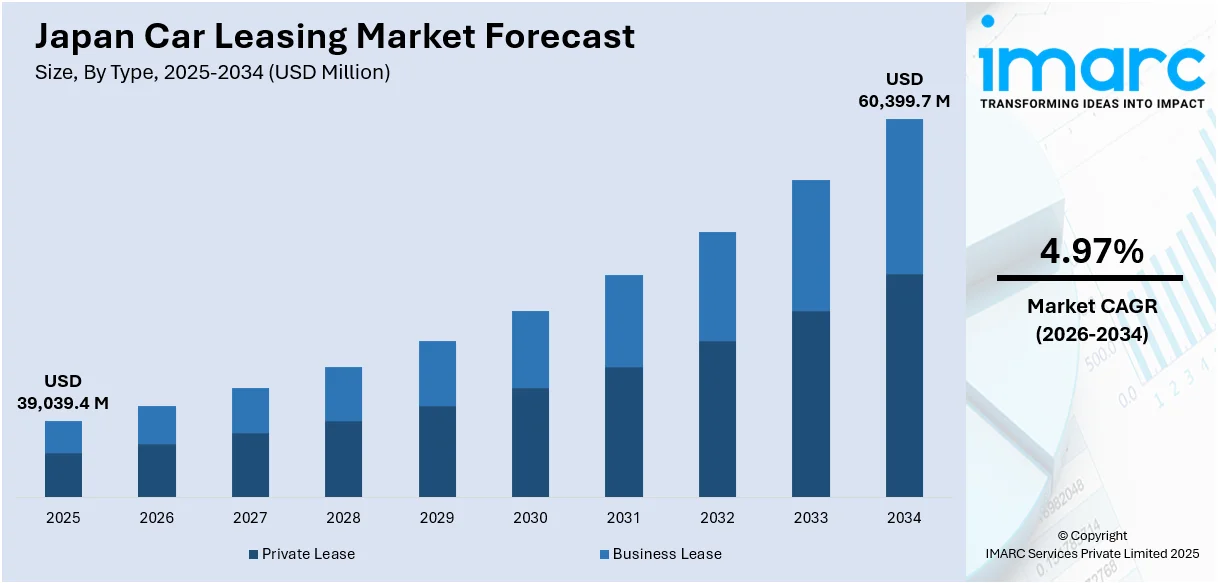

The Japan car leasing market size reached USD 39,039.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 60,399.7 Million by 2034, exhibiting a growth rate (CAGR) of 4.97% during 2026-2034. The rise in the demand for mobility solutions with flexibility is offering a favorable market outlook. This trend, along with the pace of technological changes in vehicle features, is fueling the market growth. Apart from this, environmental and regulatory forces encouraging cleaner modes of transportation are expanding the Japan car leasing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 39,039.4 Million |

| Market Forecast in 2034 | USD 60,399.7 Million |

| Market Growth Rate 2026-2034 | 4.97% |

Japan Car Leasing Market Trends:

Growing Demand for Flexible Mobility Solutions

The Japanese car leasing sector is witnessing a rise in the demand for mobility solutions with flexibility. People and companies are both looking for substitutes to car ownership, spurred by the increasing cost of car ownership, such as maintenance, insurance, and taxation. The need for more flexible forms of transport like short-term leasing or long-term renting is growing. Furthermore, the shift towards telecommuting and altered patterns of commuting are encouraging individuals to turn to car leasing, as it provides flexibility without having to pay for the vehicle directly. People are constantly examining transportation requirements as per usage and not binding themselves with long-term ownership. This movement towards flexible, on-demand mobility is becoming a key driver of the market, as leasing provides the benefit of low initial costs and increased convenience over traditional vehicle acquisition models. The Japan car rental market size is expected to reach USD 5.7 Million by 2033, as per the information presented by the IMARC Group.

To get more information on this market Request Sample

Technological Advancements in Vehicle Features

The pace of technological changes in vehicle features is fueling the Japan car leasing market growth. Customers are increasingly interested in leasing vehicles that come with the most advanced technologies, including electric vehicle (EV) technology, advanced driver assistance systems (ADAS), and autonomous driving features. These technologies are rendering leasing an increasingly desirable choice for individuals seeking access to state-of-the-art features without the responsibility of owning a vehicle. The incorporation of networked car technologies, like smartphone applications used to monitor and control automobiles, is also improving the overall leasing experience. Leasing firms are constantly upgrading their fleets to address the need for advanced technology cars, providing consumers with access to new models with little obligation. This emphasis on technological integration is therefore a major driving force as customers are always seeking ever more advanced and efficient cars to lease. In 2024, Rakuten Group Inc. announced that its online travel reservation business Rakuten Travel, a Japan leading online travel agency, started to provide its car rental reservation service for foreign visitors to Japan in several languages. The service accommodated customers with English, Korean and Traditional Chinese (Taiwan), as well as Japanese.

Environmental and Regulatory Pressures

The Japanese automobile leasing industry is influenced presently by environmental and regulatory forces encouraging cleaner modes of transportation. With Japan's growing focus on minimizing carbon emissions and achieving sustainability levels, businesses and individuals alike are turning towards cleaner vehicle solutions, including electric and hybrid cars, through leasing. These costlier vehicles to buy outright are becoming more viable through leasing contracts. Moreover, public policies and incentives like tax credits for EVs and regulations promoting the use of cleaner cars are making leasing a car a more viable and desirable choice. Organizations are also positioning their fleets with environmental considerations by leasing cars that meet more stringent emission requirements. This ongoing emphasis on sustainability is influencing customer’s choice as individuals and companies look for ways to minimize their carbon footprint while still having access to dependable transportation.

Japan Car Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, lease type, service provider type, and tenure.

Type Insights:

- Private Lease

- Business Lease

The report has provided a detailed breakup and analysis of the market based on the type. This includes private lease and business lease.

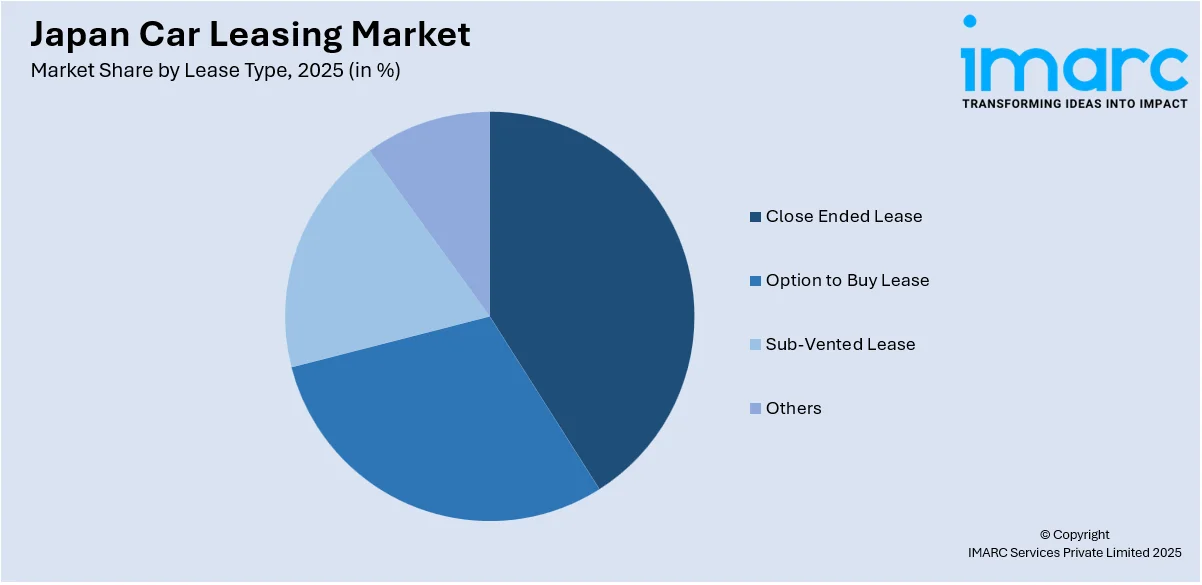

Lease Type Insights:

Access the comprehensive market breakdown Request Sample

- Close Ended Lease

- Option to Buy Lease

- Sub-Vented Lease

- Others

The report has provided a detailed breakup and analysis of the market based on the lease type. This includes close ended lease, option to buy lease, sub-vented lease, and others.

Service Provider Type Insights:

- Original Equipment Manufacturer (OEM)

- Bank Affiliated

- Nonbank Financial Companies (NBFCs)

The report has provided a detailed breakup and analysis of the market based on the service provider type. This includes original equipment manufacturer (OEM), bank affiliated, and nonbank financial companies (NBFCs).

Tenure Insights:

- Short-Term

- Long-Term

A detailed breakup and analysis of the market based on the tenure have also been provided in the report. This includes short-term and long-term.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Car Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Private Lease, Business Lease |

| Lease Types Covered | Close Ended Lease, Option to Buy Lease, Sub-Vented Lease, Others |

| Service Provider Types Covered | Original Equipment Manufacturer (OEM), Bank Affiliated, Nonbank Financial Companies (NBFCs) |

| Tenures Covered | Short-Term, Long-Term |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan car leasing market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan car leasing market on the basis of type?

- What is the breakup of the Japan car leasing market on the basis of lease type?

- What is the breakup of the Japan car leasing market on the basis of service provider type?

- What is the breakup of the Japan car leasing market on the basis of tenure?

- What is the breakup of the Japan car leasing market on the basis of region?

- What are the various stages in the value chain of the Japan car leasing market?

- What are the key driving factors and challenges in the Japan car leasing market?

- What is the structure of the Japan car leasing market and who are the key players?

- What is the degree of competition in the Japan car leasing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan car leasing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan car leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan car leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)