Japan CNC Grinding Machines Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2026-2034

Japan CNC Grinding Machines Market Overview:

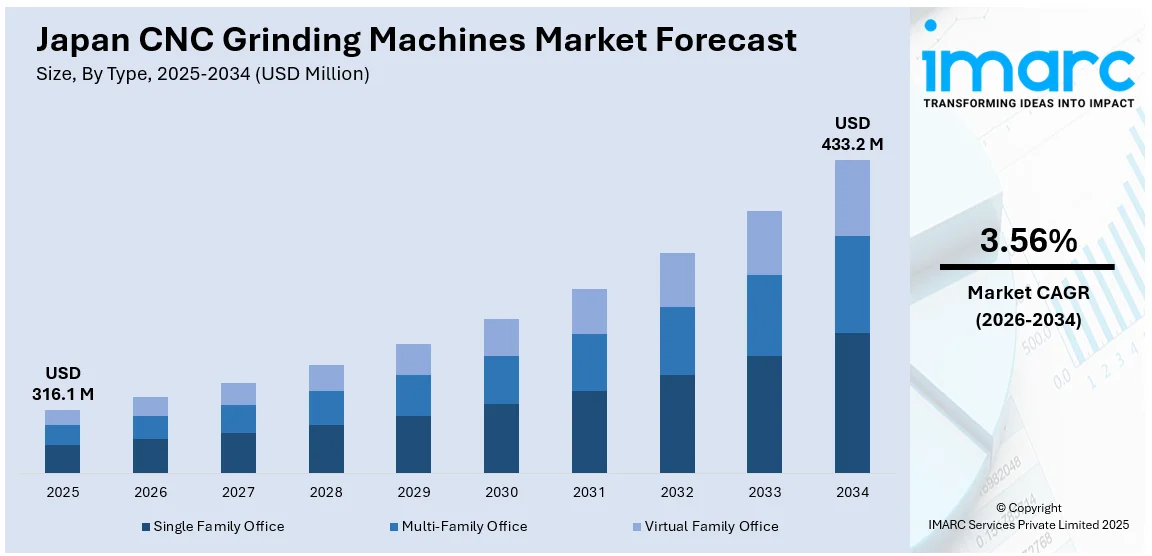

The Japan CNC grinding machines market size reached USD 316.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 433.2 Million by 2034, exhibiting a growth rate (CAGR) of 3.56% during 2026-2034. The market is growing due to rising demand for multi-process machines that streamline production, save space, and support automation in high-mix, low-volume environments. Precision tool manufacturing is also encouraging adoption, as industries require high-accuracy grinding for complex geometries. Integration of advanced software for tool design and simulation further enhances efficiency, allowing faster customization and reduced waste. These trends reflect a broader shift toward compact, flexible, and digitally integrated grinding systems across precision industries, thus contributing to the expansion of the Japan CNC grinding machines market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 316.1 Million |

| Market Forecast in 2034 | USD 433.2 Million |

| Market Growth Rate 2026-2034 | 3.56% |

Japan CNC Grinding Machines Market Trends:

Growing Demand for Integrated Multi-Process Machining Solutions

Manufacturers in Japan are progressively choosing computer numerical control (CNC) grinding machines capable of executing various tasks in one setup, motivated by the need to optimize production processes and minimize handling mistakes. The use of multi-process grinding machines, which integrates internal, external, and face grinding functions, reduces part transfers, decreases cycle times, and enhances overall dimensional uniformity. This method is especially beneficial in sectors characterized by high-mix, low-volume manufacturing and where machining accuracy directly influences product performance. Producers are also aiming to minimize their equipment footprint and enhance shop floor adaptability, leading to investments in machines that provide high performance without taking up too much space. Moreover, multi-process platforms enhance integration with automation systems and in-line quality checks, aligning with Japan's wider objectives for smart and efficient manufacturing. The shift to these systems is further supported by workforce limitations, as there are fewer skilled employees available to operate various specialized machines. Combined grinding machines streamline usage and training, improving consistency. These machines also enable enhanced thermal regulation and optimized tooling, leading to better energy efficiency and long-term cost reductions. As industrial needs progress towards enhanced precision and flexibility, the need for compact, adaptable CNC grinding systems with multifunctional features is rising. In 2024, TAIYO KOKI announced the launch of the Vertical Mate 85 2nd Generation CNC vertical multi-process grinding machine. Upgraded with the speedMASTER LongNose spindle and enhanced thermal stability, it offered improved precision, energy efficiency, and digital integration. The machine debuted at the Japan International Machine Tool Fair - JIMTOF 2024 exhibition in Japan from November 5–10.

To get more information on this market Request Sample

Advancements in Tool Grinding Precision and Software Integration

The Japan CNC grinding machines market growth is attributed to the rising need for precision tool manufacturing, particularly as industries aim to create high-performance cutting tools that maintain consistent quality and minimal variation. Tool grinding demands machines capable of functioning with high precision on several axes while preserving surface integrity on intricate, small shapes. This demand is enhancing the significance of high-precision CNC grinders specifically designed for manufacturing tools. Furthermore, incorporating advanced software for designing tools and optimizing grinding paths is emerging as a crucial differentiator. Modern software solutions now allow users to digitally simulate, modify, and tailor tool geometries prior to physical grinding, minimizing errors and material waste. The blend of mechanical accuracy and digital adaptability enables manufacturers to efficiently handle custom tool requests and detailed specifications with quicker response times. This simultaneous advancement in grinding capabilities and digital tool management is crucial for addressing the changing demands of industries, such as aerospace, medical devices, and mold production. With rising expectations for stricter tolerances, specialized coatings, and intricate shapes, CNC grinding systems that offer both precise control and intelligent workflow integration are increasingly crucial to maintain competitiveness in the market. In 2024, Makino Seiki exhibited its latest high-precision CNC grinders and Tool Creator® software at JIMTOF2024 in Tokyo Big Sight, Booth E1049. The company showcased advanced machines like the DB1 micro tool grinder and AGE30FX with built-in automation features. These innovations highlighted Makino Seiki’s progress in tool grinding, inspection, and smart manufacturing.

Japan CNC Grinding Machines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and distribution channel.

Type Insights:

- Cylindrical

- Surface

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes cylindrical, surface, and others.

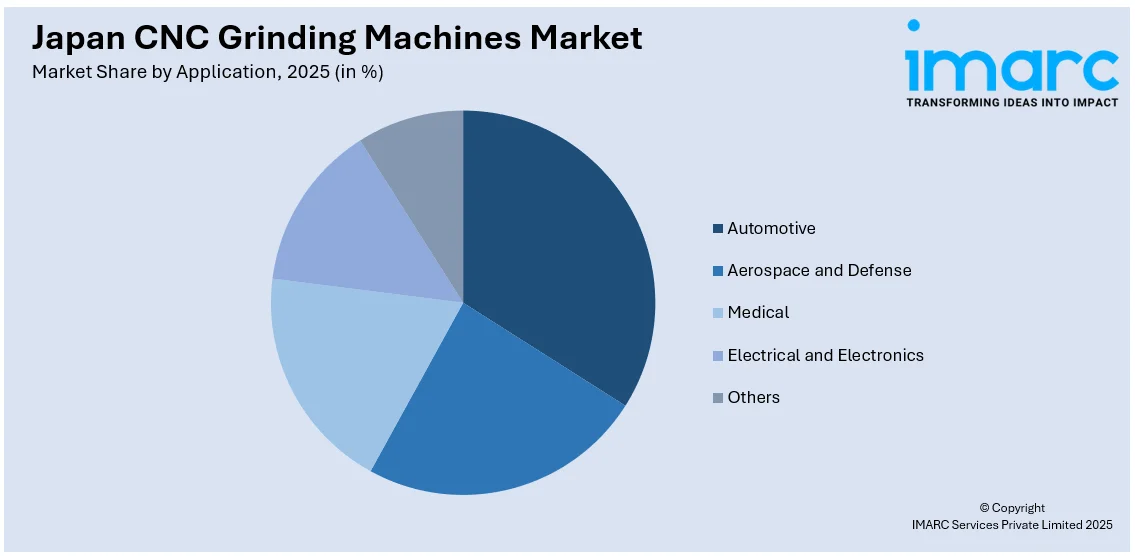

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Aerospace and Defense

- Medical

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, aerospace and defense, medical, electrical and electronics, and others.

Distribution Channel Insights:

- Online

- Company Websites

- E-commerce Websites

- Offline

- Direct Sales

- Indirect Sales

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online, company websites, e-commerce websites, offline, direct sales, and indirect sales.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan CNC Grinding Machines Market News:

- In November 2024, Joen Lih Machinery showcased its CNC high-precision surface grinder model 52CNC-HP at JIMTOF 2024 in Tokyo, Booth E4003-1. The machine featured enhanced rigidity, a user-friendly touch panel, and optional automation to boost machining efficiency. Joen Lih emphasized its custom solutions for aerospace, automotive, and semiconductor industries.

- In October 2024, Nidec Machine Tool launched its new ZFA160 and ZFA260 gear grinders, designed for high-speed, high-precision machining to meet global demand for EV and robotics components. These machines reduce non-machining time by 50% and feature inline automation with advanced measurement capabilities. They debuted at JIMTOF 2024, held from November 5–10 in Tokyo.

Japan CNC Grinding Machines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cylindrical, Surface, Others |

| Application Covered | Automotive, Aerospace and Defense, Medical, Electrical and Electronics, Others |

| Distribution Channels Covered | Online, Company Websites, E-commerce Websites, Offline, Direct Sales, Indirect Sales |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan CNC grinding machines market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan CNC grinding machines market on the basis of type?

- What is the breakup of the Japan CNC grinding machines market on the basis of application?

- What is the breakup of the Japan CNC grinding machines market on the basis of distribution channel?

- What is the breakup of the Japan CNC grinding machines market on the basis of region?

- What are the various stages in the value chain of the Japan CNC grinding machines market?

- What are the key driving factors and challenges in the Japan CNC grinding machines market?

- What is the structure of the Japan CNC grinding machines market and who are the key players?

- What is the degree of competition in the Japan CNC grinding machines market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan CNC grinding machines market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan CNC grinding machines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan CNC grinding machines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)