Japan Composite Market Size, Share, Trends and Forecast by Product, MFG Process, Application, and Region, 2026-2034

Japan Composite Market Overview:

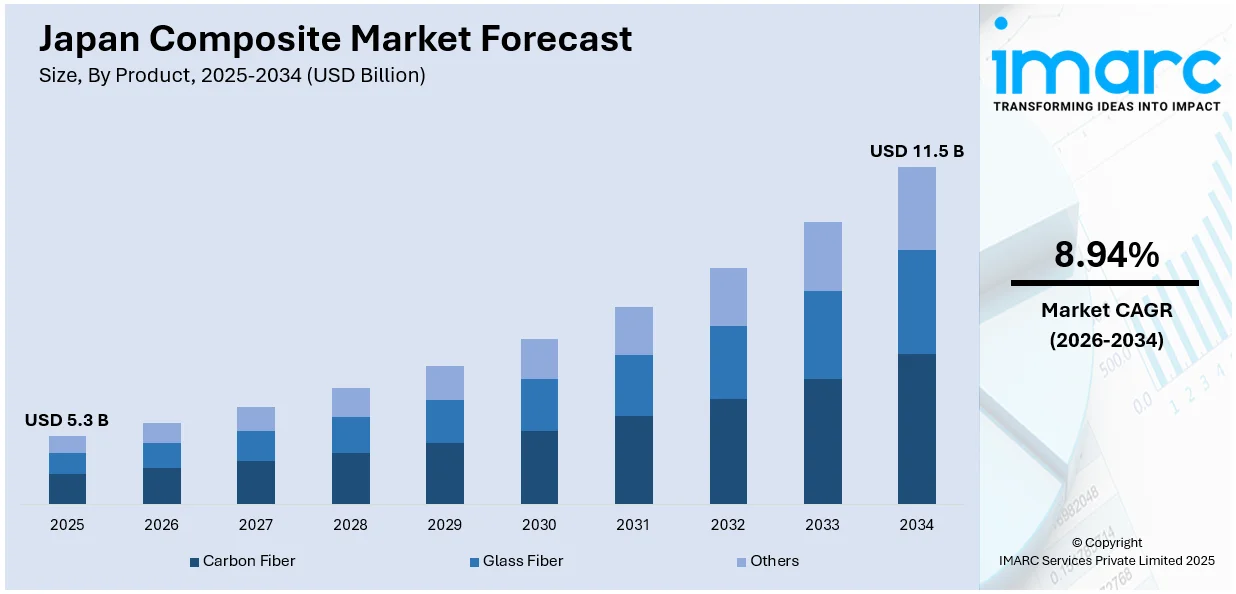

The Japan composite market size reached USD 5.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 11.5 Billion by 2034, exhibiting a growth rate (CAGR) of 8.94% during 2026-2034. The market is driven by technological advancements in composite materials, which improve performance and broaden application possibilities across industries. Growing demand for lightweight materials in the automotive and aerospace sectors supports the widespread adoption of composites for improved fuel efficiency and reduced emissions. Government initiatives, along with industry collaboration enhance the market's development by fostering innovation and providing support for sustainable material solutions, further augmenting the Japan composite market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.3 Billion |

| Market Forecast in 2034 | USD 11.5 Billion |

| Market Growth Rate 2026-2034 | 8.94% |

Japan Composite Market Trends:

Technological Advancements in Composite Materials

Technological innovations in composite materials are a leading driver of the growth of the market. Material science breakthroughs, especially the development of sophisticated carbon fiber, glass fiber, and bio-based composites, have made a broad range of uses across industries like automotive, aerospace, and construction possible. Japan has historically been at the forefront of technological advancements, and composite materials are no exception, with Japan having made significant strides in improving the strength, longevity, and performance of composites. On April 23, 2025, S&P Global released the au Jibun Bank Flash Japan Composite PMI® for April, showing that Japan's private sector returned to growth with a Composite Output Index of 51.1, up from 48.9 in March. The rise was driven by a stronger performance in services, which saw a business activity index of 52.2, while manufacturing output continued to decline but at a slower rate, registering 48.9. Despite inflationary pressures and challenges such as weaker foreign demand and staff shortages, new business in the services sector showed strong growth, contributing to an optimistic but cautious outlook for Japan's economy. Moreover, advances in manufacturing methods, including automated fiber placement (AFP) and 3D printing, have enhanced the efficiency and accuracy of producing composites. These technological developments make composite materials more cost-effective and accessible, encouraging their adoption in sectors that were traditionally reliant on metals or other materials. As innovation continues in composite materials, Japan is positioned to remain at the forefront of the industry, with technology continuing to drive new applications for Japan composite market growth.

To get more information on this market Request Sample

Government Initiatives and Industry Collaboration

Government initiatives and collaboration between industry stakeholders have played a pivotal role in the development of the market. The Japanese government has been proactive in supporting the growth of advanced materials industries through various programs that promote research, development, and commercialization of composite technologies. Key initiatives under Japan’s "Innovation Strategy 2020" and “Society 5.0” emphasize the importance of advanced manufacturing technologies, including composites, in achieving economic growth and technological leadership. Public-private partnerships have also facilitated the development of new composite manufacturing processes, as well as the scaling of these technologies to meet industry needs. Furthermore, Japan's commitment to sustainability and carbon neutrality has led to government incentives aimed at encouraging the adoption of lightweight, energy-efficient materials, particularly in transportation and construction. On March 11, 2025, the Fraunhofer IGCV research institute in Germany and the ICC Kanazawa Institute of Technology in Japan announced their collaboration on the FIP-Mirai@ICC project, focusing on recycling carbon fiber composites. The partnership, with a budget of EUR 2 million (USD 2.13 million), will run for five years, aiming to explore sustainable solutions for composite recycling, initially targeting construction, infrastructure, and potentially the automotive and aerospace industries in the long term. The project combines expertise in advanced manufacturing techniques, such as automated fiber placement, non-destructive evaluation, and thermal recycling, to offer a comprehensive approach to the recycling challenges in composite materials. These initiatives are aligned with the country's long-term economic and environmental goals, creating a favorable environment for the composite industry. Industry collaboration, particularly between automotive, aerospace, and construction sectors, has accelerated the adoption of composites, as these industries work together to integrate more sustainable and innovative materials into their product lines. Such initiatives continue to create growth opportunities for Japan's composite market, fostering both technological advancements and market expansion.

Japan Composite Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, MFG process, and application.

Product Insights:

- Carbon Fiber

- Glass Fiber

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes carbon fiber, glass fiber, and others.

MFG Process Insights:

- Layup

- Filament

- Injection Molding

- Pultrusion

- Compression Molding

- RTM

- Others

The report has provided a detailed breakup and analysis of the market based on the MFG process. This includes layup, filament, injection molding, pultrusion, compression molding, RTM, and others.

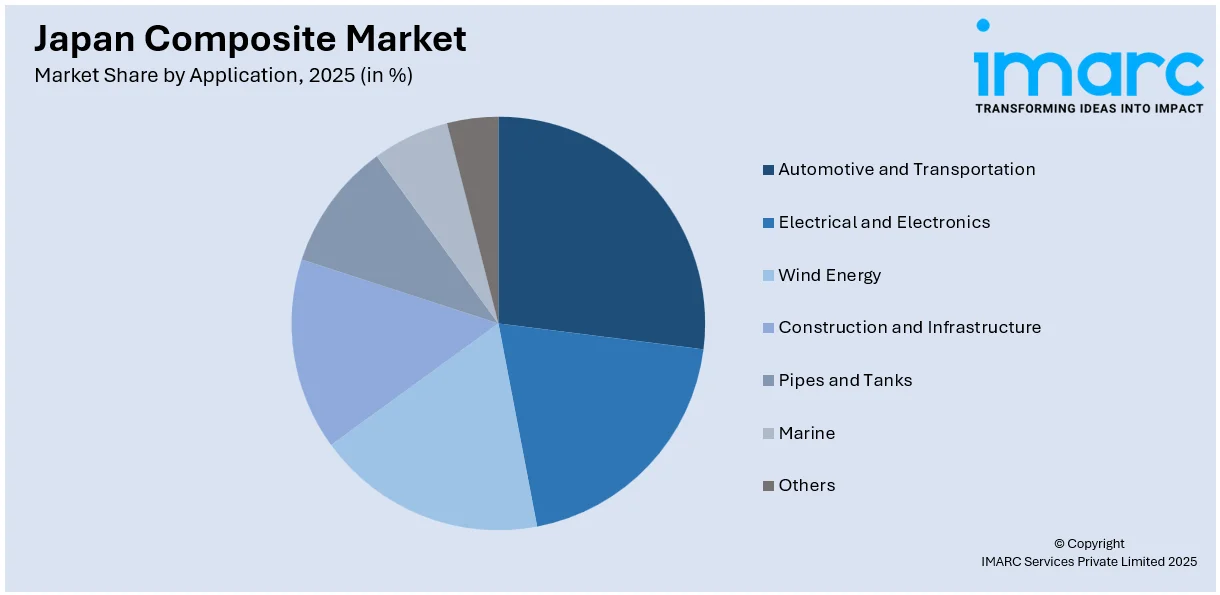

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive and Transportation

- Electrical and Electronics

- Wind Energy

- Construction and Infrastructure

- Pipes and Tanks

- Marine

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive and transportation, electrical and electronics, wind energy, construction and infrastructure, pipes and tanks, marine, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Composite Market News:

- On April 21, 2025, HEAD launched the BOOM RAW tennis racquet, utilizing Toray's 100% bio-circular carbon fibers in a composite material, as part of their commitment to sustainability. Sourced from agricultural and forestry waste, the BOOM RAW racquet offers the same high performance as the regular BOOM model while reducing its environmental impact. This collaboration reflects both HEAD's and Toray's ongoing efforts to innovate sustainably, with HEAD also transitioning its production to green energy, aiming to cut carbon emissions by approximately 7,000 tons annually.

- On November 7, 2024, Daikin Industries, Ltd. announced its investment in Advanced Composite Corporation, a manufacturer of aluminum-based metal matrix composite materials. The investment aims to accelerate the development of lightweight, high-strength materials for heating, ventilation, air conditioning, and refrigeration components, particularly compressors. This collaboration, which began in 2019, focuses on using Advanced Composite's aluminum composite materials to reduce compressor weight, improving energy efficiency and contributing to energy savings in Daikin’s products.

Japan Composite Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Carbon Fiber, Glass Fiber, Others |

| MFG Processes Covered | Layup, Filament, Injection Molding, Pultrusion, Compression Molding, RTM, Others |

| Applications Covered | Automotive and Transportation, Electrical and Electronics, Wind Energy, Construction and Infrastructure, Pipes and Tanks, Marine, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan composite market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan composite market on the basis of product?

- What is the breakup of the Japan composite market on the basis of MFG process?

- What is the breakup of the Japan composite market on the basis of application?

- What is the breakup of the Japan composite market on the basis of region?

- What are the various stages in the value chain of the Japan composite market?

- What are the key driving factors and challenges in the Japan composite market?

- What is the structure of the Japan composite market and who are the key players?

- What is the degree of competition in the Japan composite market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan composite market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan composite market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan composite industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)