Japan CCTV Market Size, Share, Trends and Forecast by Type, End User, and Region, 2026-2034

Japan CCTV Market Overview:

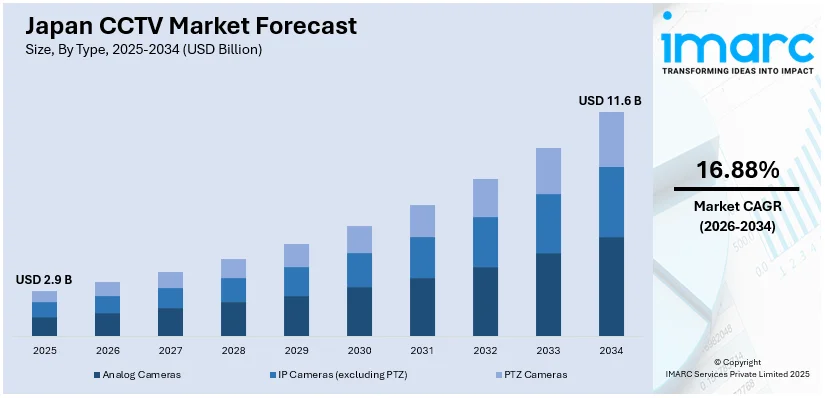

The Japan CCTV market size reached USD 2.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.6 Billion by 2034, exhibiting a growth rate (CAGR) of 16.88% during 2026-2034. The market is fueled by increased public security needs, introduction of new technologies, and heightened demand for effective urban management. AI integration and smart analytics improving the efficiency of the system, facilitating real-time observation and crowd management has also increased the installation of CCTVs across the country. Government efforts for smart city advancement, where surveillance is made a prime facilitator of monitoring Japan's multifaceted and aging infrastructure, further increases the Japan CCTV market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.9 Billion |

| Market Forecast in 2034 | USD 11.6 Billion |

| Market Growth Rate 2026-2034 | 16.88% |

Japan CCTV Market Trends:

Growing Role of CCTV in Aging Society

The rapidly aging population Japan is primarily shaping the development of its CCTV market. With a large percentage of citizens aged 65 and older, surveillance technologies are being modified to enable public security in a distinct environment. Governments and private companies are using CCTV systems for conventional crime protection, and also to observe and protect susceptible old citizens. For instance, some areas are testing AI-based surveillance which can detect wandering behavior typical of dementia patients and alert families or the emergency services. Such efforts are most active in suburban and rural communities where aging is more severe. CCTV is also being applied in care homes for the elderly to provide security and always enhance the quality of care without physical monitoring. This change is an indicator of Japan's pioneering application of surveillance technology to meet demographic challenges, hinting at a unique market trend characterized by the nation's societal determinants and devotion to caregiving and public health.

To get more information on this market Request Sample

Sophisticated Surveillance in Urban Transport Networks

Japan's nationwide and effective public transportation network has also emerged as a key deployment ground for sophisticated CCTV technology. In cities such as Tokyo, Osaka, and Yokohama, high-definition cameras are mounted along train stations, subway stations, and bus terminals to promote commuter safety and efficient operations. AI is deployed in CCTV systems as well to track crowd concentration, identify suspicious behavior, and alert the authorities in real time. This is especially crucial during national events, festive seasons, or peak traffic periods when public safety threats multiply. Japan's focus on timeliness and operational efficiency in transport makes monitoring an essential instrument for security, and for logistics control. With cities seeking to be smarter and more responsive, video monitoring is being combined with data analysis to yield actionable insights for city planners and law enforcers. These urban deployments are a significant trend in the Japanese CCTV market, which overlap with security, efficiency, and smart city objectives, further propelling the Japan CCTV market growth.

Privacy-Conscious Implementation and Regulatory Balance

Although Japan has adopted CCTV technology, it retains a culturally nuanced attitude toward privacy and surveillance. In contrast to some parts of the world where mass surveillance would be subject to minimal resistance, Japanese society strongly values personal privacy and mutual trust within society. This cultural context determines how and where CCTV systems are deployed. Surveillance is usually narrowly applied to areas of public necessity, e.g., transportation, business districts, and key infrastructure, taking care not to intrude into residential or private spaces. Most municipalities release public information about location and camera use policies. Japan also enforces rigorous regulations on data retention and use, preventing video recording from being abused or kept for longer than an optimum period. Such practices drive product design and vendor strategy, preferring systems that meet local regulations and societal norms. Therefore, one characterizing trend in Japan's CCTV industry is the attempt to reconcile technological innovation with ethical obligation and regulatory adherence.

Japan CCTV Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Government

- Industrial

- BFSI

- Transportation

- Others

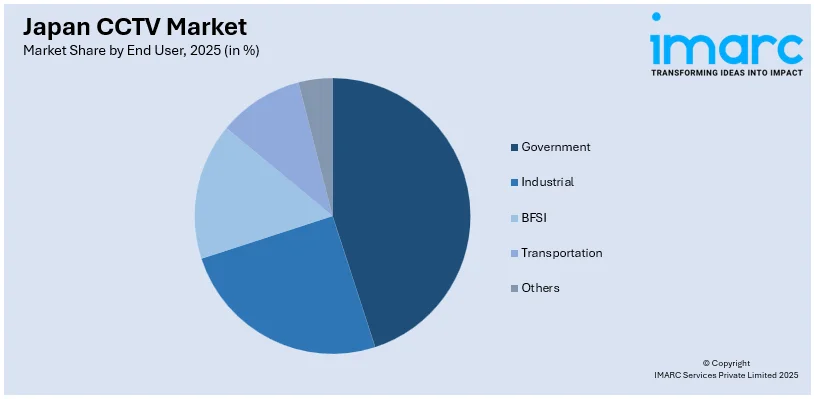

The report has provided a detailed breakup and analysis of the market based on the end user. This includes government, industrial, BFSI, transportation, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central /Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan CCTV Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (Excluding PTZ), PTZ Cameras |

| End Users Covered | Government, Industrial, BFSI, Transportation, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan CCTV market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan CCTV market on the basis of type?

- What is the breakup of the Japan CCTV market on the basis of end user?

- What is the breakup of the Japan CCTV market on the basis of region?

- What are the various stages in the value chain of the Japan CCTV market?

- What are the key driving factors and challenges in the Japan CCTV market?

- What is the structure of the Japan CCTV market and who are the key players?

- What is the degree of competition in the Japan CCTV market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan CCTV market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan CCTV market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan CCTV industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)