Japan Cargo Insurance Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, End User, and Region, 2026-2034

Japan Cargo Insurance Market Summary:

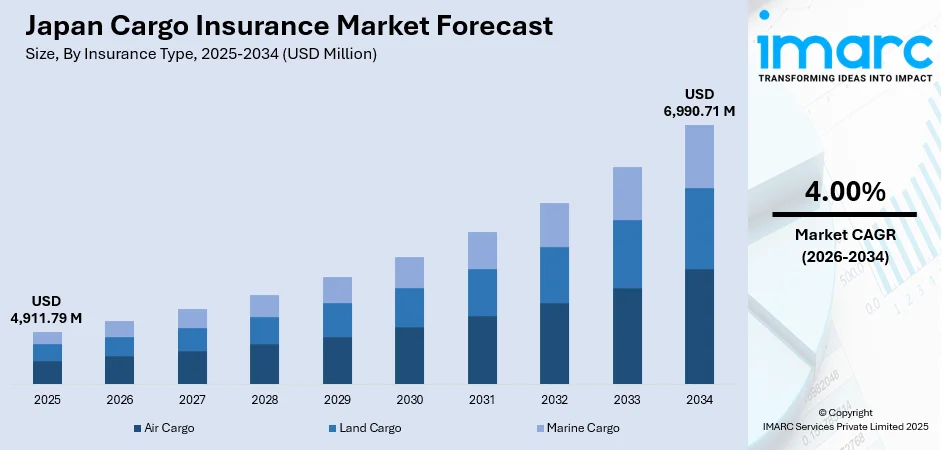

The Japan cargo insurance market size was valued at USD 4,911.79 Million in 2025 and is projected to reach USD 6,990.71 Million by 2034, growing at a compound annual growth rate of 4.00% from 2026-2034.

The Japan cargo insurance market is experiencing steady expansion driven by the nation's robust international trade activities and strategic position as a major maritime hub in the Asia-Pacific region. Rising exports of semiconductors, automobiles, and industrial machinery are amplifying demand for comprehensive cargo coverage. Increasing awareness among businesses regarding risk mitigation, coupled with regulatory requirements for goods in transit, is strengthening adoption across trading enterprises and logistics operators.

Key Takeaways and Insights:

-

By Insurance Type: Marine cargo dominates the market with a share of 69% in 2025, driven by Japan's island geography and heavy reliance on maritime routes for import-export activities. The extensive network of major ports including Tokyo, Yokohama, and Kobe supports substantial seaborne trade volumes requiring comprehensive insurance coverage.

-

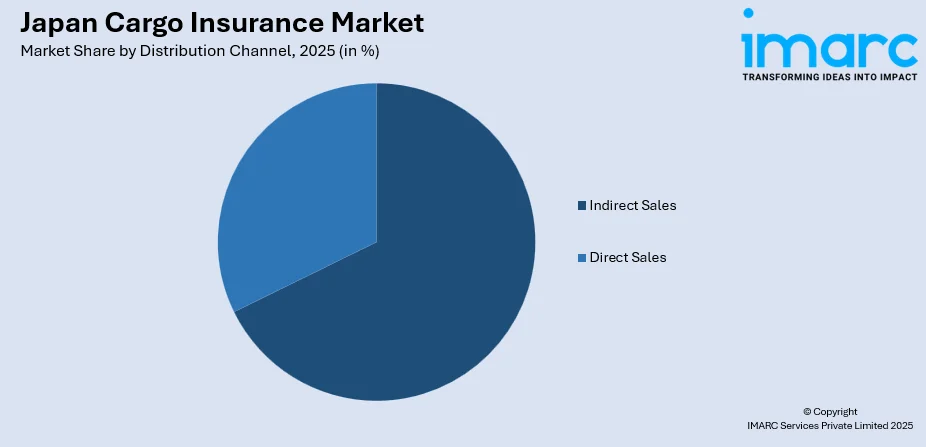

By Distribution Channel: Indirect sales lead the market with a share of 63% in 2025, reflecting the established agency network infrastructure in Japan's insurance industry. Insurance agents and brokers provide specialized advisory services, policy comparisons, and tailored coverage solutions that enterprises value for complex cargo insurance requirements.

-

By End User: Traders represent the largest segment with a market share of 38% in 2025, owing to their direct exposure to international trade risks and regulatory compliance requirements. Trading enterprises handling high-value goods prioritize comprehensive insurance to safeguard against transit-related losses and supply chain disruptions.

-

By Region: Kanto Region dominates the market with 36% share in 2025, driven by the concentration of Japan's major ports including Tokyo and Yokohama, headquarters of leading trading companies, and robust industrial manufacturing clusters supporting extensive import-export operations.

-

Key Players: Key players drive the Japan cargo insurance market by expanding coverage options, enhancing digital platforms for policy management, and strengthening partnerships with logistics providers. Their investments in risk assessment technologies, underwriting capabilities, and claims processing efficiency boost service quality and accelerate adoption across diverse trading segments.

To get more information on this market Request Sample

The Japan cargo insurance market is witnessing sustained growth as businesses increasingly recognize the importance of protecting goods during transit across complex supply chains. The expansion of international trade relationships, particularly with Asian markets, North America, and Europe, is generating heightened demand for comprehensive cargo coverage solutions. Technological advancements in risk assessment, including satellite tracking and IoT-enabled monitoring systems, are enhancing underwriting precision and enabling insurers to offer customized policies. The growing sophistication of logistics operations, combined with rising awareness of geopolitical and climate-related transit risks, is encouraging enterprises to secure robust insurance coverage. Additionally, regulatory developments emphasizing supply chain resilience and corporate risk management are further strengthening the market foundation.

Japan Cargo Insurance Market Trends:

Digital Transformation in Insurance Operations

The Japan cargo insurance market is undergoing significant digital transformation as insurers integrate advanced technologies into underwriting and claims management processes. Carriers are deploying artificial intelligence-powered risk assessment tools, blockchain-enabled documentation systems, and automated claims processing platforms to enhance operational efficiency. These innovations streamline policy issuance, improve accuracy in premium calculations, and deliver faster customer service, positioning technology-forward insurers competitively in the evolving market landscape.

Expansion of Comprehensive All-Risk Coverage Policies

Growing demand for comprehensive protection is driving expansion of all-risk coverage policies within the Japan cargo insurance market. Businesses are increasingly seeking policies that provide maximum protection against diverse transit risks including theft, damage, natural disasters, and delays. This trend reflects heightened awareness of supply chain vulnerabilities exposed during recent global disruptions. Insurers are responding by developing flexible coverage options that address emerging risks such as cyber threats to logistics systems and climate-related cargo damage, ensuring policyholders receive holistic protection tailored to contemporary trading environments.

Integration of ESG Considerations in Underwriting

Environmental, social, and governance considerations are increasingly influencing underwriting decisions within the Japan cargo insurance market. Leading insurers have committed substantial resources to sustainable investments, with significant allocations toward green bonds and renewable energy project financing. This shift toward sustainability-conscious operations is reshaping coverage criteria, with insurers implementing stricter assessments for carbon-intensive cargo and preferential terms for environmentally responsible shipping practices, reflecting broader industry commitment to sustainable development.

Market Outlook 2026-2034:

The Japan cargo insurance market outlook remains positive as sustained international trade activity and evolving risk landscapes continue driving demand for comprehensive coverage solutions. Insurers are expected to further integrate advanced technologies including artificial intelligence, blockchain, and real-time cargo monitoring systems to enhance service delivery. The market generated a revenue of USD 4,911.79 Million in 2025 and is projected to reach a revenue of USD 6,990.71 Million by 2034, growing at a compound annual growth rate of 4.00% from 2026-2034. Strategic partnerships between insurers and logistics providers, coupled with regulatory developments supporting supply chain resilience, are anticipated to sustain steady market expansion throughout the forecast period.

Japan Cargo Insurance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Insurance Type | Marine Cargo | 69% |

| Distribution Channel | Indirect Sales | 63% |

| End User | Traders | 38% |

| Region | Kanto Region | 36% |

Insurance Type Insights:

- Air Cargo

- Land Cargo

- Marine Cargo

Marine cargo dominates with a market share of 69% of the total Japan cargo insurance market in 2025.

Marine cargo insurance represents the cornerstone of Japan's cargo insurance market, reflecting the nation's fundamental dependence on maritime trade as an island country. Japan's geographic configuration necessitates seaborne transport for the vast majority of international trade, creating substantial demand for comprehensive marine coverage. The presence of world-class ports facilitates massive cargo volumes requiring protection against transit risks, underscoring the scale of maritime commerce demanding insurance coverage.

The marine cargo insurance segment benefits from Japan's position as a leading exporter of high-value manufactured goods including automobiles, electronics, and precision machinery. These premium products require robust coverage against potential losses during long-distance ocean voyages. Additionally, rising e-commerce cross-border trade and increasing complexity of global supply chains are amplifying demand for flexible marine coverage options. Insurers are responding by developing specialized policies addressing contemporary risks such as piracy, geopolitical disruptions, and climate-related vessel delays that affect modern maritime operations.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Direct Sales

- Indirect Sales

Indirect sales lead with a share of 63% of the total Japan cargo insurance market in 2025.

Indirect sales channels dominate Japan's cargo insurance distribution landscape, reflecting the deeply entrenched agency network structure characterizing the nation's insurance industry. Insurance agents provide invaluable expertise in navigating complex cargo coverage requirements, offering personalized advice and comprehensive policy comparisons that businesses value highly. The General Insurance Association of Japan reports that the agency network remains the primary channel for general insurance distribution, with agents serving as trusted intermediaries between insurers and commercial clients seeking specialized cargo protection solutions.

The strength of indirect sales channels stems from Japanese business culture's emphasis on relationship-based commerce and preference for face-to-face advisory services, particularly for complex commercial insurance products. Agents and brokers deliver value through expertise in risk assessment, claims advocacy, and policy customization that direct channels cannot easily replicate. However, digital transformation is gradually reshaping distribution dynamics, with major insurers developing online platforms to complement traditional agency services and address evolving customer preferences for convenient digital interactions alongside personal advisory support.

End User Insights:

- Traders

- Cargo Owners

- Ship Owners

- Others

Traders exhibit a clear dominance with a 38% share of the total Japan cargo insurance market in 2025.

Trading enterprises represent the largest end-user segment in Japan's cargo insurance market, driven by their direct exposure to international trade risks and substantial volumes of goods requiring transit protection. Japan's trading companies, including major general trading houses known as sogo shosha, handle diverse commodity flows ranging from raw materials to finished products across global markets. These enterprises prioritize comprehensive cargo insurance as essential risk management infrastructure supporting their expansive commercial operations and contractual obligations with international partners.

The prominence of traders reflects Japan's export-oriented economy and the critical role of trading companies in facilitating international commerce. With Japan recording record-high exports of semiconductor manufacturing equipment growing by 27.2% to 4.5 Trillion Yen in 2024, traders handling these high-value shipments require robust insurance coverage. Additionally, regulatory compliance requirements and contractual obligations with overseas buyers mandate adequate cargo protection, further strengthening insurance adoption among trading enterprises operating in competitive global markets.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region represent the leading segment with a 36% share of the total Japan cargo insurance market in 2025.

The Kanto Region dominates Japan's cargo insurance market, anchored by the Greater Tokyo metropolitan area's position as the nation's economic and commercial epicenter. This region houses Japan's largest container port facilities including the Port of Tokyo, and the Port of Yokohama serving as a critical gateway for international trade with North America and Europe. The concentration of major trading houses, multinational corporate headquarters, and financial institutions in Tokyo creates substantial demand for sophisticated cargo insurance solutions supporting complex global supply chain operations.

Kanto Region’s prominence reflects its comprehensive logistics infrastructure connecting maritime, air, and land transportation networks that facilitate seamless cargo movement. Narita International Airport complements seaport facilities, enabling multimodal shipment coverage requirements. The region's advanced technological ecosystem supports digital insurance innovations, with major insurers headquartered in Tokyo developing cutting-edge risk assessment and claims processing capabilities. Additionally, the presence of Japan's regulatory authorities and insurance industry associations in Tokyo facilitates market development and standardization efforts benefiting the broader cargo insurance sector.

Market Dynamics:

Growth Drivers:

Why is the Japan Cargo Insurance Market Growing?

Expansion of International Trade Activities

The sustained expansion of Japan's international trade activities serves as a primary growth driver for the cargo insurance market. Japan maintains robust trading relationships with major economic partners including the United States, China, and European Union nations, generating continuous demand for comprehensive cargo protection. The nation's export portfolio spanning automobiles, semiconductors, machinery, and precision equipment requires specialized insurance coverage addressing diverse transit risks across global shipping routes. Growing intra-Asian trade flows, facilitated by regional trade agreements and supply chain integration, are further amplifying cargo volumes requiring insurance protection. As businesses expand market reach and diversify sourcing strategies, the complexity of international logistics operations increases correspondingly, necessitating sophisticated coverage solutions that cargo insurers are well-positioned to provide.

Rising Awareness of Supply Chain Risk Management

Heightened awareness of supply chain vulnerabilities is driving increased adoption of cargo insurance across Japanese enterprises. Recent global disruptions have underscored the critical importance of protecting goods during transit against unforeseen events including natural disasters, geopolitical conflicts, and logistics bottlenecks. Businesses are increasingly recognizing cargo insurance as essential risk management infrastructure rather than discretionary expense. In January 2024, NorthStandard announced a collaboration with Tokio Marine to offer Japanese ship owners expanded insurance options through a new mutual P&I arrangement, reflecting industry efforts to address evolving risk management needs. Corporate governance reforms emphasizing comprehensive risk mitigation strategies are further encouraging enterprises to secure adequate cargo coverage as fundamental business practice.

Technological Advancement in Insurance Services

Technological advancement is catalyzing growth in Japan's cargo insurance market by enhancing service delivery efficiency and expanding coverage accessibility. Insurers are deploying artificial intelligence for risk assessment, blockchain for documentation management, and Internet of Things sensors for real-time cargo monitoring, creating value propositions that attract technology-conscious businesses. These innovations reduce administrative burdens, accelerate claims processing, and enable customized policy structures addressing specific cargo characteristics. Digital platforms complement traditional distribution channels, reaching new customer segments while improving service quality for existing clients seeking streamlined insurance experiences.

Market Restraints:

What Challenges the Japan Cargo Insurance Market is Facing?

Complex Regulatory and Compliance Requirements

Japan's cargo insurance market faces challenges from complex regulatory frameworks governing insurance operations and international trade activities. Compliance requirements spanning domestic insurance regulations, international maritime conventions, and cross-border trade documentation create administrative burdens for both insurers and policyholders. Navigating these multifaceted regulatory landscapes requires specialized expertise, potentially limiting market participation among smaller enterprises lacking dedicated compliance resources.

Competitive Pressure on Premium Rates

Intense competition among insurers creates downward pressure on premium rates, challenging market profitability. The abundance of capacity in the cargo insurance segment, combined with relatively favorable loss ratios in recent years, has intensified price competition. Insurers must balance competitive pricing with sustainable underwriting practices, potentially limiting investment in service enhancements and technological innovations that could otherwise accelerate market development.

Evolving Risk Landscapes and Climate Uncertainty

The cargo insurance market contends with evolving risk landscapes including climate-related weather events and geopolitical uncertainties affecting global shipping routes. Increasing frequency of typhoons, port congestion issues, and supply chain disruptions create underwriting challenges requiring sophisticated risk modeling capabilities. Insurers must continuously adapt coverage frameworks and pricing methodologies to address these dynamic risk factors while maintaining adequate protection for policyholders.

Competitive Landscape:

The Japan cargo insurance market features a concentrated competitive structure. Established players leverage extensive distribution networks, comprehensive product portfolios, and substantial financial resources to maintain competitive positions. Competition is increasingly focused on technological innovation, service quality differentiation, and specialized coverage development. International insurers and brokers are expanding presence in Japan following regulatory shifts, introducing fresh competitive dynamics. Strategic partnerships between domestic carriers and global reinsurers enhance capacity and risk management capabilities. Market participants are investing in digital transformation initiatives, sustainable underwriting practices, and customer experience enhancements to secure competitive advantages in the evolving landscape.

Japan Cargo Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Air Cargo, Land Cargo, Marine Cargo |

| Distribution Channels Covered | Direct Sales, Indirect Sales |

| End Users Covered | Traders, Cargo Owners, Ship Owners, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan cargo insurance market size was valued at USD 4,911.79 Million in 2025.

The Japan cargo insurance market is expected to grow at a compound annual growth rate of 4.00% from 2026-2034 to reach USD 6,990.71 Million by 2034.

Marine cargo dominated the market with a share of 69%, driven by Japan's island geography and heavy reliance on maritime routes for international trade, with major ports handling substantial cargo volumes requiring comprehensive seaborne coverage.

Key factors driving the Japan cargo insurance market include expansion of international trade activities, rising awareness of supply chain risk management, technological advancement in insurance services, growing e-commerce cross-border transactions, and regulatory emphasis on corporate risk mitigation.

Major challenges include complex regulatory and compliance requirements, competitive pressure on premium rates, evolving risk landscapes from climate uncertainty and geopolitical tensions, attritional claim concerns, and the need for continuous technological investment to meet customer expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)