Japan Cigarette Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Japan Cigarette Market Overview:

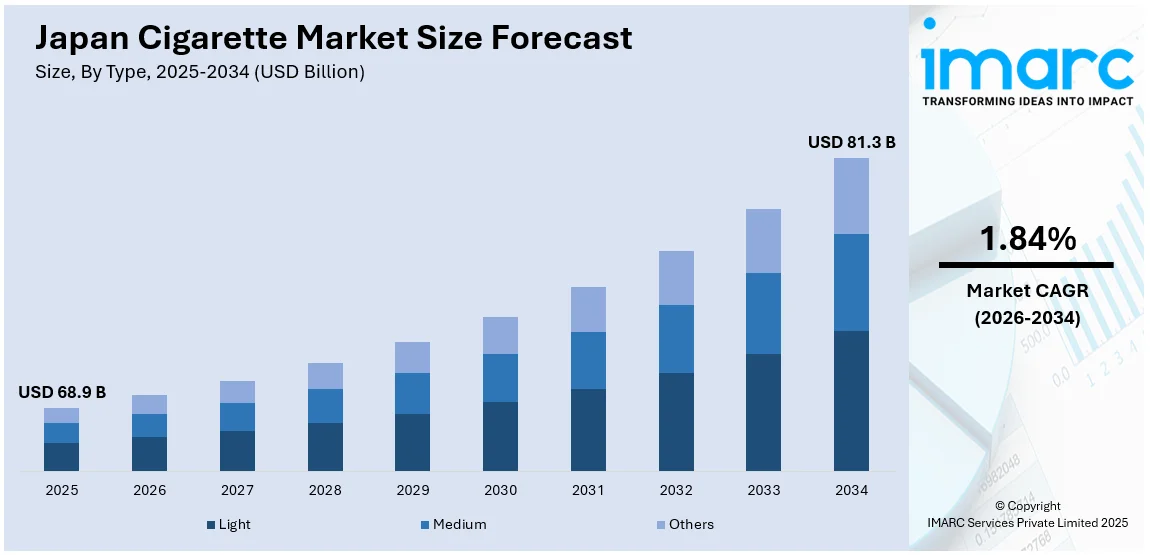

The Japan cigarette market size reached USD 68.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 81.3 Billion by 2034, exhibiting a growth rate (CAGR) of 1.84% during 2026-2034. The market is being driven by strong brand loyalty, a growing premiumization trend among older consumers, and the rising popularity of innovative heated tobacco products, supported by favorable regulatory tolerance compared to other countries, which together sustain steady demand despite overall declining smoking rates among the younger population.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 68.9 Billion |

| Market Forecast in 2034 | USD 81.3 Billion |

| Market Growth Rate 2026-2034 | 1.84% |

Japan Cigarette Market Trends:

Cultural and Social Integration of Smoking Habits

In Japan, cigarette smoking has long been embedded in social habits, company culture, and even gender relations. Smoking was not just a personal activity but also a communal experience that helped create social relationships, particularly in workplace settings. Conformity and group activities were the hallmark of traditional social structures, and smoking rooms served as significant areas for casual networking, business meetings, and establishing friendships among coworkers. This normalization of smoking habits across generations was responsible for the continuance of high smoking rates despite increasing health consciousness throughout the world. Further, smoking in Japan had a sort of image of sophistication and masculinity, further ingraining it into social identity, especially among older groups. Public opinion tended to favor tolerating smoking, and even though designated smoking areas are now widespread, they remain ubiquitous and very accessible. In contrast to most Western nations where cigarette smoking is highly stigmatized, Japan's approach has traditionally been more measured and favored a gradual reduction in smoking.

To get more information on this market Request Sample

Governmental Influence via Regulation and Ownership Stakes

Another force behind the Japan cigarette market has been government intervention, both regulatory and fiscal. In a unique twist, the Japanese government has a major stake in Japan Tobacco Inc. (JT), which is one of the world's largest tobacco firms. This direct fiscal interest has over the years correlated the government's priorities with the economic prosperity of the tobacco industry, leading to a complicated relationship between public health programs and revenues. Tobacco taxation, however large, has been expertly managed not to bring the industry down, weighing fiscal revenues against low-key public health programs. Cigarette advertising and packaging policies have been relatively loose compared to tighter Western norms, permitting firms to hold on to brand loyalty and market power. Additionally, regulatory initiatives like incremental tobacco price rises are gradually and systematically implemented, avoiding steep falls in consumer trends. Government-sponsored studies of alternative nicotine delivery systems have also assisted in overall tobacco industry stability without coercively encouraging quitting among smokers.

Japan Cigarette Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Light

- Medium

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes light, medium, and others.

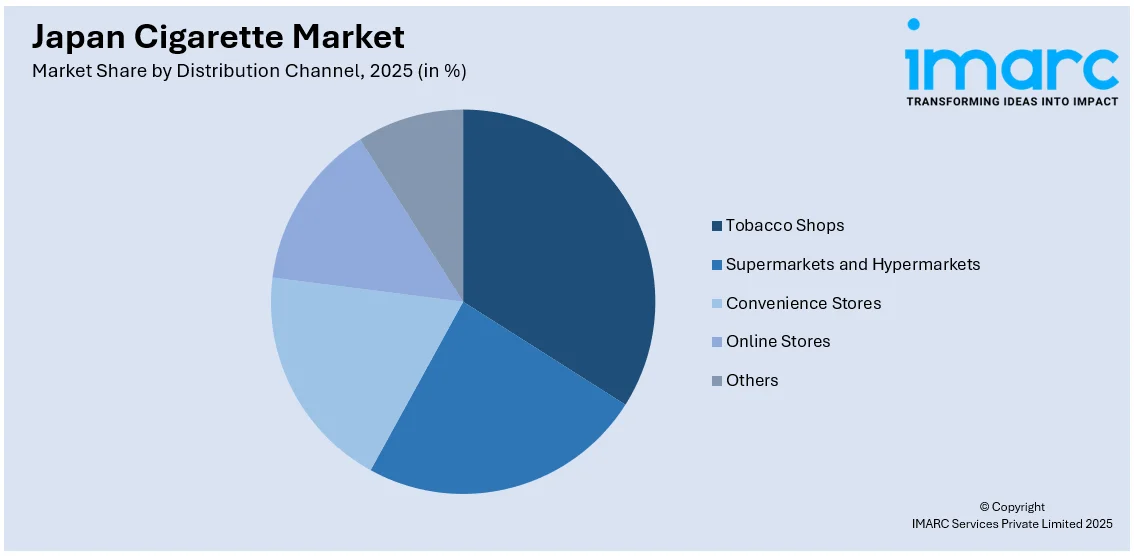

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Tobacco Shops

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes tobacco shops, supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Cigarette Market News:

- August 2024: JT Group announced that it would acquire Vector Group’s tobacco business for USD 2.4 billion. This strategic move boosts JT Group’s global competitiveness and innovation capabilities. The enhanced brand strength and operational scale support growth momentum in the Japan cigarette market.

- May 2024: JT Group announced an investment of JPY 450 billion (USD 2.9 billion) in heated tobacco products from 2024 to 2026, stepping up from its previous JPY 300 billion commitment. JT also aims to triple the number of markets selling its Ploom brand to about 45 by 2026, focusing strongly on expansion in the Middle East and Africa.

Japan Cigarette Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light, Medium, Others |

| Distribution Channels Covered | Tobacco Shops, Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan cigarette market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan cigarette market on the basis of type?

- What is the breakup of the Japan cigarette market on the basis of distribution channel?

- What is the breakup of the Japan cigarette market on the basis of region?

- What are the various stages in the value chain of the Japan cigarette market?

- What are the key driving factors and challenges in the Japan cigarette market?

- What is the structure of the Japan cigarette market and who are the key players?

- What is the degree of competition in the Japan cigarette market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cigarette market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan cigarette market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cigarette industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)