Japan Cold Chain Market Size, Share, Trends and Forecast by Type, Temperature Range, Application, and Region, 2026-2034

Japan Cold Chain Market Overview:

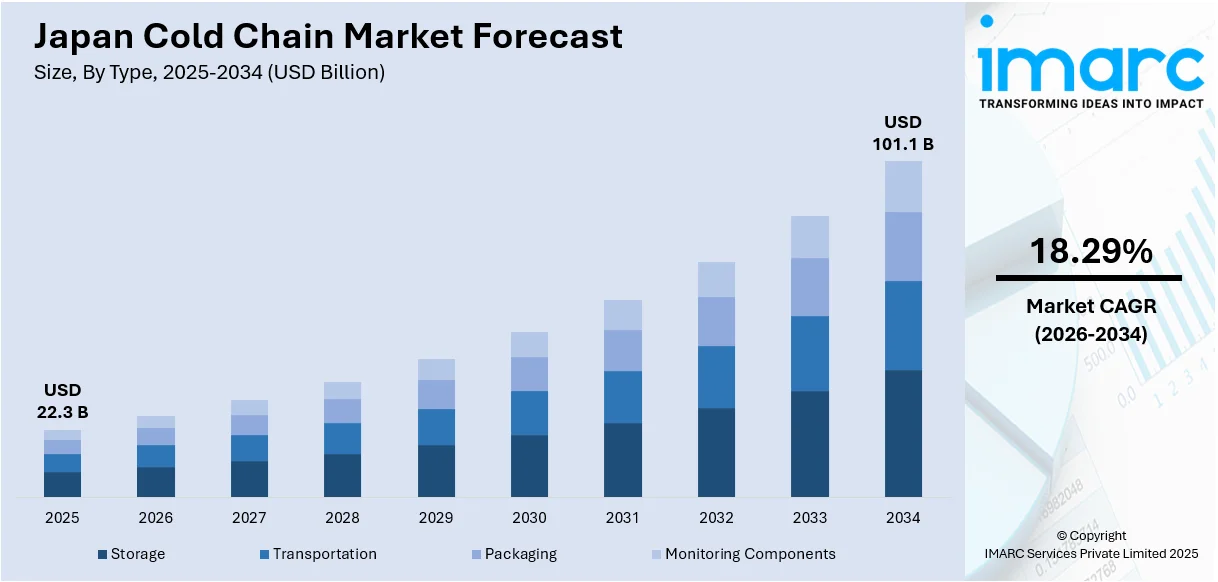

The Japan cold chain market size reached USD 22.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 101.1 Billion by 2034, exhibiting a growth rate (CAGR) of 18.29% during 2026-2034. The market is growing steadily, driven by increasing demand for temperature-sensitive goods, expansion of energy-efficient infrastructure, and supportive government initiatives. Technological advancements in storage and transport systems are reducing spoilage rates and encouraging broader adoption of cold chain solutions across agriculture, food, and pharmaceutical sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 22.3 Billion |

| Market Forecast in 2034 | USD 101.1 Billion |

| Market Growth Rate 2026-2034 | 18.29% |

Japan Cold Chain Market Trends:

Eco-Friendly Logistics Enhancing Market Reliability

Japan’s cold chain market is steadily advancing as sustainability becomes a central focus in logistics planning. With the need to transport perishable goods like produce, seafood, and pharmaceuticals under strict temperature control, the market is turning to energy-efficient systems and low-emission technologies to reduce environmental impact and operational costs. These upgrades not only help ensure product freshness but also contribute to reducing wastage across supply chains. In June 2024, Fosun Hive and Idera launched a joint venture in Osaka, backed by a JPY 15 Billion investment, to develop a modern cold storage facility. Designed with natural CO₂ refrigerants and energy-saving systems, the project aligned with Japan’s national climate goals while offering high-precision preservation for agri-products. The introduction of such infrastructure supports long-term growth by improving reliability in storage and transportation. As businesses seek more predictable cold chain performance, eco-conscious investments are strengthening the sector’s resilience. The move toward greener logistics also positions Japan as a regional leader in sustainable cold chain management, helping stakeholders from retailers to exporters maintain quality standards while aligning with carbon neutrality targets and consumer expectations for responsible supply chains.

To get more information on this market Request Sample

Smart Technologies Driving Operational Precision

Technological advancement is reshaping Japan’s cold chain logistics by introducing greater precision and transparency into product handling. With temperature-sensitive goods requiring strict control, logistics operators are investing in intelligent monitoring tools, IoT integration, and automation to improve quality assurance and traceability. These systems allow real-time visibility into storage and transport conditions, helping detect issues early and reduce spoilage risks. In December 2024, Panasonic completed its acquisition of Area Cooling in Poland, securing access to eco-friendly refrigeration technologies such as inverter-controlled and CO₂-based condensing units. These technologies provide stable, efficient cooling with lower environmental impact an important upgrade for Japan’s logistics providers managing complex cold chain operations. The move bolstered Panasonic’s capabilities to deliver high-performance systems within Japan and across Asia. With enhanced data capture and equipment automation, cold chain operators can now analyze conditions more effectively, improving accountability in the event of product damage or delays. This transformation supports logistics companies in maintaining strict compliance with food safety and pharmaceutical handling regulations. As smart technologies become standard, they are enabling a new level of operational efficiency, accuracy, and trust across the cold chain sector, reinforcing Japan’s reputation for precision and innovation in temperature-controlled logistics.

Japan Cold Chain Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, temperature range, and application.

Type Insights:

- Storage

- Facilities/Services

- Refrigerated Warehouse

- Cold Room

- Equipment

- Blast Freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

- Facilities/Services

- Transportation

- By Mode

- Road

- Sea

- Rail

- Air

- By Offering

- Refrigerated Vehicles

- Refrigerated Containers

- By Mode

- Packaging

- Crates

- Insulated Containers and Boxes

- Large (32 to 66 liters)

- Medium (21 to 29 liters)

- Small (10 to 17 liters)

- X-small (3 to 8 liters)

- Petite (0.9 to 2.7 liters)

- Cold Chain Bags/Vaccine Bags

- Ice Packs

- Others

- Monitoring Components

- Hardware

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Others

- Software

- On-premises

- Cloud-based

- Hardware

The report has provided a detailed breakup and analysis of the market based on the type. This includes storage [facilities/services (refrigerated warehouse, cold room), equipment (blast freezer, walk-in cooler and freezer, deep freezer, others)], transportation [by mode (road, sea, rail, air), by offering (refrigerated vehicles, refrigerated containers)], packaging [crates, insulate containers and boxes (large (32 to 66 liters, medium (21 to 29 liters), small (10 to 17 liters), x-small (3 to 8 liters), petite (0.9 to 2.7 liters), cold chain bags/vaccine bags, ice packs, others], monitoring components [hardware (sensors, RFID devices, telematics, networking devices, others), software (on-premises, cloud-based)].

Temperature Range Insights:

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

A detailed breakup and analysis of the market based on the temperature range have also been provided in the report. This includes chilled (0°C to 15°C), frozen (-18°C to -25°C), and deep-frozen (below -25°C).

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Fruits and Vegetables

- Fruit Pulp and Concentrates

- Dairy Products

- Milk

- Butter

- Cheese

- Ice Cream

- Others

- Fish, Meat, and Seafood

- Processed Food

- Bakery and Confectionary

- Others

- Pharmaceuticals

- Vaccines

- Blood Banking

- Others

- Others

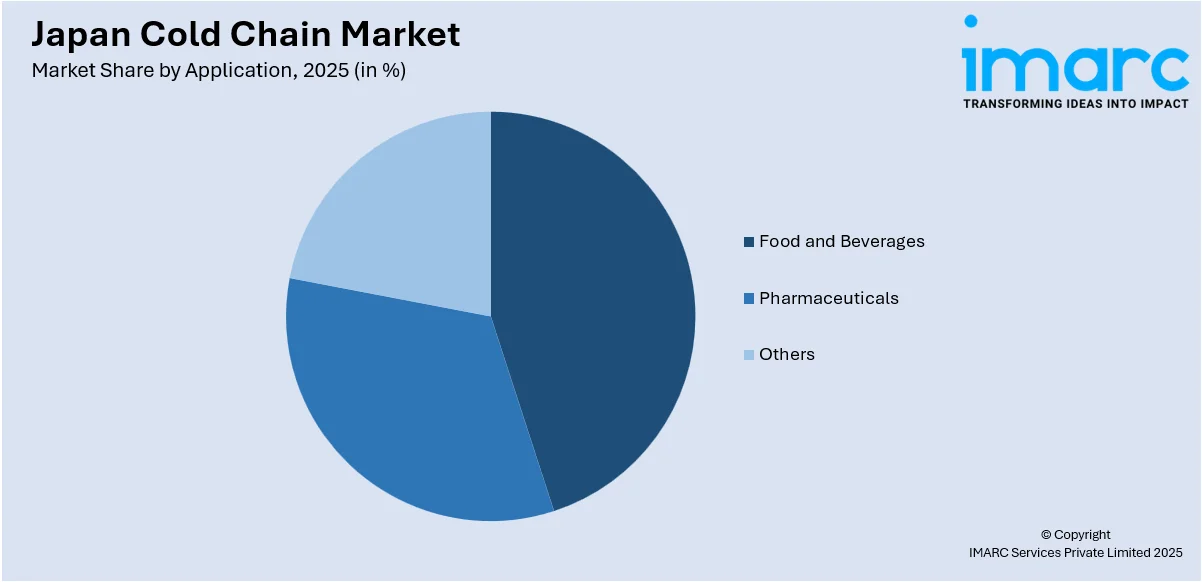

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages [fruits and vegetables, fruit pulp and concentrates, dairy products (milk, butter, cheese, ice cream, others), fish, meat, and seafood, processed food, bakery and confectionary, others], pharmaceuticals (vaccines, blood banking, others), and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/ Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Cold Chain Market News:

- April 2025: Cold Chain Technologies launched the CCT Tower Elite, a reusable 1600L pallet shipper featuring multi-temperature control and IoT-enabled tracking. This innovation enhanced the secure transport of temperature-sensitive goods in Japan, improving delivery reliability and supporting the growth of advanced cold chain logistics.

- June 2024: CONCOR partnered with Japan’s ITE to implement ice battery technology in cold chain containers, improving temperature stability for agri-produce transportation. This development enhanced Japan’s cold chain capabilities by reducing spoilage and energy dependence, reinforcing the market's shift toward sustainable and efficient logistics solutions.

Japan Cold Chain Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

|

Temperature Ranges Covered |

|

| Applications Covered |

|

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan cold chain market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan cold chain market on the basis of type?

- What is the breakup of the Japan cold chain market on the basis of temperature range?

- What is the breakup of the Japan cold chain market on the basis application?

- What is the breakup of the Japan cold chain market on the basis of region?

- What are the various stages in the value chain of the Japan cold chain market?

- What are the key driving factors and challenges in the Japan cold chain?

- What is the structure of the Japan cold chain market and who are the key players?

- What is the degree of competition in the Japan cold chain market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan cold chain market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan cold chain market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan cold chain industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)