Japan Cargo Containers Market Size, Share, Trends and Forecast by Type, Size, End User, and Region, 2026-2034

Japan Cargo Containers Market Summary:

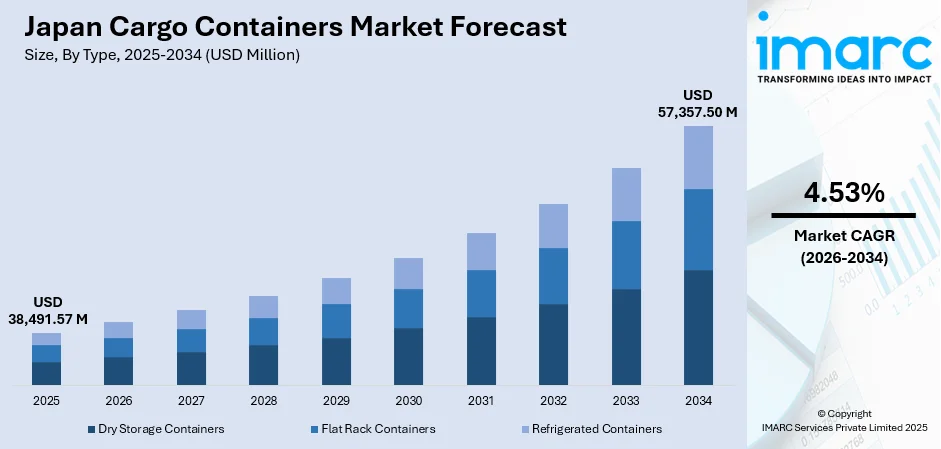

The Japan cargo containers market size was valued at USD 38,491.57 Million in 2025 and is projected to reach USD 57,357.50 Million by 2034, growing at a compound annual growth rate of 4.53% from 2026-2034.

The Japan cargo container market is growing steadily due to expanding international trade activities, volumes of e-commerce transactions, and continuous port infrastructure modernization. The strategic position of the country as a major hub for shipping, connecting Asia with global markets, underlines the prospects of continued demand for standard shipping containers. Applications of smart container technologies, increased containerization in various industries, and government investments in port digitalization are expected to further boost the share in the Japan cargo container market.

Key Takeaways and Insights:

- By Type: Dry Storage Containers dominate the market with a share of 72.3% in 2025, owing to their versatility and cost-effectiveness in transporting general cargo including electronics, consumer goods, machinery, and industrial products across domestic and international routes.

- By Size: Medium Containers (40 ft) lead the market with a share of 58.7% in 2025, attributed to their optimal balance between cargo capacity and operational flexibility, making them suitable for both major international ports and regional distribution networks.

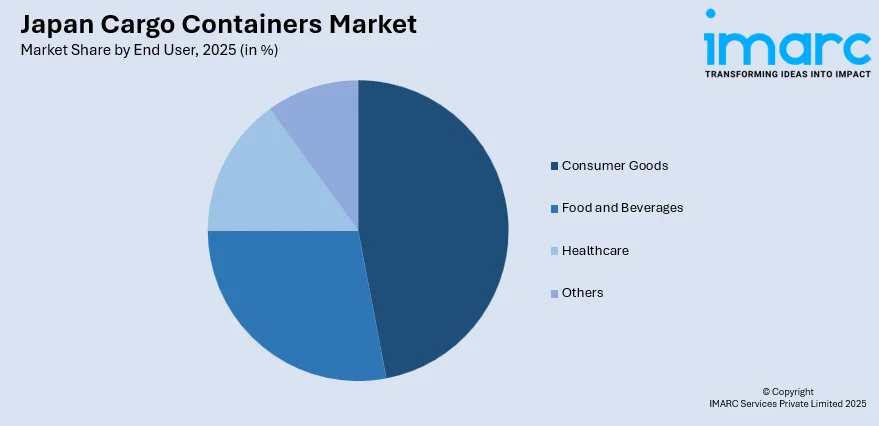

- By End User: Consumer Goods represent the largest segment with a market share of 46.5% in 2025, driven by Japan's robust e-commerce sector, high consumer spending patterns, and extensive retail distribution networks requiring efficient containerized shipping solutions.

- By Region: Kanto Region accounts for the largest share of 35.0% in 2025, reflecting the concentration of major ports including Tokyo and Yokohama, extensive logistics infrastructure, and the region's role as Japan's primary hub for international trade.

- Key Players: The Japan cargo containers market features a competitive landscape with global container manufacturers and leasing companies operating alongside domestic logistics providers, focusing on innovation in smart container technologies, sustainable materials, and integrated supply chain solutions.

To get more information on this market Request Sample

The Japan cargo containers market is undergoing significant transformation, driven by technological innovation and sustainability initiatives. Major ports, including Tokyo, Yokohama, Nagoya, Kobe, and Osaka, handle large container volumes that support domestic distribution and international trade. Government efforts promoting smart port infrastructure and carbon-neutral operations are accelerating the adoption of IoT-enabled containers and digital tracking systems. In line with that, in December 2023 the governments of Ministry of Land, Infrastructure, Transport and Tourism (MLIT) of Japan and Maritime and Port Authority of Singapore (MPA Singapore) signed a MoC to establish the Singapore–Japan Green and Digital Shipping Corridor, covering major ports like Tokyo, Yokohama, Osaka, Kobe, and Nagoya, to accelerate maritime decarbonisation and digitalisation. Meanwhile, artificial intelligence integration in logistics is improving container utilization and supply chain visibility. These developments position Japan as a leader in maritime technology innovation, enhancing operational efficiency and fostering sustainable, future-ready container handling across the Asia-Pacific region.

Japan Cargo Containers Market Trends:

Adoption of Smart Container Technologies and IoT Integration

The adoption of smart container technologies, including IoT devices, sensors, and real-time tracking systems, is transforming Japan’s cargo logistics. These innovations enhance supply chain visibility, enable more efficient planning, improve security, and reduce cargo damage or loss. For instance, in April 2025, Mitsubishi Logisnext deployed a smart container terminal gate system at the Port of Osaka, using AI and 5G-enabled devices to streamline container entry and exit, significantly improving operational efficiency. Logistics providers are integrating GPS tracking, temperature monitoring, and tamper detection into container fleets, supporting demand for transparent, reliable, and efficient cargo management across domestic and international shipping operations.

Decarbonization and Green Shipping Initiatives

Japan’s focus on carbon neutrality is driving investment in sustainable shipping and eco-friendly port operations. Initiatives promoting zero-emission vessels, dual-fuel ships, and green fuel adoption are reshaping container logistics. In March 2024, NYK Line announced plans to introduce ammonia-powered vessels on key domestic and regional routes, supporting Japan’s decarbonization goals and setting a benchmark for greener maritime operations. Ports are enhancing infrastructure to support cleaner maritime operations, while shipping lines transition toward environmentally responsible practices. These efforts reinforce Japan’s leadership in sustainable container shipping, balancing operational efficiency with environmental stewardship across its domestic and regional maritime networks.

Port Automation and Digital Transformation

Automation and digital technologies are modernizing Japanese ports to enhance container handling and operational efficiency. Terminals are integrating remotely operated cranes, AI-based logistics platforms, and automated reservation systems. In October 2025, the Yokohama Kawasaki International Port Corp. (YKIP), together with JFE Engineering, launched a trial to operate a large gantry crane at the Port of Yokohama by remote control, marking Japan’s first remote-crane trial. Digital solutions streamline workflows, reduce reliance on manual labor, and support secure, contactless operations. Government programs encourage AI-driven terminal management and smart logistics integration, driving productivity gains, lowering operational costs, and strengthening competitiveness in Japan’s domestic and global shipping networks.

Market Outlook 2026-2034:

The Japan cargo containers market is positioned for sustained growth throughout the forecast period, supported by expanding e-commerce activities, increasing international trade volumes, and ongoing infrastructure modernization. The convergence of smart container technologies, sustainable shipping practices, and automated port operations is creating new opportunities for efficiency gains across the logistics sector. Rising consumer goods demand, particularly driven by cross-border e-commerce expansion, continues to fuel container throughput at major Japanese ports. The market generated a revenue of USD 38,491.57 Million in 2025 and is projected to reach a revenue of USD 57,357.50 Million by 2034, growing at a compound annual growth rate of 4.53% from 2026-2034.

Japan Cargo Containers Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Dry Storage Containers | 72.3% |

| Size | Medium Containers (40 ft) | 58.7% |

| End User | Consumer Goods | 46.5% |

| Region | Kanto Region | 35.0% |

Type Insights:

- Dry Storage Containers

- Flat Rack Containers

- Refrigerated Containers

The dry storage containers dominate with a market share of 72.3% of the total Japan cargo containers market in 2025.

Dry storage containers represent the most widely utilized container type in Japan's cargo transportation network, serving as the standard solution for shipping non-perishable goods across domestic and international routes. These versatile containers efficiently transport diverse cargo including electronics, clothing, machinery, consumer products, and industrial components. The global manufacturing and retail industries heavily rely on dry containers for their transportation requirements, with Japan's robust export sectors in automotive parts, electronics, and machinery driving consistent demand. In 2025, Nippon Express completed a large-scale deployment of an IoT-based fleet-tracking solution for chassis at the Port of Tokyo, equipping hundreds of chassis across 17 yards with real-time tracking to improve visibility, reduce idle time, and speed up dispatch operations. The rise of e-commerce has further amplified the need for these containers, as they effectively facilitate the movement of consumer products across the nation's extensive distribution networks and international trade routes.

In addition, advancements in container tracking, handling technologies, and standardized designs are enhancing operational efficiency and cargo security. This ensures timely deliveries, reduces logistical errors, and strengthens Japan’s overall supply chain resilience.

Size Insights:

- Small Containers (20 ft)

- Medium Containers (40 ft)

- Large Containers (Above 40 ft)

The medium Containers (40 ft) lead with a share of 58.7% of the total Japan cargo containers market in 2025.

Medium-sized forty-foot containers represent the preferred choice for Japanese shippers, offering an optimal balance between cargo capacity and operational flexibility suitable for both major international ports and regional distribution centers. These containers provide cost-effective transportation solutions for a wide range of goods while maintaining compatibility with standard handling equipment at terminals throughout Japan's port network. The growing demand for consumer electronics, automotive components, and household products transported via these containers supports their market dominance. High cube variants within this category are experiencing increased adoption, providing additional cubic capacity for lightweight yet bulky cargo such as electronics and automotive parts without requiring specialized handling infrastructure.

Furthermore, innovations in container tracking, insulation, and stacking technologies are enhancing operational efficiency and cargo protection. These improvements support timely deliveries, minimize damage, and strengthen the reliability of Japan’s supply chain network.

End User Insights:

Access the Comprehensive Market Breakdown Request Sample

- Food and Beverages

- Consumer Goods

- Healthcare

- Others

The consumer goods dominate with a market share of 46.5% of the total Japan cargo containers market in 2025.

Consumer goods transportation drives significant container demand in Japan, supported by the nation's substantial e-commerce market valued at over two hundred billion dollars and growing at robust annual rates. Japanese consumers demonstrate strong preferences for convenient online shopping, creating sustained demand for containerized shipping of electronics, apparel, home appliances, and household products. Major e-commerce platforms including Amazon Japan, Rakuten, and Yahoo Shopping generate extensive logistics requirements that translate into consistent container utilization. For example, in January 2025 Sustainable Shared Transport (SST), a subsidiary of Yamato Holdings and Fujitsu, launched a joint transportation and delivery platform intended to match shippers and logistics providers, optimizing loading efficiency and reducing empty miles, a move that supports high container utilization for consumer‑goods shipments across Japan. The sector benefits from Japan's highly developed logistics infrastructure, with carriers like Yamato Transport and Sagawa Express facilitating efficient distribution of containerized consumer goods throughout the nation's extensive retail networks.

Additionally, advancements in real-time tracking, smart packaging, and automated handling systems are enhancing supply chain efficiency and reliability, ensuring timely delivery of consumer goods and reducing logistical disruptions across Japan.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto Region exhibits a clear dominance with a 35.0% share of the total Japan cargo containers market in 2025.

The Kanto Region dominates Japan's cargo containers market as the nation's largest logistics hub, equipped with cutting-edge infrastructure and extensive transportation networks. The Port of Tokyo leads Japan's container operations, handling over 4.4 million TEUs annually, while Yokohama serves as the second-largest container port with strong connections to North American and European trade routes. The region's strategic location supports both domestic distribution and international trade, with Narita Airport providing additional air cargo capabilities.

The Kanto Region’s advanced warehousing facilities integrated multimodal transport systems, and adoption of digital logistics solutions further strengthen its role as Japan’s key cargo container hub, supporting efficient, reliable, and scalable supply chain operations.

Market Dynamics:

Growth Drivers:

Why is the Japan Cargo Containers Market Growing?

Expanding E-commerce Sector and Rising Consumer Goods Demand

Japan’s e-commerce sector continues to grow rapidly, driven by consumers’ increasing preference for online shopping convenience. The Japan e-commerce market size reached USD 258.0 Billion in 2024, and looking forward, IMARC Group expects it to reach USD 692.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.02% during 2025–2033. Rising household adoption of digital retail has created significant demand for containerized shipping of consumer goods, including electronics, apparel, and home essentials. Leading logistics providers have invested heavily in infrastructure to meet this surge. Innovative services, such as digital delivery platforms integrating with major carriers, are streamlining operations. As online retail expands, Japan’s distribution networks face sustained pressure to provide efficient, reliable transportation solutions that connect producers, warehouses, and consumers nationwide.

Smart Container Technologies and Digital Supply Chain Integration

The adoption of smart container technologies is reshaping cargo logistics in Japan, enhancing supply chain visibility, security, and efficiency. IoT-enabled containers with GPS, temperature monitoring, and tamper detection allow real-time tracking and predictive management, reducing losses and delays. In 2023, IHI Jet Service (IJS), a subsidiary of IHI Corporation, began offering a service that combines AI‑driven satellite/AIS data for real‑time container‑ship tracking with a digital customs‑clearance platform, enabling accurate container‑arrival predictions and streamlined customs processing. Blockchain-based documentation systems are increasingly used to ensure secure and transparent cargo handling. Artificial intelligence supports predictive maintenance and accurate delivery estimates, optimizing operations. These innovations enable logistics companies to manage container fleets more effectively, improving planning, minimizing disruptions, and enhancing the reliability of domestic and international goods transport.

Port Modernization and Infrastructure Development Initiatives

Japan is investing in modernizing port infrastructure to strengthen container handling and enhance competitiveness in global shipping. Smart port initiatives focus on automated terminals, digital cargo management, and improved intermodal connectivity. For example, in the first half of 2025 the Port of Tokyo handled 2.42 million TEUs, a 6.5% increase over the same period the previous year. Major ports are deploying remotely operated cranes, advanced reservation systems, and other technologies to increase operational efficiency and reduce turnaround times. These efforts support smoother cargo flows, allowing ports to accommodate rising container volumes and complex logistics demands. Infrastructure upgrades are reinforcing Japan’s role as a major trade hub, ensuring the nation can meet both domestic and international shipping requirements effectively.

Market Restraints:

What Challenges the Japan Cargo Containers Market is Facing?

Labor Shortages and Workforce Constraints in Logistics Sector

Japan's aging population and declining workforce present significant challenges for the logistics sector, with labor shortages impacting container handling operations and transportation services. New regulations limiting truck driver overtime hours have constrained road transportation capacity, potentially affecting container distribution networks. The logistics industry faces projected labor shortfalls that could reduce transport capacity by over thirty percent by the end of the decade without intervention through automation and technology adoption.

High Operational and Infrastructure Costs

Japan's highly developed logistics infrastructure entails substantial costs including premium warehouse rentals, technology investments, and elevated fuel and labor expenses. These operational costs are ultimately transferred to shippers, compelling companies to rationalize container utilization and negotiate competitive terms with logistics providers. Smaller operators may struggle to maintain profitability amid rising expenses for equipment, maintenance, and regulatory compliance.

Global Trade Uncertainties and Shipping Route Disruptions

International trade policy fluctuations and geopolitical developments create uncertainties affecting container shipping volumes and trade patterns. Disruptions to major shipping routes, including diversions from traditional transit corridors, impact vessel schedules and container availability. These factors introduce volatility into the container market, requiring logistics operators to maintain flexibility in fleet management and route planning.

Competitive Landscape:

The Japan cargo containers market exhibits a competitive environment featuring global container manufacturers, international shipping lines, and domestic logistics providers. Market participants differentiate through technological innovation, particularly in smart container solutions, sustainable materials, and integrated digital platforms. Strategic partnerships between international carriers and Japanese port operators facilitate efficient container operations and infrastructure development. The competitive landscape reflects ongoing consolidation as larger players expand capabilities through acquisitions while specialized firms target niche applications in refrigerated transport, high-value cargo, and last-mile distribution services.

Recent Developments:

- In May 2025, Nippon Express launched the Vienna Consolidation ocean freight service connecting major Japanese ports, including Tokyo, Yokohama, Nagoya, Kobe, Hakata, and Moji, with 26 destinations in Central and Eastern Europe. The service uses a central consolidation hub in Vienna for efficient deconsolidation and distribution, offering cost-effective and high-quality container transport solutions that enhance efficiency in Japan’s cargo containers market.

- In April 2025, Mitsubishi Logisnext deployed an advanced container terminal gate system at the Port of Osaka’s Yumeshima Terminal. The system, equipped with 5G handheld terminals and AI-powered cameras, streamlined container entry and exit processes, reduced congestion, and improved operational efficiency, contributing to enhanced performance and competitiveness in Japan’s cargo containers market.

Japan Cargo Containers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dry Storage Containers, Flat Rack Containers, Refrigerated Containers |

| Sizes Covered | Small Containers (20 ft), Medium Containers (40 ft), Large Containers (Above 40 ft) |

| End Users Covered | Food and Beverages, Consumer Goods, Healthcare, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan cargo containers market size was valued at USD 38,491.57 Million in 2025.

The Japan cargo containers market is expected to grow at a compound annual growth rate of 4.53% from 2026-2034 to reach USD 57,357.50 Million by 2034.

Dry storage containers held the largest type segment share at 72.3%, driven by their versatility and cost-effectiveness in transporting general cargo including electronics, consumer goods, and industrial products across Japan's extensive transportation networks.

Key factors driving the Japan cargo containers market include expanding e-commerce sector generating increased shipping demand, adoption of smart container technologies with IoT integration, port infrastructure modernization initiatives, and growing international trade volumes through major Japanese ports.

Major challenges include labor shortages and workforce constraints in the logistics sector, high operational and infrastructure costs, global trade uncertainties affecting shipping volumes, and the need for substantial investments in automation to address declining workforce availability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)