Japan Concrete Market Size, Share, Trends and Forecast by Concrete Type, Application, End Use Industry, and Region, 2026-2034

Japan Concrete Market Overview:

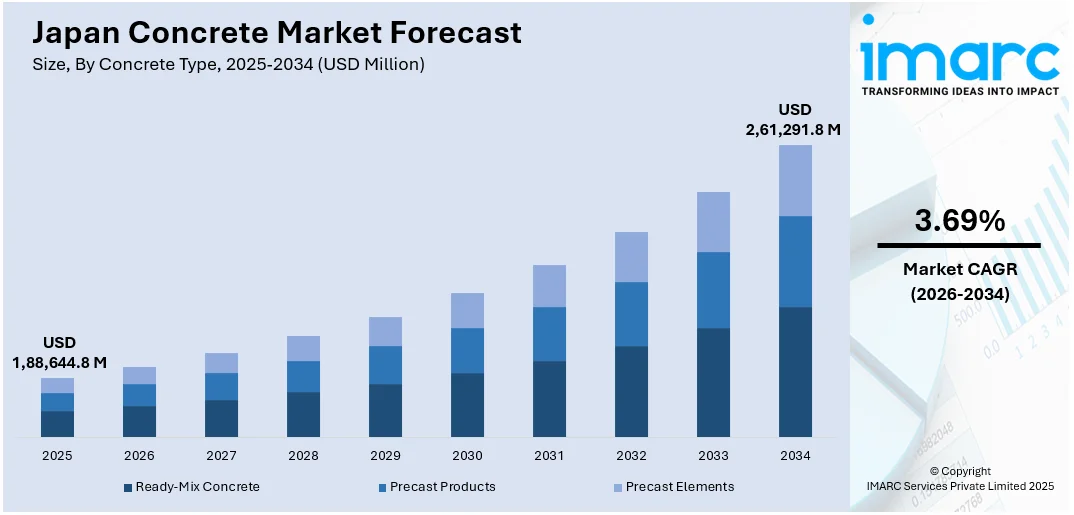

The Japan concrete market size reached USD 1,88,644.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,61,291.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.69% during 2026-2034. The market is driven by urban renewal projects that prioritize seismic-resistant structures and compliance with stringent building standards. Environmental targets and carbon-neutrality goals are accelerating the shift toward low-emission materials and circular construction practices across both public and private sectors, fueling the market. Technological advancements in digital construction, prefabrication, and automation are optimizing structural performance and reducing labor dependence, further augmenting the Japan concrete market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,88,644.8 Million |

| Market Forecast in 2034 | USD 2,61,291.8 Million |

| Market Growth Rate 2026-2034 | 3.69% |

Japan Concrete Market Trends:

Urban Redevelopment and Seismic-Resistant Infrastructure Demand

Japan’s urban planning strategies are increasingly oriented toward renewing aging infrastructure across major cities. With a significant portion of buildings and civil structures constructed during the post-war economic boom, the government has accelerated renewal projects to address structural deterioration. In earthquake-prone regions such as Kanto and Tohoku, the demand for high-strength, seismically resistant concrete solutions has grown consistently, especially in transport networks, bridges, and mixed-use complexes. Reconstruction policies now prioritize robust material selection to meet stringent seismic performance standards while maintaining environmental and architectural harmony. Urban redevelopment initiatives, such as Tokyo’s Yaesu and Shibuya districts, emphasize advanced concrete formulations, including high-performance and ultra-high-performance concrete, to ensure long-term structural integrity. Japan has actively developed concrete-polymer composites over the past five decades, focusing on polymer-modified concrete, polymer concrete, and polymer-impregnated concrete due to their high performance, multifunctionality, and sustainability compared to traditional concrete. Key innovations include polymer-cement ratios ranging from 20% to 300% in waterproofing membranes with tensile strengths between 0.7 and 8.0 MPa, and the use of hardener-free epoxy-modified mortars that achieve two to three times higher flexural strength than ordinary cement mortar through accelerated curing methods. Moreover, national guidelines on infrastructure resilience have driven local administrations to revise building codes and demand materials with superior compressive strength and durability. These standards, combined with aging population pressures and the need for accessible, future-ready infrastructure, have created a consistent demand for innovative concrete applications in public spaces and vertical developments. After over 80 words of context, it becomes evident that structural renewal and seismic resilience directly contribute to Japan concrete market growth.

To get more information on this market Request Sample

Integration of Low-Carbon Technologies and Circular Construction Practices

Japan’s concrete industry is undergoing a technological transformation as sustainability benchmarks tighten under national and international climate frameworks. The integration of low-carbon cements, alternative binders, and recycled aggregates aligns with Japan’s goal of carbon neutrality by 2050. Japanese manufacturers are now scaling up their research and deployment of carbon capture, utilization, and storage (CCUS) systems, as well as developing geopolymer and magnesium-based concretes. These innovations reduce dependency on clinker-based Portland cement, significantly lowering CO₂ emissions during production. In parallel, a growing number of contractors are incorporating circular design principles into projects, utilizing construction demolition waste as aggregate while optimizing transportation logistics through prefabrication. Such efforts are supported by a public-private partnership framework that funds green construction innovation and accelerates its commercialization. On January 29, 2025, Mitsubishi UBE Cement Corporation (MUCC) invested USD 5 million in MCi Carbon, an Australian cleantech company, to advance mineral carbonation technology for reducing CO2 emissions in cement and concrete production. The investment, part of a USD 20 million fundraising round, includes a collaboration agreement with MUCC and a three-way Memorandum of Understanding with ITOCHU Corporation to promote low-carbon concrete solutions in Japan. This partnership supports the launch of MCi’s “Myrtle” demonstration plant and aims to accelerate Japan’s concrete industry decarbonization aligned with national climate targets. As carbon accounting becomes mandatory for public infrastructure bids, sustainability credentials are increasingly influencing procurement decisions. With these low-emission materials and processes gaining traction in government tenders and private developments alike, the pathway is clearly established for future market expansion.

Japan Concrete Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on concrete type, application, and end use industry.

Concrete Type Insights:

- Ready-Mix Concrete

- Transit Mix Concrete

- Central Mix Concrete

- Shrink Mix Concrete

- Precast Products

- Paving Stones and Slabs

- Bricks

- AAC Blocks

- Others

- Precast Elements

- Facade

- Floor

- Building blocks

- Pipe

- Others

The report has provided a detailed breakup and analysis of the market based on the concrete type. This includes ready-mix concrete (transit mix concrete, central mix concrete, and shrink mix concrete), precast products (paving stones and slabs, bricks, AAC blocks, and others), and precast elements (facade, floor, building blocks, pipe, and others).

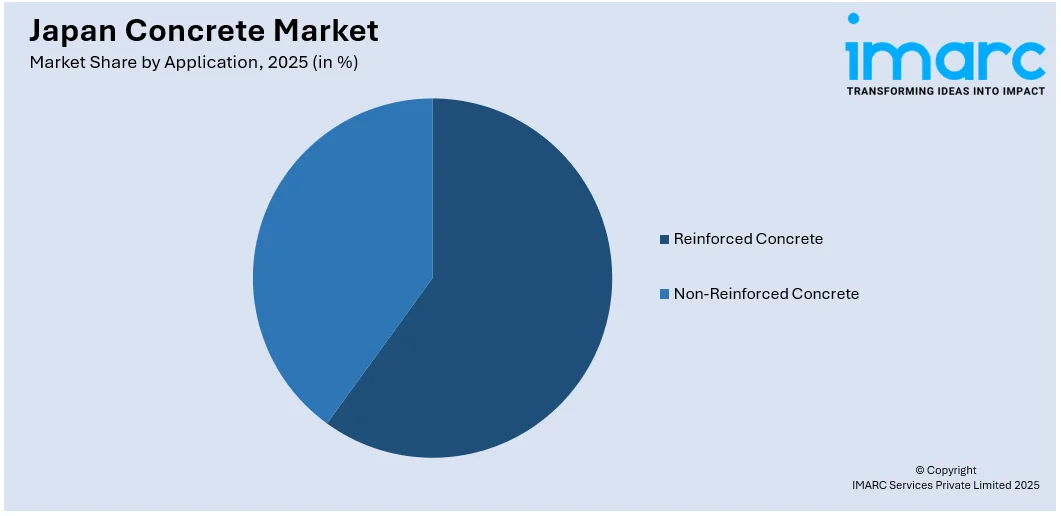

Application Insights:

Access the comprehensive market breakdown Request Sample

- Reinforced Concrete

- Non-Reinforced Concrete

The report has provided a detailed breakup and analysis of the market based on the application. This includes reinforced concrete and non-reinforced concrete.

End Use Industry Insights:

- Roads and Highways

- Tunnels

- Residential Buildings

- Non-Residential Buildings

- Dams and Power Plants

- Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes roads and highways, tunnels, residential buildings, non-residential buildings, dams and power plants, mining, and others.

Regional Insights:

- Kanto Region

- Kansai/Kinki Region

- Central/Chubu Region

- Kyushu-Okinawa Region

- Tohoku Region

- Chugoku Region

- Hokkaido Region

- Shikoku Region

The report has also provided a comprehensive analysis of all major regional markets. This includes Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, and Shikoku Region.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Japan Concrete Market News:

- On August 23, 2024, Japanese construction company Kajima Corp. developed CO2-Suicom, the world’s first carbon-negative concrete that absorbs CO2 during production, reducing net emissions below zero. Since its launch in 2008, CO2-Suicom has been used in paving blocks and concrete piers, with new larger-scale versions now available for civil engineering. Kajima’s innovations in eco-friendly concrete support Japan’s climate goals and could significantly impact global concrete industry decarbonization efforts.

Japan Concrete Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Concrete Types Covered |

|

| Applications Covered | Reinforced Concrete, Non-Reinforced Concrete |

| End Use Industries Covered | Roads and Highways, Tunnels, Residential Buildings, Non-Residential Buildings, Dams and Power Plants, Mining, Others |

| Regions Covered | Kanto Region, Kansai/Kinki Region, Central/Chubu Region, Kyushu-Okinawa Region, Tohoku Region, Chugoku Region, Hokkaido Region, Shikoku Region |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Japan concrete market performed so far and how will it perform in the coming years?

- What is the breakup of the Japan concrete market on the basis of concrete type?

- What is the breakup of the Japan concrete market on the basis of application?

- What is the breakup of the Japan concrete market on the basis of end use industry?

- What is the breakup of the Japan concrete market on the basis of region?

- What are the various stages in the value chain of the Japan concrete market?

- What are the key driving factors and challenges in the Japan concrete market?

- What is the structure of the Japan concrete market and who are the key players?

- What is the degree of competition in the Japan concrete market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Japan concrete market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Japan concrete market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Japan concrete industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)