Japan Command and Control System Market Size, Share, Trends and Forecast by Platform, Solution, Application, and Region, 2026-2034

Japan Command and Control System Market Summary:

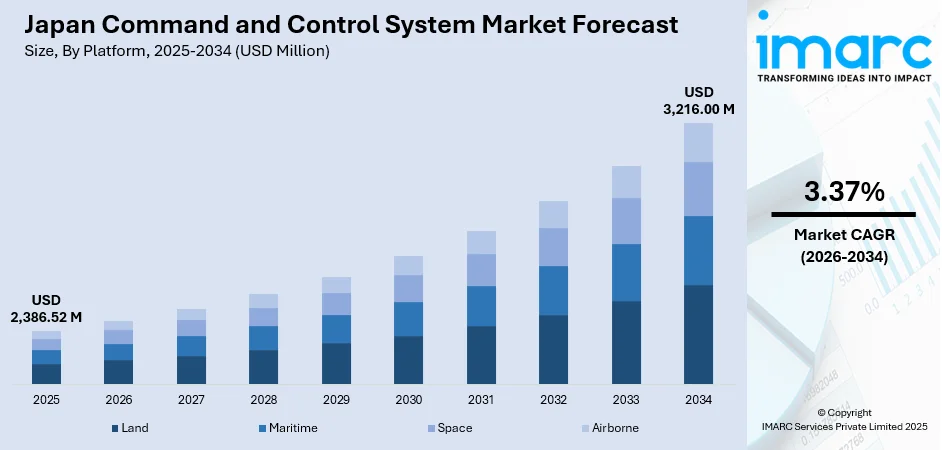

The Japan command and control system market size was valued at USD 2,386.52 Million in 2025 and is projected to reach USD 3,216.00 Million by 2034, growing at a compound annual growth rate of 3.37% from 2026-2034.

The Japan command and control system market demonstrates robust expansion driven by national defense modernization priorities and evolving regional security dynamics. This sector is poised to grow as the country has a strategic thrust on the integrated battlefield management, improved situational awareness capabilities, and real-time decision-making systems. The convergence of technologies with artificial intelligence (AI), cloud computing infrastructure, and advanced communications networks introduces a complex market environment that supports the military and civilian applications that run on various operational platforms.

Key Takeaways and Insights:

- By Platform: Land segment dominates the market with a share of 35% in 2025, driven by Japan's comprehensive ground-based defense infrastructure requirements, extensive territorial surveillance networks, and integrated army command operations supporting national security objectives.

- By Solution: Hardware segment leads the market with a share of 42% in 2025, reflecting substantial investments in advanced computing systems, sophisticated sensor arrays, communication equipment, and display consoles essential for effective military command operations.

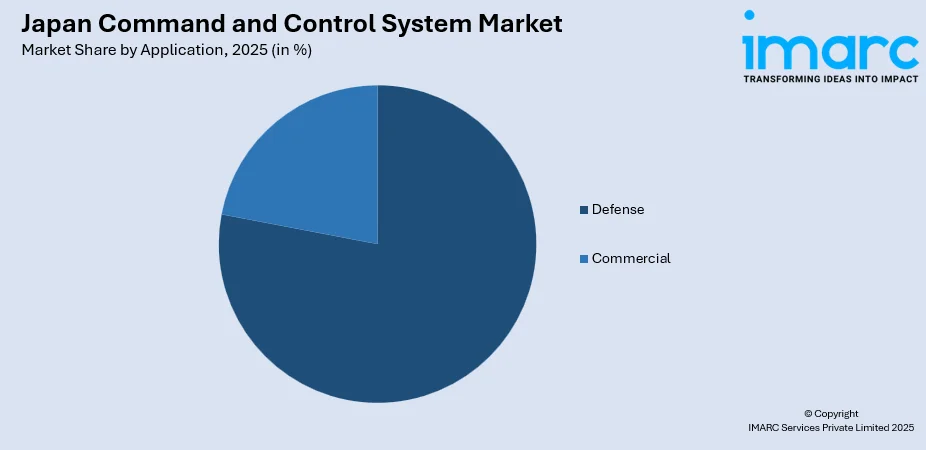

- By Application: Defense sector represents the largest segment with a market share of 78% in 2025, attributable to Japan's heightened defense spending priorities, strategic military modernization programs, and evolving geopolitical circumstances requiring enhanced operational capabilities.

- By Region: Kanto Region holds the largest share of 32% in 2025, owing to the concentration of defense headquarters, major military installations, government administrative centers, and leading technology development facilities in the Tokyo metropolitan area.

- Key Players: The Japan command and control system market exhibits a competitive structure characterized by established defense contractors, specialized technology providers, and system integrators. Market participants focus on technological innovation, interoperability solutions, and long-term government contracting relationships to maintain competitive positioning.

To get more information on this market Request Sample

Japan's command and control system market reflects the nation's commitment to maintaining advanced defense capabilities while addressing contemporary security challenges. The market ecosystem encompasses sophisticated hardware platforms, intelligent software solutions, and comprehensive service offerings that enable seamless coordination across military branches. Strategic initiatives emphasizing joint operations capability, allied interoperability, and network-centric warfare drive continuous investment in command and control infrastructure. The integration of emerging technologies, including artificial intelligence algorithms, machine learning capabilities, and predictive analytics transforms traditional command structures into agile, responsive operational frameworks. Japan's Self-Defense Forces increasingly deploy interconnected systems supporting real-time intelligence processing, threat assessment, and coordinated response mechanisms across land, maritime, air, and space domains.

Japan Command and Control System Market Trends:

Accelerated Digital Transformation in Defense Infrastructure

Japan's defense sector witnesses rapid digital transformation as command and control systems evolve toward fully networked architectures. Military organizations prioritize seamless data sharing across platforms, enabling unified operational pictures supporting strategic decision-making. Cloud-based solutions gain traction for their scalability, enabling rapid deployment and resource optimization while maintaining stringent security protocols essential for sensitive defense applications. For instance, in March 2025, Japan formally established a new command within the Self-Defense Forces to unify its ground, air, and maritime operations, marking a significant restructuring of its defense framework. The initiative is intended to enhance seamless coordination with US forces, particularly as regional security concerns rise amid increasing uncertainty surrounding potential scenarios involving Taiwan.

Integration of Autonomous Systems and Unmanned Platforms

The proliferation of autonomous systems reshapes command and control requirements throughout Japan's military establishment. Unmanned aerial vehicles, autonomous underwater systems, and robotic ground platforms demand sophisticated coordination capabilities. For instance, in October 2025, Japan’s Ground Self-Defense Force initiated a fresh round of unmanned ground vehicle testing, featuring Milrem Robotics’ THeMIS and Rheinmetall’s Mission Master SP. These platforms are being assessed for roles such as logistics support, reconnaissance tasks, and aiding deployed units. The effort underscores Japan’s broader push to enhance robotic capabilities within its defense forces, minimize risks to personnel, and stay aligned with the global shift toward advanced autonomous ground technologies. Modern command frameworks incorporate specialized interfaces managing swarm operations, human-machine teaming, and autonomous decision protocols essential for next-generation warfare scenarios.

Enhanced Cybersecurity and Resilient Communications

Growing cyber threats drive substantial investment in secure, resilient command and control infrastructure across Japanese defense networks. Japan’s National Police Agency (NPA) attributed more than 200 cyberattacks over the past five years to the hacking group MirrorFace. The campaign has struck key government institutions, including the Ministry of Foreign Affairs, the Ministry of Defense, and the Japan Aerospace Exploration Agency (JAXA). Advanced encryption technologies, quantum-resistant communication protocols, and hardened system architectures become standard requirements. Military planners emphasize redundancy, rapid recovery capabilities, and distributed processing to ensure operational continuity against sophisticated electronic warfare and cyber attack scenarios.

Market Outlook 2026-2034:

The Japan command and control system market anticipates sustained expansion throughout the forecast period, underpinned by escalating defense budgets and strategic modernization imperatives. National security priorities emphasizing enhanced surveillance capabilities, improved response coordination, and allied interoperability create favorable conditions for continued market development. Technology advancement trajectories point toward increasingly intelligent, adaptive command systems leveraging artificial intelligence and advanced analytics. Commercial applications in disaster management, critical infrastructure protection, and public safety expand the addressable market beyond traditional defense sectors. The market generated a revenue of USD 2,386.52 Million in 2025 and is projected to reach a revenue of USD 3,216.00 Million by 2034, growing at a compound annual growth rate of 3.37% from 2026-2034.

Japan Command and Control System Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Platform | Land | 35% |

| Solution | Hardware | 42% |

| Application | Defense | 78% |

| Region | Kanto Region | 32% |

Platform Insights:

- Land

- Maritime

- Space

- Airborne

The land segment dominates with a market share of 35% of the total Japan command and control system market in 2025.

Land-based command and control systems constitute the foundation of Japan's territorial defense architecture, supporting ground force operations across diverse tactical scenarios. These systems enable comprehensive battlefield management through integrated sensor networks, communication arrays, and processing centers coordinating troop movements and resource deployment. The Japan Ground Self-Defense Force continuously upgrades land-based command infrastructure to address evolving threat landscapes and operational requirements spanning conventional warfare to disaster response missions.

The prominence of land platform systems reflects Japan's geographic and strategic realities, requiring robust ground-based defense capabilities. Advanced tactical data links connect dispersed units, enabling coordinated operations across mountainous and urban terrains characteristic of Japanese geography. Mobile command posts and transportable communication systems provide operational flexibility essential for rapid deployment scenarios, while fixed installations offer comprehensive coverage supporting national defense coordination requirements.

Solution Insights:

- Hardware

- Software

- Services

The hardware segment leads with a share of 42% of the total Japan command and control system market in 2025.

Hardware solutions encompass the physical infrastructure underpinning Japan's command and control capabilities, including advanced computing platforms, ruggedized display systems, and sophisticated sensor equipment. These components form the tangible backbone enabling data processing, visualization, and communication essential for military operations. Investment in hardware modernization reflects requirements for increased processing power, enhanced reliability, and improved interoperability with allied systems across multinational operational frameworks.

The substantial hardware segment share demonstrates Japan's commitment to maintaining cutting-edge physical infrastructure supporting defense operations. Procurement priorities emphasize systems meeting demanding military specifications for durability, electromagnetic compatibility, and operational performance under adverse conditions. Hardware investments increasingly incorporate modular designs enabling technology refresh cycles without complete system replacement, optimizing lifecycle costs while maintaining operational effectiveness.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Defense

- Commercial

The defense application exhibits clear dominance with a 78% share of the total Japan command and control system market in 2025.

Defense applications represent the primary demand driver for command and control systems throughout Japan, encompassing air defense networks, naval operations centers, and integrated joint force management platforms. The Japan defense market size reached USD 36.4 Billion in 2025. Looking forward, the market is expected to reach USD 45.1 Billion by 2034, exhibiting a growth rate (CAGR) of 2.43% during 2026-2034. These systems provide critical capabilities for threat detection, response coordination, and strategic planning supporting national security objectives. Japan's evolving security environment and modernization priorities ensure sustained investment in advanced defense command and control infrastructure.

The overwhelming defense segment dominance reflects Japan's strategic imperatives requiring sophisticated military command capabilities. Self-Defense Force modernization programs prioritize interoperable systems enabling seamless coordination with allied forces while maintaining autonomous operational capacity. Defense applications increasingly incorporate artificial intelligence capabilities enhancing threat assessment, decision support, and operational planning functions across all military branches.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The Kanto region leads with a 32% share of the total Japan command and control system market in 2025.

Kanto region dominance stems from the concentration of national defense infrastructure in the greater Tokyo metropolitan area including the Ministry of Defense headquarters, Self-Defense Force command centers, and primary research facilities. The region houses major defense contractors and technology development organizations, driving innovation in command and control capabilities. Strategic decision-making authority centralized in Kanto reinforces the region's primacy in procurement, development, and operational deployment of advanced systems.

Geographic positioning and infrastructure density establish Kanto as Japan's command and control hub supporting nationwide defense coordination. Advanced telecommunications networks, power infrastructure, and transportation access enable rapid system deployment and maintenance activities. The region's concentration of skilled technical workforce and academic institutions provides essential human capital supporting continued advancement in command and control technology development and implementation.

Market Dynamics:

Growth Drivers:

Why is the Japan Command and Control System Market Growing?

Accelerating Defense Modernization and Budget Expansion

Japan's strategic pivot toward enhanced defense capabilities drives substantial investment in command and control infrastructure modernization. For instance, in December 2025, Japan’s Defense Minister Shinjiro Koizumi and his Australian counterpart Richard Marles signed the Framework for Strategic Defence Coordination (FSDC), marking a major step forward in bilateral security cooperation. The agreement, reached after high-level talks, reinforces joint defense alignment as both nations respond to escalating regional tensions and growing strategic uncertainty. Government commitment to strengthening national security posture manifests through expanded defense budgets prioritizing advanced systems acquisition and indigenous technology development. The Self-Defense Forces undertake comprehensive modernization programs, replacing legacy equipment with next-generation platforms offering superior performance, reliability, and interoperability. Strategic planning emphasizes network-centric capabilities enabling integrated operations across military branches and allied forces. Procurement priorities reflect lessons from regional security developments highlighting requirements for rapid response, enhanced situational awareness, and coordinated multi-domain operations supporting national defense objectives.

Evolving Regional Security Environment and Threat Landscape

The dynamic security environment surrounding Japan necessitates continuous enhancement of command and control capabilities to address emerging threats and strategic challenges. Regional developments including territorial disputes, military modernization by neighboring states, and evolving missile threats, create an imperative for sophisticated defense systems. Japan's geographic position demands comprehensive surveillance, early warning, and rapid response capabilities coordinated through advanced command infrastructure. Ballistic missile defense integration, maritime domain awareness, and air defense network coordination require increasingly sophisticated command and control platforms. Strategic partnerships with allied nations further drive interoperability requirements, shaping system specifications and procurement decisions throughout Japan's defense establishment.

Technological Innovation and Digital Transformation Initiatives

Rapid technological advancement creates opportunities for transformative improvements in command and control system capabilities throughout Japan's defense sector. Artificial intelligence integration enables automated threat detection, predictive analysis, and decision support functions, enhancing operational effectiveness. For instance, in June 2025, Abnormal AI, a frontrunner in AI-driven human behavior security, officially began operations in Japan. This move expands the company’s footprint across the Asia-Pacific region and underscores its dedication to safeguarding organizations globally from sophisticated email threats through advanced behavioral AI technology. Cloud computing adoption provides scalable processing resources supporting real-time data fusion from diverse sensor networks. Advanced communication technologies, including secure satellite links and resilient tactical networks, ensure reliable connectivity across operational domains. Digital transformation initiatives modernize information architecture, enabling seamless data sharing, collaborative planning, and coordinated execution. These technological drivers sustain market growth through continuous capability enhancement requirements and system upgrade cycles.

Market Restraints:

What Challenges the Japan Command and Control System Market is Facing?

Complex System Integration and Interoperability Challenges

Integration complexity presents significant obstacles when incorporating advanced command and control systems with existing defense infrastructure. Legacy equipment compatibility requirements constrain modernization approaches while diverse platform specifications complicate unified system architectures. Achieving seamless interoperability across multiple vendors, platforms, and allied systems demands substantial engineering effort extending procurement timelines and implementation schedules.

Cybersecurity Vulnerabilities and Electronic Warfare Threats

Sophisticated cyber threats and electronic warfare capabilities targeting command and control systems impose demanding security requirements. Protecting sensitive military networks against state-sponsored intrusion attempts requires continuous investment in defensive measures. The expanding attack surface from networked systems and internet-connected components creates vulnerabilities requiring ongoing vigilance, security updates, and personnel training throughout system lifecycles.

Skilled Workforce Shortage and Technical Expertise Constraints

Specialized technical expertise requirements for advanced command and control systems encounter workforce availability constraints. Recruiting and retaining personnel with necessary skills in systems engineering, software development, and cybersecurity presents ongoing challenges. Demographic factors and competition from private sector technology employers complicate defense sector workforce development efforts affecting system development and operational sustainment capabilities.

Competitive Landscape:

The Japan command and control system market exhibits a structured competitive environment characterized by established defense contractors, specialized technology providers, and system integration specialists serving government procurement requirements. Market participants leverage extensive experience, technical capabilities, and established relationships with defense authorities to secure program participation. Competition centers on technological innovation, system performance, reliability track records, and lifecycle support capabilities,’ differentiating provider offerings. Strategic partnerships between domestic manufacturers and international defense contractors facilitate technology transfer and capability development. The procurement environment emphasizes indigenous production capabilities while accommodating foreign technology integration where strategic requirements demand. Market dynamics favor participants demonstrating comprehensive system integration expertise, robust cybersecurity credentials, and proven operational support capabilities meeting demanding military specifications and performance standards.

Recent Developments:

- January 2025: Genpact launched an AI-powered Smart Command Center in Tokyo designed to enhance equipment service and supply chain operations, utilizing artificial intelligence, machine learning, and cloud computing to provide real-time insights and automated workflow optimization.

Japan Command and Control System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Land, Maritime, Space, Airborne |

| Solutions Covered | Hardware, Software, Services |

| Applications Covered | Defense, Commercial |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/ Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Japan command and control system market size was valued at USD 2,386.52 Million in 2025.

The Japan command and control system market is expected to grow at a compound annual growth rate of 3.37% from 2026-2034 to reach USD 3,216.00 Million by 2034.

The land platform segment dominated the market with a share of 35% in 2025, driven by Japan's comprehensive ground-based defense infrastructure requirements and integrated territorial surveillance networks supporting national security operations.

Key factors driving the Japan command and control system market include accelerating defense modernization initiatives, evolving regional security dynamics, technological innovation in artificial intelligence and cloud computing, expanding autonomous systems integration, and enhanced interoperability requirements with allied defense forces.

Major challenges include complex system integration requirements with legacy infrastructure, escalating cybersecurity threats and electronic warfare vulnerabilities, skilled workforce shortages in specialized technical domains, extended procurement timelines for advanced systems, and interoperability constraints across multinational operational frameworks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)