Japan Casting and Forging Market Size, Share, Trends and Forecast by Component Type, Material Type, Manufacturing Process, Sales Channel, and Region, 2026-2034

Japan Casting and Forging Market Overview:

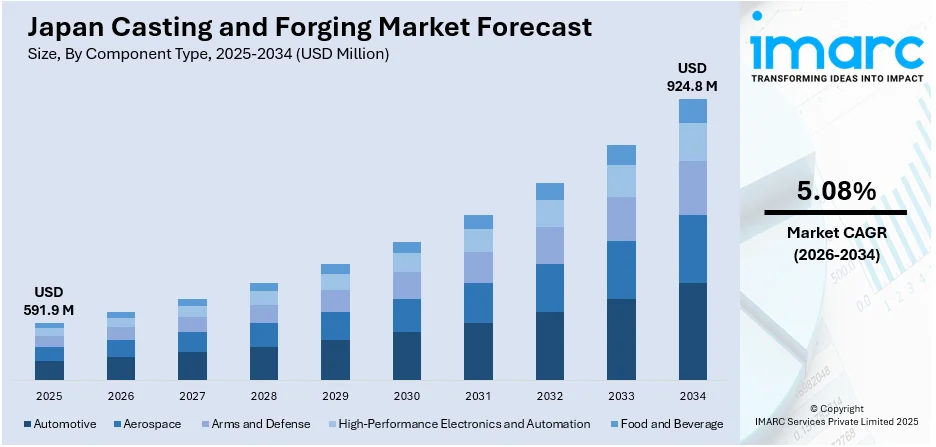

The Japan casting and forging market size reached USD 591.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 924.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.08% during 2026-2034. Robust demand from automotive, aerospace, and industrial machinery sectors, technological advancements in casting and forging processes, the growth of electric vehicles, and increasing investments in infrastructure development and manufacturing innovation are some of the factors contributing to Japan casting and forging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 591.9 Million |

| Market Forecast in 2034 | USD 924.8 Million |

| Market Growth Rate 2026-2034 | 5.08% |

Japan Casting and Forging Market Trends:

Adoption of Advanced Machinery for Precision and Efficiency in Forging

The Japanese casting and forging industry is witnessing a shift towards adopting state-of-the-art machinery to meet the growing demand for high-precision components. A recent investment in a radial-axial ring rolling machine signifies a move towards enhancing production capabilities for large, energy-efficient rings. This cutting-edge technology allows manufacturers to achieve higher accuracy in the forging process, producing components that meet the stringent requirements of industries like automotive, aerospace, and oil and gas. These industries are increasingly demanding components that offer superior strength, lightweight properties, and energy efficiency, driving the need for advanced forging solutions. By upgrading equipment, manufacturers are not only increasing the scale of their operations but also improving their ability to produce complex, high-performance parts with lower energy consumption. The focus on energy efficiency is particularly significant as companies aim to reduce their environmental footprint while maintaining high productivity. The move reflects a broader industry shift towards automation, with machines designed for both precision and cost-effective energy use, positioning Japan’s forging sector as a leader in the global market for industrial components. These factors are intensifying the Japan casting and forging market growth. For example, in June 2024, the National Road Safety Data Hub emphasized the importance of safe vehicles in Japan's goal to eliminate road fatalities and serious injuries by 2030. Advanced safety systems, including traction control, are critical components in achieving this objective.

To get more information on this market Request Sample

Expansion in Forging Capabilities for Larger and Energy-Efficient Rings

In recent developments within Japan's forging sector, companies are increasingly investing in advanced machinery to enhance production capacity. Notably, the acquisition of a radial-axial ring rolling machine marks a significant step in meeting the rising demand for larger, energy-efficient rings, especially in industries such as automotive, aerospace, and oil and gas. These advanced machines facilitate the production of high-quality rings with improved energy efficiency, aligning with global industry requirements for sustainability and performance. The integration of cutting-edge technology into forging operations not only boosts manufacturing capacity but also positions companies to better compete in high-demand markets, driving further growth and technological evolution within Japan’s casting and forging market. This move also underscores the ongoing shift towards automation and energy-efficient solutions as core pillars of manufacturing processes, addressing both environmental concerns and production scalability. For instance, in April 2023, Ohmi Press Works and Forging, a Japanese forging company, ordered a RAW 500/400-4500/800 EH radial-axial ring rolling machine from SMS Group, marking its sixth purchase from the supplier. The new machine expanded Ohmi's capacity to produce larger, energy-efficient rings for industries like automotive, aerospace, and oil and gas.

Japan Casting and Forging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on component type, material type, manufacturing process, and sales channel.

Component Type Insights:

- Automotive

- Engine Components

- Transmission Components

- Structural Components

- Suspension Components

- Exhaust System Components

- Powertrain Components

- Interior Components

- Exterior Components

- Others

- Aerospace

- Safety Critical Structural Parts

- Non-Safety Critical Parts

- Arms and Defense

- Mobility

- Arms and Gear

- High-Performance Electronics and Automation

- Heat Management

- Electronic-Housings

- Automation Structural Parts

- Food and Beverage

- Structural Components

- Functional Components

The report has provided a detailed breakup and analysis of the market based on the component type. This includes automotive (engine components, transmission components, structural components, suspension components, exhaust system components, powertrain components, interior components, exterior components, and others), aerospace (safety critical structural parts and non-safety critical parts), arms and defense (mobility and arms and gear), high-performance electronics and automation (heat management, electronic housings, and automation structural parts), and food and beverage (structural and functional components).

Material Type Insights:

- Aluminum Alloy 2xxx Series

- Aluminum Alloy 3xxx Series

- Aluminum Alloy 5xxx Series

- Aluminum Alloy 6xxx Series

- Aluminum Alloy 7xxx Series

The report has provided a detailed breakup and analysis of the market based on the material type. This includes aluminum alloy 2xxx series, aluminum alloy 3xxx series, aluminum alloy 5xxx series, aluminum alloy 6xxx series, and aluminum alloy 7xxx series.

Manufacturing Process Insights:

- Casting Process

- Sand Casting

- Die Casting

- High Pressure Die Casting

- Others

- Forging Process

- Open Die Forging

- Closed Die Forging

- Upset Forging

- Precision Forging

- Rheocasting Process

- Others

The report has provided a detailed breakup and analysis of the market based on the manufacturing process. This includes casting process (sand casting, die casting, high pressure die casting, and others), forging process (open die forging, closed die forging, upset forging, and precision forging), rheocasting process, and others.

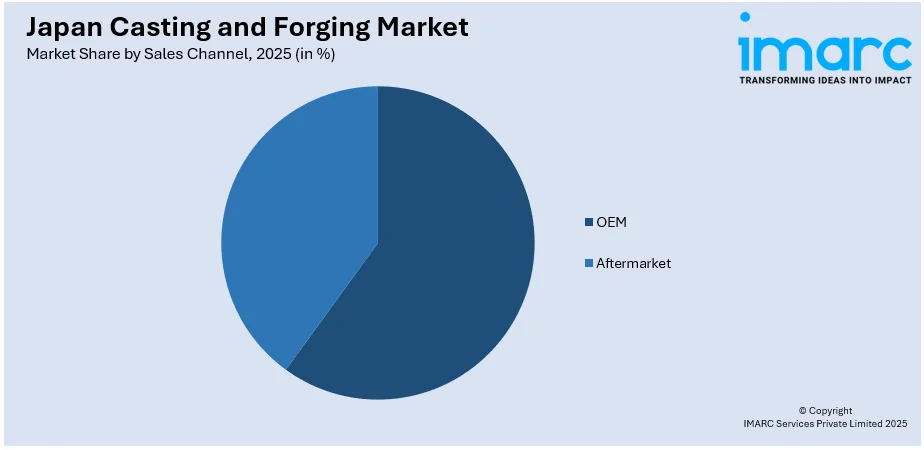

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes OEM and aftermarket.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Casting and Forging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered |

|

| Material Types Covered | Aluminium Alloy 2xxx Series, Aluminium Alloy 3xxx Series, Aluminium Alloy 5xxx Series, Aluminium Alloy 6xxx Series, Aluminium Alloy 7xxx Series |

| Manufacturing Processes Covered |

|

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan casting and forging market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan casting and forging market on the basis of component type?

- What is the breakup of the Japan casting and forging market on the basis of material type?

- What is the breakup of the Japan casting and forging market on the basis of manufacturing process?

- What is the breakup of the Japan casting and forging market on the basis of sales channel?

- What is the breakup of the Japan casting and forging market on the basis of region?

- What are the various stages in the value chain of the Japan casting and forging market?

- What are the key driving factors and challenges in the Japan casting and forging market?

- What is the structure of the Japan casting and forging market and who are the key players?

- What is the degree of competition in the Japan casting and forging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan casting and forging market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan casting and forging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan casting and forging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)