Japan Commercial Display Market Size, Share, Trends and Forecast by Product Type, Technology, Component, Panel Type, Size, Application, and Region, 2026-2034

Japan Commercial Display Market Overview:

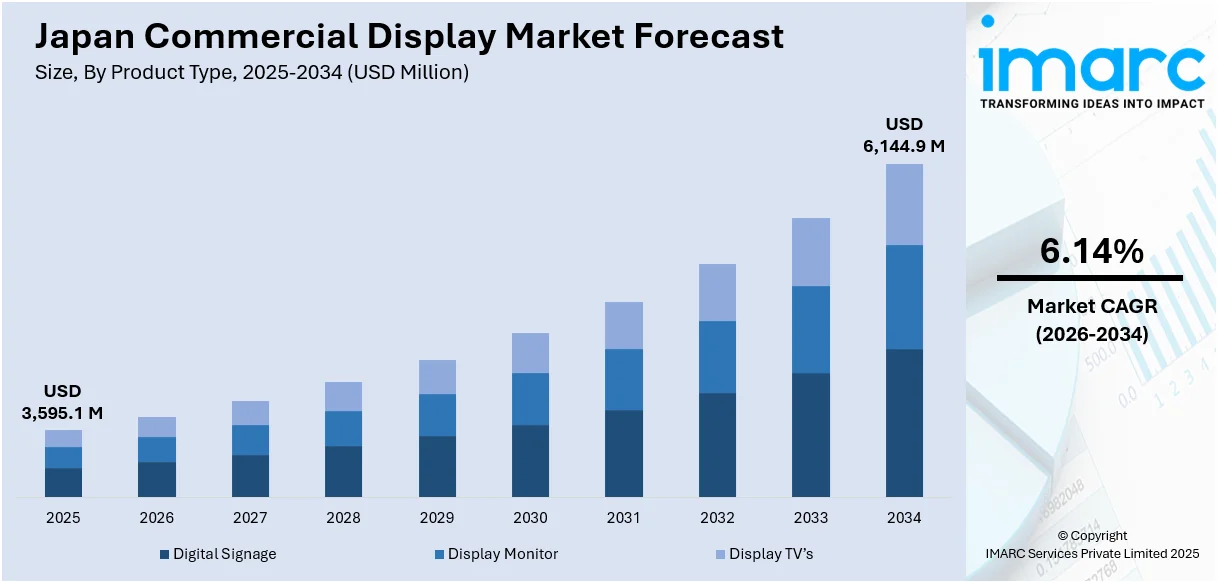

The Japan commercial display market size reached USD 3,595.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 6,144.9 Million by 2034, exhibiting a growth rate (CAGR) of 6.14% during 2026-2034. The market is driven by rising demand for digital signage, continuous advancements in Organic Light-Emitting Diode (OLED) and Liquid Crystal Display (LCD) technology, increasing adoption in retail and hospitality, growing smart city initiatives, expanding e-learning applications, rapid corporate sector digital transformation, and surging government support for innovative display solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,595.1 Million |

| Market Forecast in 2034 | USD 6,144.9 Million |

| Market Growth Rate 2026-2034 | 6.14% |

Japan Commercial Display Market Trends:

Growing Adoption of Digital Signage in Retail and Hospitality

The Japan commercial display market is witnessing a significant rise in the adoption of digital signage across the retail and hospitality sectors. Businesses in retail now employ interactive displays along with high-resolution technology to achieve customer involvement through targeted promotions and organized store routing. For instance, in early 2024, 7-Eleven convenience stores in Japan integrated AI-powered vision detection technology to optimize in-store advertising, enhancing customer engagement through personalized promotions and dynamic content displays. Moreover, the hospitality sector, including hotels and restaurants, utilizes digital displays primarily for self-service kiosks, digital menus, and interactive customer engagement technologies. The market is experiencing growing demand as businesses prioritize customer-centric marketing strategies, while the expansion of smart technology accelerates innovation and enhances engagement across industries. Furthermore, the developing smart cities, together with their active urbanization program, speed up the usage of digital signage throughout public areas and transportation centers, and entertainment facilities. The developments in OLED and LCD technology have led to commercial displays obtaining thinner designs, higher energy efficiency, and better image quality, which drives organizations to spend on display system modernization for improved customer interaction and operational effectiveness. As a result, this trend is significantly boosting the Japan commercial display market share.

To get more information on this market Request Sample

Expansion of Smart Conference and Education Displays

The Japan commercial display market is witnessing a growing requirement for intelligent conference and education displays, which is driving the Japan commercial display market growth. In addition to this, businesses collaborating with educational institutions are driving digital transformation, increasing demand for interactive whiteboards, large-format touchscreen displays, and video conferencing solutions. Moreover, the hybrid workplace demands corporate spaces to install high-quality artificial intelligence (AI)-enabled displays that allow remote collaboration and hybrid meetings. For example, in October 2024, Lenovo introduced AI-driven devices and solutions to enhance meeting rooms, boosting productivity, security, and collaboration for both in-person and virtual work environments, driving demand for intelligent commercial displays. Concurrently, educational facilities deploy smart boards as well as digital classrooms to create better interactive educational environments. Modernization programs launched by the Japanese government, along with expanding e-learning usage, are also spurring the adoption of smart education displays. Furthermore, the combination of 5G technology and cloud-based solutions has enhanced smart display connectivity along with functionality that expands their application range from business to academic use. As a result, manufacturers now concentrate their efforts on innovation because they aim to deliver features such as multi-touch capabilities, real-time content sharing, and AI-driven analytics to satisfy changing sector requirements, thus enhancing the Japan commercial display market outlook.

Japan Commercial Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product type, technology, component, panel type, size, and application.

Product Type Insights:

- Digital Signage

- Display Monitor

- Display TV’s

The report has provided a detailed breakup and analysis of the market based on the product type. This includes digital signage, display monitor, and display TV’s.

Technology Insights:

- LCD

- LED

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes LCD, LED, and others.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Panel Type Insights:

- Flat Panel

- Curved Panel

- Other

A detailed breakup and analysis of the market based on the panel type have also been provided in the report. This includes flat panel, curved panel, and other.

Size Insights:

- Below 32 inches

- 32 to 52 inches

- 52 to 75 inches

- Above 75 inches

The report has provided a detailed breakup and analysis of the market based on the size. This includes below 32 inches, 32 to 52 inches, 52 to 75 inches, and above 75 inches.

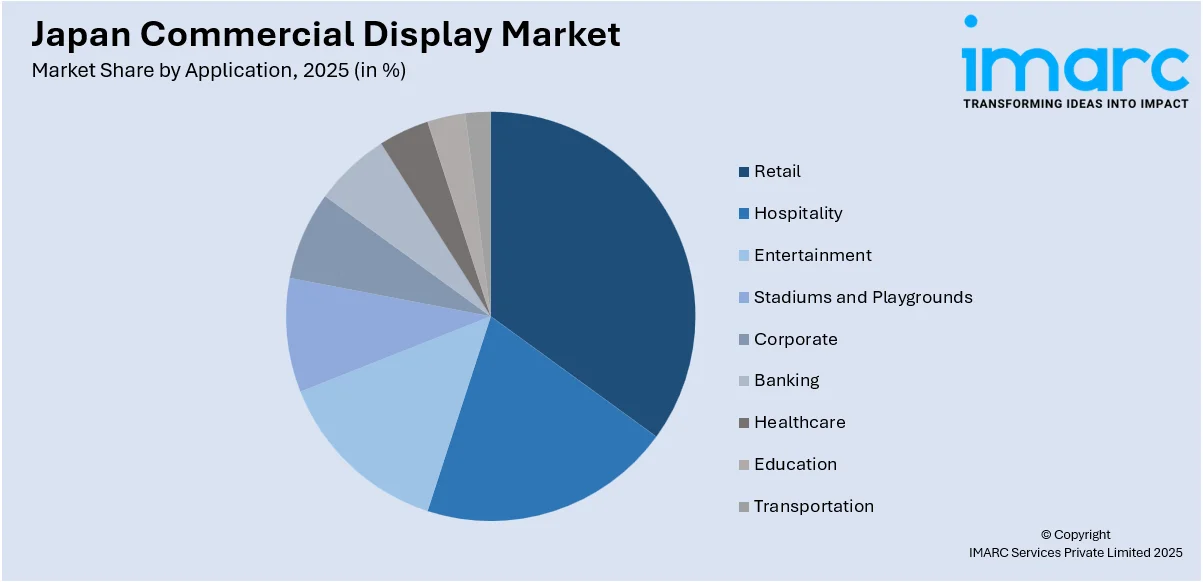

Application Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Hospitality

- Entertainment

- Stadiums and Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transportation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, and transportation.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all the major regional markets, which include Kanto, Kansai/Kinki, Central/Chubu, Kyushu-Okinawa, Tohoku, Chugoku, Hokkaido, and Shikoku regions.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Commercial Display Market News:

- In December 2024, JDI partnered with Obsidian Sensors to manufacture high-resolution thermal imaging sensors, expanding its product portfolio. This move strengthens Japan’s commercial display market by integrating advanced sensor technology, enhancing display applications in security, automotive, and industrial sectors, and driving innovation in high-performance imaging solutions.

- In March 2024, Wetouch Technology partnered with IDEC Corporation to introduce advanced touch display solutions in Japan, enhancing interactive experiences across industries. This collaboration supports the Japan commercial display market's growth by driving innovation, improving usability, and expanding applications in automation, retail, and smart infrastructure.

Japan Commercial Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Digital Signage, Display Monitor, Display TV’s |

| Technologies Covered | LCD, LED, Others |

| Components Covered | Hardware, Software, Services |

| Panel Types covered | Flat Panel, Curved Panel, Other |

| Sizes Covered | Below 32 inches, 32 to 52 inches, 52 to 75 inches, above 75 inches |

| Applications Covered | Retail, Hospitality, Entertainment, Stadiums and Playgrounds, Corporate, Banking, Healthcare, Education, Transportation |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan commercial display market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan commercial display market on the basis of product type?

- What is the breakup of the Japan commercial display market on the basis of technology?

- What is the breakup of the Japan commercial display market on the basis of component?

- What is the breakup of the Japan commercial display market on the basis of panel type?

- What is the breakup of the Japan commercial display market on the basis of size?

- What is the breakup of the Japan commercial display market on the basis of application?

- What is the breakup of the Japan commercial display market on the basis of region?

- What are the various stages in the value chain of the Japan commercial display market?

- What are the key driving factors and challenges in the Japan commercial display?

- What is the structure of the Japan commercial display market and who are the key players?

- What is the degree of competition in the Japan commercial display market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan commercial display market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan commercial display market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan commercial display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)