Japan Cognitive Health Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Sales Channel, Functionality, and Region, 2026-2034

Japan Cognitive Health Supplements Market Summary:

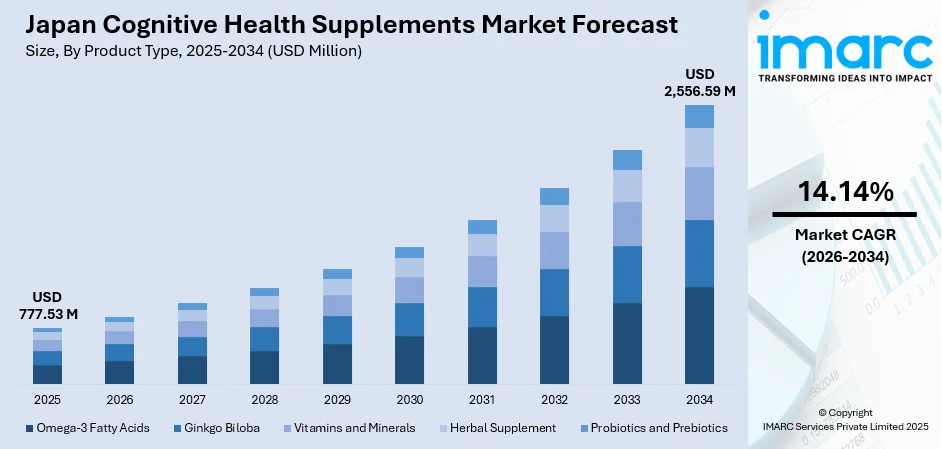

The Japan cognitive health supplements market size was valued at USD 777.53 Million in 2025 and is projected to reach USD 2,556.59 Million by 2034, growing at a compound annual growth rate of 14.14% from 2026-2034.

Japan's rapidly aging population and heightened awareness about cognitive decline are driving robust demand for brain health supplements. The nation's deeply preventive approach to healthcare, combined with cultural preferences for natural and science-backed products, has positioned cognitive supplements as essential components of daily wellness routines. Rising concerns about neurological conditions, such as Alzheimer's disease and dementia, have prompted consumers across all age groups to proactively seek solutions for maintaining mental acuity.

Key Takeaways and Insights:

- By Product Type: Omega-3 fatty acids dominate the market with a share of 28% in 2025, driven by extensive scientific research supporting the role of docosahexaenoic acid (DHA) in neuronal membrane integrity and cognitive preservation, along with cultural alignment with traditional Japanese fish-based dietary patterns.

- By Form: Capsule leads the market with a share of 34% in 2025, owing to consumer preferences for convenient, precise dosing formats that ensure standardized bioactive compound delivery and enhanced shelf stability for daily supplementation routines.

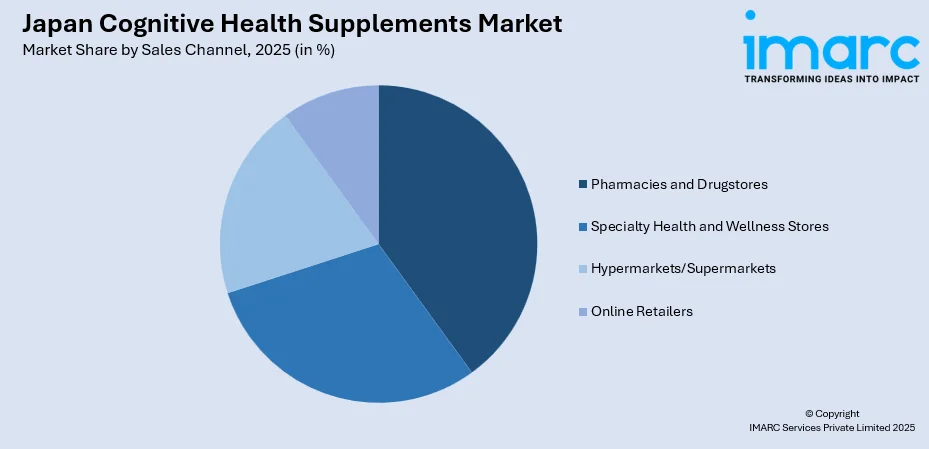

- By Sales Channel: Pharmacies and drugstores represent the largest segment with a market share of 35% in 2025. This dominance is driven by trust-based purchasing behavior, access to pharmacist consultations, and the expanding role of drugstores in preventive healthcare services.

- By Functionality: Memory support exhibits a clear dominance in the market with a share of 26% in 2025, reflecting heightened consumer focus on preventing age-related cognitive decline and maintaining recall abilities, particularly among the elderly and working professionals.

- By Region: Kanto region prevails the market with a share of 32% in 2025, attributed to Tokyo's concentration of health-conscious consumers, advanced healthcare infrastructure, and high disposable incomes supporting premium supplement purchases.

- Key Players: Key players are expanding product portfolios, improving formulations, and investing in clinical validation. Their strong distribution networks, marketing initiatives, and collaborations with pharmacies and e-commerce platforms enhance consumer reach, trust, and overall market growth.

To get more information on this market Request Sample

The market is experiencing significant transformation, driven by demographic imperatives and evolving consumer attitudes toward preventive brain health. Japan's super-aged society, where 29.3% of the population was over 65 years old in 2024, has created sustained demand for cognitive enhancement products. Japanese consumers increasingly favor supplements combining traditional botanical ingredients. such as ginkgo biloba and matcha, with contemporary nootropic compounds, reflecting the nation's capacity to blend heritage with modern scientific validation. The integration of digital tools for personalized supplement recommendations and quick response (QR)-enabled product information has further enhanced consumer engagement and compliance rates across demographic segments. The growing acceptance of preventive healthcare is further encouraging consumers to incorporate cognitive supplements into daily routines. Expanding retail and e-commerce penetration is making premium products more accessible nationwide.

Japan Cognitive Health Supplements Market Trends:

Digital Personalization Transforming Supplement Selection

Digitization has enabled customized supplement programs based on individual cognitive performance objectives, including concentration, memory enhancement, and mood stabilization. Japanese firms are incorporating QR codes on packaging to provide users with detailed clinical data, ingredient information, and interactive educational experiences. Mobile applications integrate purchase histories, health goals, and daily intake reminders to support long-term compliance. These technological integrations, particularly appeal to younger, tech-literate consumers and busy working professionals, seeking convenient, personalized wellness solutions in metropolitan regions, such as Tokyo and Osaka. As per the Annual Labor Force Survey 2024, in Japan, the count of employed people hit an all-time high of 67.81 Million in 2024, signifying the fourth year of growth.

Government Policy Support Accelerating Market Development

Japan's regulatory environment continues to foster cognitive health supplement innovations through supportive certification frameworks. The Food with Function Claims system enables manufacturers to make science-backed health assertions, enhancing consumer confidence and product differentiation. Japan implemented the Basic Act on Dementia to foster an inclusive society, on January 1, 2024, reflecting national commitment to addressing cognitive health challenges in the aging population. Such policy initiatives create favorable conditions for product development, clinical research investment, and consumer education campaigns promoting proactive brain health management.

Rising Integration of Traditional Japanese Ingredients with Modern Nootropics

Japanese consumers exhibit strong preferences for cognitive supplements, incorporating culturally familiar ingredients, alongside scientifically validated compounds. Traditional botanicals, including matcha, ginseng, turmeric, and fermented foods, such as natto, are being formulated with contemporary nootropic ingredients to create products that resonate with heritage-based health philosophies. This cultural synergy enables new products to establish trust rapidly, particularly when positioned as integral components of balanced lifestyle approaches rather than pharmaceutical interventions.

Market Outlook 2026-2034:

The Japan cognitive health supplements market is projected to experience robust expansion, driven by demographic imperatives and evolving consumer health consciousness. The market generated a revenue of USD 777.53 Million in 2025 and is projected to reach a revenue of USD 2,556.59 Million by 2034, growing at a compound annual growth rate of 14.14% from 2026-2034. Continued aging of the population, rising awareness about mild cognitive impairment, and increasing adoption among younger demographics seeking cognitive optimization will sustain demand growth. Strategic consolidation among major players, technological innovations in personalized nutrition, and expanding distribution through both pharmacy and online channels will shape competitive dynamics throughout the forecast period.

Japan Cognitive Health Supplements Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Omega-3 Fatty Acids | 28% |

| Form | Capsule | 34% |

| Sales Channel | Pharmacies and Drugstores | 35% |

| Functionality | Memory Support | 26% |

| Region | Kanto Region | 32% |

Product Type Insights:

- Omega-3 Fatty Acids

- Ginkgo Biloba

- Vitamins and Minerals

- Herbal Supplement

- Probiotics and Prebiotics

Omega-3 fatty acids dominate with a market share of 28% of the total Japan cognitive health supplements market in 2025.

Omega-3 fatty acids, particularly DHA, have established dominance in the Japan cognitive health supplements market due to extensive scientific validation and cultural dietary alignment. DHA comprises a significant portion of neural membrane phospholipids and plays essential roles in neuronal function, neurotransmitter release, and cellular membrane fluidity. Japanese consumers demonstrate strong affinity for fish-derived supplements, reflecting traditional dietary patterns where seafood consumption has historically provided natural omega-3 intake.

The product segment benefits from Japan's established infrastructure for marine-derived nutraceuticals and consumer trust in domestically sourced fish oil products. Japanese manufacturers have developed purified DHA formulations extracted from tuna eye socket tissues, achieving high concentrations suitable for targeted cognitive support. The segment addresses multiple consumer needs, including memory preservation, concentration enhancement, and prevention of age-related cognitive decline. The cultural emphasis on preventive healthcare, combined with aging demographics proactively seeking brain health solutions, continues to drive sustained demand for omega-3 supplements across pharmacy, specialty store, and online distribution channels.

Form Insights:

- Chewable

- Capsule

- Tablet

- Powder

- Liquid

Capsule leads with a share of 34% of the total Japan cognitive health supplements market in 2025.

Capsule formulations have secured market leadership through their combination of convenience, precise dosing capabilities, and superior bioactive compound preservation. Japanese consumers, particularly working professionals and elderly individuals, favor capsules for their portability, ease of integration into daily routines, and standardized delivery of active ingredients. The format enables manufacturers to encapsulate sensitive compounds, including omega-3 fatty acids and herbal extracts while protecting against oxidation and ensuring consistent potency throughout shelf life.

The capsule segment's growth is further supported by technological advancements in encapsulation technologies, including soft gel formulations, delayed-release mechanisms, and enhanced bioavailability systems. Japanese manufacturers have developed sophisticated capsule designs incorporating plant-based materials to address vegetarian and vegan consumer preferences. The format's clinical presentation appeals to health-conscious consumers seeking professional-grade supplementation, while convenience factors attract younger demographics prioritizing time-efficient wellness solutions. Ongoing innovations in nano-encapsulation and hydrogel delivery systems position capsules for continued leadership as manufacturers refine absorption characteristics and consumer experience attributes.

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Pharmacies and Drugstores

- Specialty Health and Wellness Stores

- Hypermarkets/Supermarkets

- Online Retailers

Pharmacies and drugstores exhibit a clear dominance with a 35% share of the total Japan cognitive health supplements market in 2025.

Pharmacies and drugstores maintain distribution leadership through trust-based consumer relationships, pharmacist consultation services, and comprehensive product assortments addressing diverse cognitive health needs. Japanese drugstore operate extensive store networks, offering cognitive supplements alongside prescription medications, over-the-counter (OTC) products, and wellness items. According to Japan's Ministry of Economy, Trade and Industry, more than 85% of beauty, health, and wellness sales occurred through offline retail channels in FY2023, underscoring the continued importance of physical retail despite e-commerce expansion. The channel benefits from consumer preferences for in-person product evaluation, professional guidance, and immediate purchase gratification.

The drugstore channel's prominence reflects Japan's healthcare culture emphasizing pharmacist involvement in supplement selection and medication therapy management. Drugstores increasingly function as one-stop health destinations, expanding in-store services, including health screenings, consultations, and educational programming. Major chains have developed specialized supplement sections featuring cognitive health products with staff-assisted selection support. Established domestic chains leverage strong brand recognition and supplier relationships to offer comprehensive brain health product assortments at competitive pricing.

Functionality Insights:

- Memory Support

- Focus and Concentration Improvement

- Boosting Cognitive Performance

- Stress and Anxiety Management

- Mood Enhancement

Memory support represents the leading segment with a 26% share of the total Japan cognitive health supplements market in 2025.

Memory support functionality has achieved market leadership driven by demographic concerns about age-related cognitive decline and the growing prevalence of neurological conditions in Japan's aging population. In 2024, over 18,000 seniors with dementia in Japan left their residences and went missing. Nearly 500 were subsequently discovered deceased. Japanese consumers increasingly seek preventive supplements to maintain recall abilities, verbal memory, and overall cognitive sharpness as they age. The functionality appeals across demographic segments, from elderly individuals managing early cognitive changes to working professionals seeking to maintain mental performance.

The segment benefits from extensive research supporting specific ingredients' memory-enhancing properties. Manufacturers have developed targeted formulations combining multiple memory-supporting compounds to address various cognitive mechanisms simultaneously. The functionality's prominence reflects Japan's cultural emphasis on maintaining independence and quality of life throughout aging, with consumers viewing memory supplements as proactive investments in cognitive longevity rather than treatments for existing conditions. Marketing positioning emphasizes preventive benefits and daily maintenance approaches aligned with broader Japanese wellness philosophies.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

Kanto Region dominates the market with a 32% share of the total Japan cognitive health supplements market in 2025.

The Kanto Region, encompassing Tokyo and surrounding prefectures, maintains market leadership through population concentration, advanced healthcare infrastructure, and elevated health consciousness among metropolitan consumers. The region's high disposable incomes enable premium supplement purchases, while extensive pharmacy networks and specialty retailers ensure product accessibility. Digital adoption rates support personalized nutrition platforms and online purchasing particularly popular among the region's tech-literate population.

Moreover, the region hosts numerous corporate headquarters and research-driven industries, fostering higher awareness about preventive healthcare and scientifically backed nutraceuticals. The aging population in areas surrounding Tokyo adds sustained demand for supplements targeting age-related cognitive decline. Combined with high income levels and strong consumer willingness to spend on health and wellness, Kanto maintains a clear leadership position in the market.

Market Dynamics:

Growth Drivers:

Why is the Japan Cognitive Health Supplements Market Growing?

Rapidly Aging Population Creating Sustained Demand

Japan's demographic profile represents one of the most significant drivers of the cognitive health supplement market expansion. This demographic reality creates persistent demand for products supporting cognitive maintenance and age-related decline prevention. Elderly Japanese consumers demonstrate strong preferences for preventive healthcare approaches, actively seeking supplements to preserve mental acuity. The cultural emphasis on graceful aging and quality-of-life preservation reinforces supplement adoption as standard wellness practice among senior demographics. Elderly consumers increasingly adopt preventive health habits, viewing cognitive supplements as a non-invasive and accessible way to maintain independence and quality of life. Additionally, in Japan, the cohort of individuals with mild cognitive impairment is projected to reach 5.93 Million by 2030, significantly expanding the addressable market for cognitive support products.

Strategic Industry Consolidation Expanding Market Capabilities

Strategic industry consolidation is significantly expanding market capabilities in the Japan cognitive health supplements sector by creating stronger, more innovation-focused players capable of responding to evolving consumer needs. As major manufacturers acquire smaller niche brands or form strategic alliances, they gain access to proprietary formulations and specialized expertise in brain-health ingredients. This consolidation enhances their ability to launch differentiated cognitive products, especially those registered under Japan’s Foods with Functional Claims framework, an increasingly important driver of credibility and demand. In August 2024, Kewpie Corporation unveiled Choline EX, a supplement featuring egg yolk-derived choline that supported verbal memory retention in middle-aged and elderly individuals, marking Japan's first functional food product to use egg yolk choline as a certified active ingredient under Food with Function Claims system. Larger consolidated companies can invest more heavily in clinical validation, regulatory filings, and marketing campaigns that highlight memory support, concentration enhancement, and mental fatigue reduction.

Rising Neurological Disease Awareness

Increasing awareness about cognitive decline conditions, including early-onset Alzheimer's disease and dementia, is accelerating preventive supplement adoption across demographic segments. Japanese consumers demonstrate heightened sensitivity to cognitive health risks following national media coverage of dementia prevalence and healthcare system challenges. Educational campaigns from healthcare providers, pharmaceutical companies, and government agencies have successfully communicated the importance of proactive brain health management. In September 2024, the Japanese Ministry of Health, Labour and Welfare Japan approved Kisunla for the treatment of early symptomatic Alzheimer's disease, reflecting heightened national focus on cognitive health interventions. This regulatory activity and associated media coverage elevate consumer awareness and validate supplement use as complementary preventive approaches alongside pharmaceutical treatments.

Market Restraints:

What Challenges the Japan Cognitive Health Supplements Market is Facing?

Regulatory Complexity and Compliance Requirements

Japan's supplement industry operates within stringent regulatory frameworks requiring substantial compliance investments. The Food with Function Claims system, while enabling health assertions, demands extensive clinical documentation and ongoing monitoring. Smaller manufacturers face challenges meeting certification requirements, limiting product diversity and innovation speed.

Consumer Skepticism Regarding Efficacy Claims

Despite scientific advancements, consumer skepticism persists regarding cognitive supplement effectiveness. Some consumers question whether supplements deliver measurable benefits, particularly for prevention-focused products where outcomes manifest over extended periods. Educational barriers and conflicting information sources contribute to adoption hesitancy among potential consumers.

Price Sensitivity in Economic Uncertainty

Premium cognitive supplements face price resistance during economic uncertainty periods. Consumers may reduce discretionary health spending or switch to lower-cost alternatives when facing financial pressures. This sensitivity particularly affects specialty products positioned at premium price points requiring sustained consumer commitment.

Competitive Landscape:

The Japan cognitive health supplements market exhibits moderate-to-high competitive intensity characterized by established pharmaceutical conglomerates competing alongside specialized nutraceutical manufacturers and emerging direct-to-consumer brands. Major players leverage extensive research capabilities, regulatory expertise, and established distribution networks to maintain market positions. The competitive landscape increasingly favors companies demonstrating scientific validation, functional food certifications, and integrated wellness ecosystems. Strategic acquisitions have consolidated market share among larger entities while creating barriers for smaller entrants. Innovation focus areas include personalized formulations, enhanced bioavailability technologies, and digital engagement platforms supporting consumer retention and brand loyalty.

Japan Cognitive Health Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Omega-3 Fatty Acids, Ginkgo Biloba, Vitamins and Minerals, Herbal Supplement, Probiotics and Prebiotics |

| Forms Covered | Chewable, Capsule, Tablet, Powder, Liquid |

| Sales Channels Covered | Pharmacies and Drugstores, Specialty Health and Wellness Stores, Hypermarkets/Supermarkets, Online Retailers |

| Functionalities Covered | Memory Support, Focus and Concentration Improvement, Boosting Cognitive Performance, Stress and Anxiety Management, Mood Enhancement |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central /Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan cognitive health supplements market size was valued at USD 777.53 Million in 2025.

The Japan cognitive health supplements market is expected to grow at a compound annual growth rate of 14.14% from 2026-2034 to reach USD 2,556.59 Million by 2034.

Omega-3 fatty acids held the largest product type segment share at 28%, driven by scientific validation of DHA's neuroprotective properties and alignment with traditional Japanese dietary preferences for fish-based nutrition.

Key factors driving the Japan cognitive health supplements market include the rapidly aging population seeking cognitive preservation solutions, rising awareness about neurological conditions, such as Alzheimer's and dementia, cultural preferences for preventive healthcare approaches, supportive regulatory frameworks enabling functional food claims, and strategic industry consolidation expanding innovation capabilities.

Major challenges include regulatory complexity requiring substantial compliance investments, consumer skepticism regarding supplement efficacy for cognitive benefits, price sensitivity during economic uncertainty, intense competition among established players, and the need for sustained consumer education regarding preventive cognitive health approaches.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)