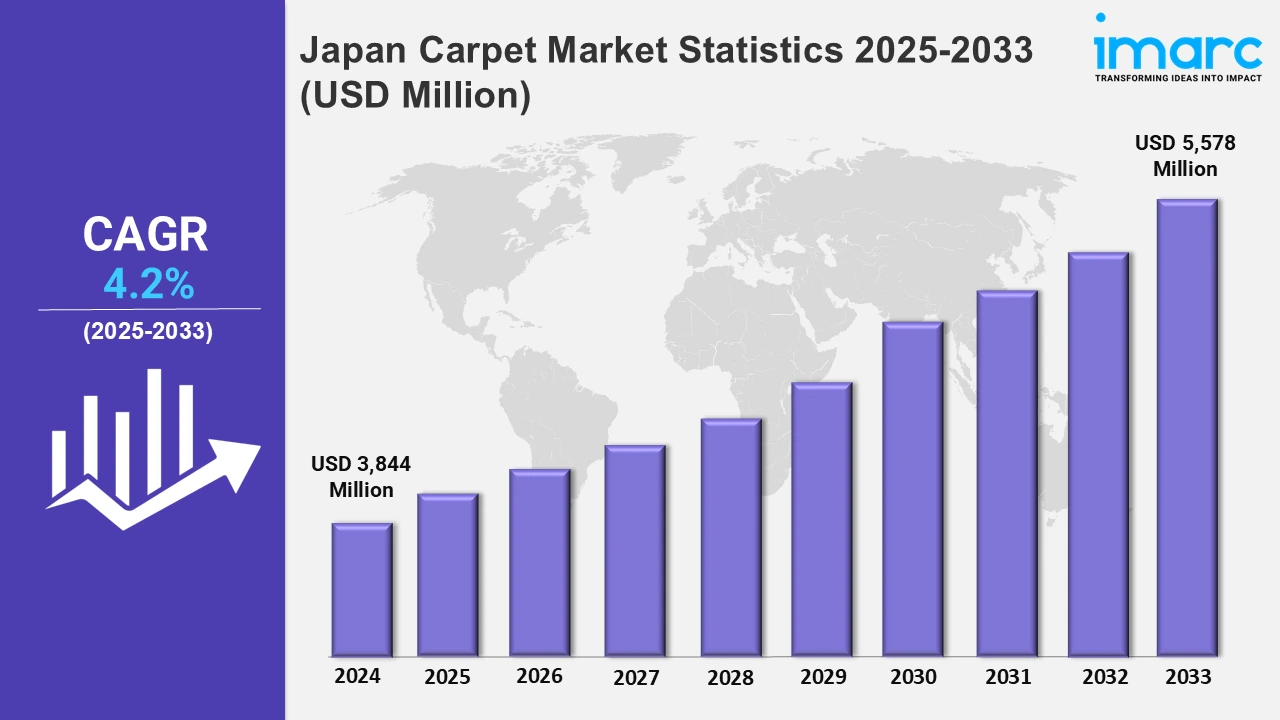

Japan Carpet Market Expected to Reach USD 5,578 Million by 2033 - IMARC Group

Japan Carpet Market Statistics, Outlook and Regional Analysis 2025-2033

The Japan carpet market size was valued at USD 3,844 Million in 2024, and it is expected to reach USD 5,578 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% from 2025 to 2033.

To get more information on this market, Request Sample

The Japanese carpet market is witnessing significant growth, driven by the rising demand for innovative, sustainable, and culturally diverse products. This trend aligns with the country's commitment to blending traditional craftsmanship with modern design techniques. Additionally, increased investments in research and development by Japanese manufacturers are fostering the introduction of unique and eco-friendly carpets, catering to domestic and international consumers. The growing appreciation for environmentally sustainable materials is further bolstering the adoption of Japanese carpets in markets. For instance, the emphasis on sustainability has resulted in the use of materials like washi paper and bamboo, reflecting a fusion of heritage and innovation. This aligns with the rising preference for designs that harmonize with nature and tradition. For example, in May 2024, Kambe Co launched tatami prayer mats made from water-repellent washi paper, designed to serve Muslim communities. These mats, symbolizing cultural integration, are set to be showcased at the 2025 Osaka-Kansai Expo, highlighting Japanese craftsmanship and innovation in carpet applications.

Similarly, in April 2024, Issey Miyake unveiled bamboo skewer carpets during Milan Design Week, showcasing hand-dyed, sustainable designs. These carpets emphasized Japanese expertise in blending traditional artistry with modern abstraction, further strengthening Japan’s influence in the carpet and design markets. Moreover, Japan's active participation in trade flows is a key driver for the carpet market's expansion. The country’s demand for high-quality, culturally diverse carpets fosters robust trade relationships, particularly with countries like Iran, known for its premium-quality rugs. According to a report published by TrendEconomy in November 2024, Japan accounted for 2.67% of global carpet imports in 2023, with a value of USD 22 million. Imports from Iran alone amounted to USD 15.4 million, representing 1.83% of carpet imports. This underscores the country’s strategic role in international carpet trade, driven by its demand for premium, culturally significant products, contributing to the growth of both its domestic market and its trade network.

Japan Carpet Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region. Increased home decor interest, commercial applications, environmental focus, technological innovation, customization trends, hygiene priorities, and supportive government initiatives drive growing demand for carpets.

Kanto Region Carpet Market Trends:

The Kanto region leads Japan's carpet market due to its dense urbanization. High demand for premium, eco-friendly carpets exists, driven by luxury housing and office spaces. The trend emphasizes soundproofing and aesthetic designs. In Tokyo, companies like Suminoe Textile cater to this demand with innovative products like antibacterial carpets. The market also shows rising interest in modular tiles for flexible interiors, aligning with the region's dynamic real estate needs.

Kinki Region Carpet Market Trends:

In the Kinki region carpets with traditional Japanese motifs are prominent. High-end hospitality and cultural centers favor custom-designed rugs for tatami rooms and event halls. Local vendors specialize in durable, stain-resistant carpets tailored for high-footfall areas. For instance, Osaka's Kansai International Airport adopted eco-friendly carpets to improve aesthetic appeal and functionality. The market also sees demand for fire-resistant materials in commercial installations.

Central/Chubu Region Carpet Market Trends:

The Chubu region has a strong focus on automotive carpeting due to the presence of companies like Toyota. Lightweight, durable materials dominate as manufacturers prioritize energy efficiency and comfort. Residential carpets with insulating properties also gain traction, especially in Nagoya's colder areas. Companies are innovating with recycled materials to align with green energy initiatives. This dual focus on automotive and home carpets shapes Chubu's market significantly.

Kyushu-Okinawa Region Carpet Market Trends:

In Kyushu-Okinawa, tropical weather influences preferences for moisture-resistant and anti-mold carpets. Okinawa favors coastal designs with lightweight, breathable materials for resorts. Residential buyers in Fukuoka focus on carpets offering thermal comfort during humid summers and mild winters. Companies incorporate materials like polypropylene for durability and water resistance. For example, Ryukyu-inspired woven mats remain a niche but growing segment, reflecting the region's cultural and climatic uniqueness.

Tohoku Region Carpet Market Trends:

Tohoku, known for its cold winters, emphasizes insulated, heat-retaining carpets. Homeowners in Sendai often prefer thick wool carpets to combat low temperatures. Demand for underfloor heating-compatible carpets is growing, enhancing comfort in harsh winters. Suppliers focus on plush, warm materials to serve residential needs. For example, locally sourced wool carpets from Iwate attract eco-conscious consumers seeking sustainable and thermally efficient solutions for energy-saving purposes.

Chugoku Region Carpet Market Trends:

The Chugoku region, including Hiroshima, leans toward carpets for public spaces like museums and schools. Durability and easy maintenance are key factors, especially for high-traffic areas. Hiroshima's Peace Memorial Museum features custom carpets to complement its solemn environment. The market also sees demand for flame-retardant carpets in industrial zones. Innovations like anti-static carpets cater to the electronics industry, which is prominent in this region.

Hokkaido Region Carpet Market Trends:

Hokkaido's extreme winters drive demand for carpets with superior insulation and moisture resistance. In Sapporo, thick pile carpets are favored for warmth and comfort. Anti-slip carpets are also popular due to icy conditions. Suppliers like Nichibei focus on products blending synthetic and natural fibers to balance durability and insulation. Demand spikes for carpets compatible with underfloor heating systems, catering to the region's focus on energy efficiency in residential spaces.

Shikoku Region Carpet Market Trends:

In Shikoku, including Kagawa, demand for lightweight, easy-to-clean carpets prevails due to its milder climate and rural lifestyle. Mats with natural fibers like jute are popular for their affordability and eco-friendliness. The market also caters to small-scale agricultural and home office spaces requiring practical, cost-effective solutions. For instance, locally made woven carpets with regional motifs reflect the cultural heritage while aligning with modern, minimalist designs preferred by buyers.

Top Companies Leading in the Japan Carpet Industry

The report offers an in-depth study of the Japanese carpet market, examining market structure, major market players, and strategic positioning. It highlights the top strategies employed by leading companies such as Oriental Weavers Japan, thereby showcasing their market dominance and unique approaches. The analysis company evaluation quadrant to assess market performance and a competitive dashboard. Further, the report provides detailed profiles of prominent companies, shedding light on their product offerings and growth tactics in Japan’s carpet industry.

Japan Carpet Market Segmentation Coverage

- On the basis of the material, the market has been bifurcated into nylon, olefin, polyester, and others. They are common synthetic fibers used in carpets, each offering distinct qualities such as durability, stain resistance, and ease of maintenance, making them popular choices for both residential and commercial spaces.

- Based on the price point, the market is categorized into economy and luxury. Carpets range from economical options for budget-conscious buyers to luxurious, high-end designs offering superior comfort, style, and quality, with varying price points to suit different consumer preferences and needs.

- On the basis of the sales channel, the market has been divided into supermarkets and hypermarkets, specialty stores, and online stores. Carpets are available in these channels, thereby offering a wide variety of styles, colors, and materials, catering to both convenience shoppers and those seeking specific or premium selections.

- Based on the end user, the market is categorized into residential and commercial. Carpets are used in both residential and commercial spaces, with residential carpets focused on comfort and aesthetics. In contrast, commercial carpets prioritize durability, stain resistance, and maintenance ease, designed to withstand high foot traffic in office and retail environments.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3,844 Million |

| Market Forecast in 2033 | USD 5,578 Million |

| Market Growth Rate 2025-2033 | 4.2% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Materials Covered | Nylon, Olefin, Polyester, Others |

| Price Points Covered | Economy, Luxury |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores |

| End Users Covered | Residential, Commercial |

| Regions Covered | Kanto Region, Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Carpet Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)