Japan Children's Entertainment Centers Market Size, Share, Trends and Forecast by Visitor Demographics, Facility Size, Revenue Source, Activity Area, and Region, 2026-2034

Japan Children's Entertainment Centers Market Summary:

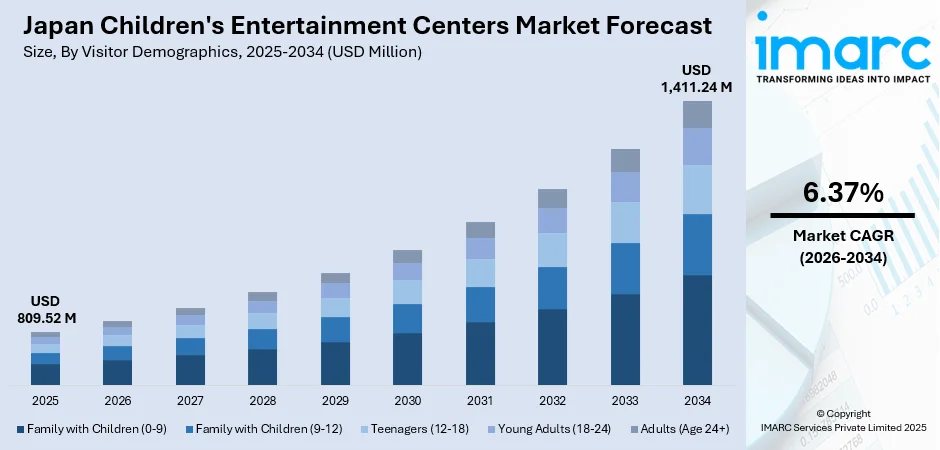

The Japan children's entertainment centers market size was valued at USD 809.52 Million in 2025 and is projected to reach USD 1,411.24 Million by 2034, expanding at a compound annual growth rate of 6.37% from 2026-2034.

The market expansion is driven by rising consumer preferences for experiential family entertainment, technological integration in entertainment offerings, and the increasing popularity of arcade-based gaming and interactive play zones among younger demographics. Japan's strong cultural affinity for gaming, coupled with its advanced technological infrastructure, continues to support robust demand for children's entertainment facilities across urban and suburban regions, contributing to the Japan children's entertainment centers market share.

Key Takeaways and Insights:

-

By Visitor Demographics: Teenagers (12-18) dominate the market with a share of 41.0% in 2025, driven by their strong engagement with competitive gaming formats, music and rhythm games, and immersive digital experiences that resonate with Japan's arcade gaming legacy and the interests of its youth culture.

-

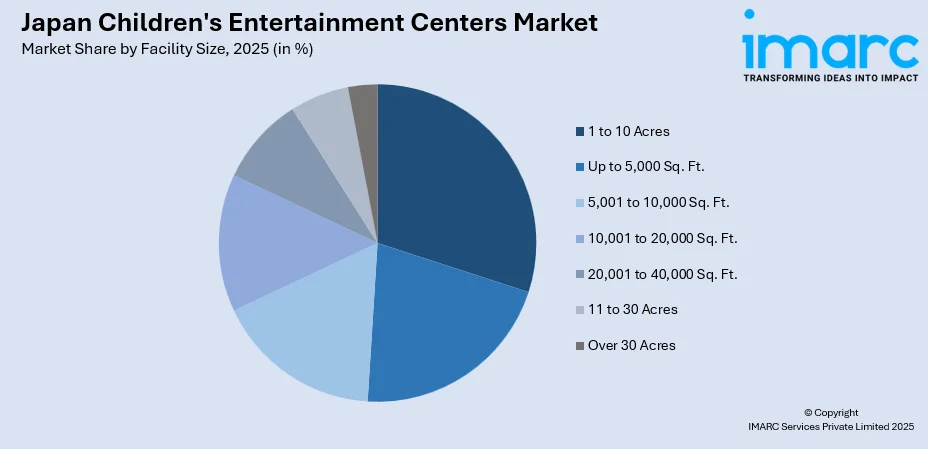

By Facility Size: 1 to 10 acres lead the market with a share of 29.4% in 2025, owing to the optimal balance between offering diverse entertainment attractions and maintaining operational efficiency within Japan's urban-suburban landscape.

-

By Revenue Source: Entry fees and ticket sales represent the largest segment with a market share of 38.1% in 2025. This dominance is driven by Japan's established pay-per-play culture, premium pricing strategies at major entertainment destinations, and consumer willingness to invest in quality family experiences.

-

By Activity Area: Arcade studios prevail the market with a share of 32.3% in 2025, supported by Japan's deeply rooted arcade gaming culture, continuous technological innovations in gaming equipment, and the integration of prize games and competitive gaming formats.

-

By Region: Kanto Region comprises the largest segment with a 35.9% market share in 2025, owing to the concentration of Japan's population in the Tokyo metropolitan area, higher disposable incomes, increasing adoption of technology, and superior entertainment infrastructure density.

-

Key Players: Key players are driving the market growth by launching innovative attractions, themed experiences, and interactive technology. They expand through malls and urban hubs, invest in safety and quality standards, and use strong branding, partnerships, and promotions to attract families and encourage repeat visits.

To get more information on this market Request Sample

The Japan children's entertainment centers market continues to evolve through technological advancements and experience diversification. According to the Themed Entertainment Association's 2024 Global Experience Index, the three main theme parks in Japan, with two being managed by Disney and one by Universal, attracted a total of 43.5 Million guests in 2024, showcasing a robust demand for entertainment options. The market benefits from Japan's position as a global leader in gaming technology, with manufacturers continuously introducing innovative attractions ranging from virtual reality (VR) experiences to interactive physical play zones. Additionally, the growing integration of educational elements into entertainment offerings, commonly referred to as edutainment, is creating new growth avenues as parents increasingly seek experiences that combine learning with leisure activities for their children.

Japan Children's Entertainment Centers Market Trends:

Digital Technology Integration Transforming Entertainment Experiences

Entertainment centers across Japan are increasingly incorporating cutting-edge digital technologies to enhance visitor engagement and differentiate their offerings. The integration of VR, augmented reality (AR), and artificial intelligence (AI)-driven gaming experiences is reshaping how children interact with entertainment facilities. As per IMARC Group, the Japan AR gaming market size reached USD 839.8 Million in 2024. This technological sophistication attracts younger demographics seeking immersive experiences beyond conventional entertainment options.

Edutainment Concept Gaining Traction Among Family Demographics

The fusion of education and entertainment is emerging as a significant market driver, with facilities increasingly incorporating learning elements into their attraction portfolios. Parents seeking value-added experiences for their children are gravitating toward centers that offer cognitive development opportunities alongside recreational activities. Interactive science exhibits, technology exploration zones, and creativity-focused play areas are becoming prevalent features, particularly in facilities targeting younger children and families. This trend aligns with Japan's cultural emphasis on early childhood development and educational achievement.

Rise of Competitive and Social Gaming Formats

Entertainment centers are increasingly focusing on competitive gaming formats that encourage social interaction and repeat visitation. The esports phenomenon continues to gain momentum in Japan, with dedicated esports arenas and competitive gaming zones becoming standard features in modern entertainment facilities. As per IMARC Group, the Japan esports market size was valued at USD 139.9 Million in 2024. Music and rhythm games, skill-based competitions, and multiplayer gaming experiences are attracting teenagers and young adults seeking communal entertainment experiences. This trend demonstrates Japan's arcade gaming history while evolving to modern desires for connected, shareable entertainment experiences.

Market Outlook 2026-2034:

The market growth will be underpinned by continued technological innovations in attraction development, expansion of entertainment facilities into suburban regions, and increasing consumer expenditure on family-oriented leisure activities. The market will benefit from major developments, including the ongoing expansion of theme park attractions and the introduction of immersive entertainment formats that leverage Japan's technological leadership. The market generated a revenue of USD 809.52 Million in 2025 and is projected to reach a revenue of USD 1,411.24 Million by 2034, growing at a compound annual growth rate of 6.37% from 2026-2034. Operators are expected to focus on diversifying revenue streams through enhanced food and beverage offerings, merchandise sales, and premium experience packages to maximize per-visitor spending.

Japan Children's Entertainment Centers Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Visitor Demographics | Teenagers (12-18) | 41.0% |

| Facility Size | 1 to 10 Acres | 29.4% |

| Revenue Source | Entry Fees and Ticket Sales | 38.1% |

| Activity Area | Arcade Studios | 32.3% |

| Region | Kanto Region | 35.9% |

Visitor Demographics Insights:

- Family with Children (0-9)

- Family with Children (9-12)

- Teenagers (12-18)

- Young Adults (18-24)

- Adults (Age 24+)

Teenagers (12-18) dominate with a market share of 41.0% of the total Japan children’s entertainment centers market in 2025.

The teenager demographic segment leads the market primarily due to their high engagement levels with gaming and entertainment activities, significant disposable income from allowances and part-time employment, and strong preference for experiential leisure options. Japanese teenagers demonstrate particular affinity for competitive gaming formats, music and rhythm games, and immersive digital experiences that entertainment centers specialize in providing.

The segment's dominance is further reinforced by Japan's deeply ingrained gaming culture, where arcades have historically served as primary social gathering spaces for youth. Entertainment centers have successfully adapted their offerings to align with teenage preferences, incorporating esports facilities, VR attractions, and trending game titles that resonate with this demographic. The social nature of many entertainment center activities makes them particularly appealing to teenagers seeking shared experiences with peers, driving both frequency of visits and extended dwell times that contribute to higher revenue generation per visitor.

Facility Size Insights:

Access the comprehensive market breakdown Request Sample

- Up to 5,000 Sq. Ft.

- 5,001 to 10,000 Sq. Ft.

- 10,001 to 20,000 Sq. Ft.

- 20,001 to 40,000 Sq. Ft.

- 1 to 10 Acres

- 11 to 30 Acres

- Over 30 Acres

1 to 10 acres lead with a share of 29.4% of the total Japan children’s entertainment centers market in 2025.

Medium to large-scale facilities in the 1 to 10 acres range dominate the market due to their capacity to offer comprehensive entertainment portfolios while maintaining operational efficiency. These facilities can accommodate diverse attraction types, including indoor play zones, arcade areas, themed attractions, and ancillary services, such as dining and retail, creating a holistic entertainment destination that appeals to multiple visitor demographics. The size allows for strategic placement in suburban commercial developments and integrated shopping complexes where land availability is more favorable than in dense urban centers.

This facility size category benefits from economies of scale in operations while remaining manageable for single-destination family outings. The format enables operators to create distinct themed zones within the facility, catering to different age groups and interest areas simultaneously. Japan's suburban expansion and the development of large-scale commercial complexes have created optimal locations for these medium-to-large facilities, supporting both resident family populations and destination visitors seeking comprehensive entertainment experiences. A new commercial center, Harajuku Quest, is set to open in 2025, only a three-minute walk from Tokyo’s Harajuku Station. The revamped Harajuku Quest will feature six stories above ground, two levels below, and a rooftop tower.

Revenue Source Insights:

- Entry Fees and Ticket Sales

- Food and Beverages

- Merchandising

- Advertising

- Others

Entry fees and ticket sales exhibit a clear dominance with a 38.1% share of the total Japan children’s entertainment centers market in 2025.

Entry fees and ticket sales constitute the primary revenue stream due to Japan's established pay-per-experience entertainment culture and the premium positioning of entertainment centers as destination attractions. Japanese consumers demonstrate willingness to pay for quality entertainment experiences, with facilities successfully implementing tiered pricing strategies that capture value from different visitor segments.

The revenue model aligns with Japan's tradition of arcade-based pay-per-play entertainment while extending to admission-based attraction pricing. The segment's dominance reflects the fundamental business model of entertainment centers where admission revenue provides operational foundation. Major entertainment facilities have refined their pricing strategies to include dynamic pricing, seasonal passes, and premium experience packages that maximize revenue capture while maintaining competitive positioning against alternative leisure options.

Activity Area Insights:

- Arcade Studios

- AR and VR Gaming Zone

- Physical Play Activities

- Skill/Competition Games

- Others

Arcade studios represent the leading segment with a 32.3% share of the total Japan children’s entertainment centers market in 2025.

Arcade studios maintain market leadership owing to Japan's unique cultural relationship with arcade gaming, which has sustained relevance despite the growth of home and mobile gaming platforms. In November 2024, LIGHTSPEED STUDIOS, a top global game developer, revealed the launch of LightSpeed Japan Studio, its new game development studio dedicated to creating original AAA action game titles, representing a significant advancement in LIGHTSPEED STUDIOS’ worldwide growth. Japanese arcades offer experiences unavailable in home settings, including large-format rhythm games, prize machines, and competitive gaming setups that attract dedicated audiences.

The segment benefits from continuous innovations by domestic manufacturers who develop Japan-exclusive titles and hardware configurations. The arcade segment's resilience reflects its evolution from pure gaming to social entertainment destination. Modern Japanese arcades incorporate diverse gaming formats, ranging from traditional fighting games to sophisticated music games, photo booths with advanced editing features, and prize games offering character merchandise from popular anime and gaming franchises. The social dimension of arcade gaming, particularly among teenagers and young adults, ensures continued relevance as entertainment centers integrate arcade studios as core attractions.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region comprises the largest segment with a 35.9% share of the total Japan children’s entertainment centers market in 2025.

The Kanto Region maintains market leadership driven by its massive population concentration. The population of North Ganto (subdivision of the larger Kanto Region), encompassing Ibaraki Prefecture, Tochigi Prefecture, and Gunma Prefecture in November 2024, was 658,921 individuals. The region benefits from Japan's high population density, creating substantial addressable consumer markets for entertainment facilities. Tokyo's position as the national capital concentrates economic activity, disposable incomes, and tourism flows that support diverse entertainment offerings.

The region's dominance is reinforced by superior entertainment infrastructure density, including major attractions, such as Tokyo Disneyland, Tokyo DisneySea, and numerous specialized entertainment centers, throughout the metropolitan area. The concentration of shopping malls, commercial complexes, and entertainment districts in the Kanto Region provides optimal locations for children's entertainment facilities. Additionally, higher average household incomes in the Tokyo metropolitan area translate to greater per-capita spending on family leisure activities, supporting premium entertainment concepts that generate higher revenues per visitor.

Market Dynamics:

Growth Drivers:

Why is the Japan Children's Entertainment Centers Market Growing?

Technological Advancements

Japan's position as a global leader in gaming and entertainment technology continues to fuel the market expansion through continuous innovations in attraction development. Entertainment centers benefit from access to cutting-edge technologies, including VR, AR, motion sensing, and AI-driven gaming systems that create unique visitor experiences unavailable elsewhere. A preview of the 2025 CESA Video Game Industry Report, carried out from June to July, revealed that 51% of the Japanese companies surveyed reported utilizing generative AI tools in the game development process. Domestic manufacturers, including major gaming and electronics companies, are investing substantially in developing exclusive attractions and gaming equipment for the Japanese market. Smart wristbands and tracking systems help operators manage crowds, improve safety, and personalize activities based on age and interests. Technology also allows real-time performance tracking in skill-based games, increasing excitement and repeat visits. Digital platforms support online booking, loyalty programs, and mobile-based promotions, strengthening customer engagement. Parents value technology-driven learning environments that combine fun with education, making centers more appealing.

Rising Consumer Expenditure on Experiential Entertainment

Rising consumer spending on experiences rather than physical goods is strongly boosting the Japan children’s entertainment centers market. Families increasingly prioritize outings that offer learning, interaction, and memorable moments over traditional toys or home entertainment. Parents view play centers as valuable environments for social interaction, physical activity, and skill development, making them willing to spend more on entry tickets, premium play zones, party packages, and memberships. Urban lifestyles and busy schedules push families towards organized leisure destinations that provide safe, well-managed fun in one place. Growing disposable incomes also allow parents to choose higher-quality facilities with better infrastructure and themed attractions. Additionally, experiential entertainment is often shared on social media, adding emotional and social value to visits. As expectations for premium, engaging experiences rise, spending continues to flow into modern children’s centers.

Surging Tourism Activities

Increasing tourism activities in Japan are significantly supporting the children’s entertainment centers market growth in Japan. As reported by the Japan National Tourism Organization (JNTO), the forecasted number of foreign visitors to Japan in September 2025 was 3,266,800 (+13.7% from 2024). Traveling families look for indoor recreational options that are safe, engaging, and weatherproof, making play centers a convenient choice. Entertainment facilities located in malls, airports, and tourist districts benefit from high footfall from both domestic and international visitors. Parents often seek short-duration activities to keep children engaged between sightseeing stops, which increases spontaneous visits. Family-focused tourism also encourages demand for kid-friendly attractions alongside cultural and shopping experiences. Hotels and travel planners increasingly highlight entertainment centers as part of family travel packages. Seasonal tourism peaks further raise visits during holidays and school breaks. As Japan strengthens its position as a family-friendly destination, children’s entertainment centers gain constant exposure to new customers, supporting expansion and revenue growth.

Market Restraints:

What Challenges the Japan Children's Entertainment Centers Market is Facing?

Declining Birth Rate and Shrinking Child Population

Japan's demographic challenges present significant long-term concerns for the children's entertainment market. Japan's child population dropped to 14.0 Million in 2024, marking the lowest level in history. This persistent decline in the core target demographic creates intensifying competition for a shrinking consumer base, pressuring operators to diversify towards adult and family demographics while maintaining appeal to children.

Competition from Alternative Entertainment Options

Entertainment centers face increasing competition from home-based entertainment, including gaming consoles, streaming services, and mobile gaming platforms that offer convenient alternatives to venue-based experiences. The penetration of sophisticated home entertainment systems and the proliferation of high-quality mobile games reduce the exclusive appeal of entertainment center offerings, requiring facilities to emphasize experiences impossible to replicate at home.

Real Estate Costs and Location Constraints

Japan's high real estate costs, particularly in prime urban locations, create significant barriers to market entry and expansion. Entertainment centers require substantial floor space to deliver comprehensive attraction portfolios, yet suitable locations in high-traffic areas command premium rents that impact operational economics. These constraints limit new facility development and encourage consolidation among existing operators.

Competitive Landscape:

The Japan children's entertainment centers market is characterized by a competitive landscape, featuring domestic entertainment operators, international franchise brands, and diversified leisure companies. Market participants compete across dimensions, including attraction innovations, location strategy, pricing, and ancillary service offerings. Domestic operators benefit from deep understanding of Japanese consumer preferences and established relationships with gaming equipment manufacturers, while international brands leverage global franchise recognition and experience in attraction development. The market has witnessed increasing consolidation, as operators are seeking scale advantages in attraction procurement, technology investment, and marketing reach. Competition is intensifying around technology integration, with operators investing in interactive attractions to differentiate their offerings and attract tech-savvy younger demographics. Strategic partnerships between entertainment operators, gaming companies, and popular media franchises are becoming prevalent as means to access exclusive content and create distinctive visitor experiences.

Recent Developments:

-

In March 2025, the ANO-NE Kids Club, a creative indoor play center offering temporary childcare, was set to launch in Tokyo’s Ginza area. Created by Cosmos Hotel Management Co., Ltd. and COSMOS INITIA Co., Ltd. to assist families visiting Japan, the club provided a secure, interactive environment for kids while their parents could explore Tokyo’s shopping areas, cultural sites, and restaurants.

Japan Children’s Entertainment Centers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Visitor Demographics Covered | Family With Children (0-9), Family With Children (9-12), Teenagers (12-18), Young Adults (18-24), Adults (Age 24+) |

| Facility Sizes Covered | Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., 1 to 10 Acres, 11 to 30 Acres, Over 30 Acres |

| Revenue Sources Covered | Entry Fees and Ticket Sales, Food and Beverages, Merchandising, Advertising, Others |

| Activity Areas Covered | Arcade Studios, AR and VR Gaming Zone, Physical Play Activities, Skill/Competition Games, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan children's entertainment centers market size was valued at USD 809.52 Million in 2025.

The Japan children's entertainment centers market is expected to grow at a compound annual growth rate of 6.37% from 2026-2034 to reach USD 1,411.24 Million by 2034.

Teenagers (12-18) held the largest market share of 41.0%, driven by their strong engagement with gaming formats, social entertainment preferences, and significant spending capacity within entertainment center environments.

Key factors driving the Japan children's entertainment centers market include technological advancements in attraction development, rising consumer expenditure on experiential entertainment, international visitor growth, integration of edutainment concepts, and Japan's strong cultural affinity for gaming and interactive entertainment.

Major challenges include Japan's declining birth rate and shrinking child population, competition from home-based entertainment alternatives, including gaming consoles and streaming services, high real estate costs limiting facility expansion, the need for continuous technology investment to maintain visitor interest, and adapting business models to serve broader demographic segments beyond children.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)