Japan Cold Chain Equipment Market Size, Share, Trends and Forecast by Equipment Type, Application, and Region, 2026-2034

Japan Cold Chain Equipment Market Overview:

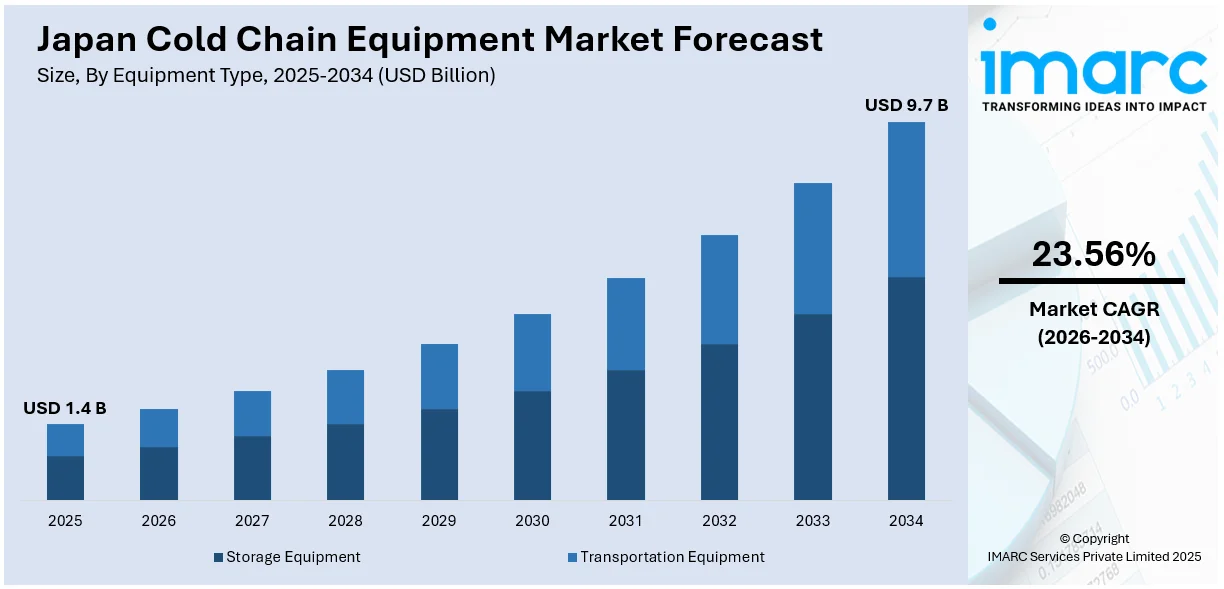

The Japan cold chain equipment market size reached USD 1.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 9.7 Billion by 2034, exhibiting a growth rate (CAGR) of 23.56% during 2026-2034. Increasing need for fresh, high-quality food and the expansion of online grocery services are some of the factors contributing to Japan cold chain equipment market share. Additionally, the rising demand for temperature-sensitive pharmaceuticals, fueled by an aging population, necessitates advanced cold chain solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.4 Billion |

| Market Forecast in 2034 | USD 9.7 Billion |

| Market Growth Rate 2026-2034 | 23.56% |

Japan Cold Chain Equipment Market Trends:

Eco-Friendly Refrigerated Transport Gaining Traction

The temperature-controlled distribution landscape in Japan is witnessing a notable pivot toward environmentally conscious operations. Cutting-edge passive refrigeration systems are gaining momentum as a means to lessen ecological footprints. A recent collaboration highlights the application of sophisticated thermal accumulation technology in refrigerated transport, effectively negating the requirement for conventional, emissions-producing generators. This inventive approach ensures stable temperature and humidity control for prolonged periods, which is crucial for safeguarding delicate cargo. This move underscores a deepening commitment to eco-friendly and resource-efficient methodologies within the cold chain sector, promising a greener future for the movement of perishable items. The ability to sustain conditions for up to three days signifies a substantial leap in autonomous, green logistics capabilities. These factors are intensifying the Japan cold chain equipment market growth. For example, in June 2024, ITE Japan and CONCOR collaborated on green cold chain logistics, utilizing ITE's 'Ice Battery technology'. This innovative passive cooling system eliminates the need for diesel generators in refrigerated transport, offering an eco-friendly solution. The technology maintains the necessary temperature and humidity for 72 hours, ideal for perishable goods.

To get more information on this market Request Sample

Expanding Cold Storage for Vaccine Security

An increasing emphasis on robust vaccine storage solutions is evident in international health initiatives. A recent instance involves the funding of walk-in cold rooms in other nations, facilitated through a partnership involving a global children's agency. These large-capacity refrigerators aim to significantly enhance the ability to preserve temperature-sensitive vaccines across numerous districts within the recipient country. This action mirrors a broader pattern of support that includes providing portable vaccine carriers and temperature monitoring tools. Such collaborative efforts, potentially influenced by expertise and resources from Japan, known for its advanced cold chain technologies, underscore a growing worldwide commitment to strengthening vaccine supply chains and ensuring their integrity until administration. For instance, in January 2023, the Japanese government, through UNICEF, funded walk-in cold rooms for vaccine storage in Sri Lanka. These large refrigerators enhance the capacity to safely hold temperature-sensitive vaccines across several districts. This contribution builds upon previous support of portable vaccine carriers and temperature monitors.

Japan Cold Chain Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on equipment type and application.

Equipment Type Insights:

- Storage Equipment

- On-Grid

- Walk-in Coolers

- Walk-in Freezers

- Ice-Lined Refrigerators

- Deep Freezers

- Off-Grid

- Solar Chillers

- Milk Coolers

- Solar Powered Cold Boxes

- Others

- Others

- On-Grid

- Transportation Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes storage equipment [on-grid (walk-in coolers, walk-in freezers, ice-lined refrigerators, and deep freezers), off-grid (solar chillers, milk coolers, solar powered cold boxes, and others), and others] and transportation equipment.

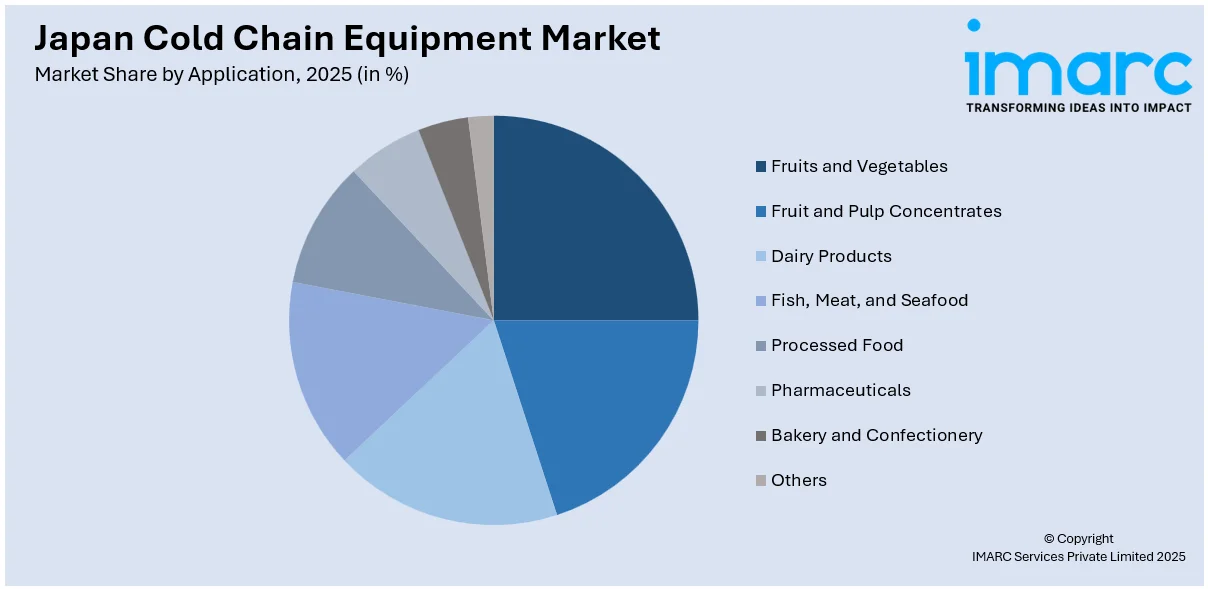

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fruits and Vegetables

- Fruit and Pulp Concentrates

- Dairy Products

- Fish, Meat, and Seafood

- Processed Food

- Pharmaceuticals

- Bakery and Confectionery

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, fruit and pulp concentrates, dairy products, fish, meat, and seafood, processed food, pharmaceuticals, bakery and confectionery, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto region, Kansai/Kinki region, Central/Chubu region, Kyushu-Okinawa region, Tohoku region, Chugoku region, Hokkaido region, and Shikoku region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Cold Chain Equipment Market News:

- In July 2024, Japan's government, through UNICEF funding, provided nine refrigerated trucks to Sri Lanka to enhance vaccine delivery. The Ambassador of Japan emphasized the nation's commitment to Sri Lanka's health. These trucks would improve the safe and timely transport of temperature-sensitive vaccines nationwide. This contribution is part of a larger USD 3 Million aid package for cold chain equipment, highlighting Japan's role in supporting global immunization efforts with its technology.

Japan Cold Chain Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered |

|

| Applications Covered | Fruits and Vegetables, Fruit and Pulp Concentrates, Dairy Products, Fish, Meat, and Seafood, Processed Food, Pharmaceuticals, Bakery and Confectionery, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan cold chain equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan cold chain equipment market on the basis of equipment type?

- What is the breakup of the Japan cold chain equipment market on the basis of application?

- What is the breakup of the Japan cold chain equipment market on the basis of region?

- What are the various stages in the value chain of the Japan cold chain equipment market?

- What are the key driving factors and challenges in the Japan cold chain equipment market?

- What is the structure of the Japan cold chain equipment market and who are the key players?

- What is the degree of competition in the Japan cold chain equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cold chain equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan cold chain equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cold chain equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)