Japan Cement Additives Market Size, Share, Trends and Forecast by Type, Function, and Region, 2026-2034

Japan Cement Additives Market Summary:

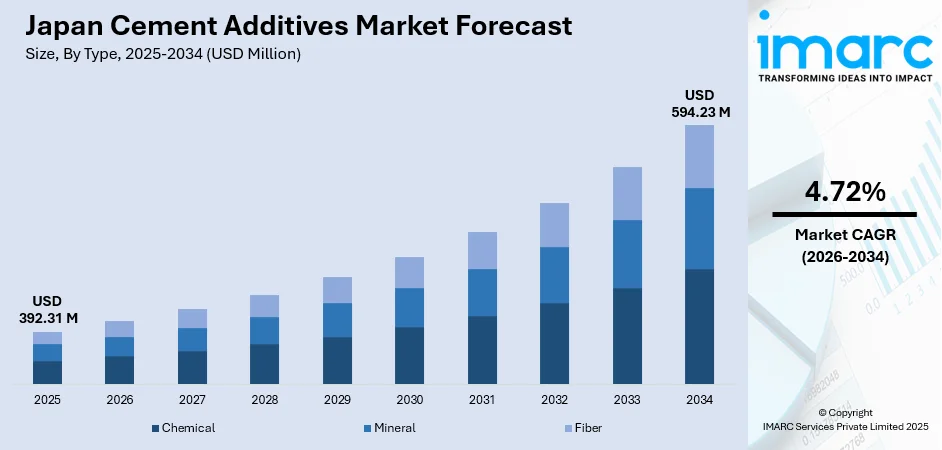

The Japan cement additives market size was valued at USD 392.31 Million in 2025 and is projected to reach USD 594.23 Million by 2034, growing at a compound annual growth rate of 4.72% from 2026-2034.

The market is driven by extensive infrastructure development, stringent earthquake-resistant construction regulations, and a growing focus on sustainable and eco-friendly building practices. Rising adoption of high-performance concrete in seismic retrofitting, along with urban renewal initiatives and expansion of transportation networks, is increasing demand for advanced cement additives that improve durability, workability, and structural longevity. These trends, coupled with the need for innovative solutions in modern construction, are contributing significantly to the growth and Japan cement additives market share.

Key Takeaways and Insights:

- By Type: Chemical dominates the market with a share of 55% in 2025, driven by their superior performance in enhancing concrete workability, durability, and resistance to environmental degradation in Japan's demanding construction environment.

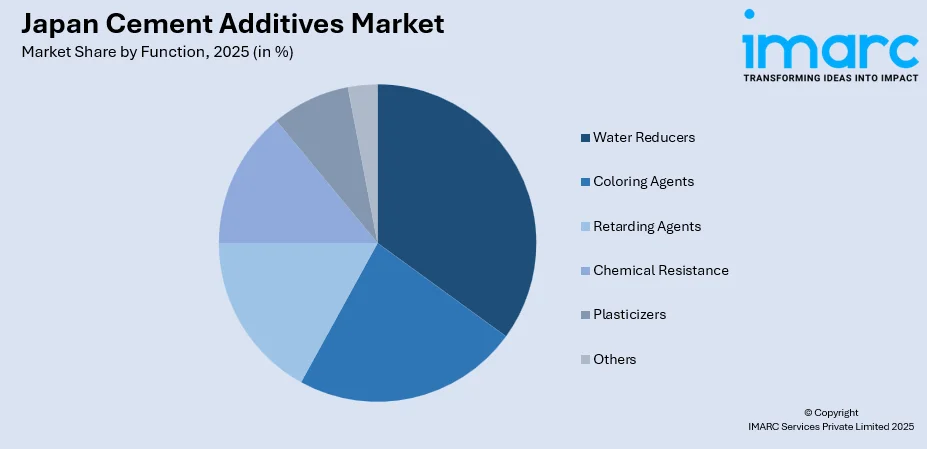

- By Function: Water Reducers lead the market with a share of 30% in 2025, owing to their critical role in producing high-strength concrete with reduced water content while maintaining optimal workability for complex structural applications.

- Key Players: The Japan cement additives market is competitive, with global chemical giants and domestic specialty manufacturers driving innovation in sustainable, high-performance additive solutions, enhancing concrete durability, workability, and supporting modern construction demands across infrastructure and urban development projects.

To get more information on this market Request Sample

The market is driven by substantial infrastructure development initiatives, increasing adoption of modular and prefabricated construction methods, and heightened demand for specialized concrete formulations in seismic-resistant applications. As per sources, in April 2025, Japan announced plans to invest over 20 trillion yen from fiscal 2026 to enhance resilience against natural disasters, upgrade aging infrastructure, and strengthen earthquake preparedness. Japan's construction sector prioritizes enhanced durability, workability, and structural resilience, fueling demand for advanced additive solutions. Growing emphasis on sustainable building practices and the renovation of aging infrastructure further accelerates market expansion. These factors collectively contribute to the expanding Japan cement additives market share.

Japan Cement Additives Market Trends:

Adoption of Seismic-Resilient Concrete Formulations

Japan's susceptibility to earthquakes has intensified focus on developing specialized concrete formulations with enhanced flexibility and resistance to structural failure. Construction professionals increasingly incorporate advanced cement additives designed to improve concrete elasticity and crack resistance under seismic stress. In May 2024, Sika provided concrete admixtures for Japan’s tallest Azabudai Hills Mori JP Tower, reinforcing foundations and steel tubes to improve earthquake resistance and structural resilience. These formulations allow structures to absorb and dissipate energy during seismic events, minimizing damage and ensuring occupant safety. The trend encompasses both new construction projects and retrofitting existing infrastructure, with additives playing crucial roles in achieving required performance specifications. This emphasis on seismic resilience shapes product development priorities throughout the cement additives industry.

Integration of Sustainable and Low-Carbon Additive Solutions

Environmental consciousness within Japan's construction sector drives demand for cement additives that reduce carbon footprints while maintaining structural performance standards. Industry participants increasingly prioritize formulations incorporating supplementary cementitious materials that decrease clinker content and associated emissions. In April 2024, UBE Mitsubishi Cement and Shimizu Corporation developed eco-friendly concrete replacing 80% of cement with ground granulated blast furnace slag, cutting CO₂ emissions during production by 80%. Moreover, these sustainable solutions enable construction projects to meet stringent environmental regulations while achieving durability requirements. The trend extends beyond product composition to encompass manufacturing processes, with producers implementing cleaner production technologies. This sustainability focus aligns with Japan's broader environmental commitments and influences procurement decisions across public and private construction projects.

Advancement in High-Performance Specialty Applications

The growing complexity of construction projects in Japan necessitates increasingly sophisticated cement additive solutions tailored for specialty applications. High-rise construction, marine infrastructure, and underground facilities require formulations delivering exceptional resistance to environmental stressors including moisture penetration, chemical exposure, and extreme temperatures. Additive manufacturers respond by developing innovative products addressing specific performance requirements across diverse application environments. In March 2025, Kajima deployed a fully automated tunnel lining concrete pouring system using on-site high-fluidity concrete with newly developed admixtures, improving productivity, quality, and reducing labor requirements. Further, this specialization trend reflects the construction industry's evolution toward more demanding structural specifications and longer service life expectations. The emphasis on performance optimization drives continuous research and development efforts throughout the supply chain.

Market Outlook 2026-2034:

The Japan cement additives market demonstrates sustained growth potential through the forecast period, supported by ongoing infrastructure modernization and expanding construction activities nationwide. Market revenue is projected to experience steady expansion as demand intensifies for high-performance concrete solutions across residential, commercial, and industrial segments. The increasing complexity of construction projects combined with stringent quality requirements positions cement additives as essential components within Japan's building materials landscape. Infrastructure renewal programs addressing aging transportation networks and public facilities generate consistent demand for advanced additive formulations. The market generated a revenue of USD 392.31 Million in 2025 and is projected to reach a revenue of USD 594.23 Million by 2034, growing at a compound annual growth rate of 4.72% from 2026-2034.

Japan Cement Additives Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Chemical | 55% |

| Function | Water Reducers | 30% |

Type Insights:

- Chemical

- Mineral

- Fiber

The chemical dominates with a market share of 55% of the total Japan cement additives market in 2025.

Chemical additives represent the dominant segment within Japan's cement additives market, holding the largest revenue share across all types. These additives include a wide range of formulations designed to modify cement and concrete properties during production and application. Their popularity is driven by proven effectiveness in enhancing workability, controlling setting times, and improving final product performance, making them essential in both large-scale infrastructure and specialized construction projects throughout Japan. In February 2024, the Japan Concrete Institute highlighted the effectiveness of chemical admixtures and shrinkage-reducing agents, reducing concrete drying shrinkage by 5–15% and enhancing durability in reinforced structures.

The segment's growth is further supported by the rising demand for performance-enhancing solutions tailored to complex construction challenges. Innovations in chemical additives are enabling better durability, reduced environmental impact, and improved compatibility with supplementary cementitious materials. Additionally, manufacturers increasingly focus on products that optimize energy efficiency, minimize material wastage, and meet evolving regulatory standards, positioning the chemical additives segment as a key driver of the Japan cement additives market.

Function Insights:

Access the Comprehensive Market Breakdown Request Sample

- Water Reducers

- Coloring Agents

- Retarding Agents

- Chemical Resistance

- Plasticizers

- Others

The water reducers lead with a share of 30% of the total Japan cement additives market in 2025.

Water reducers are the dominant functional segment in Japan’s cement additives market, enabling concrete mixtures with lower water content while maintaining or enhancing workability. Their use improves placement efficiency, reduces shrinkage, and supports faster construction timelines, making them vital for large-scale infrastructure projects. The growing emphasis on durable, high-performance concrete in urban redevelopment, transportation networks, and commercial construction further drives adoption of water-reducing additives across diverse applications.

Innovation in the water reducer segment focuses on environmentally friendly formulations and compatibility with supplementary cementitious materials such as fly ash and slag. In June 2024, Flowric Co., Ltd. launched high-performance water-reducing agents Flowric VP900K and Flowric VP900F in Japan, enhancing concrete workability and enabling efficient, low-cement, highly fluid concrete production. Advanced products enhance concrete pumpability, reduce segregation, and support energy-efficient curing processes. These improvements align with sustainability goals and stringent Japanese building codes, ensuring the functional segment maintains strong growth and continues to play a critical role in modern construction practices.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region, encompassing Tokyo and surrounding prefectures, drives demand for cement additives due to ongoing urban development, infrastructure expansion, and high-rise construction. Emphasis on sustainability encourages use of additives enhancing concrete durability, workability, and energy efficiency, aligning with environmentally conscious building practices in this economically dynamic area.

Kansai/Kinki Region, including Osaka, Kyoto, and Kobe, witnesses steady growth in cement additives usage. Regional construction emphasizes retrofitting, high-quality commercial buildings, and resilient infrastructure projects. Innovative additives improving concrete strength, setting time, and environmental compliance are favored, reflecting focus on heritage preservation, earthquake-resistant structures, and modernization of urban centers.

Central/Chubu Region, a key industrial hub including Nagoya, experiences demand for cement additives driven by heavy industry, transport infrastructure, and urban residential projects. Additives improving workability, setting efficiency, and durability are valued, supporting large-scale construction while promoting sustainable practices. The region balances industrial growth with ecological awareness in material selection.

Kyushu-Okinawa Region’s construction sector focuses on coastal infrastructure, disaster-resistant buildings, and urban expansion. Cement additives enhancing corrosion resistance, workability, and longevity are in demand, supporting resilience against typhoons and humidity. Sustainable construction practices and innovative material solutions are increasingly incorporated in public and private projects across this region.

Tohoku Region’s post-disaster reconstruction and infrastructure development fuel demand for cement additives that improve concrete strength and durability. Focus on earthquake-resistant structures, thermal efficiency, and environmental compliance encourages adoption of high-performance additives. Regional projects balance modernization with resilience, emphasizing long-term structural stability and sustainable construction practices.

Chugoku Region, with cities like Hiroshima and Okayama, emphasizes industrial facilities, residential projects, and transport infrastructure. Cement additives improving concrete longevity, workability, and environmental efficiency are preferred. Regional construction balances economic growth with disaster resilience and sustainability, promoting innovative additive solutions that enhance structural performance while supporting eco-friendly building practices.

Hokkaido Region’s cold climate and snowfall necessitate cement additives that enhance freeze-thaw resistance, durability, and workability. Infrastructure and residential construction demand additives that ensure long-lasting concrete performance in extreme weather. Sustainable and efficient building materials are prioritized to support energy-conscious and resilient construction practices throughout this northern region.

Shikoku Region’s construction sector focuses on rural infrastructure, urban housing, and industrial facilities. Cement additives enhancing concrete strength, longevity, and workability are preferred to meet regional development needs. Sustainability, disaster resilience, and cost-efficiency drive adoption, while local projects incorporate innovative materials supporting modern construction standards and environmentally responsible practices.

Market Dynamics:

Growth Drivers:

Why is the Japan Cement Additives Market Growing?

Expanding Infrastructure Renewal and Development Programs

Japan's commitment to modernizing aging infrastructure generates substantial demand for cement additives across transportation, utilities, and public facilities sectors. According to sources, in June 2025, Japan approved a $139 billion, five-year plan to modernize aging infrastructure, focusing on bridges, sewer systems, flood defenses, and disaster preparedness through 2030. Furthermore, government initiatives prioritize upgrading roads, bridges, tunnels, and public buildings that have reached or exceeded their designed service lives. These renewal programs necessitate advanced concrete formulations capable of delivering enhanced durability and extended operational lifespans under demanding service conditions. Cement additives enable contractors to achieve specified performance requirements while maintaining construction efficiency and cost-effectiveness. The scale and scope of infrastructure investments ensure sustained market growth as projects progress through planning, construction, and completion phases over extended timeframes.

Rising Demand for Earthquake-Resistant Construction Materials

Japan's geographic location within an active seismic zone creates persistent demand for construction materials capable of withstanding earthquake forces. Building codes and construction standards mandate specific performance characteristics for structures in seismically active regions, driving adoption of specialized cement additives. In October 2024, Japanese startup Aster Co., Ltd. launched Aster Power Coating, a resin-based material that significantly enhances masonry walls’ earthquake resistance, already applied in Taiwan and tested for use in the Philippines. Moreover, these formulations enhance concrete flexibility, crack resistance, and energy absorption capabilities essential for structural survival during seismic events. The combination of regulatory requirements and public awareness regarding earthquake safety motivates consistent investment in enhanced construction materials. This seismic resilience imperative influences material selection across residential, commercial, and infrastructure projects throughout Japan.

Growth in Modular and Prefabricated Construction Methods

The expanding adoption of modular and prefabricated construction techniques stimulates demand for specialized cement additive formulations. As per sources, in July 2025, Japan’s prefabricated construction market was projected to reach JPY 5.46 trillion by 2029, supported by government initiatives, carbon-reduction mandates, and rising demand across residential and infrastructure sectors. These construction methods require concrete components that cure rapidly, maintain dimensional stability during transportation, and achieve specified strength characteristics efficiently. Cement additives enable manufacturers to optimize formulations for off-site production environments while ensuring consistent quality across high-volume manufacturing operations. The modular construction sector's growth trajectory reflects broader industry trends toward increased efficiency, reduced waste, and shortened project timelines. This construction methodology evolution positions cement additives as essential enabling materials supporting modern building practices.

Market Restraints:

What Challenges the Japan Cement Additives Market is Facing?

Fluctuations in Raw Material Availability and Pricing

The cement additives market faces ongoing exposure to volatility in raw material supply chains and associated pricing fluctuations. Key ingredients utilized in additive formulations depend upon diverse sourcing arrangements subject to disruption from various factors including production constraints, logistics challenges, and demand variations across industries. These supply uncertainties complicate procurement planning and cost management for manufacturers and end-users. Market participants must navigate pricing volatility while maintaining product quality and competitive positioning.

Complexity of Meeting Diverse Performance Specifications

Construction projects increasingly specify customized concrete performance requirements that challenge standard additive formulations. Meeting diverse specifications across different applications, environmental conditions, and regulatory frameworks necessitates extensive product portfolios and technical expertise. Smaller market participants may struggle to develop and maintain comprehensive product ranges addressing specialized requirements. This complexity creates barriers to market entry and constrains growth opportunities for manufacturers lacking resources for extensive research and development activities.

Environmental and Regulatory Compliance Requirements

Stringent environmental regulations governing chemical product formulations and manufacturing processes impose compliance burdens on cement additive producers. Requirements addressing emissions, waste management, and product safety necessitate ongoing investments in environmental controls and documentation systems. Regulatory frameworks continue evolving as authorities implement more demanding environmental standards, requiring manufacturers to anticipate and adapt to changing requirements. These compliance obligations add operational complexity and costs that potentially constrain market expansion.

Competitive Landscape:

The Japan cement additives market exhibits a moderately consolidated competitive structure characterized by established domestic manufacturers operating alongside international specialty chemical producers. Market participants compete across multiple dimensions including product performance, technical support capabilities, pricing strategies, and distribution network coverage. Innovation drives competitive differentiation as participants invest in research and development activities targeting emerging application requirements and sustainability objectives. The market demonstrates consistent demand patterns supporting stable competitive dynamics, though participants continuously seek opportunities for market share expansion through product enhancements and customer relationship development. Technical expertise and application knowledge represent critical competitive assets, enabling suppliers to provide value-added services beyond product supply. Industry participants increasingly emphasize sustainability credentials and environmental performance as competitive differentiators.

Recent Developments:

- In February 2024, Sika strengthened its presence in Japan through acquisitions, including MBCC, and launched an R&D center focused on ultra-high-strength concrete. This facility enables the development of customized admixtures for seismic-resistant and high-performance construction, supporting infrastructure, high-rise, and civil engineering projects nationwide.

Japan Cement Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chemical, Mineral, Fiber |

| Functions Covered | Water Reducers, Coloring Agents, Retarding Agents, Chemical Resistance, Plasticizers, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan cement additives market size was valued at USD 392.31 Million in 2025.

The Japan cement additives market is expected to grow at a compound annual growth rate of 4.72% from 2026-2034 to reach USD 594.23 Million by 2034.

Chemical dominates the market, enhancing concrete performance, improving workability, controlling setting times, and enabling tailored solutions for diverse construction projects, making them essential for modern infrastructure, commercial developments, and specialized building applications.

Key factors driving the market include expanding infrastructure development initiatives, growing demand for seismic-resistant construction materials, rising adoption of modular and prefabricated construction methods, and increasing emphasis on sustainable building practices.

Major challenges include raw material price volatility and supply chain uncertainties, complexity of meeting diverse performance specifications across applications, stringent environmental and regulatory compliance requirements, skilled labor shortages in the construction industry, and competition from alternative construction materials and methodologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)